1. What is the projected Compound Annual Growth Rate (CAGR) of the High Barrier Flexible Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High Barrier Flexible Packaging

High Barrier Flexible PackagingHigh Barrier Flexible Packaging by Type (Aluminum Packaging, Plastic Packaging, Paper Packaging), by Application (Food, Beverage, Personal Care Products, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

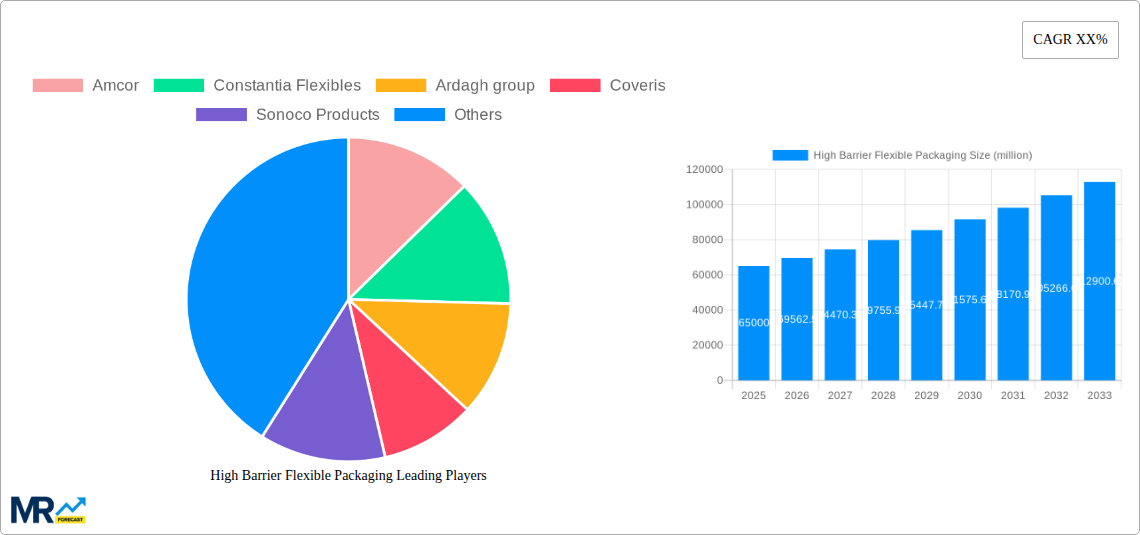

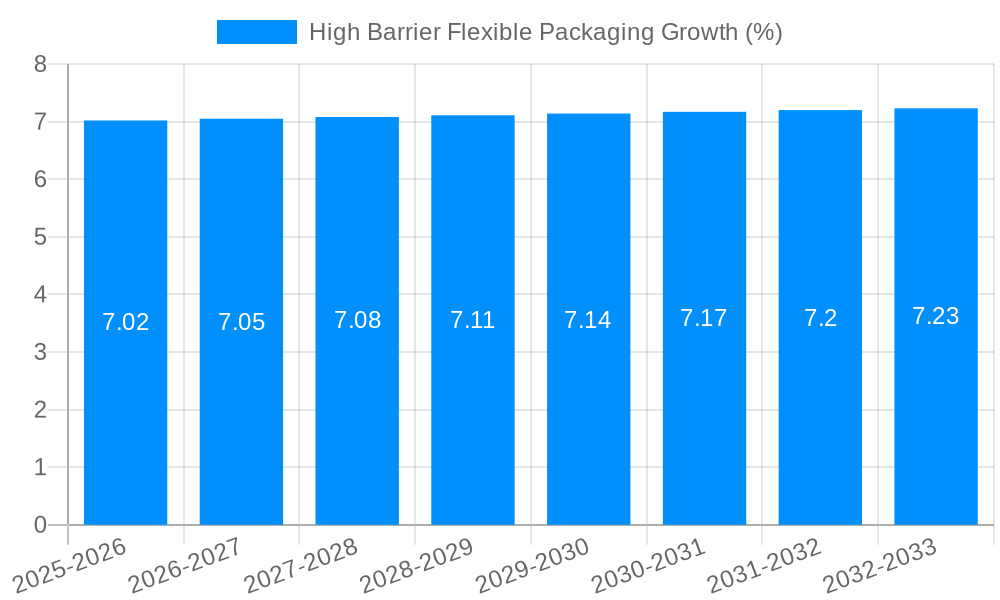

The High Barrier Flexible Packaging market is poised for significant expansion, projected to reach approximately USD 65,000 million by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This growth is primarily propelled by the escalating demand for extended shelf life and enhanced product protection across diverse applications, especially within the food and beverage industries. Consumers' increasing preference for convenience, coupled with the need to reduce food waste, is a critical driver, pushing manufacturers to adopt advanced packaging solutions that preserve freshness and integrity. Furthermore, rising disposable incomes in developing economies are fueling a demand for premium packaged goods, further bolstering the market. The personal care sector also contributes significantly, as brands leverage high barrier packaging to maintain the efficacy and appeal of their products. Innovations in material science, such as the development of advanced polymers and multi-layer films, are enabling superior oxygen, moisture, and light barrier properties, directly addressing consumer and industry needs.

The market's trajectory is also influenced by evolving regulatory landscapes and a growing emphasis on sustainability. While plastic packaging remains dominant due to its versatility and cost-effectiveness, there's a palpable shift towards more eco-friendly alternatives like advanced paper-based and bio-plastic solutions. This trend presents both opportunities and challenges, driving research and development into recyclable and compostable high barrier materials. Restraints such as fluctuating raw material prices and the initial investment costs for advanced manufacturing technologies are present. However, the overarching demand for superior product preservation, coupled with technological advancements in material science and processing, is expected to outweigh these limitations, ensuring a dynamic and expanding market for high barrier flexible packaging solutions globally. Key players are focusing on R&D to develop innovative, sustainable, and cost-effective solutions to meet the evolving demands of a discerning global market.

