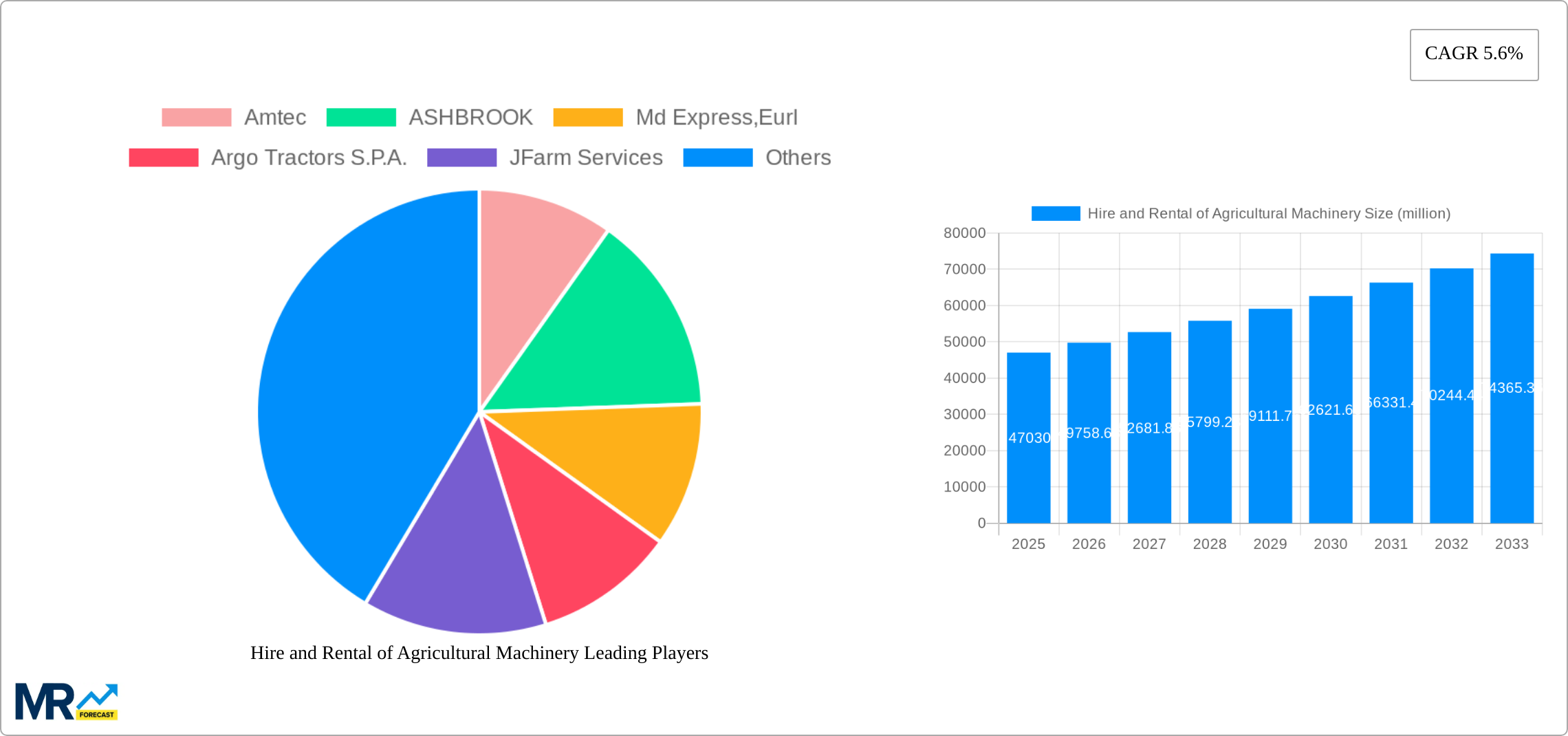

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hire and Rental of Agricultural Machinery?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Hire and Rental of Agricultural Machinery

