1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Orthopedic Braces and Supports Market?

The projected CAGR is approximately 4.3 %%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

U.S. Orthopedic Braces and Supports Market

U.S. Orthopedic Braces and Supports MarketU.S. Orthopedic Braces and Supports Market by Product (Upper Extremity {Wrist Braces, Supports, Shoulder Braces, Supports, Elbow Braces, Supports, Spinal Orthoses, Others}, Lower Extremity {Ankle & Foot Braces, Supports, Knee Braces, Supports, Others}), by Distribution Channel (O&P Clinics, Orthopedic Clinics, Hospital Pharmacies, Retail & Online Pharmacies), by Forecast 2026-2034

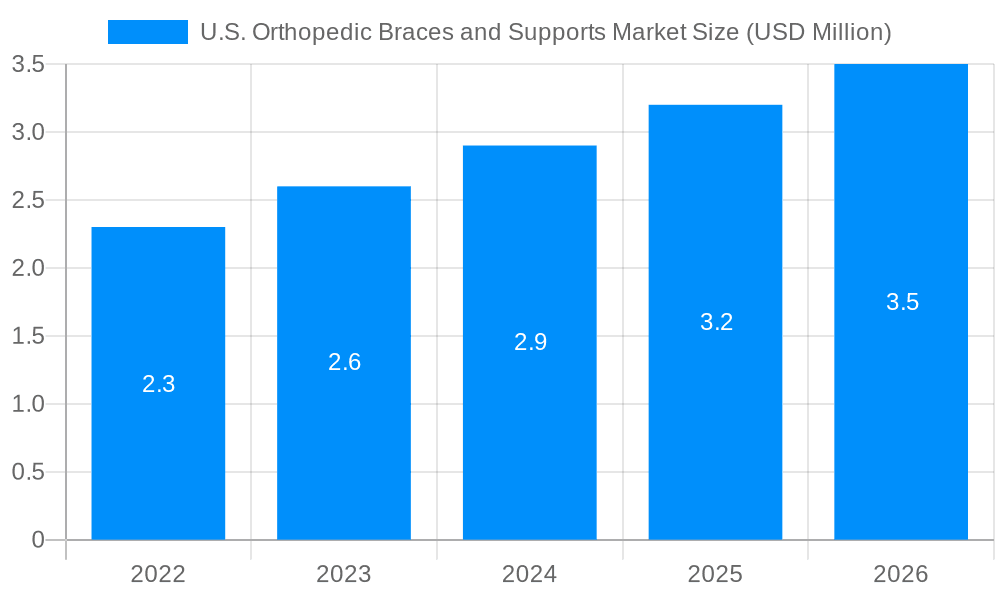

The U.S. orthopedic braces and supports market, valued at approximately $2.09 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 4.3% from 2025 to 2033. This growth is fueled by several key factors. The aging population, with its increased susceptibility to osteoarthritis, osteoporosis, and other age-related musculoskeletal conditions, is a significant driver. Furthermore, rising rates of sports injuries and work-related musculoskeletal disorders contribute to elevated demand for these products. Technological advancements in brace design, leading to improved comfort, functionality, and efficacy, are also positively impacting market expansion. The increasing prevalence of chronic conditions like back pain and knee pain further bolsters market growth. Growth is further supported by the expanding awareness regarding the benefits of preventative measures and conservative treatments to avoid surgical interventions, leading to higher adoption of bracing solutions.

Market segmentation reveals a significant share held by upper extremity braces and supports (wrist, shoulder, elbow braces) reflecting the high incidence of injuries and conditions affecting these areas. Lower extremity braces (ankle, knee braces) also constitute a substantial market segment. Distribution channels are diverse, including O&P clinics, orthopedic clinics, hospital pharmacies, and retail/online pharmacies, with O&P clinics and orthopedic clinics likely holding larger market shares due to the specialized nature of fitting and prescribing these devices. Key players in this market are established companies with strong brands and distribution networks, reflecting a relatively consolidated competitive landscape. Future growth will likely be influenced by factors such as insurance coverage policies, technological innovations, and the introduction of new materials and designs to further enhance product performance and patient comfort. The market's steady, albeit moderate, growth trajectory suggests sustained opportunities for market participants in the coming years.

The U.S. orthopedic braces and supports market is experiencing robust growth, projected to reach XXX billion by 2033, expanding at a CAGR of XXX% during the forecast period (2025-2033). This significant expansion is fueled by several interconnected factors. The aging population, with its increased susceptibility to musculoskeletal disorders, forms a substantial consumer base. Furthermore, rising rates of obesity and related conditions like osteoarthritis contribute significantly to market demand. Advancements in brace technology, including lighter, more comfortable, and technologically advanced designs, are driving adoption. These innovations cater to improved patient compliance and effectiveness. The increasing awareness of the benefits of early intervention and non-surgical treatment options further boosts market growth. The market is witnessing a surge in demand for specialized braces, catering to specific injuries and conditions, reflecting a shift towards personalized healthcare. Simultaneously, the expansion of telehealth and remote patient monitoring capabilities is creating new avenues for product distribution and patient engagement, adding another layer to this dynamic market's expansion. The market also showcases a clear shift towards a preference for innovative, digitally integrated solutions, which enhances therapy effectiveness and patient experience. The estimated market value for 2025 stands at XXX billion, highlighting the current strength of the market and its trajectory.

