1. What is the projected Compound Annual Growth Rate (CAGR) of the Heat Resistant Electronic Lables?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Heat Resistant Electronic Lables

Heat Resistant Electronic LablesHeat Resistant Electronic Lables by Type (Barcode Label, RFID Label, Others, World Heat Resistant Electronic Lables Production ), by Application (Consumer Electronics Products, Household Appliances, Aerospace, Medical, Others, World Heat Resistant Electronic Lables Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

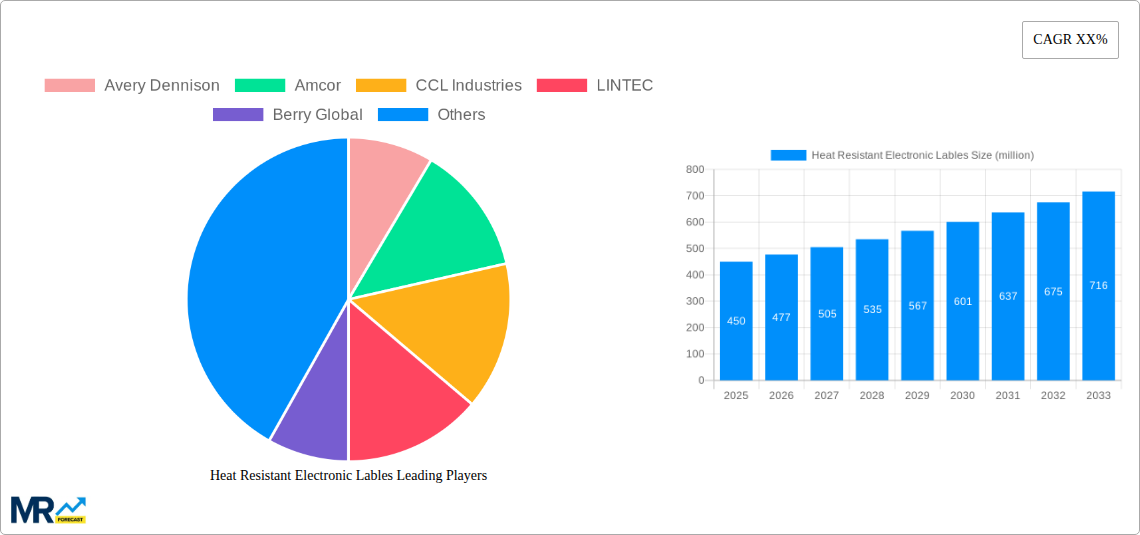

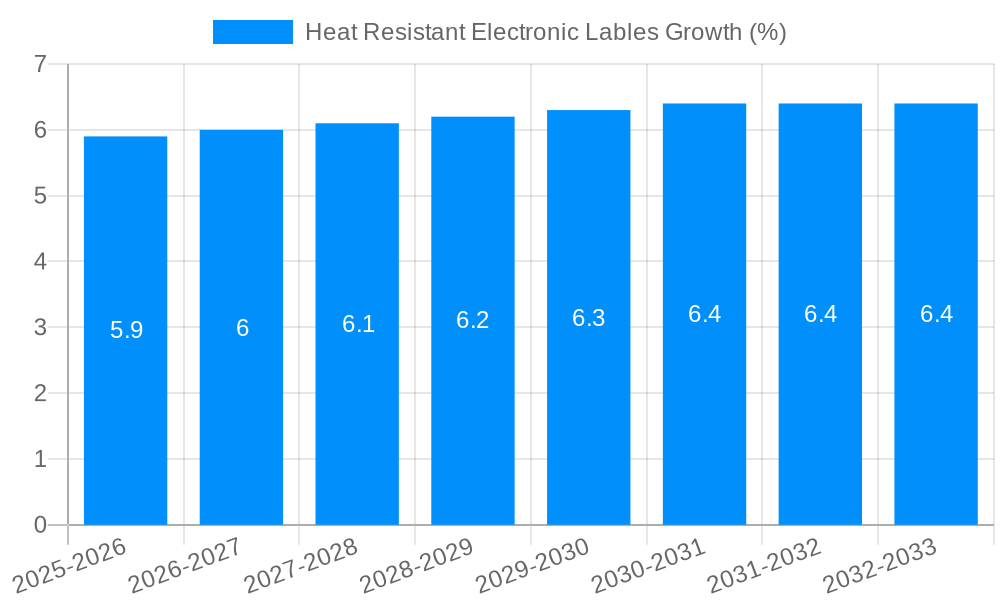

The global Heat Resistant Electronic Labels market is poised for substantial growth, driven by increasing demand across critical sectors like consumer electronics, aerospace, and medical devices. While the precise market size for heat-resistant electronic labels is not explicitly stated, industry analysis suggests it operates within a significant segment of the broader label and packaging market, potentially valued in the hundreds of millions of dollars, and projected to experience robust expansion. The Compound Annual Growth Rate (CAGR) of approximately 5-7% indicates a healthy and sustained upward trajectory. Key drivers include the ever-growing complexity of electronic components that require durable and reliable labeling solutions, the stringent regulatory requirements in industries like aerospace and medical for traceability and component identification, and the miniaturization of electronics which necessitates specialized labeling capable of withstanding high operating temperatures and harsh environments. The increasing adoption of smart labels incorporating RFID technology, offering enhanced data management capabilities, further fuels this growth.

The market is segmented into Barcode Labels and RFID Labels, with RFID Labels expected to witness higher growth rates due to their advanced functionalities. Applications span a wide array of high-stakes industries, with consumer electronics and household appliances forming a significant base, while aerospace and medical sectors represent high-value segments due to demanding performance criteria. Restraints include the cost associated with advanced heat-resistant materials and manufacturing processes, and the potential for substitution by alternative marking or identification methods in less demanding applications. However, the ongoing innovation in material science and label printing technologies, coupled with a growing awareness of the long-term benefits of reliable labeling in preventing product failures and ensuring safety, are expected to overcome these challenges. Prominent players like Avery Dennison, CCL Industries, and LINTEC are actively investing in research and development to cater to the evolving needs of this dynamic market.

This comprehensive report provides an in-depth analysis of the global Heat Resistant Electronic Labels market, meticulously examining its trajectory from the historical period of 2019-2024, through the base and estimated year of 2025, and projecting its growth through the forecast period of 2025-2033. The report aims to equip stakeholders with critical market intelligence, enabling informed strategic decision-making.

