1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Gift Packaging Boxes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Gift Packaging Boxes

Luxury Gift Packaging BoxesLuxury Gift Packaging Boxes by Application (Cosmetics and Fragrances, Confectionery, Premium Alcoholic Drinks, Tobacco, Gourmet Food and Drinks, Watches and Jewellery, Others, World Luxury Gift Packaging Boxes Production ), by Type (Glass, Metal, Plastic, Textiles, Wood, Others, World Luxury Gift Packaging Boxes Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

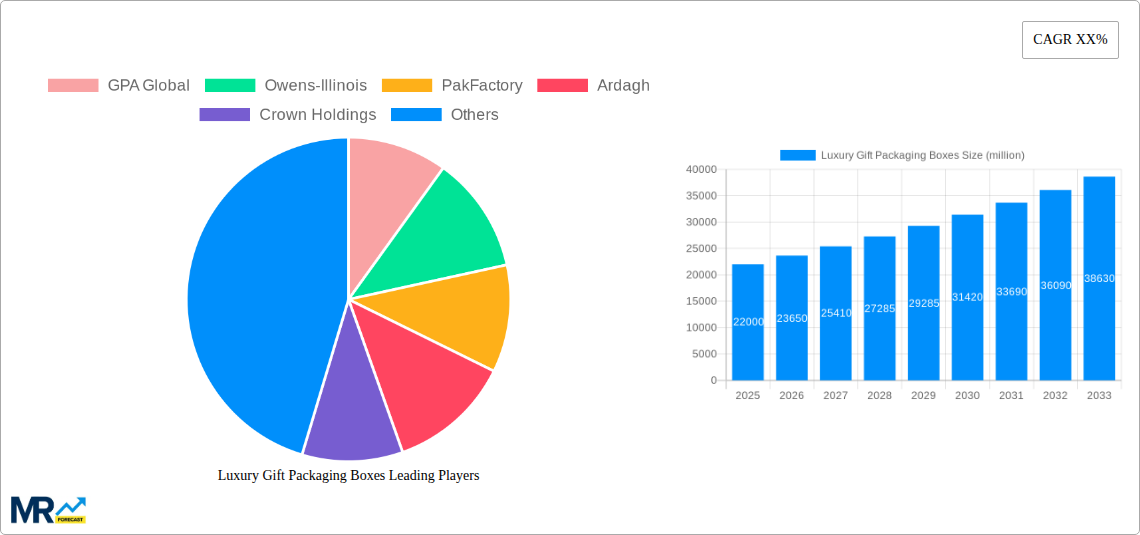

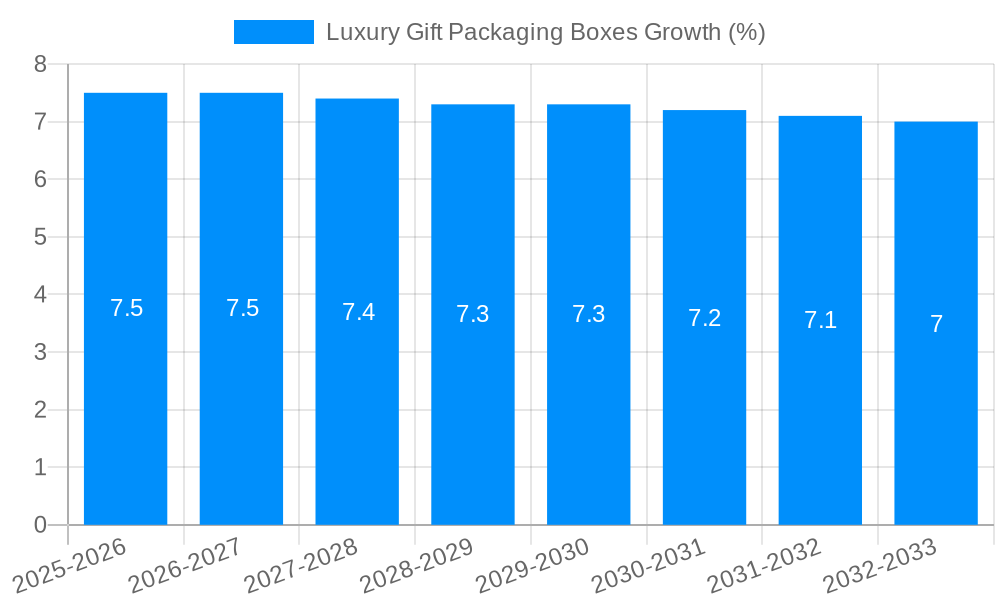

The global market for Luxury Gift Packaging Boxes is poised for substantial growth, projected to reach an estimated market size of $22,000 million by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This upward trajectory is primarily fueled by the escalating consumer demand for premium and aesthetically pleasing packaging that enhances the perceived value of gifts, particularly within the burgeoning luxury goods sector. Key applications driving this expansion include Cosmetics and Fragrances, Confectionery, and Premium Alcoholic Drinks, where the unboxing experience has become as crucial as the product itself. The increasing trend of gifting for special occasions, coupled with a growing disposable income among affluent consumers worldwide, underpins the market's strong performance. Furthermore, the rising importance of sustainability and eco-friendly packaging solutions is shaping product development, with brands increasingly opting for recyclable and biodegradable materials, appealing to environmentally conscious buyers.

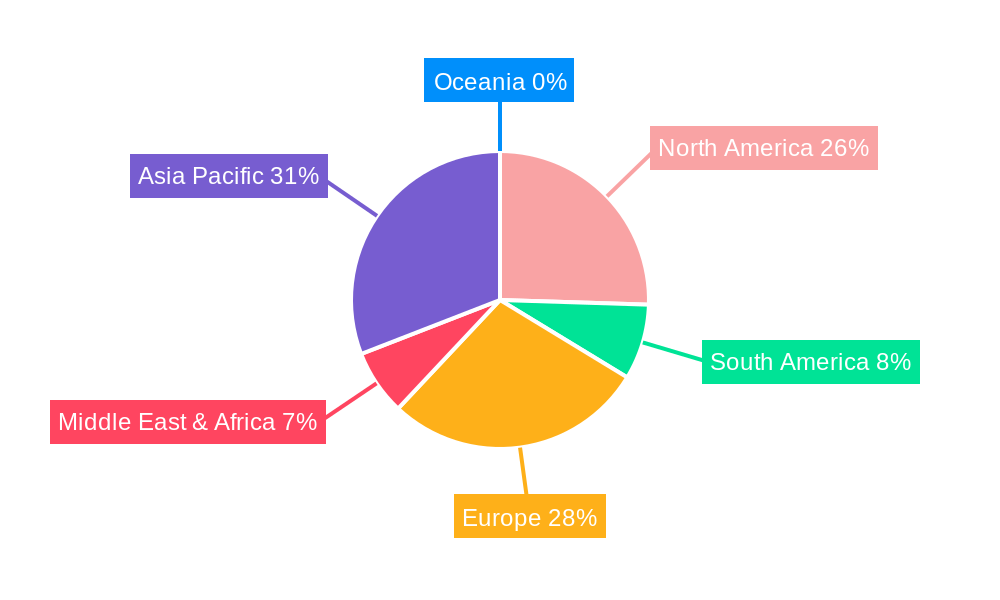