Several key factors are driving the expansion of the U.S. orthopedic braces and supports market. The escalating prevalence of chronic musculoskeletal disorders, such as osteoarthritis, rheumatoid arthritis, and spinal injuries, is a primary driver. An aging population necessitates increased support for managing age-related joint problems and mobility issues. The rising incidence of sports injuries, particularly among young adults actively participating in athletic activities, fuels demand for specialized braces offering protection and recovery support. Moreover, advancements in brace technology, encompassing materials, design, and functionality, lead to improved comfort, effectiveness, and patient compliance. This technological innovation encompasses the integration of smart technologies into some braces, which allows for enhanced monitoring and personalized treatment plans. Increased healthcare expenditure and improved insurance coverage for orthopedic devices also contribute to the market's growth. Finally, a growing awareness among consumers regarding the benefits of non-surgical treatments and preventive measures boosts demand for these supports.

Despite the significant growth potential, the U.S. orthopedic braces and supports market faces certain challenges. High costs associated with advanced braces and related treatments can limit accessibility for some patients, particularly those without adequate insurance coverage. The market is also characterized by intense competition among numerous players, leading to price pressures and the need for continuous innovation to maintain market share. Stringent regulatory requirements for medical devices pose significant hurdles for manufacturers, increasing the time and cost associated with product development and approval. Furthermore, the market is subject to fluctuations based on economic conditions and changes in healthcare spending patterns. The prevalence of counterfeit and low-quality products can also undermine consumer confidence and market integrity. Finally, ensuring proper fitting and patient education for optimal brace use remains a critical challenge.

The U.S. orthopedic braces and supports market is geographically diverse, with significant regional variations in market size and growth rates. However, the Lower Extremity segment, encompassing ankle, foot, knee, and other braces and supports, is projected to dominate the market throughout the forecast period.

High Prevalence of Lower Extremity Conditions: Conditions affecting the lower extremities such as osteoarthritis, ACL injuries, and other joint issues are prevalent, leading to high demand for these products.

Technological Advancements: Significant advancements in knee braces, including those incorporating advanced materials and technologies for enhanced support and rehabilitation, are driving segment growth.

Rising Sports Participation: Increased participation in sports and recreational activities results in a rise in sports-related injuries to the lower extremities, significantly boosting demand.

Aging Population: The aging population is more prone to age-related conditions such as arthritis, increasing the need for lower extremity supports.

The O&P Clinics and Orthopedic Clinics distribution channels also hold significant market share. These channels provide a more personalized and expert-driven approach to brace fitting and patient education, positively influencing adoption rates.

Specialized Expertise: O&P clinics and orthopedic clinics possess specialized expertise in assessing patient needs and selecting the appropriate brace, ensuring better outcomes and patient satisfaction.

Direct Patient Interaction: These channels allow for direct interaction with patients, facilitating personalized consultations and ongoing support for proper brace usage.

Higher-Value Products: O&P and orthopedic clinics often carry higher-value, technologically advanced products, contributing to increased market value for this distribution segment.

Within the product categories, knee braces currently hold the largest share and are expected to continue this dominance. However, substantial growth is expected in the ankle and foot brace segment, fueled by rising diabetes prevalence and its associated foot complications, resulting in greater demand for specialized support and management solutions.

Several factors are accelerating growth within the U.S. orthopedic braces and supports industry. Technological advancements resulting in lighter, more comfortable, and functionally superior braces are enhancing patient compliance and treatment effectiveness. Increased healthcare expenditure and better insurance coverage are widening access to these devices. Growing awareness among consumers of the benefits of non-surgical treatment options and preventive care are driving demand. The rise of telehealth and remote patient monitoring systems facilitates increased engagement with patients and improved treatment outcomes. Lastly, strategic partnerships and acquisitions within the industry are streamlining supply chains, expanding product portfolios, and leading to an overall boost in innovation and market expansion.

This report provides a comprehensive overview of the U.S. orthopedic braces and supports market, covering market size and growth trends from 2019 to 2033. It delves into market segmentation by product type (upper and lower extremity braces and supports) and distribution channel (O&P clinics, orthopedic clinics, pharmacies). Detailed competitive analysis of key market players, including their strategies and recent developments, is included. The report also identifies major growth drivers and challenges within the market. In essence, this report offers invaluable insights into current market dynamics and future growth prospects within the U.S. orthopedic braces and supports sector, making it a critical resource for industry stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3 %% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.3 %%.