The global Heat Resistant Electronic Labels market is experiencing a dynamic evolution, driven by an increasing demand for robust and reliable labeling solutions in environments characterized by extreme temperatures. The study period from 2019 to 2033, with a base year of 2025, highlights a significant shift towards advanced materials and innovative printing technologies that can withstand rigorous thermal conditions without compromising data integrity or adhesion. In the historical period (2019-2024), the market saw steady growth as industries, particularly in consumer electronics and automotive, began to recognize the limitations of conventional labels in high-heat applications. The estimated year of 2025 marks a pivotal point where specialized heat-resistant solutions are becoming a standard requirement rather than a niche offering. Looking ahead to the forecast period (2025-2033), the market is projected to witness accelerated expansion, fueled by several key trends. Firstly, the increasing miniaturization of electronic components, coupled with their integration into more demanding applications like advanced automotive systems and industrial machinery, necessitates labels that can maintain their performance under intense heat. This trend is particularly evident in electric vehicles, where battery packs and power control units generate significant thermal loads. Secondly, the burgeoning aerospace sector, with its stringent safety and performance standards, is a substantial contributor to the demand for heat-resistant electronic labels. These labels are crucial for tracking and identifying critical components that are exposed to extreme temperatures during flight and ground operations. Furthermore, the medical industry is increasingly adopting heat-resistant labels for sterilization processes and for monitoring the temperature of sensitive medical devices and pharmaceuticals during storage and transport. The development of smart labels incorporating RFID technology that can operate reliably at elevated temperatures is another significant trend. These labels offer enhanced traceability and inventory management capabilities, particularly in supply chains involving temperature-sensitive goods or manufacturing processes. The growth in the production of specialized adhesives and substrates that can withstand thermal cycling without delaminating or degrading is a fundamental enabler of these trends. The market is witnessing a considerable influx of investment in research and development by key players, focusing on creating labels that not only offer superior heat resistance but also possess other essential properties such as chemical resistance, durability, and excellent printability. The projected production volume in the millions of units for these specialized labels underscores their growing importance across a diverse range of industries. As regulations concerning product safety and traceability become more stringent globally, the demand for reliable and high-performance heat-resistant electronic labels is expected to remain robust.

