1. What is the projected Compound Annual Growth Rate (CAGR) of the NFT Art?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

NFT Art

NFT ArtNFT Art by Type (Photos, Videos, Music, Paintings, Others), by Application (Personal Use, Commercial Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

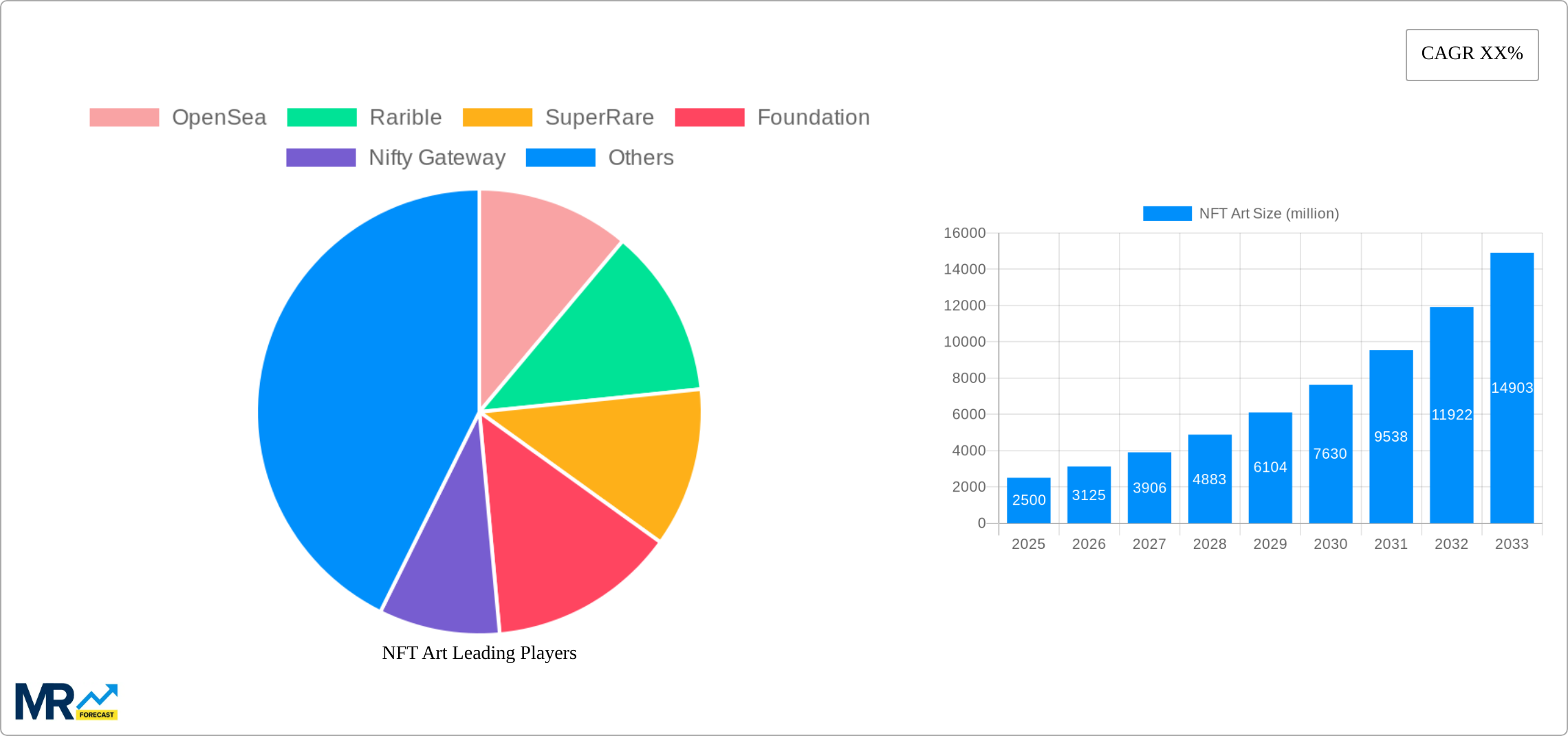

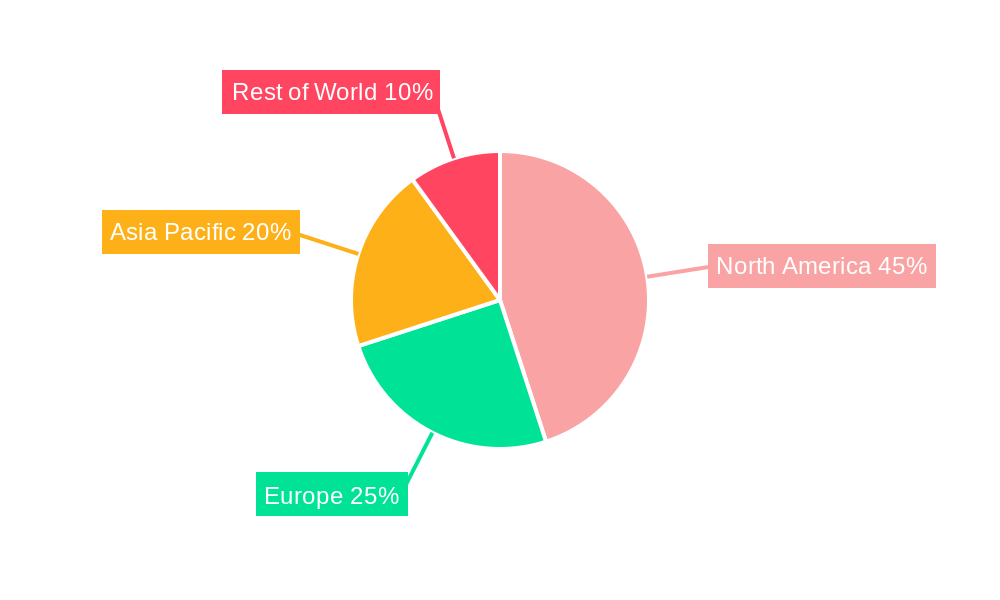

The NFT art market, encompassing digital collectibles like photos, videos, music, and paintings, experienced significant growth between 2019 and 2024. While precise figures for market size and CAGR aren't provided, industry analysis suggests a substantial increase during this period, driven by factors such as increasing digital art adoption, the rise of metaverse platforms, and the growing appeal of blockchain technology for ownership verification and provenance tracking. Key trends observed include the emergence of diverse NFT marketplaces (OpenSea, Rarible, etc.), the integration of NFTs into gaming and virtual worlds (Enjin), and the evolution of innovative NFT formats such as generative art and fractional ownership. However, the market also faces challenges, including volatility in cryptocurrency prices, regulatory uncertainty, and the potential for scams and fraud within the space. The market segmentation highlights a split between personal and commercial use, indicating diverse applications across individual collectors and businesses integrating NFTs into branding or marketing campaigns. The geographical distribution shows strong interest across North America, Europe, and Asia Pacific, with each region exhibiting unique market characteristics and growth potential.