This report offers a comprehensive analysis of the global High Barrier Flexible Packaging market, projecting a robust expansion from a market size of approximately 30,000 million units in the Base Year of 2025 to an estimated 55,000 million units by 2033. The study period spans from 2019 to 2033, with a keen focus on the Historical Period of 2019-2024 and the Forecast Period of 2025-2033. The Estimated Year of 2025 serves as a critical benchmark for understanding current market dynamics. This in-depth research delves into the intricate interplay of various packaging types, including Aluminum Packaging, Plastic Packaging, and Paper Packaging, and their application across diverse sectors such as Food, Beverage, Personal Care Products, and Others. The report meticulously examines the industry's trajectory, identifying key drivers, formidable challenges, and the strategic initiatives shaping the future of high barrier flexible packaging.

XXX The High Barrier Flexible Packaging market is experiencing a dynamic evolution driven by an escalating demand for extended shelf life, superior product protection, and enhanced consumer appeal. Throughout the Study Period (2019-2033), the market has witnessed a significant shift from traditional rigid packaging solutions towards more sustainable and versatile flexible alternatives. In the Base Year of 2025, the market is valued at an estimated 30,000 million units, a testament to its burgeoning importance. This growth is underpinned by the increasing preference for lightweight, space-saving, and convenient packaging formats that offer superior oxygen, moisture, and aroma barrier properties. For instance, the food industry, a dominant consumer of high barrier flexible packaging, is increasingly adopting these solutions to preserve freshness, reduce spoilage, and meet stringent food safety regulations. This trend is particularly evident in the packaging of fresh produce, processed meats, dairy products, and ready-to-eat meals, where maintaining product integrity is paramount. The beverage sector is also seeing a rise in the adoption of high barrier flexible pouches for products like juices, dairy beverages, and even certain alcoholic drinks, offering advantages in terms of portability and reduced shipping costs. Furthermore, the personal care and pharmaceutical industries are leveraging these advanced packaging materials to protect sensitive formulations from degradation and contamination, ensuring product efficacy and safety. The growing emphasis on sustainability is also a major trend, with manufacturers actively investing in the development of recyclable and compostable high barrier flexible packaging solutions, thereby addressing environmental concerns and aligning with circular economy principles. This focus on eco-friendly materials, while maintaining high performance, is a defining characteristic of the market's trajectory. The integration of advanced printing technologies and smart packaging features, such as active and intelligent packaging, is also contributing to market expansion by offering enhanced functionality and consumer engagement.