The heat-resistant electronic labels market is being propelled by a confluence of powerful driving forces that are reshaping its landscape. At the forefront is the escalating demand for enhanced product safety and reliability, especially within industries subjected to extreme operating conditions. As electronic components are increasingly integrated into demanding applications like automotive powertrains, industrial machinery, and aerospace systems, the integrity of their identification and tracking labels becomes paramount. Conventional labels often fail under sustained high temperatures, leading to data loss, incorrect identification, and potential safety hazards. This has created a significant impetus for the adoption of specialized heat-resistant labels that can maintain their adhesion, legibility, and functionality even when exposed to temperatures exceeding 200 degrees Celsius. The rapid advancement and widespread adoption of technologies such as electric vehicles (EVs) and renewable energy systems are also major catalysts. Battery packs in EVs, for instance, generate substantial heat, requiring labels on various components that can withstand these thermal stresses. Similarly, solar panels and other renewable energy infrastructure often operate in environments with significant temperature fluctuations. Furthermore, the growing sophistication of manufacturing processes across various sectors, including semiconductor fabrication and aerospace component production, introduces elevated temperatures as a common operational parameter. This necessitates labels that can endure these processes without degradation, ensuring accurate traceability and quality control throughout the production lifecycle. The stringent regulatory frameworks being implemented globally, emphasizing product traceability, compliance, and end-of-life management, further bolster the demand for durable and reliable labeling solutions. Heat-resistant electronic labels are critical in meeting these regulatory requirements, particularly for components that are difficult to access or replace once installed. The continuous innovation in material science and printing technologies is also a significant driver, enabling the development of labels with improved thermal stability, chemical resistance, and adhesion properties.

Despite the robust growth trajectory, the Heat Resistant Electronic Labels market faces several significant challenges and restraints that could impede its full potential. A primary concern revolves around the higher cost of production associated with specialized heat-resistant materials and manufacturing processes. These labels often incorporate advanced polymers, specialized adhesives, and sophisticated printing techniques, which inherently translate to a higher unit cost compared to conventional labels. This cost differential can be a deterrent for price-sensitive industries or applications where the extreme heat requirement is only marginally present. Another significant challenge is the complexity of material selection and application. Identifying the precise heat-resistant label that meets the specific thermal, chemical, and environmental requirements of a given application can be a complex process, often requiring extensive testing and expertise. Misapplication or incorrect material selection can lead to label failure, undermining the very purpose of employing these specialized solutions. Limited awareness and understanding of specialized solutions in certain segments of the market also pose a restraint. While major industries are well-versed in these requirements, smaller manufacturers or those in emerging sectors might not be fully aware of the availability and benefits of heat-resistant electronic labels, leading to a slower adoption rate. Furthermore, the availability of raw materials and supply chain disruptions can impact the production and pricing of heat-resistant labels. The specialized nature of these materials means that their supply chains might be more vulnerable to geopolitical events, natural disasters, or manufacturing bottlenecks, potentially leading to price volatility and availability issues. Lastly, the development of alternative identification and tracking technologies, such as direct part marking (DPM) or integrated sensor technologies, although not directly competing with labels, can present a long-term challenge by offering different approaches to managing product information in harsh environments.