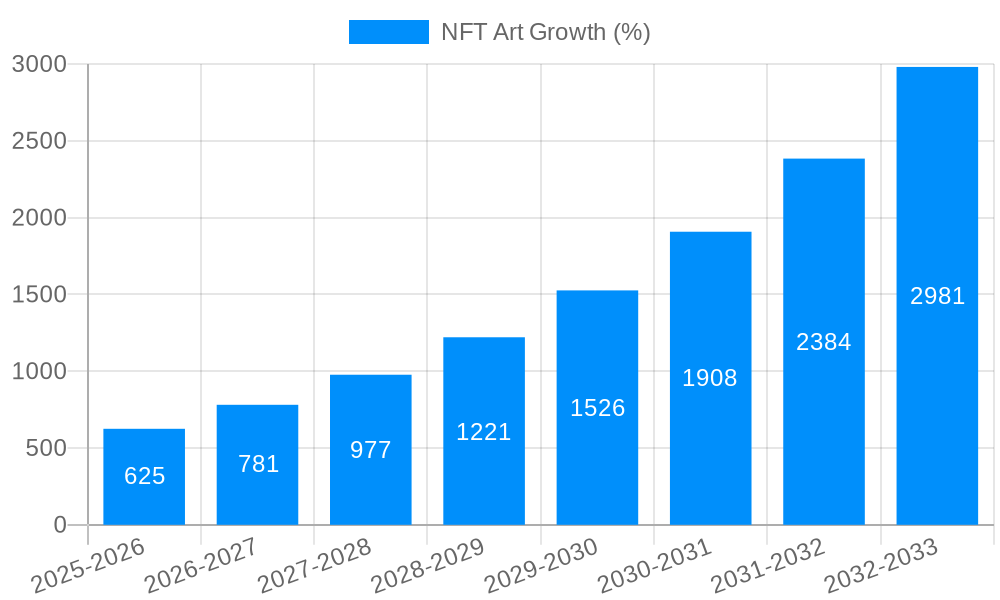

Looking ahead to 2033, the NFT art market is projected to continue expanding, though perhaps at a more moderated pace than its initial explosive growth. Continued technological advancements, increased mainstream adoption, and the development of more robust infrastructure will be key drivers. However, addressing challenges related to environmental concerns (energy consumption of blockchain), copyright issues, and the potential for market manipulation will be crucial for sustainable and responsible growth. The segmentation by art type and application is expected to diversify further, with new forms of digital art and novel use cases emerging. Regional growth will depend on factors such as regulatory frameworks, technological infrastructure, and the level of public awareness and interest in NFTs. The continued success of existing marketplaces and the emergence of new players will shape the competitive landscape in the coming years.

The NFT art market, valued at millions, experienced explosive growth during the study period (2019-2024), transitioning from a niche phenomenon to a mainstream conversation. The historical period (2019-2024) witnessed a surge in both artist adoption and investor interest, fueled by technological advancements and a growing awareness of digital ownership. The base year (2025) marks a crucial point, where market maturity and technological integration are expected to reshape the landscape. While the initial hype cycle has subsided, the market continues to demonstrate resilience. We project robust growth during the forecast period (2025-2033), driven by increasing mainstream acceptance, the evolution of the metaverse, and innovative use cases beyond simple digital art ownership. The estimated year (2025) indicates a market stabilization, with clearer market segmentation emerging based on art type, application, and technological integration. This report analyzes the key market insights driving these trends, examining the interplay between technological innovation, artistic expression, and investor sentiment to provide a comprehensive understanding of this dynamic market. Furthermore, the report considers the impact of fluctuating cryptocurrency values, regulatory uncertainty, and evolving consumer preferences on the long-term prospects of the NFT art market. The transition from purely speculative investment to a more balanced ecosystem of artistic merit and commercial value is a key trend to watch in the years ahead. This shift suggests a growing sophistication within the market, with collectors and artists alike valuing quality and longevity over purely short-term gains. The millions invested in NFT art demonstrate a growing belief in the long-term potential of this digital asset class.

Several factors have converged to propel the NFT art market's growth. Technological advancements, particularly the development of blockchain technology and its capacity to verify and secure digital ownership, provide the foundational underpinning for NFTs. The ease of creating and trading NFTs, coupled with the accessibility of various marketplaces like OpenSea, Rarible, and SuperRare, has democratized access for both artists and collectors. The rise of the metaverse and the increasing integration of NFTs into virtual worlds offers new opportunities for artists to showcase their work and for users to interact with digital art in immersive environments. Additionally, the growing acceptance of cryptocurrencies has further facilitated transactions and increased liquidity within the market. The increasing demand for unique, verifiable digital assets, combined with the growing acceptance of digital art as a legitimate form of artistic expression, underpins the market's ongoing success. The scarcity and exclusivity associated with certain NFTs also contribute to their value, appealing to both art collectors and speculators. Ultimately, the convergence of technology, art, and finance creates a powerful synergy, driving both innovation and market growth. The increasing institutional involvement, albeit still cautious, signals a wider acceptance and growing recognition of NFT art as a significant part of the future digital asset landscape.

