1. What is the projected Compound Annual Growth Rate (CAGR) of the Peel off Labels?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Peel off Labels

Peel off LabelsPeel off Labels by Type (Single Layer, Double Layer, Triple Layer and above), by Application (Pharmaceutical Industry, Chemical Industry, Food and Beverage, Cosmetic, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

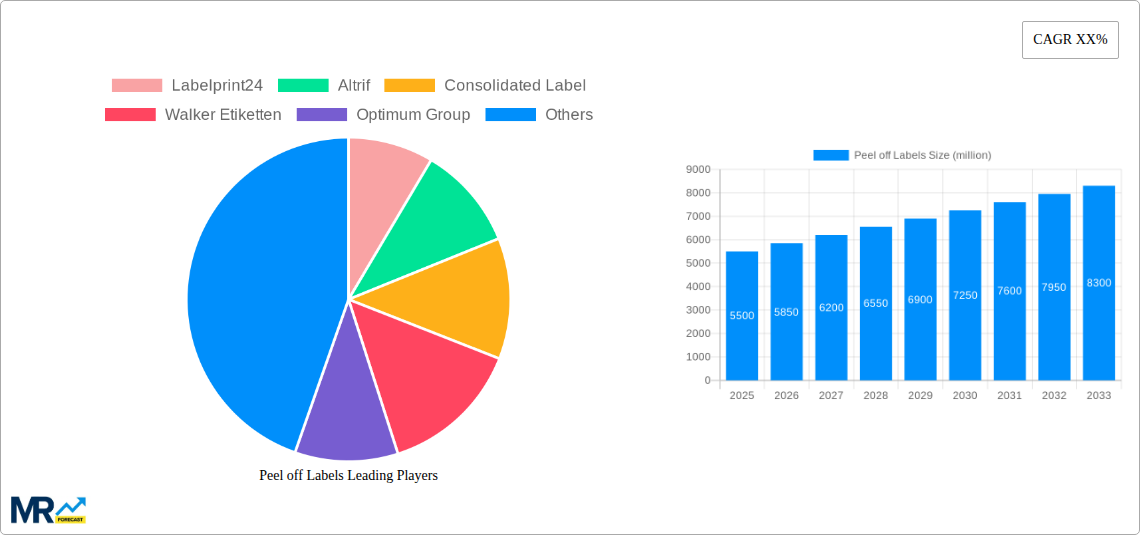

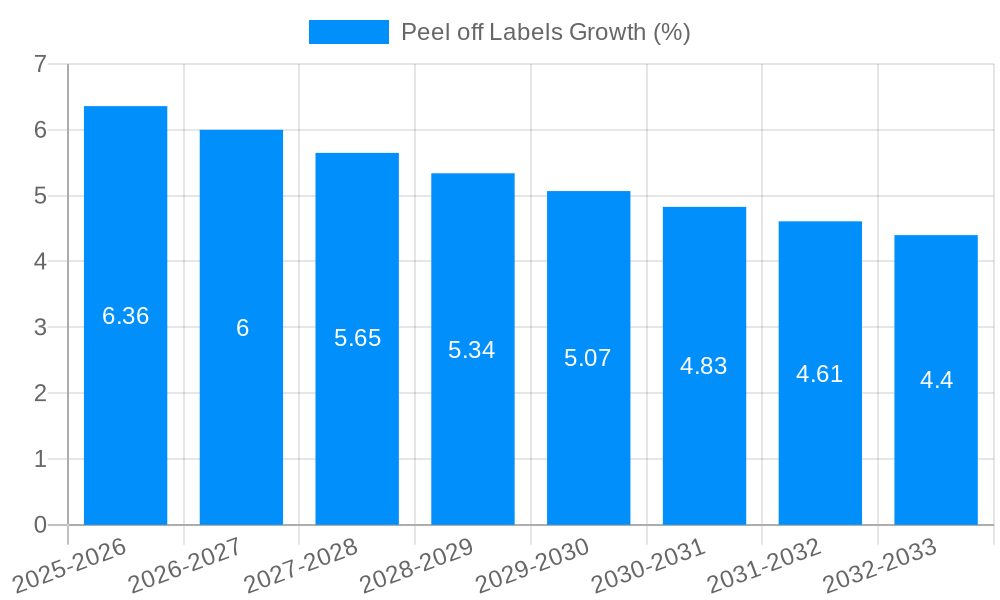

The global Peel off Labels market is poised for significant expansion, driven by a growing demand for product differentiation, enhanced traceability, and consumer convenience across various industries. With an estimated market size of approximately USD 5,500 million in 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period of 2025-2033. This robust growth is primarily fueled by the pharmaceutical sector, where peel off labels are essential for tamper-evident packaging, patient information leaflets, and promotional offers, ensuring compliance and enhancing patient safety. The chemical industry also contributes significantly, utilizing these labels for hazard communication and product identification. Furthermore, the increasing consumer awareness regarding product information, ingredients, and promotional content in the food & beverage and cosmetic sectors is a key catalyst for the adoption of multi-layered peel off labels. The convenience of accessing additional information without compromising the primary product label is a major draw for consumers and a strategic advantage for brands.

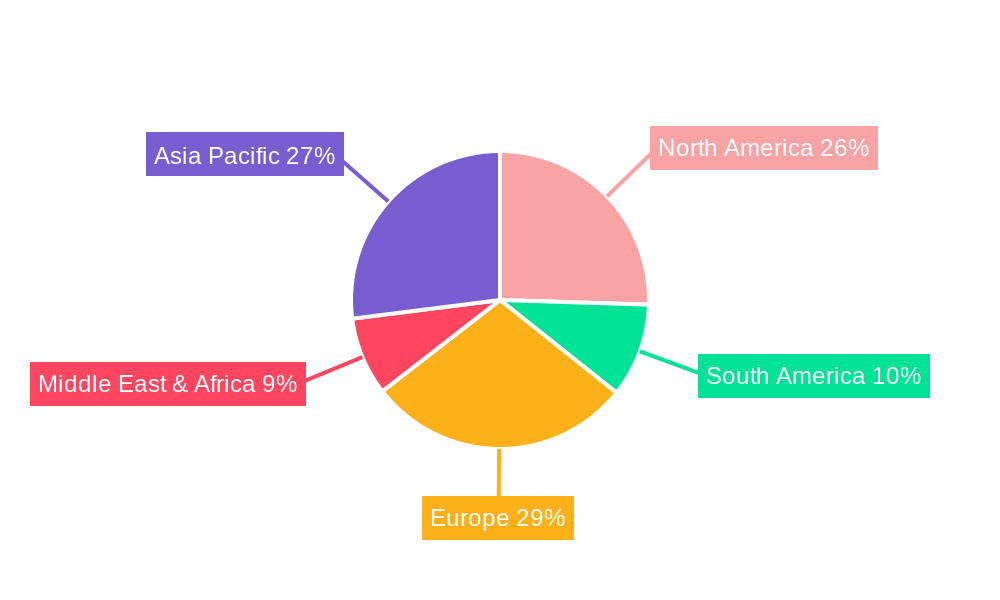

The market's expansion is further supported by technological advancements in printing and material science, leading to more sophisticated and cost-effective peel off label solutions. Innovations such as enhanced adhesive technologies for repositionability and re-sealability, as well as the integration of smart features