The market is characterized by a diverse range of materials, with Glass, Metal, and Plastic holding significant shares due to their versatility and ability to convey a sense of opulence. However, innovative uses of Textiles and Wood are also gaining traction, offering unique tactile and visual appeal. Geographically, the Asia Pacific region, led by China and India, is emerging as a dominant force, driven by rapid economic development, a growing middle class, and a cultural emphasis on gifting. Europe and North America remain mature yet significant markets, with a strong existing demand for high-end packaging. While opportunities abound, potential restraints include the rising costs of raw materials and production, as well as increasing competition from e-commerce platforms offering standardized shipping solutions. Nevertheless, the continuous innovation in design, personalization, and the integration of smart packaging technologies are expected to further propel market growth and redefine the luxury gift packaging landscape.

Here's a comprehensive report description on Luxury Gift Packaging Boxes, incorporating your specified details:

Report Title: Global Luxury Gift Packaging Boxes Market: Production, Trends, and Forecasts (2019-2033)

Report Overview:

This in-depth report provides a comprehensive analysis of the global luxury gift packaging boxes market, offering detailed insights into production volumes, evolving trends, and future projections. Spanning the historical period of 2019-2024, the base year of 2025, and a robust forecast period from 2025 to 2033, this study meticulously examines the market dynamics. We delve into the intricate factors shaping this premium segment, including key industry developments, emerging technologies, and the competitive landscape. The report quantifies market size in millions of units, providing a clear understanding of production scale and growth trajectories. Furthermore, it dissects the market by application, type, and offers regional insights to equip stakeholders with actionable intelligence for strategic decision-making.

