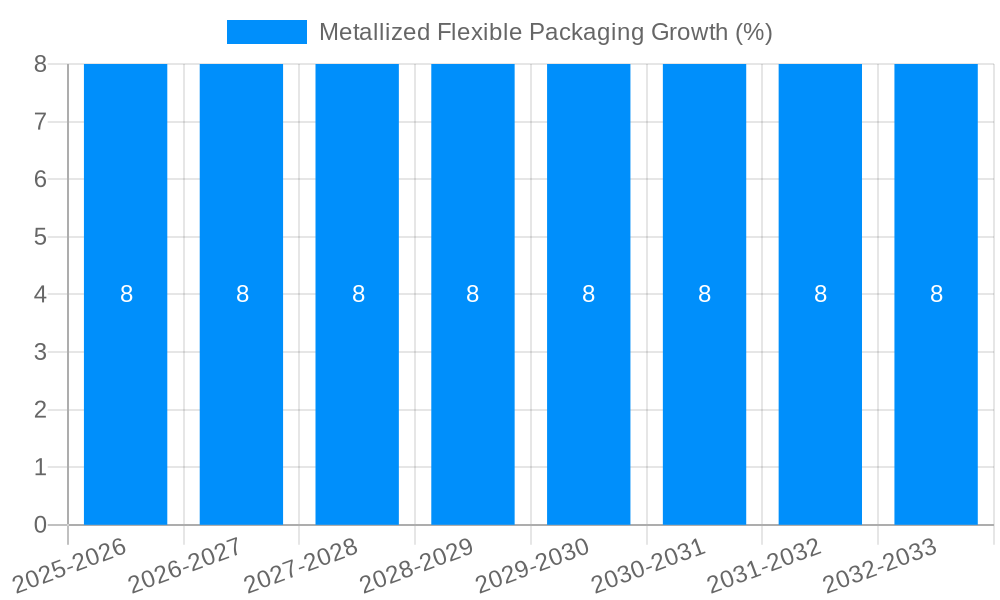

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metallized Flexible Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Metallized Flexible Packaging

Metallized Flexible PackagingMetallized Flexible Packaging by Type (/> Aluminium Foil based Flexible Packaging, Metalized Film Flexible Packaging), by Application (/> Food and Beverages, Personal Care, Pharmaceuticals, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

