1. What is the projected Compound Annual Growth Rate (CAGR) of the NFT Art?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

NFT Art

NFT ArtNFT Art by Type (Photos, Videos, Music, Paintings, Others), by Application (Personal Use, Commercial Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

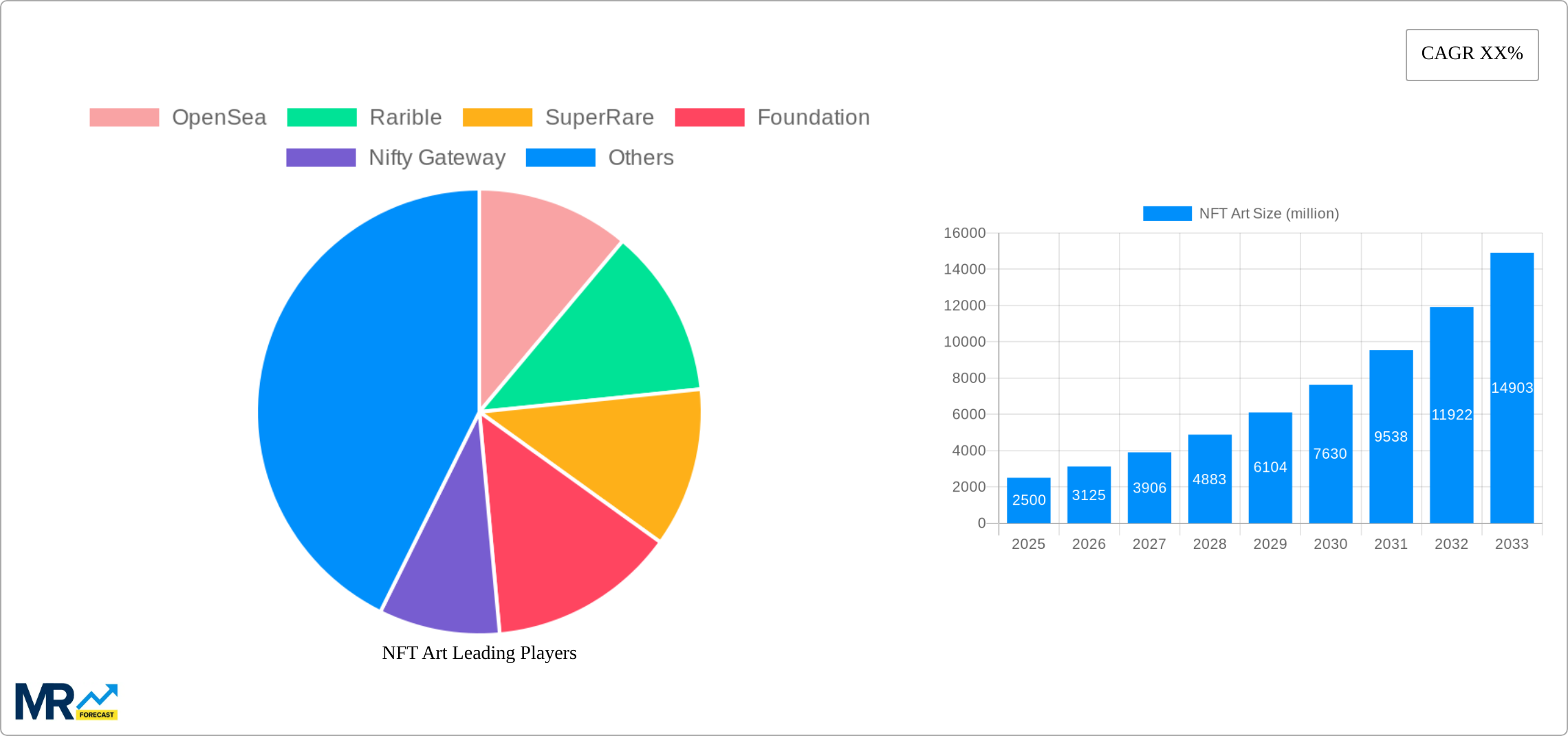

The NFT art market, encompassing digital artwork like photos, videos, music, and paintings, experienced explosive growth in recent years. While precise figures for the past are unavailable, a conservative estimate places the 2024 market size at around $2 billion, based on reported transaction volumes and market analysis from reputable sources. This signifies a significant increase from previous years, driven by factors such as increasing mainstream adoption of cryptocurrencies, the growing interest in digital collectibles, and the unique ownership and authenticity offered by blockchain technology. The market is further propelled by the integration of NFTs into gaming and metaverse applications, attracting a wider audience beyond traditional art collectors. Key segments include personal and commercial use, with commercial use showing considerable potential for growth as brands explore NFTs for marketing and brand building initiatives. Major players like OpenSea, Rarible, and SuperRare dominate the market, but the landscape is rapidly evolving with new marketplaces and artists emerging.