Hire and Rental of Agricultural MachineryHire and Rental of Agricultural Machinery by Type (Financial Leasing Model, Operating Leasing Model), by Application (Farm, Personal), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

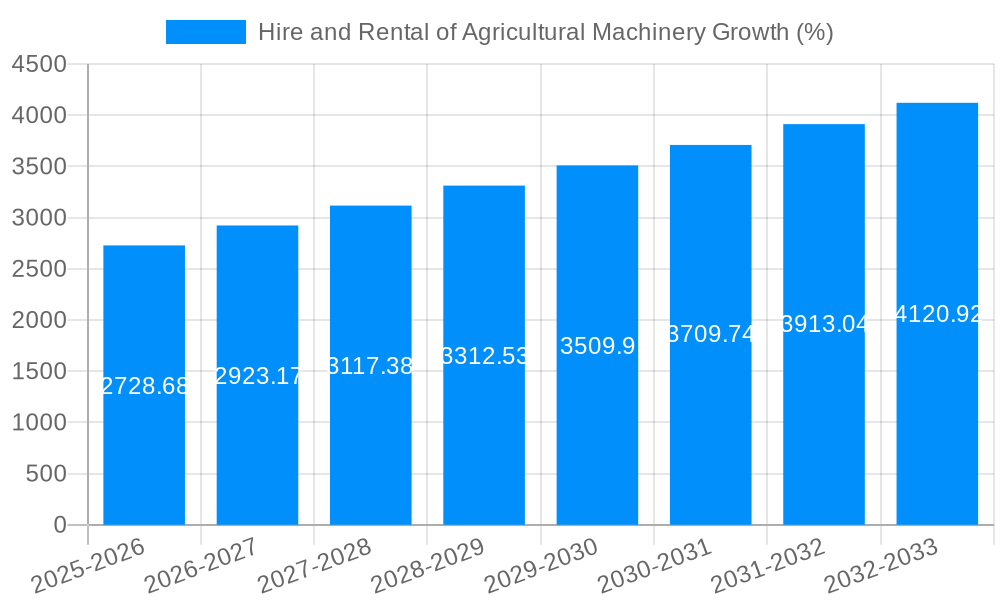

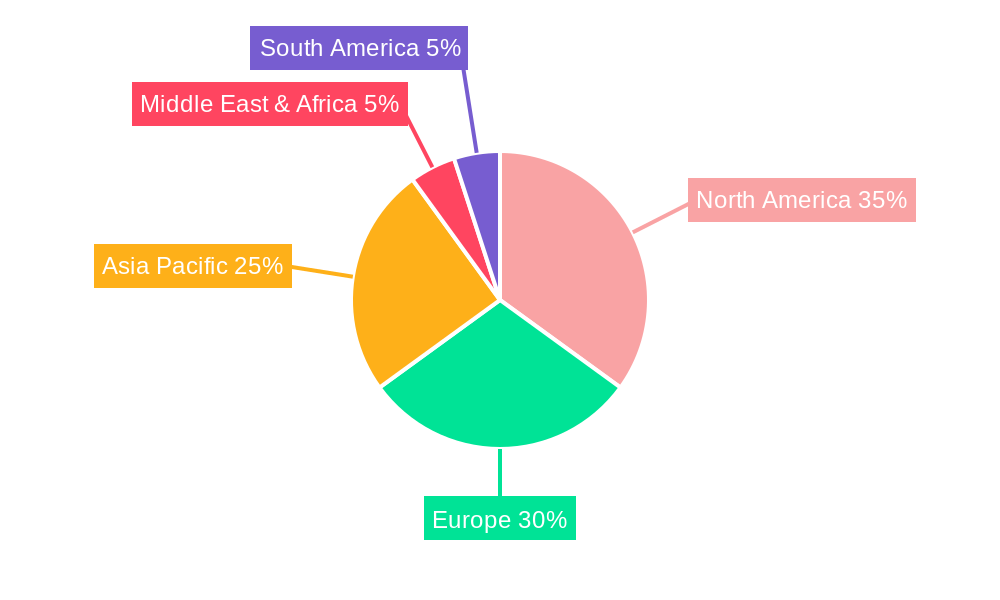

The global market for hire and rental of agricultural machinery is experiencing robust growth, projected to reach \$47.03 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. This expansion is driven by several factors. Firstly, the increasing demand for efficient and cost-effective farming practices encourages farmers to rent specialized machinery instead of making significant capital investments. Secondly, technological advancements leading to the availability of high-tech equipment with advanced features are driving rental demand. This allows farmers to access cutting-edge technology without the burden of large upfront costs and maintenance responsibilities. Thirdly, the growing global population and consequent need for increased food production are bolstering the market. Smaller farms and those lacking the financial resources to buy expensive machinery benefit most from rental services. The market is segmented by leasing model (financial and operating) and application (farm and personal use), with the farm segment dominating. Key players like John Deere, CNH Industrial, Kubota, and Mahindra & Mahindra are leveraging their established networks and brand recognition to solidify their market presence, while smaller regional players cater to specific needs and geographic areas. The market's geographical spread is substantial, with North America and Europe currently holding significant shares due to high agricultural productivity and adoption of advanced technologies. However, developing economies in Asia-Pacific and parts of Africa are exhibiting significant growth potential, driven by rising agricultural activity and government support for modernization initiatives.

The continuous improvement in rental services, encompassing convenient access, timely delivery, and comprehensive maintenance packages, is further fostering market expansion. Furthermore, the integration of technology, such as precision agriculture tools and GPS-guided machinery, available via rental, enhances operational efficiency and yield for farmers, making rental an attractive proposition. While the initial investment in machinery for rental companies might present a challenge, the long-term return on investment and the increasing demand for efficient farming practices are likely to outweigh the risks. The competitive landscape is characterized by a mix of large multinational corporations and specialized regional players, indicating an ongoing process of consolidation and diversification within the industry. The predicted growth trajectory suggests that the hire and rental of agricultural machinery will remain a dynamic and profitable sector within the broader agricultural technology landscape.