The global luxury gift packaging boxes market is currently witnessing a significant metamorphosis, driven by an increasing consumer demand for experiential unboxing and a heightened emphasis on brand storytelling. XXX, as projected by the base year of 2025, is indicative of a robust market, anticipated to reach millions of units. This trend is intrinsically linked to the burgeoning luxury goods sector, where the packaging is no longer just a protective layer but an integral component of the brand's identity and the overall gifting experience. Sustainable materials are rapidly gaining prominence, with a noticeable shift away from single-use plastics towards recyclable, compostable, and biodegradable alternatives such as premium paperboards, sustainably sourced wood, and innovative textile applications. The aesthetic appeal of these boxes is also evolving; while classic elegance remains a strong contender, there's an increasing adoption of minimalist designs, artisanal craftsmanship, and personalized touches that resonate with the discerning luxury consumer.

Furthermore, the integration of smart technologies, albeit in nascent stages, is beginning to influence the luxury packaging landscape. Features like augmented reality (AR) enabled packaging, which can reveal digital content or brand narratives upon scanning, are starting to appear, offering an enhanced interactive experience. The tactile quality of packaging materials is also becoming paramount, with consumers seeking textures that convey opulence and exclusivity, from soft-touch finishes to embossed patterns and intricate foiling. The influence of e-commerce, while often associated with simpler packaging, is also shaping the luxury segment, necessitating robust yet aesthetically pleasing shipping solutions that maintain the unboxing surprise. This means that even for online purchases, the inner luxury gift box is designed to impress, often accompanied by protective yet premium outer packaging. The strategic use of color palettes, sophisticated typography, and unique structural designs are key differentiators that brands are leveraging to capture consumer attention and foster brand loyalty within this highly competitive market. The increasing sophistication of printing techniques, allowing for intricate details and vibrant finishes, further amplifies the visual appeal and perceived value of these luxury containers. This dynamic evolution underscores the packaging's role as a silent ambassador of luxury, contributing significantly to the perceived value and desirability of the enclosed gift.

Several potent forces are synergistically driving the expansion of the luxury gift packaging boxes market. Foremost among these is the escalating disposable income and the growing affluence of consumers worldwide, particularly in emerging economies. This financial uplift translates into a greater propensity to indulge in premium gifting, where the packaging plays a crucial role in signifying the gift's value and the giver's thoughtfulness. The burgeoning global luxury goods industry, encompassing everything from high-end cosmetics and fragrances to premium alcoholic beverages and fine jewelry, provides a constant and expanding demand for sophisticated packaging solutions. As brands within these sectors strive to differentiate themselves in a crowded marketplace, exceptional packaging becomes a critical tool for capturing consumer attention and reinforcing brand prestige.

Moreover, the increasing pervasiveness of social media and the culture of "unboxing" have transformed packaging from a functional necessity into a shareable experience. Consumers are more likely to document and share visually appealing and creatively designed luxury gift boxes online, acting as organic marketing for both the product and its packaging. This phenomenon incentivizes brands to invest more heavily in innovative and aesthetically pleasing packaging to garner social media buzz and enhance brand visibility. The rise of personalized gifting, where consumers seek unique and tailored presents, also fuels demand for customizable luxury packaging options that can be adapted to individual preferences and special occasions. This personalized approach further elevates the perceived value of the gift and strengthens the emotional connection between the consumer, the brand, and the occasion.

Despite the robust growth trajectory, the luxury gift packaging boxes market faces several significant challenges and restraints that could temper its expansion. A primary concern revolves around the increasing environmental consciousness of consumers and regulatory bodies. The perception of luxury often clashes with sustainability, as traditional luxury packaging materials can be perceived as wasteful or environmentally detrimental. This is leading to growing pressure on manufacturers to adopt eco-friendly materials and production processes, which can sometimes be more expensive and require significant investment in research and development for innovative sustainable solutions. Navigating this balance between luxury aesthetics and genuine environmental responsibility is a delicate act for brands.