like QR codes and RFID, are expected to propel market growth. However, the market faces certain restraints, including the fluctuating prices of raw materials such as paper and adhesives, and stringent regulatory requirements in certain regions that may impact production costs and timelines. Nevertheless, the dominant trend towards sustainable and eco-friendly packaging solutions is creating new opportunities for biodegradable and recyclable peel off labels. Regionally, Asia Pacific is expected to emerge as a leading market, driven by rapid industrialization, a burgeoning consumer base, and increasing investments in the packaging sector, particularly in China and India. North America and Europe are also anticipated to witness steady growth, owing to well-established pharmaceutical and food industries and a high adoption rate of innovative packaging solutions.

This report provides an in-depth analysis of the global Peel off Labels market, offering valuable insights for industry stakeholders. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period extending from 2025 to 2033, this comprehensive report leverages a robust historical analysis from 2019-2024 to project future market trajectories. The estimated year of 2025 serves as a pivotal point for current market valuation and understanding. The report delves into various aspects of the market, including key trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant developments. By examining a wide array of peel-off label types, applications across diverse industries, and the intricate landscape of industry developments, this report aims to equip businesses with the strategic intelligence needed to navigate and capitalize on the evolving peel-off labels sector. The global market size is projected to reach USD 5,500 million by 2025, with an anticipated growth to USD 7,800 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 4.5% during the forecast period.

