1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Tractor Rental?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Agricultural Tractor Rental

Agricultural Tractor RentalAgricultural Tractor Rental by Type (Low- Powered Engines, High- Powered Engines), by Application (Farmland, Pasture, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

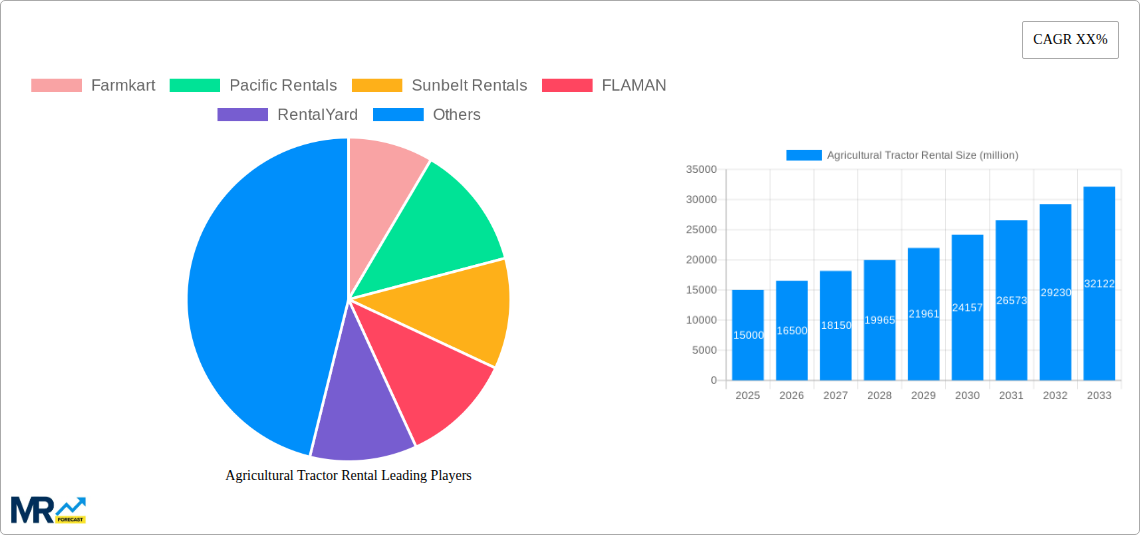

The global agricultural tractor rental market is experiencing robust growth, driven by increasing demand for efficient farming practices and rising land costs. The market, estimated at $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033, reaching approximately $28 billion by 2033. This growth is fueled by several key factors. Firstly, the rising popularity of precision agriculture and the adoption of technology-driven farming methods are boosting the demand for rental tractors equipped with advanced features. Secondly, the increasing number of small and medium-sized farms, particularly in developing economies, are opting for rental services rather than purchasing expensive equipment outright. This trend reduces upfront capital investment and operational costs. Furthermore, the growing awareness of sustainable farming practices is also contributing to market expansion as rental companies offer a more environmentally friendly option, allowing farmers to access modern, fuel-efficient tractors without the long-term commitment of ownership. The market is segmented by tractor power (low and high) and application (farmland, pasture, and others), with farmland currently dominating. Key players in the market include Farmkart, Pacific Rentals, Sunbelt Rentals, and others, leveraging their extensive networks and diverse fleet offerings to cater to diverse farming needs. Geographical expansion is also a prominent factor, with North America and Europe currently leading the market, but significant growth potential exists in rapidly developing economies of Asia-Pacific and South America. However, factors like fluctuating fuel prices and seasonal variations in demand could pose challenges to sustained growth.

The competitive landscape is characterized by both large multinational rental companies and smaller, regional players. Companies are focusing on expanding their service offerings, including maintenance and repair services, to enhance customer satisfaction and build long-term relationships. Technological advancements like telematics and remote monitoring are also playing a crucial role in optimizing equipment utilization and reducing downtime. Future growth will likely be influenced by government policies promoting sustainable agriculture, technological innovation in tractor design and functionalities, and the overall economic conditions affecting the agricultural sector. The rental market is expected to continue to adapt to evolving farmer needs and technological advancements, leading to further market expansion and consolidation in the coming years.

