1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Plastic and Metal Gift Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Plastic and Metal Gift Packaging

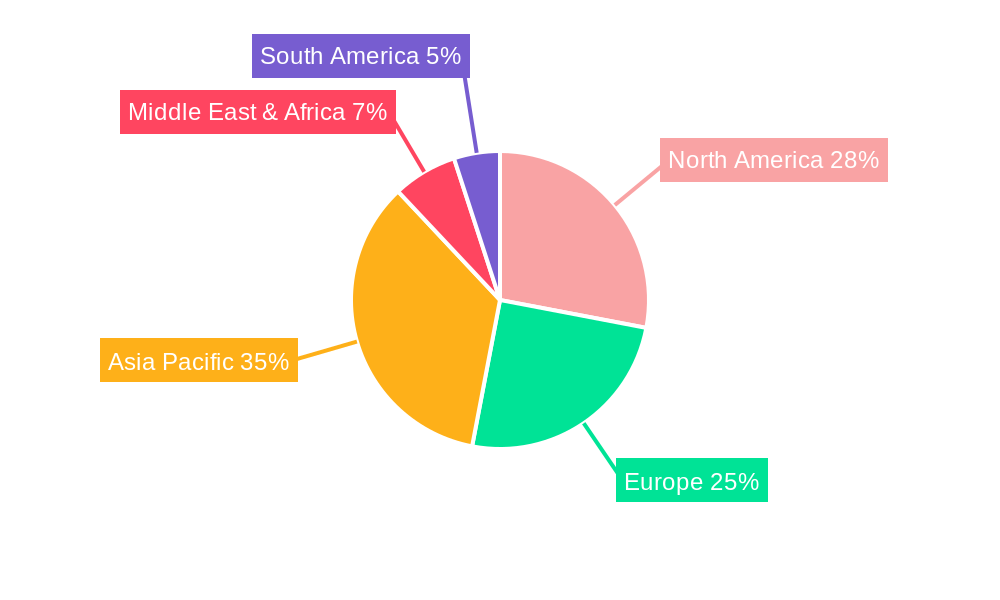

Luxury Plastic and Metal Gift PackagingLuxury Plastic and Metal Gift Packaging by Application (Cosmetics and Fragrances, Confectionery, Premium Alcoholic Drinks, Tobacco, Gourmet Food and Drinks, Watches and Jewellery, Others, World Luxury Plastic and Metal Gift Packaging Production ), by Type (Rigid Packaging, Flexible Packaging, World Luxury Plastic and Metal Gift Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

