1. What is the projected Compound Annual Growth Rate (CAGR) of the NFT Art?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

NFT Art

NFT ArtNFT Art by Type (Photos, Videos, Music, Paintings, Others), by Application (Personal Use, Commercial Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

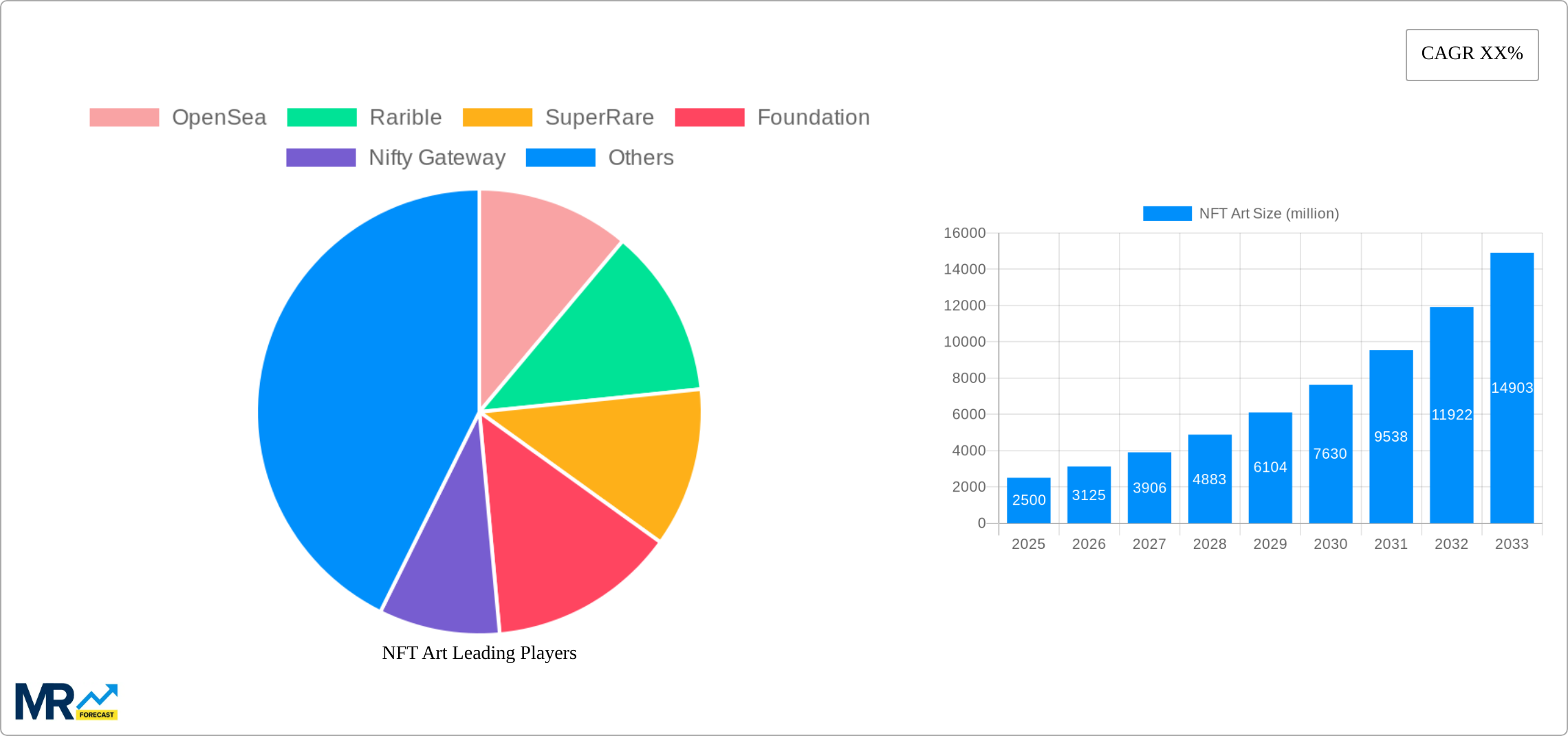

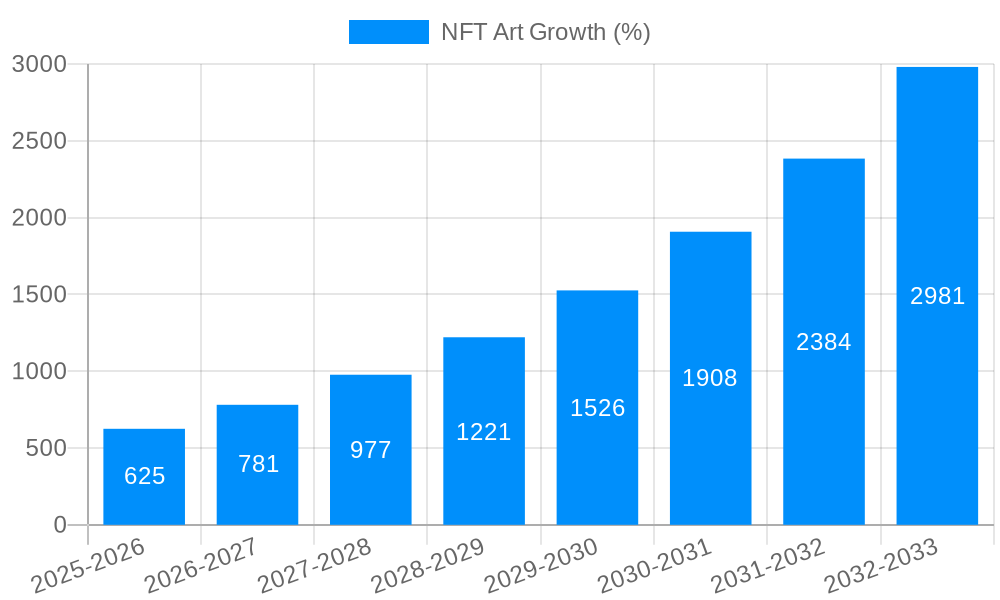

The NFT art market, encompassing digital artwork like photos, videos, music, and paintings, is experiencing rapid growth. While precise figures for the market size in 2025 aren't provided, a reasonable estimation based on reported past growth and current market trends suggests a market value of approximately $5 billion. Considering a projected CAGR (Compound Annual Growth Rate) of, say, 25% – a conservative estimate given the sector's volatility and potential – the market could reach $10 billion by 2028 and beyond $20 billion by 2033. Several factors drive this growth, including increasing digital art adoption, the rise of the metaverse, and the appeal of NFTs as a form of digital ownership and investment. The market is segmented by artwork type (photos, videos, music, paintings, and others) and application (personal and commercial use). Key players like OpenSea, Rarible, and SuperRare dominate the marketplace landscape, creating a competitive but dynamic environment.