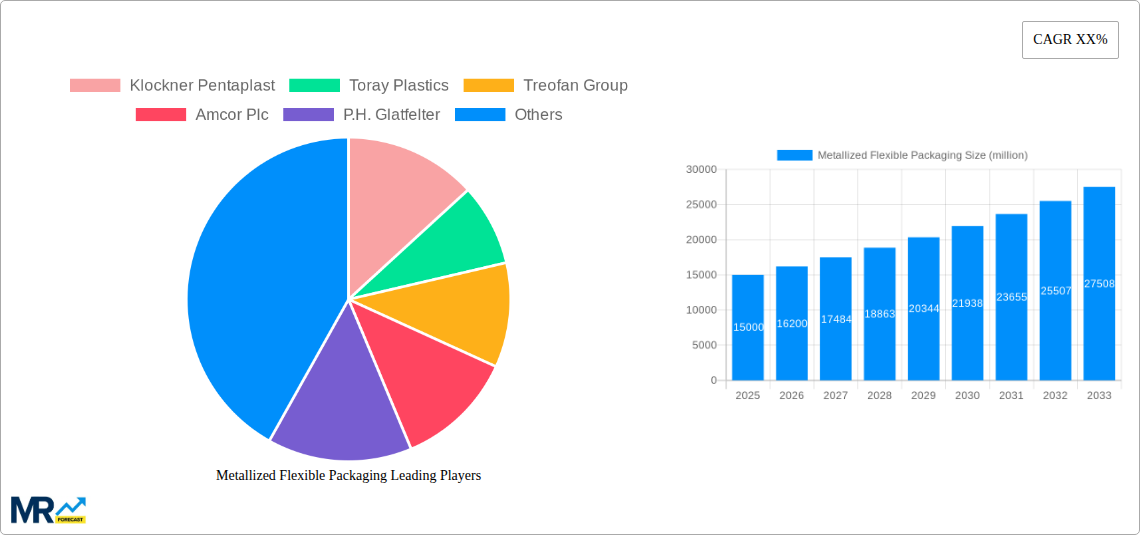

The global Metallized Flexible Packaging market is poised for significant expansion, projected to reach an estimated XXX million in 2025 and exhibit a Compound Annual Growth Rate (CAGR) of XX% through 2033. This robust growth is primarily fueled by the escalating demand for aesthetically appealing, high-barrier packaging solutions across diverse industries. The inherent properties of metallized films, such as enhanced barrier protection against moisture, oxygen, and light, combined with their premium visual appeal, make them an indispensable choice for food and beverage manufacturers seeking to extend product shelf life and attract consumers. The personal care and pharmaceutical sectors are also witnessing a substantial uptake, driven by stringent regulatory requirements for product integrity and a growing consumer preference for sophisticated packaging. Key market drivers include the continuous innovation in material science leading to improved performance characteristics, increasing consumer awareness regarding sustainable packaging options, and the growing e-commerce landscape that necessitates durable and visually appealing packaging for online retail. The market's trajectory indicates a strong preference for metallized flexible packaging that offers a blend of functionality and aesthetic appeal.

Further analysis reveals that the market is segmented by type into Aluminium Foil based Flexible Packaging and Metalized Film Flexible Packaging, with both categories contributing to the overall market dynamism. The application segment is dominated by Food and Beverages, followed by Personal Care and Pharmaceuticals, underscoring the critical role of these packaging solutions in consumer goods. While the market presents a promising outlook, certain restraints such as the fluctuating raw material prices and the increasing competition from alternative packaging materials like advanced polymers and sustainable paper-based solutions need to be strategically addressed by market players. However, ongoing technological advancements in printing, lamination, and material composition are expected to mitigate these challenges. Geographically, Asia Pacific, particularly China and India, is emerging as a high-growth region due to rapid industrialization, a burgeoning middle class, and a significant increase in packaged food consumption. North America and Europe continue to be substantial markets, driven by established industries and a strong consumer demand for premium packaging.

This comprehensive report delves into the dynamic and rapidly evolving global Metallized Flexible Packaging market. Spanning a detailed Study Period from 2019-2033, the analysis leverages a robust Base Year of 2025 and an Estimated Year of 2025 to provide precise market valuations. The Forecast Period from 2025-2033 offers critical forward-looking insights, built upon a thorough examination of the Historical Period from 2019-2024. This report quantifies market size in millions of units, offering actionable data for stakeholders.

The global metallized flexible packaging market is experiencing a significant upswing, driven by a confluence of factors that underscore its growing importance across diverse industries. A pivotal trend observed is the escalating demand for enhanced product protection and extended shelf-life, particularly within the Food and Beverages segment. Metallized films, with their superior barrier properties against oxygen, moisture, and light, are proving indispensable in preserving the freshness and quality of packaged goods, thereby minimizing food waste and meeting consumer expectations for premium products. This efficacy is translating into an increased adoption of metallized solutions for snacks, confectionery, ready-to-eat meals, and beverages. Furthermore, the visual appeal and premium look that metallization imparts to packaging are crucial in a competitive retail landscape. Brands are increasingly leveraging the reflective and aesthetic qualities of metallized films to differentiate their products on shelves, attract consumer attention, and convey a sense of quality and sophistication. This has led to a surge in demand for custom-printed and highly designed metallized packaging. The Personal Care and Pharmaceuticals sectors are also witnessing a parallel growth trajectory. In personal care, metallized packaging enhances the perceived value and protects sensitive formulations from degradation. For pharmaceuticals, the stringent barrier requirements for drug stability and safety make metallized flexible packaging a preferred choice, ensuring efficacy and compliance with regulatory standards. The industry is also characterized by a steady shift towards lighter-weight and more sustainable packaging solutions. While traditional metallized packaging often relies on multi-layer constructions, ongoing research and development are focused on creating thinner yet equally effective metallized films, reducing material usage and transportation costs. The growing environmental consciousness among consumers and stringent regulations are pushing manufacturers to explore innovative metallization techniques and substrate combinations that offer improved recyclability or compostability, albeit challenges remain in achieving widespread circularity for certain metallized structures. The market is also witnessing an increased emphasis on advanced printing technologies and finishing techniques applied to metallized films, allowing for intricate designs, holographic effects, and anti-counterfeiting features, further enhancing the value proposition for end-users.