The global hire and rental market for agricultural machinery is experiencing robust growth, projected to reach XXX million units by 2033. This expansion is fueled by several key factors. Firstly, the increasing adoption of precision farming techniques necessitates access to specialized equipment that many farmers cannot afford to purchase outright. The rental model provides a cost-effective solution, allowing farmers to utilize advanced technology without significant capital investment. Secondly, fluctuating crop prices and economic uncertainties make owning expensive machinery a risky proposition. Rental agreements provide farmers with flexibility, allowing them to adjust their equipment needs based on seasonal demands and market conditions. This reduces financial burdens and minimizes the risk of asset devaluation. Thirdly, the growth of contract farming and large-scale agricultural operations further enhances the demand for rental services. These large-scale operations often require significant equipment but prefer to rent rather than buy, allowing for better capital management. Finally, technological advancements in agricultural machinery are leading to more efficient and specialized equipment, much of which is made available through rental. This facilitates the adoption of innovation within the industry, driving overall productivity. The historical period (2019-2024) saw steady growth, with the base year (2025) representing a significant inflection point, indicating a market poised for accelerated expansion during the forecast period (2025-2033). The operating leasing model currently holds a larger market share, driven by its accessibility and flexibility; however, financial leasing is gaining traction due to its potential long-term cost advantages for larger farms.

Several key factors are propelling the growth of the agricultural machinery hire and rental market. Firstly, the rising global population and increasing demand for food are driving the need for efficient and advanced agricultural practices. This necessitates the use of specialized machinery, often beyond the financial reach of smaller farms. Rental provides a viable alternative. Secondly, government initiatives and subsidies aimed at promoting agricultural modernization and technological adoption are creating a favorable environment for the rental industry. These programs often incentivize the use of modern equipment, indirectly stimulating demand for rental services. Thirdly, the increasing availability of technologically advanced machinery, including GPS-guided equipment and precision farming tools, available through rental schemes makes it easier for farmers to adopt cutting-edge technologies and enhance productivity without massive upfront investment. Lastly, the rise of specialized rental companies offering comprehensive services, including maintenance, repair, and operator training, makes the rental process more efficient and attractive to farmers. These factors together create a supportive ecosystem for sustained growth in this sector.