Despite the significant growth, the NFT art market faces several challenges. Price volatility remains a major concern, influenced by both market sentiment and the inherent fluctuations in the value of cryptocurrencies. The lack of clear regulatory frameworks poses a significant obstacle, leading to uncertainty and potentially hindering wider adoption. Environmental concerns surrounding the energy consumption of some blockchain networks are also a growing area of criticism, necessitating further development of more sustainable technologies. Moreover, the market is still plagued by issues of fraud and scams, potentially damaging consumer trust and undermining market stability. The high entry barrier for new artists and the difficulty in discerning quality and authentic pieces represent other challenges. The inherent complexity of the technology and the need for specialized knowledge can also limit broader participation. Finally, the lack of a standardized secondary market and the potential for fragmentation across various platforms create challenges for both artists and collectors. Overcoming these challenges requires a collaborative approach from policymakers, technology developers, and market participants to establish a more transparent, sustainable, and accessible ecosystem.

The global NFT art market is geographically diverse, but certain regions and segments are expected to demonstrate stronger growth than others.

Dominating Segments:

Type: Digital paintings and photos currently dominate the market, owing to their relatively straightforward creation and broad appeal. However, videos and music NFTs are expected to witness substantial growth driven by increased integration in the metaverse and immersive experiences.

Application: Commercial use of NFT art is expected to surpass personal use in the long term. Brands are increasingly leveraging NFTs for marketing, loyalty programs, and the creation of unique digital experiences, driving significant market demand. This is fueled by the ability to create exclusive content and engage directly with consumers. Personal use remains significant, but the commercial sector is poised for rapid expansion during the forecast period.

Dominating Regions/Countries (Inferred):

While precise regional dominance fluctuates, areas with strong tech infrastructure, high cryptocurrency adoption, and a thriving creative industry are expected to lead. These include:

United States: The US maintains a strong position due to its established tech sector, venture capital funding, and large creative community.

East Asia (China, Japan, South Korea): Significant early adoption of NFTs and the potential for integration with existing Asian digital entertainment markets point towards strong growth.

Europe (United Kingdom, Germany, France): High levels of internet penetration, significant investment in technology and art, and a burgeoning metaverse sector will contribute to ongoing market development.

The paragraph above highlights that the market's dynamic nature requires continuous monitoring. While some segments are leading currently, the future holds significant potential for others to rise. The synergy between technological innovation, artistic expression, and commercial application is key to understanding regional and segmental dominance within the constantly evolving NFT art landscape. Millions in investments are being strategically allocated to leverage growth opportunities within these key areas.

Several factors will continue to fuel growth within the NFT art industry. The ongoing development of the metaverse provides new platforms for artists to showcase their work and for collectors to interact with digital assets in immersive ways. The increasing integration of NFTs into gaming and other digital experiences broadens market reach and diversifies applications. Furthermore, improved blockchain scalability and energy efficiency will address some of the current environmental concerns and increase overall accessibility. Finally, the emergence of new technological innovations within the NFT space, such as fractional ownership and dynamic NFTs, will continue to drive interest and innovation, further stimulating market growth.

This report offers a comprehensive overview of the NFT art market, encompassing its historical performance, current trends, and future projections. The analysis covers key market drivers, challenges, and growth catalysts, providing insights into both the artistic and commercial aspects of this evolving sector. By examining leading companies, significant developments, and dominant market segments, this report aims to offer a valuable resource for investors, artists, collectors, and anyone interested in the future of digital art and the broader digital asset landscape. The report's findings are based on rigorous market research and analysis, providing a clear and concise view of this fast-paced and innovative market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include OpenSea, Rarible, SuperRare, Foundation, Nifty Gateway, Enjin Marketplace, KnownOrigin, Async Art, Mintable, Makers Place, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "NFT Art," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the NFT Art, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.