The global agricultural tractor rental market is experiencing robust growth, projected to reach multi-million unit figures by 2033. Driven by increasing demand for efficient farming practices and the rising cost of purchasing new tractors, the rental model offers farmers greater flexibility and cost-effectiveness. The historical period (2019-2024) witnessed a steady increase in rentals, particularly among smaller farms and those undertaking seasonal operations. The base year (2025) shows a significant market expansion, reflecting the industry's ongoing consolidation and the entry of new players offering diverse rental options. The forecast period (2025-2033) predicts continued market expansion, fueled by technological advancements in tractor technology and the increasing adoption of precision agriculture techniques. This growth is further supported by favorable government policies promoting sustainable agricultural practices and the increasing availability of online platforms for tractor rental bookings. The market is segmented by tractor power (low and high), application (farmland, pasture, others), and geographical region, allowing for a granular understanding of market dynamics. Key trends include the rising popularity of rental subscription models, the integration of telematics for tractor monitoring and maintenance, and a growing focus on providing comprehensive service packages alongside tractor rentals. The market’s competitive landscape is relatively fragmented, with both large multinational players and smaller, regional operators vying for market share. However, a trend towards consolidation is discernible as larger companies acquire smaller businesses to achieve economies of scale. This consolidation, combined with technological advancements, is driving the market towards increased efficiency and professionalism.

Several factors are propelling the growth of the agricultural tractor rental market. Firstly, the high initial cost of purchasing new tractors presents a significant barrier to entry for many farmers, particularly small-scale operations. Renting offers a viable alternative, allowing farmers to access the necessary equipment without a substantial upfront investment. Secondly, the seasonal nature of many agricultural activities means that tractors are often underutilized for extended periods. Rental allows farmers to access equipment only when needed, avoiding the expense of owning and maintaining idle machinery. Technological advancements in tractor technology, including precision agriculture features and GPS-guided systems, are increasing the demand for modern tractors, but the high cost of these advanced machines makes rental a more attractive option for farmers seeking these benefits. Government initiatives and subsidies aimed at promoting sustainable agricultural practices and encouraging the adoption of modern farming technologies also contribute to increased rental demand. Lastly, the growth of online platforms dedicated to agricultural equipment rentals is streamlining the booking process and making it easier for farmers to access rental services. This increased accessibility is significantly driving market expansion, especially in regions with limited access to traditional equipment rental channels.

Despite the significant growth potential, several challenges restrain the agricultural tractor rental market. One major challenge is the seasonal nature of demand, which can lead to fluctuating revenue streams for rental companies. Effectively managing inventory and balancing supply and demand across different seasons requires sophisticated logistics and forecasting capabilities. Furthermore, the risk of equipment damage or theft is a significant concern for rental businesses, requiring stringent insurance policies and robust risk management strategies. Competition from established agricultural equipment dealerships and the emergence of new players in the rental market also adds to the challenges. Maintaining a competitive pricing strategy while ensuring profitability requires a deep understanding of market dynamics. Additionally, the need for skilled technicians to maintain and repair rented tractors can pose a significant challenge, particularly in areas with limited access to qualified personnel. Finally, ensuring the efficient and timely delivery and pick-up of rental equipment adds logistical complexity to the operation, impacting overall efficiency and customer satisfaction.

The agricultural tractor rental market displays significant regional variations in growth potential. North America and Europe currently hold substantial market shares, driven by high levels of agricultural mechanization and the presence of established rental companies. However, rapidly developing economies in Asia, particularly India and China, are emerging as significant growth markets due to the expanding agricultural sector and increasing demand for efficient farming techniques. Within the market segmentation, the high-powered engine segment is expected to dominate due to the increasing adoption of large-scale farming practices and the demand for tractors capable of handling heavy workloads in diverse applications such as plowing extensive farmlands and transporting heavy agricultural produce. The farmland application segment also holds a significant portion of the market share due to the dominance of field crop production in many agricultural regions.

The combination of high-powered engines and farmland applications represents the most lucrative segment, exhibiting the highest growth potential. These tractors are essential for large-scale operations and contribute significantly to overall agricultural productivity. The need for high efficiency and output in extensive farming operations makes this segment crucial for sustainable agriculture growth.

Several factors are catalyzing growth within the agricultural tractor rental industry. Technological advancements, such as precision farming technologies integrated into tractors, are driving demand. The rising cost of tractor ownership and the benefits of flexible rental options make it an attractive choice for farmers. Increasing government support for sustainable agriculture also plays a significant role, while the expanding online presence of rental platforms is simplifying access for farmers. The rise of agritech solutions and a growing focus on improving agricultural efficiency through advanced equipment are also contributing factors to the industry’s expansion.

This report provides a detailed analysis of the agricultural tractor rental market, covering market trends, drivers, challenges, and key players. It offers a comprehensive overview of the industry's current state and future growth potential, including detailed segment analysis by tractor power, application, and geographic region. The report analyzes historical data, current market dynamics, and future projections, providing valuable insights for stakeholders involved in the agricultural equipment rental sector. The information included supports strategic decision-making regarding investments, market entry, and competitive strategies within the growing agricultural tractor rental market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Farmkart, Pacific Rentals, Sunbelt Rentals, FLAMAN, RentalYard, TotalRental, Papé Machinery Agriculture & Turf, Xtreme Returns Farms, Ag-Pro, Kelly Tractor, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Agricultural Tractor Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Agricultural Tractor Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.