Furthermore, the rising costs of raw materials, including premium paperboards, high-quality plastics, metals, and specialized textiles, directly impact the production costs of luxury packaging. Fluctuations in global commodity prices, supply chain disruptions, and geopolitical uncertainties can further exacerbate these cost pressures, potentially leading to price increases that could affect affordability for some consumers or necessitate a reduction in packaging embellishments. The complexity of designing and manufacturing intricate luxury packaging, often involving specialized finishes, intricate structural designs, and artisanal touches, also contributes to higher production costs and longer lead times. This can be a restraint in situations requiring rapid turnaround or high-volume production.

Moreover, counterfeiting remains a persistent challenge within the luxury goods sector, and packaging can be a target for counterfeiters. Developing sophisticated anti-counterfeiting measures within packaging, while maintaining aesthetic appeal and cost-effectiveness, presents an ongoing hurdle for legitimate manufacturers and brands. The logistics of transporting fragile and often bulky luxury packaging can also incur significant costs and pose risks of damage, especially for global distribution networks. Finally, the discerning nature of the luxury consumer means that any perceived misstep in packaging quality, design, or sustainability can have a disproportionately negative impact on brand perception and sales, demanding constant innovation and meticulous attention to detail.

The Cosmetics and Fragrances segment, within the Application category, is poised to be a dominant force in the global luxury gift packaging boxes market, driven by its inherent association with indulgence, self-care, and gifting. Consumers in this segment are highly receptive to visually appealing and tactile packaging that enhances the sensory experience of the product. The constant innovation in product launches, seasonal collections, and limited editions within the cosmetics and fragrances industry necessitates a continuous demand for fresh and captivating packaging designs. The inherent desire to impress and delight recipients makes luxury packaging a non-negotiable aspect of high-value beauty and scent products.

Regionally, North America and Europe are expected to continue their dominance in the luxury gift packaging boxes market, owing to their established luxury consumer bases and the presence of leading luxury brands.

Within the Type category, Textiles and Wood are emerging as significant contributors to the luxury gift packaging boxes market, particularly in niche applications and for brands emphasizing artisanal quality and eco-consciousness.

The interplay between these dominant application and regional segments, coupled with innovative material choices, will shape the future landscape of the luxury gift packaging boxes market, with projections indicating continued growth in millions of units as consumer preferences evolve.

The luxury gift packaging boxes industry is experiencing robust growth fueled by several key catalysts. The escalating affluence and increasing disposable incomes globally are directly translating into a higher demand for premium gifting experiences, where packaging is paramount. Furthermore, the booming e-commerce sector, while presenting logistical challenges, also necessitates innovative and protective luxury packaging that maintains the surprise and delight of the unboxing moment for online luxury purchases. The rising influence of social media and the "unboxing" trend encourage brands to invest in visually stunning and shareable packaging, acting as powerful organic marketing tools. Finally, a growing consumer preference for personalized and unique gifts is driving demand for customizable luxury packaging options that cater to individual tastes and special occasions.

This comprehensive report offers an unparalleled deep dive into the global luxury gift packaging boxes market, providing an exhaustive analysis that caters to a wide array of stakeholders. From manufacturers and suppliers to brands and investors, the report equips readers with actionable intelligence for strategic planning and market positioning. The study encompasses detailed market segmentation by application (Cosmetics and Fragrances, Confectionery, Premium Alcoholic Drinks, Tobacco, Gourmet Food and Drinks, Watches and Jewellery, Others) and by type (Glass, Metal, Plastic, Textiles, Wood, Others), offering a granular understanding of segment-specific trends and growth potentials. Its coverage extends to an in-depth analysis of key regional markets, identifying dominant geographies and emerging opportunities. The report quantifies market sizes in millions of units, providing a clear picture of production volumes and future forecasts from 2019 to 2033, with a focused analysis on the base year of 2025. Additionally, it explores significant industry developments, technological advancements, and the competitive landscape, featuring leading players in the market. This holistic approach ensures that readers gain a thorough understanding of the market's past performance, present dynamics, and future trajectory, enabling informed decision-making in this dynamic and evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GPA Global, Owens-Illinois, PakFactory, Ardagh, Crown Holdings, Amcor, Progress Packaging, HH Deluxe Packaging, Prestige Packaging, Pendragon Presentation Packaging, Luxpac, Print & Packaging, Tiny Box Company, B Smith Packaging, Taylor Box Company, Pro Packaging, Rombus Packaging, Stevenage Packaging, Clyde Presentation Packaging, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Gift Packaging Boxes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Gift Packaging Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.