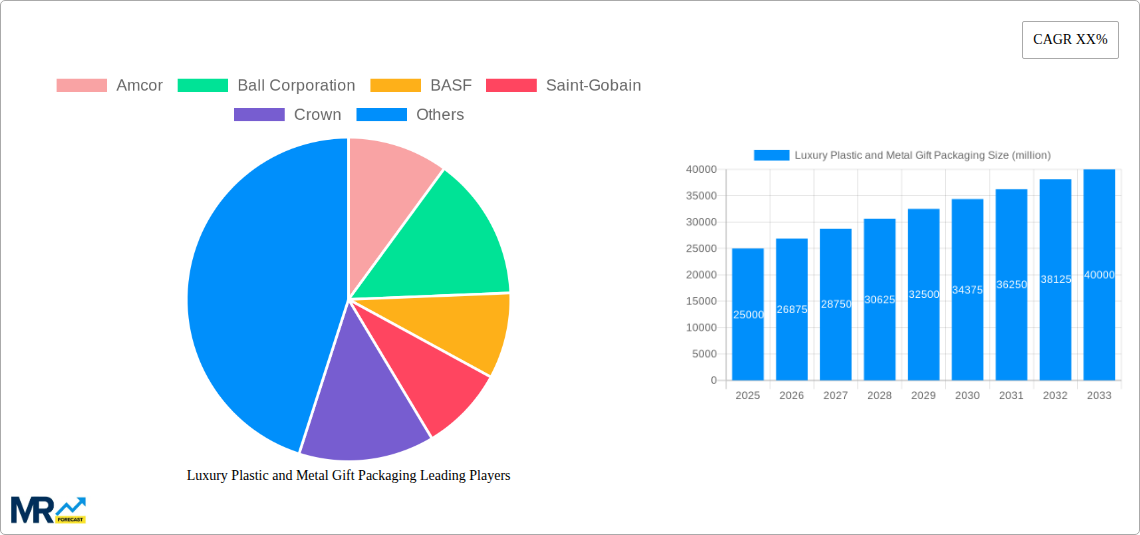

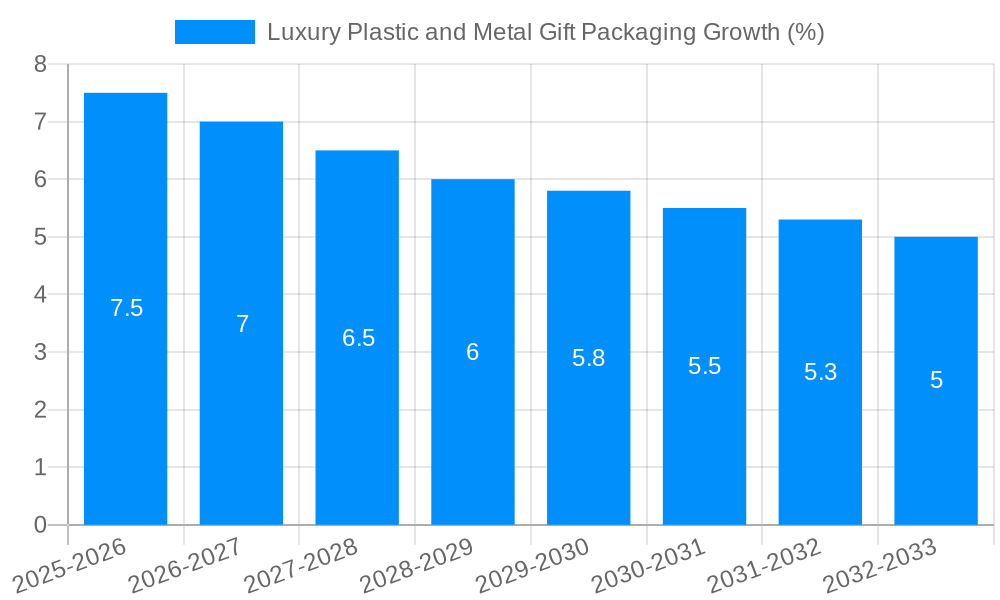

The global luxury plastic and metal gift packaging market is poised for significant growth, driven by an increasing consumer demand for premium and aesthetically pleasing presentation of gifts across various sectors. With a projected market size in the billions of USD and a robust Compound Annual Growth Rate (CAGR) estimated around 6-8%, the industry is benefiting from the rising disposable incomes and a burgeoning culture of gifting, particularly during festive seasons and special occasions. The "experience economy" is also playing a crucial role, where the packaging itself is an integral part of the luxury product's appeal, enhancing brand perception and customer satisfaction. Key applications like cosmetics and fragrances, premium alcoholic beverages, and high-end confectionery are leading this expansion, as brands invest heavily in creating unique and memorable unboxing experiences to differentiate themselves in a competitive landscape. The sophistication and perceived value of plastic and metal packaging, offering both durability and a premium finish, make them the preferred choice for high-value items.

Furthermore, the market is witnessing a notable shift towards sustainable and innovative packaging solutions, even within the luxury segment. While traditional rigid and flexible plastic and metal packaging continue to dominate, there's a growing emphasis on recycled materials, biodegradable options, and minimalist yet elegant designs. Geographically, the Asia Pacific region, particularly China and India, is emerging as a major growth engine due to rapid urbanization and a growing middle class with a penchant for luxury goods. North America and Europe remain substantial markets, characterized by established luxury brands and a sophisticated consumer base that values quality and design. However, the market is not without its challenges. Increasing raw material costs, stringent environmental regulations, and the growing preference for minimalistic packaging in some niche luxury segments could potentially moderate growth. Despite these factors, the overall outlook for luxury plastic and metal gift packaging remains exceptionally positive, fueled by continuous innovation and an enduring consumer desire for exceptional gifting experiences.