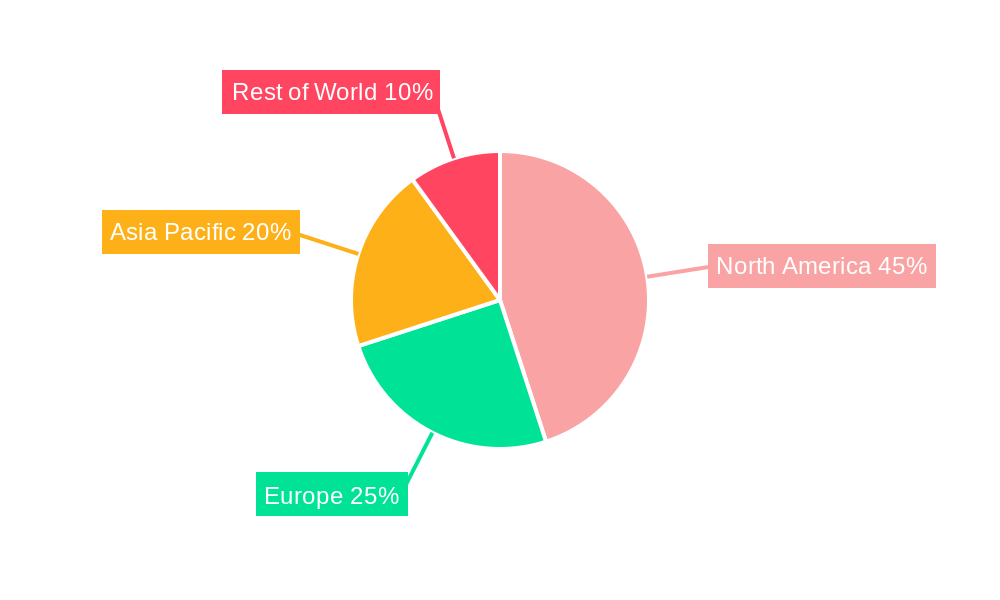

The market's growth isn't uniform across all regions. North America, particularly the United States, is currently a major market leader. However, rapid adoption is seen in Asia Pacific, specifically in countries like China, India, and Japan, fueled by growing internet penetration and a young, tech-savvy population. Europe also plays a significant role, with the UK, Germany, and France being major contributors. Challenges and restraints include regulatory uncertainty surrounding NFTs, volatility in cryptocurrency markets affecting NFT prices, and concerns about environmental impact due to the energy consumption of blockchain networks. Nonetheless, technological advancements, increasing investor interest, and the evolving nature of digital art are poised to drive further expansion, making NFT art a compelling sector for investment and innovation. Continuous evolution of technology and increasing user experience improvements will drive the market growth further.

