1. What is the projected Compound Annual Growth Rate (CAGR) of the Dietary Supplements During Pregnancy?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Dietary Supplements During Pregnancy

Dietary Supplements During PregnancyDietary Supplements During Pregnancy by Type (Liquid, Tablet, Capsule), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

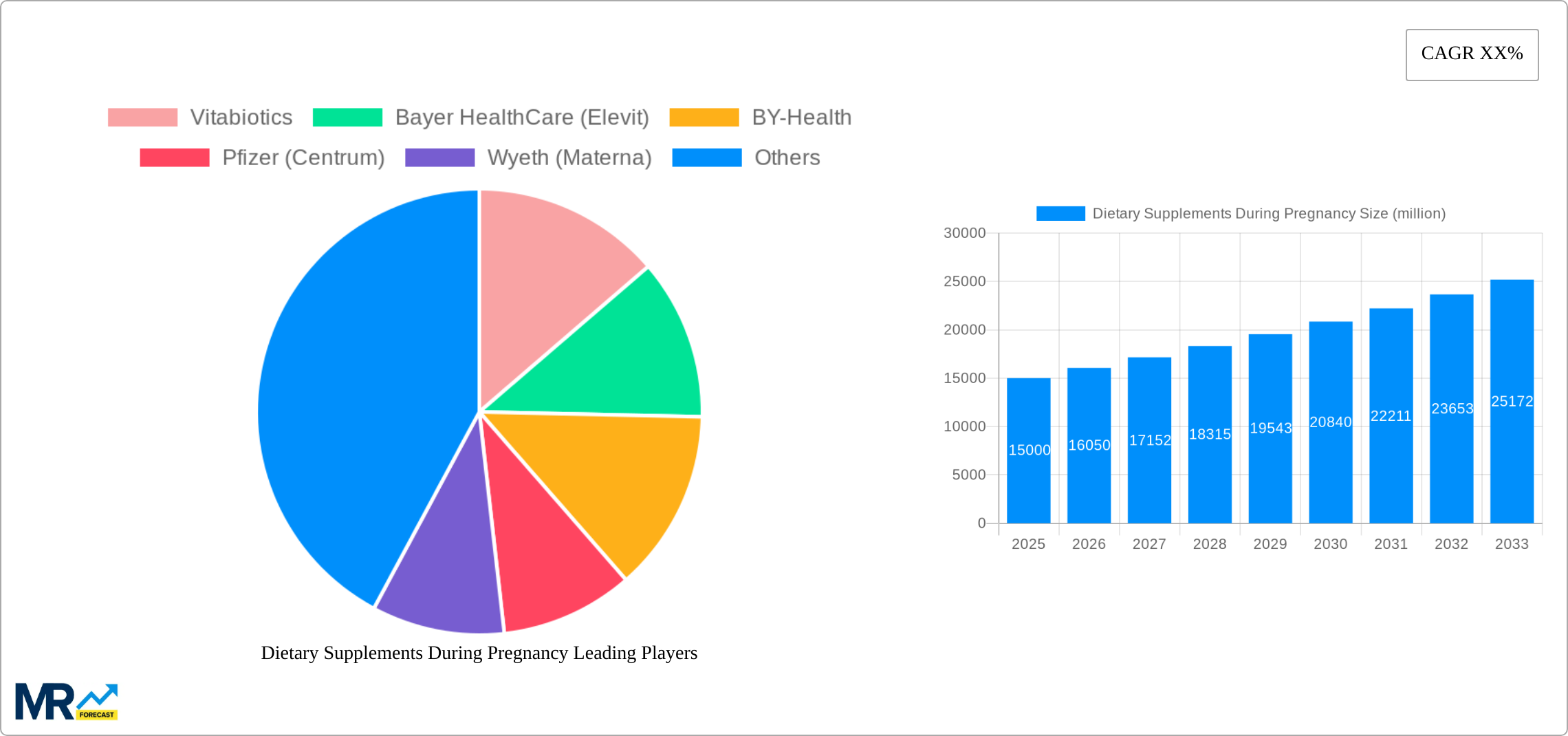

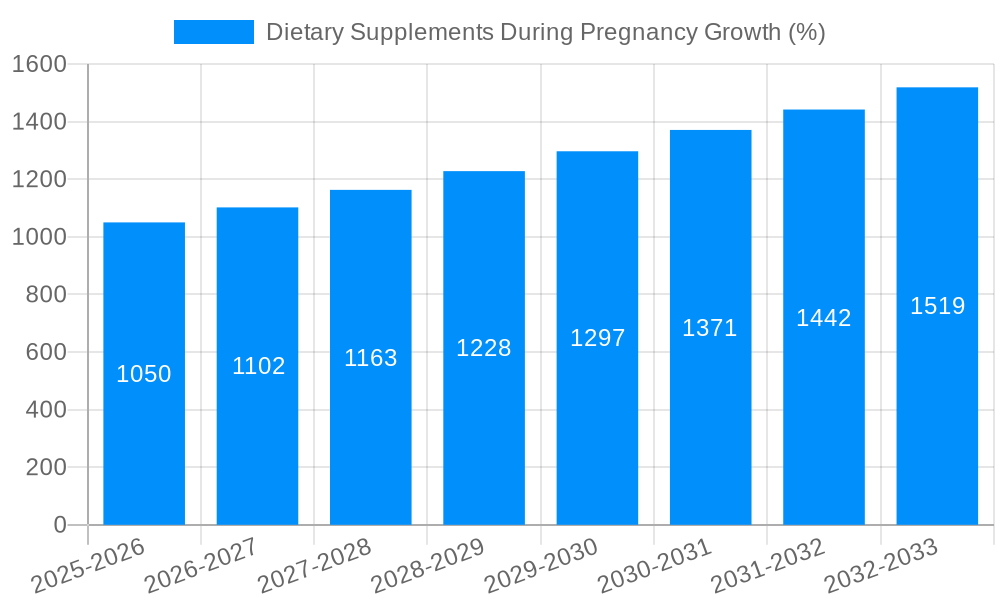

The global market for dietary supplements during pregnancy is experiencing robust growth, driven by increasing awareness of prenatal health, rising maternal age, and a growing preference for natural and holistic approaches to wellness. The market, estimated at $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033, reaching approximately $25 billion by 2033. This expansion is fueled by several key factors. Firstly, a heightened focus on maternal and fetal well-being is pushing expectant mothers towards supplementation to address potential nutrient deficiencies and support healthy pregnancy outcomes. Secondly, the increasing prevalence of chronic conditions like diabetes and hypertension among pregnant women further fuels demand for targeted dietary supplements. Thirdly, the growing adoption of online sales channels provides