This comprehensive report offers an in-depth analysis of the global Luxury Plastic and Metal Gift Packaging market, projecting its trajectory from a historical base in 2019-2024 to an estimated valuation in 2025 and a robust forecast through 2033. The market, currently experiencing significant growth, is expected to witness a substantial expansion, with production volumes reaching hundreds of millions of units by the forecast period. This report delves into the intricate dynamics shaping this lucrative sector, providing actionable insights for stakeholders navigating its evolving landscape.

The study meticulously examines both Rigid Packaging and Flexible Packaging segments, assessing their respective contributions and growth potential. A granular breakdown of key applications, including Cosmetics and Fragrances, Confectionery, Premium Alcoholic Drinks, Tobacco, Gourmet Food and Drinks, and Watches and Jewellery, reveals nuanced market demands and consumer preferences driving packaging innovation. Furthermore, the report investigates the overarching World Luxury Plastic and Metal Gift Packaging Production trends and significant Industry Developments that are redefining the market's future.

Key industry players such as Amcor, Ball Corporation, BASF, Saint-Gobain, Crown, Sonoco Products, Sealed Air Corporation, Mondi Group, Berry Global, Huhtamaki OYJ, Greif, Ardagh, Silgan, Huber Packaging, Kian Joo Group, JL Clark, Avon Crowncaps & Containers, UnitedCan Company, Macbey, William Say, Can Pack Group, HUBER Packaging, and Toyo Seikan are analyzed for their strategic contributions and market positioning. This report is an indispensable resource for manufacturers, suppliers, brand owners, and investors seeking to capitalize on the opportunities within the dynamic luxury gift packaging market.

The global Luxury Plastic and Metal Gift Packaging market is experiencing a paradigm shift, driven by an escalating consumer demand for premium, experiential gifting. In the historical period (2019-2024), the market demonstrated consistent growth, fueled by an increased disposable income and a heightened appreciation for aesthetically pleasing and high-quality packaging. The base year (2025) signifies a crucial inflection point, with production volumes anticipated to reach tens of millions of units, setting the stage for accelerated expansion. The forecast period (2025-2033) projects a CAGR that will push production into the hundreds of millions of units, underscoring the market's robustness. This growth is intrinsically linked to the evolving definition of luxury itself, which now encompasses not just the product but also the entire unboxing experience. Consumers are increasingly willing to invest in packaging that enhances the perceived value of a gift, making it memorable and shareable, particularly across social media platforms.

The primary trend observed is the growing emphasis on sustainability without compromising on luxury. Brands are actively seeking eco-friendly plastic alternatives and recycled or recyclable metal options. This includes the adoption of bioplastics, post-consumer recycled (PCR) plastics, and responsibly sourced aluminum and steel. The integration of sophisticated design elements, such as intricate embossing, metallic finishes, unique textures, and minimalist aesthetics, continues to be paramount. Furthermore, the demand for personalized and customizable packaging solutions is surging, allowing brands to cater to specific gifting occasions and individual preferences. Smart packaging technologies, incorporating features like NFC tags or QR codes for authentication and enhanced consumer engagement, are also gaining traction. The rise of e-commerce has also necessitated the development of robust and aesthetically appealing protective packaging that can withstand transit while maintaining its luxury appeal, leading to innovations in both rigid and flexible formats.

Several powerful forces are propelling the luxury plastic and metal gift packaging market into a new era of growth. The primary driver remains the burgeoning global middle class and the subsequent rise in disposable incomes, particularly in emerging economies. As more consumers enter the luxury segment, their purchasing power for premium gifts, and consequently, the packaging that accompanies them, increases significantly. This is further amplified by a cultural shift towards experiential gifting; consumers are no longer just buying a product but an entire experience. High-quality, aesthetically pleasing, and often reusable packaging plays a pivotal role in crafting this desirable unboxing ritual, making the gift more memorable and shareable, especially across digital platforms.