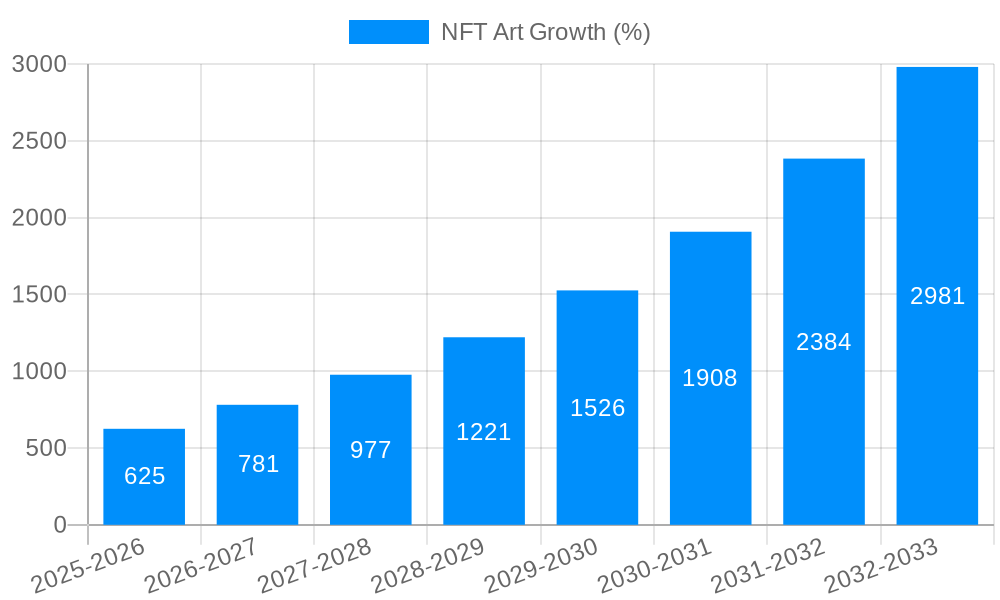

Despite the rapid growth, challenges remain. Regulatory uncertainty surrounding NFTs and cryptocurrencies in various jurisdictions poses a significant hurdle. The volatility of cryptocurrency prices directly impacts NFT valuations, making the market susceptible to price swings. Furthermore, concerns regarding environmental impact due to energy consumption associated with some blockchain networks need to be addressed for sustainable long-term growth. Despite these challenges, the long-term outlook for the NFT art market remains positive, projecting a Compound Annual Growth Rate (CAGR) of approximately 25% from 2025 to 2033. This indicates a projected market size exceeding $10 billion by 2033. This growth will be fueled by further technological advancements, broader user adoption, and innovative use cases within the metaverse and the broader digital economy. The segmentation of the market into types of artwork and use cases presents various opportunities for targeted investment and growth.

The NFT art market, having exploded onto the scene in the early 2020s, continues to evolve at a breathtaking pace. The historical period (2019-2024) witnessed a surge in popularity, driven by factors like increased cryptocurrency adoption and the desire for digital ownership. The base year of 2025 shows a market valued in the hundreds of millions, a testament to its enduring appeal. While initial hype has subsided, the market remains robust, with a shift towards greater maturity and institutional involvement. We're seeing a move away from purely speculative investments towards a focus on the artistic merit and potential utility of NFTs. The estimated year 2025 showcases a market size exceeding several hundred million dollars, driven by factors such as the increasing acceptance of NFTs as legitimate art forms and expanding use cases beyond simple JPEGs. High-value sales continue to grab headlines, but the volume of transactions in the lower price brackets suggests a broadening base of collectors and creators. The forecast period (2025-2033) projects continued growth, albeit potentially at a slower rate than the initial boom, as the market matures and finds its equilibrium. This maturation involves a refinement of technology, improved regulatory frameworks, and a clearer understanding of the long-term value proposition of NFT art. This market shift signifies a move beyond speculative bubbles toward a sustainable and integrated part of the wider art and digital worlds. The market is becoming more sophisticated, with a clearer understanding of the legal implications of ownership and the artistic integrity of digital pieces. Increased integration with the metaverse and other digital platforms is also a key driver of this continuing growth. Furthermore, the increasing use of NFTs in other sectors, like gaming and music, is expanding the reach of the technology and bringing new audiences into the fold.

Several factors are driving the continued growth of the NFT art market. Firstly, the inherent scarcity and verifiable ownership provided by blockchain technology are powerful selling points, attracting collectors seeking unique and authentic digital assets. This contrasts sharply with the easily reproducible nature of digital art, offering a compelling value proposition. Secondly, the increasing accessibility of NFT marketplaces like OpenSea, Rarible, and SuperRare has lowered the barrier to entry for both artists and collectors. These platforms provide user-friendly interfaces and streamlined processes for minting, buying, and selling NFTs. Thirdly, the rise of the metaverse and other immersive digital environments has created new opportunities for showcasing and utilizing NFT art. Digital art pieces are no longer static; they are interactive, dynamic, and integrated into broader digital experiences, enhancing their value and appeal. Furthermore, the expanding community of artists, collectors, and enthusiasts fuels the market's momentum. This active community drives innovation, fosters collaboration, and creates a vibrant ecosystem for NFT art. Finally, the ongoing evolution of blockchain technology and the development of new standards and protocols are continuously improving the functionality and security of NFTs, enhancing their long-term viability. The convergence of these factors creates a powerful synergy that ensures the NFT art market will continue its growth trajectory over the forecast period.