The global High Barrier Flexible Packaging market is experiencing significant momentum, propelled by a confluence of powerful driving forces. Foremost among these is the escalating consumer demand for convenience and extended product shelf life. Modern lifestyles, characterized by busy schedules and a preference for on-the-go consumption, necessitate packaging that can preserve product freshness and quality for longer periods, thereby reducing food waste and enabling consumers to stock up on their favorite items. The food and beverage industries, in particular, are major beneficiaries of these advancements, with high barrier packaging playing a crucial role in protecting sensitive products from oxygen, moisture, and light, all of which can lead to spoilage and degradation. Furthermore, the burgeoning e-commerce landscape has amplified the need for robust and protective packaging that can withstand the rigors of shipping and handling. High barrier flexible packaging, with its inherent durability and lightweight nature, is ideally suited to meet these requirements, minimizing product damage during transit and reducing overall shipping costs. Growing environmental consciousness among consumers and stricter regulatory frameworks are also acting as significant catalysts. Manufacturers are increasingly investing in the development of sustainable high barrier flexible packaging solutions, including recyclable and biodegradable materials, to reduce their environmental footprint and appeal to eco-conscious consumers. This focus on sustainability is not just a response to consumer demand but also a strategic imperative for companies seeking to maintain a competitive edge and comply with evolving environmental regulations. Moreover, advancements in material science and manufacturing technologies are continuously enhancing the barrier properties and functionalities of flexible packaging, enabling its use in a wider array of applications and for more sensitive products.

Despite its robust growth trajectory, the High Barrier Flexible Packaging market is not without its inherent challenges and restraints. A primary concern revolves around the complex multi-material structures often employed to achieve superior barrier properties. While these structures offer excellent protection, they can pose significant hurdles in terms of recyclability. The intricate layering of different plastics, aluminum, and adhesives makes it difficult and often economically unfeasible to separate and recycle these materials, leading to a considerable amount of packaging waste ending up in landfills. This poses a direct conflict with the growing global emphasis on a circular economy and sustainable packaging solutions. Consequently, there is a continuous push from regulatory bodies and consumer advocacy groups for more sustainable alternatives, which can sometimes limit the adoption of certain high-barrier solutions. Another significant challenge is the cost associated with advanced barrier materials and manufacturing processes. The specialized resins, coatings, and equipment required to produce high-barrier flexible packaging often translate into higher production costs compared to conventional packaging. This can make it a less attractive option for price-sensitive markets or for packaging lower-value products, thereby limiting its widespread adoption. Furthermore, the performance of high barrier packaging can be sensitive to processing conditions and end-use environments. Factors such as heat, moisture exposure during storage, and physical stress can potentially compromise the barrier integrity, leading to product spoilage or loss of efficacy. Ensuring consistent and reliable barrier performance throughout the product's lifecycle requires stringent quality control measures and careful material selection, adding to the complexity and cost of production. The development and implementation of effective recycling infrastructure and collection systems for flexible packaging also remain a persistent challenge in many regions, hindering the achievement of true circularity.

The High Barrier Flexible Packaging market is poised for significant dominance in Plastic Packaging, particularly within the Food application segment, with North America and Asia Pacific emerging as key regions driving this growth. The dominance of Plastic Packaging is a direct consequence of its inherent versatility, cost-effectiveness, and the continuous advancements in polymer science that enable it to achieve remarkable barrier properties. In 2025, Plastic Packaging is projected to account for a substantial portion of the 30,000 million units market size, with its share expected to grow considerably throughout the forecast period (2025-2033). This growth is propelled by the ongoing development of sophisticated multi-layer films and advanced coating technologies that incorporate materials like polyethylene, polypropylene, PET, and specialized barrier polymers. These materials, when combined, offer exceptional protection against oxygen, moisture, UV light, and other environmental factors, which are critical for preserving the freshness and extending the shelf life of a wide variety of food products.

Within the Food application segment, high barrier flexible packaging is indispensable for a broad spectrum of products. This includes processed meats and seafood, dairy products (like cheese and yogurt), ready-to-eat meals, snacks, confectionery, and baked goods. The ability of these packaging solutions to maintain product integrity, prevent spoilage, and enhance consumer appeal by offering features like resealability and attractive graphics makes them the preferred choice for manufacturers aiming to reduce food waste and improve market reach. For instance, the demand for flexible pouches and sachets for single-serve portions of sauces, condiments, and dehydrated food items continues to surge due to their convenience and portability.