The global Peel off Labels market is experiencing a dynamic evolution, driven by an increasing demand for sophisticated labeling solutions that offer enhanced functionality and consumer engagement. A significant trend observed is the burgeoning adoption of multi-layer peel-off labels, particularly Triple Layer and Above constructions. These labels are increasingly preferred for their capacity to convey extensive product information, regulatory compliance details, and promotional content without compromising aesthetic appeal. For instance, the Pharmaceutical Industry is a major driver, requiring detailed patient instructions, dosage information, and tamper-evident features, all of which are effectively managed by multi-layer peel-off labels. The market has seen a substantial increase in the utilization of these advanced labels, with their market share projected to grow from approximately 25% in 2019 to over 35% by 2025, and further to an estimated 45% by 2033. This shift underscores the growing need for labels that can serve as information hubs.

Furthermore, the integration of smart technologies within peel-off labels is emerging as a significant trend. Concepts like QR codes and NFC tags embedded within these labels are becoming more prevalent, enabling seamless consumer interaction, product authentication, and supply chain tracking. This is particularly relevant in the Food and Beverage sector, where traceability and authenticity are paramount. Consumer demand for transparency regarding ingredients, origin, and ethical sourcing is pushing manufacturers to adopt labeling solutions that facilitate this. The Cosmetic Industry is also embracing this trend, using peel-off labels for detailed ingredient lists, usage instructions, and even augmented reality experiences, enhancing brand engagement. The market for technologically integrated peel-off labels, while still nascent, is expected to witness exponential growth, potentially contributing an additional 10-15% to the overall market value by 2033.

The increasing emphasis on sustainability is another pivotal trend shaping the peel-off labels market. Manufacturers are actively seeking eco-friendly materials and production processes. This includes a rise in demand for recyclable, biodegradable, and compostable peel-off label materials. Companies are investing in R&D to develop innovative adhesive technologies that minimize environmental impact while maintaining optimal performance. This focus on sustainability is not just a regulatory imperative but also a consumer-driven demand, with a growing segment of consumers actively choosing products with environmentally conscious packaging. Consequently, labels made from recycled content or bio-based materials are expected to see a significant uptake, potentially capturing a market share of 20% by 2028. The market is also witnessing a rise in demand for specialized coatings and finishes that enhance label durability and aesthetics while adhering to environmental standards, further contributing to the dynamic nature of this sector. The overall market size for peel-off labels, which stood at approximately USD 4,200 million in 2019, is anticipated to reach USD 5,500 million in 2025 and continue its upward trajectory to USD 7,800 million by 2033, reflecting these multifaceted trends.

Several powerful forces are collectively propelling the growth of the global Peel off Labels market. Paramount among these is the escalating demand from the Pharmaceutical Industry. The stringent regulatory requirements for drug packaging, which necessitate clear and comprehensive patient information, dosage instructions, and tamper-evident features, make multi-layer peel-off labels indispensable. As pharmaceutical companies strive for greater product security and enhanced patient safety, the adoption of advanced peel-off labeling solutions is on the rise, contributing significantly to market expansion. This is further fueled by the increasing global healthcare expenditure and the continuous introduction of new pharmaceutical products, each requiring detailed and compliant labeling.

Another significant driver is the burgeoning Food and Beverage Industry. With a growing consumer consciousness regarding product information, traceability, and authenticity, food and beverage manufacturers are increasingly opting for peel-off labels. These labels provide ample space for nutritional facts, ingredient lists, allergen warnings, origin details, and promotional offers, thereby enhancing consumer trust and facilitating informed purchasing decisions. The rise of e-commerce and direct-to-consumer sales models also necessitates labels that can withstand varying shipping conditions and provide a premium unboxing experience. This demand for enhanced product information and consumer engagement is directly translating into increased demand for sophisticated peel-off labels, pushing the market size from an estimated USD 4,200 million in 2019 towards the projected USD 7,800 million by 2033.

Furthermore, the continuous innovation in label technology and materials is a key propellant for market growth. The development of advanced adhesives, specialized coatings, and multi-layer printing techniques allows for the creation of peel-off labels with enhanced functionalities, such as durability, water resistance, temperature resilience, and security features. The integration of smart technologies, including QR codes and NFC tags, is further broadening the application spectrum and consumer interaction capabilities of peel-off labels. This technological advancement caters to the evolving needs of various industries, including the Cosmetic Industry and other niche applications, ensuring that the market remains dynamic and responsive to emerging requirements.