Despite its rapid growth, the NFT art market faces several challenges. Volatility remains a significant concern, with prices fluctuating wildly based on market sentiment and speculative trading. This volatility can deter both artists and collectors, particularly those seeking long-term investments. Regulatory uncertainty is another key issue. The lack of clear legal frameworks regarding intellectual property rights, taxation, and consumer protection creates risks and uncertainty for all stakeholders. Environmental concerns surrounding the energy consumption of some blockchains used for NFTs also pose a significant hurdle to overcome for the market’s sustainability. The perception of the NFT market as a speculative bubble, fueled by the occasional extremely high-value sales, negatively affects broader market adoption. Furthermore, the lack of standardization and interoperability across different NFT platforms can hinder the seamless exchange and trading of NFTs. Finally, the technical complexity of interacting with blockchain technology and NFT marketplaces can be a barrier for entry, especially for less tech-savvy individuals. Addressing these challenges will be critical to ensuring the long-term health and sustainability of the NFT art market.

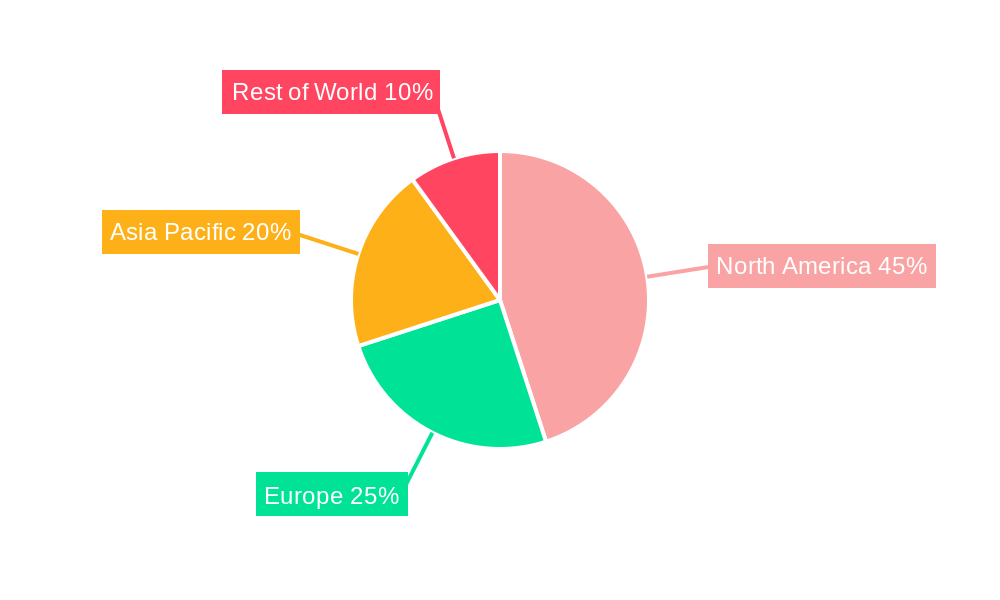

The global NFT art market is characterized by a geographically dispersed user base, however, certain regions exhibit more robust growth. The United States remains a major player, consistently ranking high in terms of both trading volume and the number of active users. Asia, particularly countries like China, Japan, and South Korea, showcase substantial growth potential, with increasing adoption of blockchain technology and a rising interest in digital art.

The increasing demand for NFT art in commercial applications creates a dynamic market environment. The combination of high-value sales in the digital paintings segment with the growing utilization across marketing and branding strategies will likely drive substantial growth in the market’s overall value. The forecast period (2025-2033) predicts this trend to continue, with a noticeable shift toward diversification within the art forms themselves.

Several factors will propel growth in the NFT art industry. The expanding metaverse and immersive digital experiences will create new opportunities for displaying and utilizing NFT art, driving demand. The integration of NFTs into gaming and other entertainment sectors will also increase their adoption and mainstream appeal. Improvements in blockchain technology and the emergence of more environmentally sustainable solutions will address current limitations and enhance the overall user experience. Finally, the evolution of regulatory frameworks will provide much-needed clarity and reduce risk for all market participants, furthering market confidence and accelerating growth.

This report provides a comprehensive overview of the NFT art market, analyzing key trends, driving forces, challenges, and growth opportunities. It examines leading players, significant developments, and forecasts future market growth based on historical data and current market dynamics. The report segments the market by type of art (photos, videos, music, paintings, others) and application (personal, commercial) offering a detailed analysis of each segment’s growth trajectory. The report serves as a valuable resource for investors, artists, collectors, and anyone interested in understanding the rapidly evolving landscape of the NFT art market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include OpenSea, Rarible, SuperRare, Foundation, Nifty Gateway, Enjin Marketplace, KnownOrigin, Async Art, Mintable, Makers Place, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "NFT Art," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the NFT Art, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.