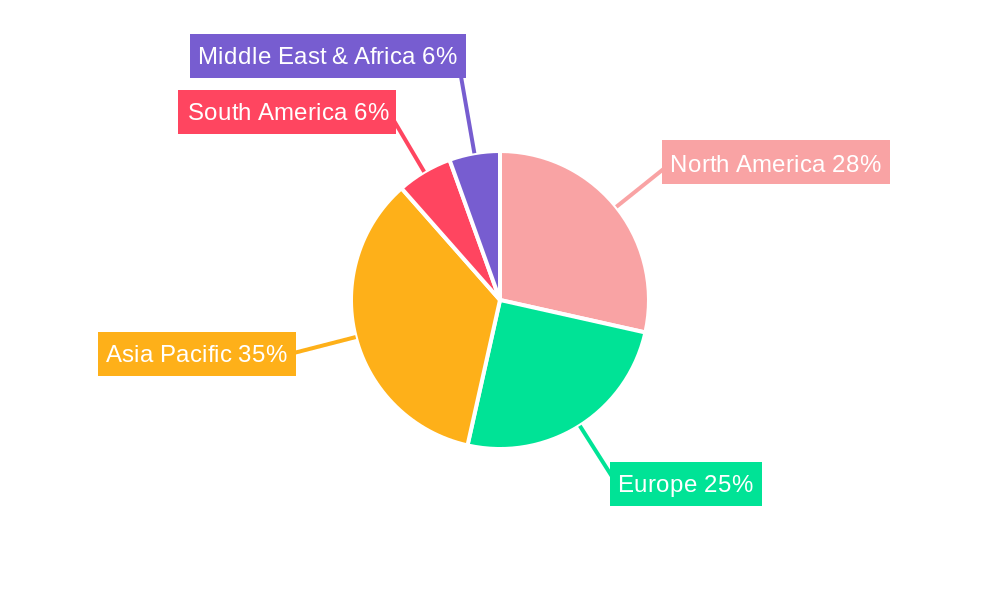

North America is expected to maintain its leading position in the High Barrier Flexible Packaging market due to a strong emphasis on product quality, food safety standards, and a well-established food processing industry. The region exhibits a high adoption rate of advanced packaging technologies and a consumer base that is increasingly conscious of product shelf life and convenience. The presence of major food and beverage manufacturers, coupled with significant investments in R&D by packaging companies, further bolsters North America's market share. The regulatory landscape in North America also encourages the adoption of high-barrier solutions to meet stringent food safety regulations.

The Asia Pacific region is identified as the fastest-growing market for High Barrier Flexible Packaging. This rapid expansion is driven by a rapidly growing middle class, increasing disposable incomes, and a burgeoning demand for packaged foods and beverages. As urbanization accelerates and retail infrastructure develops across countries like China, India, and Southeast Asian nations, the need for effective and safe food packaging solutions escalates. The shift from traditional, unpackaged food consumption to modern retail formats, which rely heavily on packaged goods, further fuels the demand for high barrier flexible packaging. Moreover, increasing awareness about food safety and hygiene in these developing economies is prompting consumers and manufacturers to opt for superior packaging that ensures product integrity. The cost-effectiveness and adaptability of plastic packaging solutions make them particularly attractive for this vast and diverse market.

Several key factors are acting as significant growth catalysts for the High Barrier Flexible Packaging industry. The relentless pursuit of extending product shelf life and minimizing food waste is a primary driver, as consumers and manufacturers alike recognize the economic and environmental benefits. Furthermore, the expansion of the e-commerce sector necessitates robust, lightweight, and protective packaging, a role that high barrier flexible solutions are ideally positioned to fulfill. Advancements in material science are continuously yielding innovative barrier materials and structures, enhancing performance and opening up new application possibilities. The increasing global demand for convenience and single-serve packaging formats also fuels adoption.

This report provides an exhaustive exploration of the High Barrier Flexible Packaging market, encompassing a detailed examination of trends, drivers, and challenges from 2019 to 2033. It offers granular insights into regional market dynamics, with a particular focus on the dominance of Plastic Packaging in Food applications across North America and Asia Pacific. The report meticulously analyzes the competitive landscape, featuring a comprehensive list of leading players and their strategic initiatives. Furthermore, it delves into significant technological advancements and developments shaping the industry. The comprehensive coverage ensures stakeholders have the necessary intelligence to navigate this complex and evolving market, capitalizing on emerging opportunities and mitigating potential risks, ultimately contributing to the sustainable growth of the high barrier flexible packaging sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amcor, Constantia Flexibles, Ardagh group, Coveris, Sonoco Products, Mondi Group, Huhtamaki, Flair Flexible Packaging Corporation, Winpak, ProAmpac, Berry Plastics Corporation, Bryce Corporation, Aptar Group, Printpack, Kendall Packaging, Foxpak, MeiFeng Plastic, St. Johns Packaging, Toppan, C-P Flexible Packaging.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "High Barrier Flexible Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High Barrier Flexible Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.