Despite the robust growth trajectory, the Peel off Labels market is not without its share of challenges and restraints that could potentially impede its expansion. One of the primary challenges is the increasing cost of raw materials. The production of sophisticated peel-off labels often involves specialized substrates, adhesives, and inks, the prices of which can be volatile and subject to global supply chain fluctuations. For instance, the rising costs of paper pulp, synthetic polymers, and specialized chemicals directly impact the manufacturing costs of these labels, potentially affecting their affordability for smaller businesses or price-sensitive segments of the market. This could lead to a consolidation of the market towards larger players with better purchasing power.

Another significant restraint is the complexity in manufacturing and application. Multi-layer peel-off labels, while offering numerous benefits, require advanced printing technologies and precise application processes. This can lead to higher capital investment for manufacturers and a steeper learning curve for end-users. The intricate design and construction of these labels necessitate skilled labor and sophisticated machinery, which might not be readily available or economically viable for all businesses, particularly in emerging economies. The risk of label delamination, adhesive failure, or printing defects during the manufacturing or application stages also presents a challenge, requiring stringent quality control measures.

Furthermore, the growing environmental concerns and regulations surrounding waste management and the use of non-recyclable materials pose a restraint. While the industry is actively pursuing sustainable solutions, the transition to fully eco-friendly peel-off labels across all applications can be a gradual and costly process. The disposal of multi-layer labels, which can sometimes be difficult to separate for recycling, also raises environmental questions. Regulatory bodies worldwide are increasingly scrutinizing packaging waste, and stricter regulations could necessitate costly reformulation or redesign of existing peel-off label solutions, impacting profitability and market accessibility. The market, while projected to reach USD 7,800 million by 2033, must navigate these challenges to achieve its full potential.

The global Peel off Labels market is characterized by a dynamic interplay of regional strengths and segment-specific dominance, with certain regions and segments poised to lead the market's growth trajectory.

Dominant Segments:

Triple Layer and Above: This segment is witnessing exceptional growth and is projected to be a dominant force in the market. The increasing demand for comprehensive product information, regulatory compliance, and enhanced consumer engagement across various industries fuels this dominance.

Pharmaceutical Industry (Application): This industry stands out as a significant driver and a dominant application segment for peel-off labels. The critical need for accuracy, security, and comprehensive information in pharmaceutical packaging makes peel-off labels an indispensable component.

Dominant Regions:

North America: This region is expected to maintain its leading position in the peel-off labels market.

Europe: Europe is another key region with a substantial market share, driven by its advanced economies and stringent regulatory landscape.

Asia Pacific: This region is anticipated to witness the highest growth rate during the forecast period.

The Peel off Labels industry is being propelled by several key growth catalysts. The escalating stringent regulatory requirements across industries, particularly in pharmaceuticals and food, are mandating the use of labels that provide comprehensive, easily accessible information and tamper-evident features. Furthermore, the increasing consumer demand for product transparency, traceability, and detailed ingredient information is pushing manufacturers to adopt labels that can effectively communicate these aspects. The ongoing technological advancements in printing, materials science, and smart labeling solutions, such as the integration of QR codes and NFC tags, are expanding the functionalities and applications of peel-off labels, thereby driving innovation and market expansion. The growing e-commerce landscape also contributes, requiring durable and informative packaging.

This report offers a comprehensive overview of the Peel off Labels market, extending its analytical scope beyond market size and forecasts. It meticulously examines the intricate trends shaping the industry, from the increasing preference for multi-layer labels in pharmaceuticals to the integration of smart technologies for enhanced consumer engagement. The report also dissects the pivotal driving forces, such as evolving regulatory landscapes and consumer demand for transparency, which are propelling market growth. Conversely, it addresses the significant challenges, including raw material cost volatility and manufacturing complexities, that market players must navigate. By identifying dominant segments and regions, and highlighting key growth catalysts, this report provides actionable intelligence for strategic decision-making. The inclusion of leading players and a timeline of significant developments offers a holistic perspective on the market's evolution, enabling stakeholders to anticipate future opportunities and challenges within the global Peel off Labels sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Labelprint24, Altrif, Consolidated Label, Walker Etiketten, Optimum Group, Albeniz, Faubel, Froben Druck, Palladio Group, Bizerba, MPS, SKK, S. Anand Packaging, Eltronis, Labelnet, Etiketa, MD Labels, Adhesif.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Peel off Labels," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Peel off Labels, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.