The ever-evolving demands of key application segments such as Cosmetics & Fragrances, Premium Alcoholic Drinks, and Watches & Jewellery are also critical. These industries inherently associate their products with luxury and exclusivity, and their packaging is a direct extension of their brand identity. The relentless pursuit of brand differentiation in a competitive marketplace compels these sectors to invest heavily in innovative and visually striking packaging solutions that capture attention and convey superior quality. Furthermore, the growing awareness and demand for sustainable luxury are pushing manufacturers to develop eco-conscious yet sophisticated packaging options. This includes the adoption of recycled content, bioplastics, and innovative metal alloys that minimize environmental impact without compromising on the premium feel and functionality required for luxury goods.

Despite its promising growth trajectory, the luxury plastic and metal gift packaging market faces several significant challenges and restraints that could impede its full potential. A primary concern revolves around the increasing scrutiny and regulatory pressures surrounding single-use plastics and their environmental impact. While many luxury applications opt for durable and reusable packaging, the perception and ongoing efforts to reduce plastic waste can create a negative association, even for high-end products. This necessitates significant investment in research and development for sustainable alternatives, which can be costly and may not always meet the desired aesthetic or functional requirements for luxury goods.

The volatility in raw material prices, particularly for metals like aluminum and steel, as well as the fluctuating costs of specialized plastics, presents another considerable restraint. Fluctuations in these commodity prices can significantly impact production costs and, consequently, the final pricing of the packaging, potentially affecting profit margins for manufacturers and the affordability for brands. Furthermore, the sophisticated design and manufacturing processes required for premium packaging often involve higher tooling costs and longer lead times, making it challenging for smaller brands or those with rapidly changing product lines to adopt bespoke luxury packaging solutions. The supply chain disruptions, exacerbated by geopolitical events and global health crises, can also lead to delays and increased costs, impacting the timely delivery of critical packaging components and further complicating market dynamics.

The global luxury plastic and metal gift packaging market is poised for significant growth, with specific regions and application segments set to lead the charge.

Dominant Segments:

Dominant Regions:

The interplay between these dominant segments and regions, driven by consumer aspirations and brand strategies, will shape the overall market landscape. The World Luxury Plastic and Metal Gift Packaging Production is expected to see a collective output reaching hundreds of millions of units by 2033, with these key areas forming the bedrock of this expansion.

Several key factors are acting as potent catalysts for the growth of the luxury plastic and metal gift packaging industry. The persistent rise in global disposable incomes and the expanding middle class in emerging economies are directly translating into increased demand for premium gifting options. Furthermore, a significant cultural shift towards experiential gifting, where the packaging is integral to the overall unboxing experience, is a powerful driver. The intense competition among brands across various luxury sectors necessitates distinctive packaging for brand differentiation and enhanced consumer engagement. Innovations in sustainable materials, coupled with advancements in design and manufacturing technologies, are enabling the creation of more sophisticated and eco-conscious luxury packaging solutions, meeting evolving consumer preferences.

This comprehensive report provides an exhaustive overview of the luxury plastic and metal gift packaging market, encompassing its current status and future potential. It delves deep into the market's intricate workings, offering valuable insights into the driving forces behind its expansion, such as the growing global affluence and the increasing importance of the unboxing experience in luxury gifting. Simultaneously, it thoroughly examines the challenges and restraints that could influence market dynamics, including regulatory pressures on plastics and raw material price volatility. The report meticulously analyzes key regions and dominant segments, highlighting their specific contributions and growth trajectories within the overall World Luxury Plastic and Metal Gift Packaging Production, which is projected to reach hundreds of millions of units by 2033. Furthermore, it identifies crucial growth catalysts and provides an in-depth look at significant industry developments and leading market players, equipping stakeholders with the knowledge necessary to navigate this evolving and lucrative sector effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amcor, Ball Corporation, BASF, Saint-Gobain, Crown, Sonoco Products, Sealed Air Corporation, Mondi Group, Berry Global, Huhtamaki OYJ, Greif, Ardagh, Silgan, Huber Packaging, Kian Joo Group, JL Clark, Avon Crowncaps & Containers, UnitedCan Company, Macbey, William Say, Can Pack Group, HUBER Packaging, Toyo Seikan.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Plastic and Metal Gift Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Plastic and Metal Gift Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.