Several potent forces are actively propelling the growth of the metallized flexible packaging market. Paramount among these is the escalating consumer demand for convenience and extended shelf-life, particularly within the burgeoning Food and Beverages industry. Consumers are increasingly opting for ready-to-eat meals, snacks, and beverages that require robust packaging to maintain freshness, prevent spoilage, and deliver an optimal sensory experience. Metallized flexible packaging, with its exceptional barrier properties against oxygen, moisture, and UV light, directly addresses these needs, significantly extending product shelf-life and reducing food waste. This benefit is invaluable in a global supply chain where products often travel long distances. Moreover, the growing global population and the accompanying rise in disposable incomes in emerging economies are fueling a higher consumption of packaged goods, thereby directly boosting the demand for effective and aesthetically pleasing packaging solutions like metallized films. The intrinsic aesthetic appeal and premium perception that metallized packaging offers are also significant drivers. The reflective and vibrant finish of metallized films helps brands capture consumer attention on crowded retail shelves, enhancing product visibility and contributing to impulse purchases. This visual merchandising advantage is crucial for brand differentiation and market penetration. Furthermore, the stringent quality and safety standards in the Pharmaceuticals sector necessitate packaging that provides an impermeable barrier to protect sensitive drug formulations from environmental degradation and contamination. Metallized flexible packaging meets these rigorous requirements, ensuring drug efficacy and patient safety, thus driving consistent demand from this critical industry. Finally, ongoing innovations in metallization technologies, including thinner film applications and improved adhesion techniques, are making these packaging solutions more cost-effective and versatile, further broadening their application spectrum and market appeal.

Despite its robust growth trajectory, the metallized flexible packaging market faces several significant challenges and restraints that can temper its expansion. A primary concern revolves around the recyclability and end-of-life management of many metallized flexible packaging structures. The complex multi-material nature, often combining plastic films with aluminum layers, makes them difficult to separate and recycle through conventional streams, leading to a higher landfill burden and contributing to environmental pollution. This poses a significant hurdle as regulatory bodies and consumers increasingly prioritize sustainable packaging solutions. The perception of being less environmentally friendly compared to mono-material or easily recyclable alternatives can also lead to market resistance and a preference for substitute materials, particularly in regions with strong environmental regulations and consumer awareness. Another key challenge is the fluctuating raw material costs, especially for aluminum and the various polymers used in the construction of metallized films. Volatility in these commodity prices can directly impact the manufacturing costs of metallized packaging, leading to price instability and affecting the profitability of manufacturers and the affordability for end-users. Furthermore, the technological complexity and investment required for advanced metallization processes can act as a barrier to entry for smaller players, potentially limiting competition and innovation. The specialized equipment and expertise needed for high-quality metallization can also lead to higher production costs, making them less competitive in price-sensitive markets or for certain product categories. The development of alternative high-barrier packaging materials that offer comparable performance with improved sustainability credentials also presents a competitive threat. Innovations in non-metallized barrier films, such as advanced polymer coatings and co-extruded structures, are continuously emerging, offering viable alternatives that may circumvent the recyclability issues associated with metallized films. Finally, stringent regulatory requirements and evolving standards related to food contact, product safety, and environmental impact can necessitate significant investment in research, development, and compliance for manufacturers of metallized flexible packaging.

The global Metallized Flexible Packaging market is poised for significant growth across various regions and segments, with distinct areas expected to lead the charge.

Dominant Regions/Countries:

Asia Pacific: This region is anticipated to be a dominant force in the metallized flexible packaging market.

North America: This region will continue to be a key contributor to the market, driven by advanced manufacturing capabilities and high consumer standards.

Dominant Segments:

Type: Metalized Film Flexible Packaging:

Application: Food and Beverages:

The metallized flexible packaging industry is being propelled forward by several key growth catalysts. The relentless consumer demand for extended shelf-life and superior product protection, particularly in the Food and Beverages sector, remains a primary driver. Innovations in metallization techniques, leading to thinner, more efficient, and potentially more sustainable metallized films, are expanding their applicability and cost-effectiveness. The increasing emphasis on aesthetic appeal and brand differentiation on retail shelves further fuels demand for the premium look and feel that metallized packaging provides. Moreover, the growing pharmaceutical sector's need for high-barrier packaging to ensure drug stability and efficacy continues to be a consistent source of growth.

This report provides an exhaustive examination of the global metallized flexible packaging market, offering a granular analysis across its multifaceted landscape. It meticulously quantifies market size, segmentation, and regional dynamics, utilizing millions of units as a primary metric. The study details key trends, meticulously dissects the driving forces behind market expansion, and critically evaluates the inherent challenges and restraints. Furthermore, it identifies dominant regions, countries, and product segments, providing in-depth explanations supported by market projections. The report also highlights critical growth catalysts and presents a comprehensive list of leading industry players. Significant past developments are cataloged to provide historical context. This holistic approach ensures that stakeholders gain a profound understanding of the current market status, future trajectories, and competitive dynamics, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Klockner Pentaplast, Toray Plastics, Treofan Group, Amcor Plc, P.H. Glatfelter, Verso, Lecta, UPM-Kymmene Oyj, Nissha, Dunmore, SRF, Cosmo Films, Polyplex, Uflex, Jindal Poly Films, Sealed Air, Sonoco Products, Ester Industries, Constantia Flexibles, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Metallized Flexible Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Metallized Flexible Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.