convenient access to a wider range of products and enhances market penetration. However, regulatory hurdles, concerns regarding supplement safety and efficacy, and varying consumer perceptions across different regions present challenges to market expansion.

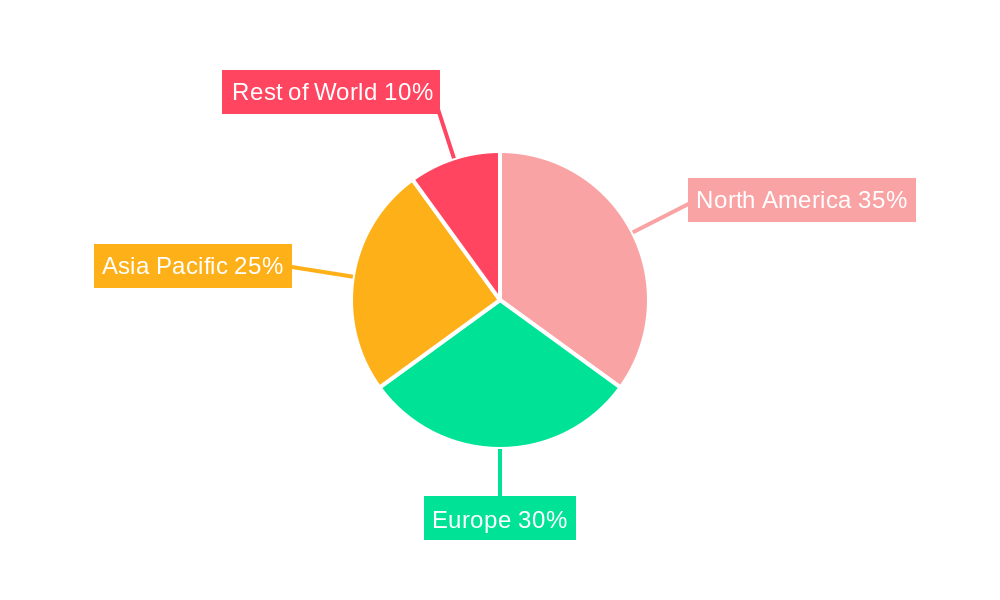

Segment-wise, liquid supplements are projected to hold the largest market share, due to ease of consumption and better absorption rates. Online sales are experiencing rapid growth due to the convenience factor. Leading players such as Vitabiotics, Bayer HealthCare (Elevit), and Pfizer (Centrum) dominate the market, leveraging strong brand recognition and extensive distribution networks. Geographic distribution reveals strong performance in North America and Europe, reflecting higher awareness and disposable income. Asia-Pacific is also witnessing significant growth, fueled by increasing health consciousness and rising middle-class populations. Strategic collaborations, product innovation focusing on specific nutrient combinations and personalized formulations are expected to shape future market trends. Stringent regulatory compliance and transparent labeling will continue to play a vital role in establishing consumer confidence and sustainable market growth.