Despite the strong growth potential, several challenges hinder the expansion of the agricultural machinery rental market. Firstly, high initial investment costs for rental companies, especially for technologically advanced equipment, create a significant barrier to entry. This can limit competition and potentially result in higher rental rates. Secondly, the seasonal nature of agricultural activities can lead to fluctuating demand, making it difficult for rental companies to optimize their equipment utilization throughout the year. This can affect profitability. Thirdly, the risk of equipment damage or theft presents a significant challenge to rental businesses, requiring robust insurance and risk management strategies to mitigate losses. Lastly, the lack of skilled operators familiar with the advanced technology in some rented machinery can create a hurdle for farmers. Addressing these challenges requires a multi-pronged approach involving technological advancements, financial support, and skills development programs.

The North American and European markets are currently dominating the hire and rental market for agricultural machinery, driven by high adoption rates of advanced technologies and the presence of well-established rental companies. However, the Asia-Pacific region is experiencing rapid growth, especially in countries like India and China, fueled by increasing agricultural output and government support.

Dominant Segment: The Operating Leasing Model currently holds the larger market share. This is because it offers flexibility and lower upfront costs, making it particularly attractive to smaller farmers who may only need equipment seasonally. The financial leasing model is anticipated to gain traction in the coming years, particularly among larger farms or farming corporations, due to its long-term cost efficiency benefits.

Dominant Application: The Farm application segment undeniably dominates the market, driven by the vast need for machinery across various farming activities. While personal and industrial applications exist, they are considerably smaller in scale compared to the core farm sector.

The paragraph below explains these points in detail:

The dominance of North America and Europe stems from advanced agricultural practices, higher disposable incomes, and robust infrastructure supporting rental operations. However, the rapid growth in Asia-Pacific reflects the increasing mechanization of agriculture, particularly in developing economies. This trend is likely to continue, with Asia-Pacific emerging as a major growth driver in the coming years. The operating leasing model's popularity arises from its ease of access and customized rental periods, appealing to farmers with varying seasonal needs. The financial leasing model, while gaining traction among larger operators, still faces a relatively higher barrier to entry due to its long-term financial commitments. The farm application segment’s dominance is self-evident, with specialized equipment designed for planting, harvesting, and other agricultural activities comprising the majority of the rental market.

The continued growth of the hire and rental agricultural machinery industry is fueled by several factors: increasing demand for food production globally, government initiatives promoting agricultural technology adoption, the rising popularity of precision farming techniques, and the cost-effectiveness of rental compared to outright purchase, particularly in the face of economic uncertainty. Technological advancements in machinery design and efficiency further enhance the appeal of rental options.

This report offers a comprehensive analysis of the hire and rental market for agricultural machinery, including detailed market sizing, segmentation, growth drivers, and challenges. The report provides valuable insights into key market trends, leading players, and future growth opportunities, helping stakeholders to make informed business decisions in this dynamic sector. Detailed historical data (2019-2024), base-year (2025) estimates, and forecast projections (2025-2033) are included to offer a holistic view of the market’s evolution.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Amtec, ASHBROOK, Md Express,Eurl, Argo Tractors S.P.A., JFarm Services, Ben Burgess, Pacific Ag Rentals, CNH industrial NV, John Deere, Dieci S.R.L., Sunbelt Rentals, Mahindra&Mahindra Ltd., Farmease, The Papé Group, Inc, Titan Machinery, KUBOTA Corporation, AGCO Corporation, Friesen Sales & Rentals, .

The market segments include Type, Application.

The market size is estimated to be USD 47030 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Hire and Rental of Agricultural Machinery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Hire and Rental of Agricultural Machinery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.