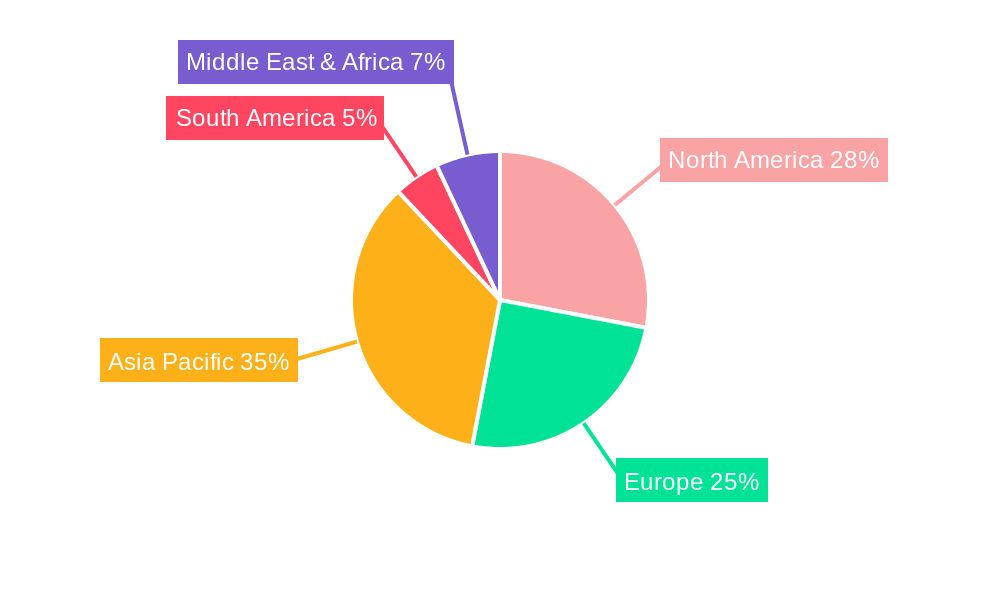

The global Heat Resistant Electronic Labels market is characterized by significant regional dominance and segment leadership, driven by the concentration of key end-user industries and technological advancements.

Dominant Regions:

North America (United States, Canada): This region is a powerhouse for the Heat Resistant Electronic Labels market, primarily due to its strong presence in advanced manufacturing, automotive innovation (especially with the burgeoning EV sector), and its significant aerospace industry. The high adoption rate of cutting-edge technologies and stringent quality control standards within these sectors necessitate reliable and durable labeling solutions. The presence of major players in the automotive supply chain, coupled with substantial investments in defense and space exploration, further solidifies North America's leading position. The regulatory environment also encourages the use of high-performance materials to ensure product safety and compliance. The production volume in millions of units from this region is expected to be substantial.

Europe (Germany, France, United Kingdom, Italy): Europe, particularly Germany, is another dominant force, driven by its robust automotive industry, advanced industrial machinery manufacturing, and a growing emphasis on sustainable technologies. The stringent environmental and safety regulations in the EU compel manufacturers to adopt labeling solutions that can withstand harsh operating conditions and contribute to product lifecycle management. The aerospace and medical device sectors in Europe also contribute significantly to the demand for specialized heat-resistant labels.

Asia Pacific (China, Japan, South Korea): While historically a manufacturing hub for cost-effective solutions, the Asia Pacific region is rapidly evolving into a key consumer and producer of high-performance Heat Resistant Electronic Labels. China, in particular, is witnessing exponential growth in its consumer electronics, automotive, and renewable energy sectors. As these industries mature and focus on higher quality and durability, the demand for advanced labeling solutions is surging. Japan and South Korea are at the forefront of technological innovation, especially in consumer electronics and automotive manufacturing, driving the need for labels that can endure extreme heat. The sheer volume of production in this region, measured in millions of units, makes it a critical market.