The global market for dietary supplements during pregnancy is experiencing robust growth, projected to reach XXX million units by 2033. The historical period (2019-2024) witnessed a steady increase in demand, driven primarily by rising awareness regarding the importance of prenatal nutrition and the increasing prevalence of nutritional deficiencies among pregnant women. The estimated market size in 2025 stands at XXX million units, reflecting continued expansion. This growth is fueled by a confluence of factors including increased disposable incomes in developing economies, enhanced access to healthcare information through digital channels, and the aggressive marketing strategies employed by leading supplement manufacturers. The market is witnessing a shift towards specialized supplements tailored to address specific nutritional needs during pregnancy, such as folic acid, iron, and omega-3 fatty acids. Consumer preferences are also diversifying, with a growing demand for organic, natural, and non-GMO options. The forecast period (2025-2033) anticipates continued expansion, driven by factors such as increasing female workforce participation and a greater focus on maternal health initiatives globally. However, challenges related to regulatory hurdles, safety concerns, and the prevalence of misinformation regarding supplement efficacy need to be carefully considered. The market is witnessing innovative product development, such as liquid supplements for better absorption and convenient formulations for busy mothers. The increasing adoption of e-commerce platforms also contributes to market growth, offering wider reach and improved accessibility to these essential products. This trend towards online sales is particularly evident in developed economies where consumers are increasingly comfortable with online purchasing.

Several key factors are driving the substantial growth of the dietary supplements during pregnancy market. Firstly, the heightened awareness among expectant mothers regarding the crucial role of nutrition in fetal development is a significant catalyst. Public health campaigns, educational initiatives, and increased access to online health information have empowered women to proactively manage their nutritional intake. Secondly, the increasing prevalence of nutritional deficiencies, particularly deficiencies in folic acid, iron, and vitamin D, among pregnant women is another critical driver. These deficiencies can lead to various complications during pregnancy and negatively impact fetal development, thus driving the demand for supplements to bridge these nutritional gaps. Furthermore, the rising disposable incomes in developing nations are enabling more women to afford these products, expanding the market's overall reach. The marketing efforts of major players, emphasizing the benefits and convenience of prenatal supplements, have also played a vital role in driving market expansion. Lastly, the growing adoption of e-commerce has significantly broadened accessibility to these products, reaching a wider audience beyond traditional retail channels. This enhanced convenience and broader access are key components of the market's expansion.

Despite the considerable growth potential, the dietary supplements during pregnancy market faces several challenges and restraints. One significant obstacle is the stringent regulatory environment surrounding these products. Differing regulations across countries complicate product approvals and market entry, presenting significant hurdles for manufacturers. Safety concerns also represent a significant challenge. Incidents of contamination or adverse reactions can severely impact consumer trust and harm the market's reputation. The prevalence of misinformation and unsubstantiated claims regarding supplement efficacy is another major concern, leading to confusion and potentially harmful choices among pregnant women. Moreover, the high cost of high-quality supplements can make them inaccessible to low-income populations, limiting market penetration. Competition from traditional food-based dietary sources and the perceived need for a balanced diet also pose a challenge. Finally, the lack of robust clinical evidence supporting the efficacy of certain supplements further complicates the market landscape and hinders its growth potential.

The market for dietary supplements during pregnancy is experiencing varied growth across different regions and segments.

Geographic Dominance: Developed economies like North America and Europe currently hold a significant market share due to higher levels of awareness regarding prenatal nutrition, greater disposable incomes, and well-established healthcare infrastructure. However, rapidly developing countries in Asia and Latin America are experiencing exponential growth, driven by rising disposable incomes and increasing awareness of maternal health.

Segment Dominance:

Tablet Segment: Tablets are currently the dominant segment, due to their ease of use, convenient dosage, and widespread availability. The established market presence, along with consumer familiarity, make this form particularly appealing.

Online Sales: The online sales segment is demonstrating rapid growth, surpassing offline sales in certain markets. The convenience of purchasing supplements online, coupled with wider product selections and competitive pricing, fuels this trend. This is particularly significant in regions with developed e-commerce infrastructure and high internet penetration.

In summary, while developed markets continue to lead in terms of absolute market size, the growth trajectory in developing economies and the rapidly expanding online sales channel indicate a dynamic and evolving market landscape.

The industry's growth is being further fueled by several key catalysts. The increasing availability of personalized nutritional plans tailored to individual pregnancy needs is enhancing product differentiation and market appeal. The growing acceptance of functional foods and supplements as an integral part of overall health management adds to the adoption rate. Furthermore, proactive marketing strategies focused on educational campaigns and raising awareness around the importance of proper prenatal nutrition are enhancing consumer confidence. This strategic communication, combined with the expanding accessibility through online and offline channels, fuels the market's robust growth trajectory.

This report provides a detailed analysis of the dietary supplements during pregnancy market, covering market size, segment analysis, regional trends, competitive landscape, and future growth projections. The report identifies key drivers, challenges, and opportunities that will shape the market's trajectory over the forecast period. It offers in-depth profiles of leading market players, highlighting their strategies, product portfolios, and market share. This comprehensive report provides valuable insights for stakeholders across the industry, including manufacturers, distributors, retailers, and investors.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Vitabiotics, Bayer HealthCare (Elevit), BY-Health, Pfizer (Centrum), Wyeth (Materna), New Chapter, Similac, Nature Made, GNC, Silian, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Dietary Supplements During Pregnancy," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dietary Supplements During Pregnancy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.