The NFT art market, a burgeoning sector within the broader digital art landscape, has experienced explosive growth since its inception, transitioning from a niche interest to a multi-million dollar industry within a short timeframe. The study period of 2019-2033 reveals a dramatic shift in how art is created, traded, and valued. The historical period (2019-2024) saw the establishment of major marketplaces like OpenSea, Rarible, and SuperRare, laying the groundwork for the market's expansion. By the estimated year 2025, the market's value is projected to reach hundreds of millions, fueled by increasing mainstream adoption and technological advancements. The forecast period (2025-2033) anticipates continued growth, driven by factors such as greater accessibility, enhanced security protocols, and the integration of NFTs into the metaverse and Web3 applications. However, the market's volatility and susceptibility to speculative bubbles remain significant concerns. Early adoption primarily focused on digital paintings and photos, but the market is rapidly diversifying to include music, videos, and even interactive, generative art. The rise of fractionalized NFTs has also allowed for greater accessibility and broader participation, enabling collectors to invest in high-value pieces collaboratively. The base year of 2025 will serve as a critical benchmark to gauge future trends and the extent of market maturation. The increasing integration of blockchain technology with other established industries – like gaming and fashion – continues to broaden the NFT art market's potential audience and use cases. The overall trend suggests a trajectory toward greater mainstream acceptance, albeit with inherent challenges related to regulation, sustainability, and market manipulation. The market's success hinges on addressing these issues to ensure long-term growth and stability.

Several key factors are propelling the growth of the NFT art market. Firstly, the unique characteristics of NFTs – their scarcity, verifiability, and provable ownership – provide artists with a new avenue for monetizing their digital creations and establishing direct relationships with their audience, bypassing traditional gatekeepers like galleries and auction houses. Secondly, the rise of blockchain technology and decentralized platforms has made it easier and more accessible for artists to create, sell, and trade NFTs. The emergence of numerous marketplaces, each catering to different niches and audiences, has significantly contributed to market expansion. Thirdly, the growing interest in digital collectibles and the expanding metaverse have created a significant demand for unique digital assets, making NFTs an attractive investment opportunity for both individual collectors and institutional investors. The increasing integration of NFTs into gaming, virtual worlds, and other digital platforms further amplifies their appeal and market potential. The excitement surrounding the potential for future value appreciation and the novelty of owning a unique, digitally verifiable piece of art have driven significant speculation and investment. Finally, influential celebrities and artists entering the NFT space have brought increased visibility and legitimacy to the market. This combination of technological advancements, shifting artistic paradigms, and entrepreneurial activity has fueled this remarkable industry growth.

Despite its rapid growth, the NFT art market faces several significant challenges. Market volatility is a primary concern; prices fluctuate wildly, driven by speculation and hype, leading to periods of dramatic price increases followed by equally sharp declines. The lack of clear regulatory frameworks poses a risk; the decentralized nature of the market makes it difficult to regulate and protect investors from scams, fraudulent activities, and market manipulation. Environmental concerns stemming from the energy consumption of some blockchain networks used to mint NFTs are a growing point of contention. Accessibility remains a barrier for many artists and collectors, especially those unfamiliar with blockchain technology or lacking access to the necessary technological infrastructure. Moreover, the long-term value and sustainability of NFTs remain uncertain. The market's reliance on speculative investment may lead to a bubble that bursts, causing significant losses for many participants. Lastly, concerns regarding copyright infringement and intellectual property rights continue to surface, especially considering the ease of creating and distributing digital copies. Addressing these challenges is crucial for ensuring the long-term health and stability of the NFT art market.

The NFT art market shows significant geographical dispersion, with no single region or country holding a complete dominance. However, several key regions and segments are poised for substantial growth:

United States: The US remains a significant player, boasting a large number of established NFT marketplaces, active artists, and collectors. Its well-developed technological infrastructure and investment capital provide fertile ground for NFT growth.

Asia: Countries like China, Japan, and South Korea are exhibiting strong growth, driven by increasing digital adoption and a large young, tech-savvy population.

Europe: While showing relatively slower initial growth than the US and some Asian markets, European nations are steadily increasing their participation driven by both local artists and investors and participation in global NFT projects.

Dominant Segments:

Digital Paintings: This segment consistently represents a significant portion of the market due to the inherent artistic value and the ease of creating and showcasing digital paintings on NFT platforms.

Commercial Use: The applications of NFTs extend beyond personal use. The use of NFTs for commercial purposes, including licensing, branding, and marketing, represents a rapidly expanding area with substantial potential for growth. Businesses use NFTs for authenticity verification, limited edition products, and unique customer experiences.

Paragraph Summary: While geographic dispersion suggests a diverse market, the US currently leads in terms of market maturity and infrastructure. Asia displays rapid growth potential with its technologically adept population. Europe shows steady progress, and the fusion of digital paintings and commercial applications continues to fuel significant market expansion. The market's diversity allows for varied approaches to reach different customers.

The NFT art industry's growth is fueled by several catalysts, including the increasing mainstream adoption of blockchain technology, the growing interest in digital ownership and scarcity, the integration of NFTs into the metaverse and virtual worlds, and the ongoing development of new platforms and applications that enhance the usability and accessibility of NFTs. The expanding community of artists, collectors, and developers further supports the industry's continued expansion and innovation.

This report provides a comprehensive overview of the NFT art market, including its trends, driving forces, challenges, key players, and future growth projections. It highlights the key segments and regions expected to dominate the market in the coming years and explores the significant developments shaping the industry. The report provides valuable insights for artists, collectors, investors, and businesses interested in understanding and navigating the evolving landscape of NFT art.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include OpenSea, Rarible, SuperRare, Foundation, Nifty Gateway, Enjin Marketplace, KnownOrigin, Async Art, Mintable, Makers Place, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "NFT Art," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the NFT Art, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.