Dominant Segments:

Type: RFID Label: Within the "Type" segment, RFID Labels are emerging as a significant growth driver and a segment poised for substantial dominance, particularly in the context of heat resistance. The ability of RFID tags to be read wirelessly and from a distance, coupled with advancements in embedding RFID technology within materials that can withstand elevated temperatures, makes them ideal for many demanding applications. In the automotive industry, RFID labels are used for tracking components in engines and exhaust systems. In aerospace, they are crucial for identifying and tracking parts in high-temperature zones of aircraft. The ability to store more data than traditional barcodes and to be rewritten makes them highly versatile. The market for heat-resistant RFID labels is projected to grow at a CAGR significantly higher than barcode labels in this niche. The production of millions of these specialized RFID labels is anticipated to cater to the increasing need for automated inventory management and enhanced traceability in thermally challenging environments.

Application: Consumer Electronics Products: The Consumer Electronics Products application segment, while often perceived as less extreme than industrial or aerospace applications, is nonetheless a major contributor to the demand for heat-resistant electronic labels. Modern consumer electronics, such as smartphones, laptops, gaming consoles, and smart home devices, are becoming increasingly powerful and compact. This leads to higher internal operating temperatures, especially during intensive use. Labels used on internal components, circuit boards, and power supplies need to withstand these temperatures to ensure longevity and prevent failure. The sheer volume of consumer electronics produced globally, measured in billions of units annually, translates into a massive demand for reliable labeling. As devices become more sophisticated and are used in a wider range of environments, the need for labels that can maintain their integrity under thermal stress will only increase.

Application: Aerospace: The Aerospace segment represents a high-value and critically important application for heat-resistant electronic labels. Components within aircraft, particularly those in the engine bays, exhaust systems, and landing gear, are exposed to extreme temperatures, vibrations, and harsh chemicals. Labels used in these applications must be exceptionally durable and capable of withstanding these conditions to ensure accurate identification, traceability, and compliance with stringent aviation regulations. The reliability of these labels directly impacts flight safety. The production volume in this segment, while smaller in sheer numbers compared to consumer electronics, commands a higher average selling price due to the rigorous testing and certification requirements. The growth in air travel and the continued development of advanced aircraft designs will continue to fuel demand in this sector.

The Heat Resistant Electronic Labels industry is experiencing accelerated growth driven by several key catalysts. The increasing adoption of advanced technologies such as electric vehicles (EVs) and renewable energy systems, which inherently involve components operating at high temperatures, is a significant growth driver. Furthermore, stringent government regulations worldwide mandating product traceability and safety in harsh environments are compelling industries to invest in high-performance labeling solutions. The continuous innovation in material science and printing technologies is leading to the development of more effective and cost-efficient heat-resistant labels, broadening their applicability. The growing demand for industrial automation and smart manufacturing, where labels play a crucial role in identifying and tracking parts in complex, high-temperature processes, also fuels market expansion.

This report provides a holistic and comprehensive view of the global Heat Resistant Electronic Labels market, offering in-depth insights into its intricate dynamics. The analysis spans from the historical period of 2019-2024 to project the market's future trajectory up to 2033, with a focus on the base and estimated year of 2025. It delves into the key market trends, meticulously analyzing the technological advancements, evolving application requirements, and regulatory landscapes that are shaping the industry. The report identifies and elaborates on the primary driving forces, such as the surge in advanced manufacturing, electric vehicles, and aerospace, as well as the challenges and restraints, including cost implications and material complexities, faced by market participants. Crucially, it highlights the dominant regions and segments, providing a granular understanding of where market growth is most pronounced and which product types are gaining traction. The report also encapsulates the significant developments and strategic moves by leading players, offering a competitive landscape analysis. Ultimately, this comprehensive coverage aims to equip stakeholders with the necessary intelligence to navigate this evolving market, identify opportunities, and mitigate risks effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Avery Dennison, Amcor, CCL Industries, LINTEC, Berry Global, Cenveo, Constantia Flexibles, Hood Packaging, Intertape Polymer Group, Karlville Development, Klckner Pentaplast, Macfarlane Group, DOW Chemical, The Label Printers, ONE2ID, Label-Aid, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Heat Resistant Electronic Lables," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Heat Resistant Electronic Lables, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.