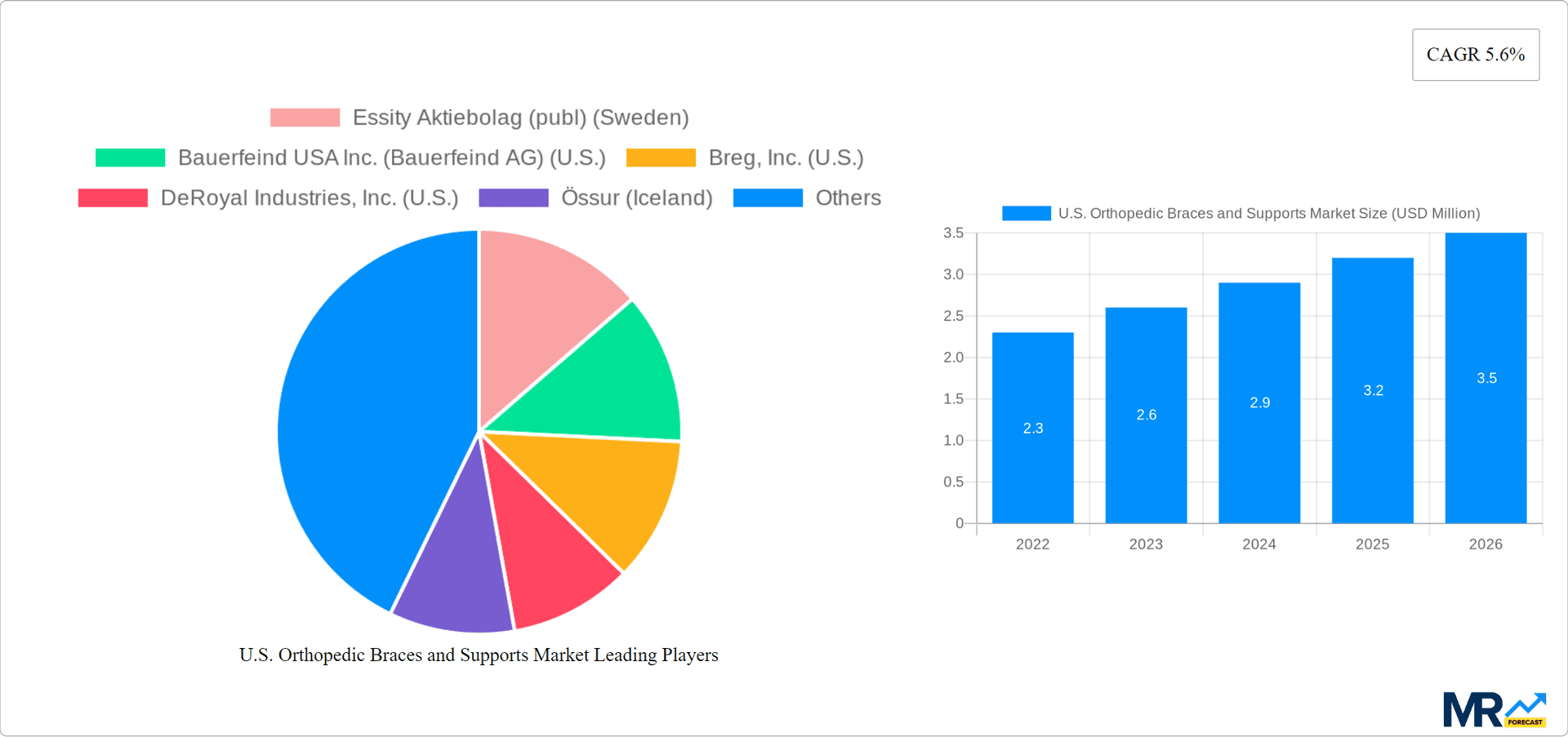

Key companies in the market include Essity Aktiebolag (publ) (Sweden), Bauerfeind USA Inc. (Bauerfeind AG) (U.S.), Breg, Inc. (U.S.), DeRoyal Industries, Inc. (U.S.), Össur (Iceland), Ottobock (Germany), Thuasne (France), DJO, LLC (Enovis) (U.S.), Ultraflex Systems (U.S.), Zimmer Biomet (U.S.), Weber Orthopedic LP. (Hely & Weber) (U.S.).

The market segments include Product, Distribution Channel.

The market size is estimated to be USD 2.09 N/A as of 2022.

Technological Advancements in Orthotic Devices to Boost Market Growth.

Increased Strategic Initiatives by Prominent Players.

Shortage of Orthotists in U.S. to Limit Market Growth.

June 2023: DJO, LLC (Enovis) completed the acquisition of Novastep, a subsidiary of Amplitude Surgical SA and a global developer of clinically proven foot and ankle solutions.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2850, USD 3850, and USD 4850 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

Yes, the market keyword associated with the report is "U.S. Orthopedic Braces and Supports Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the U.S. Orthopedic Braces and Supports Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.