1. What is the projected Compound Annual Growth Rate (CAGR) of the Glass Packaging Bottles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Glass Packaging Bottles

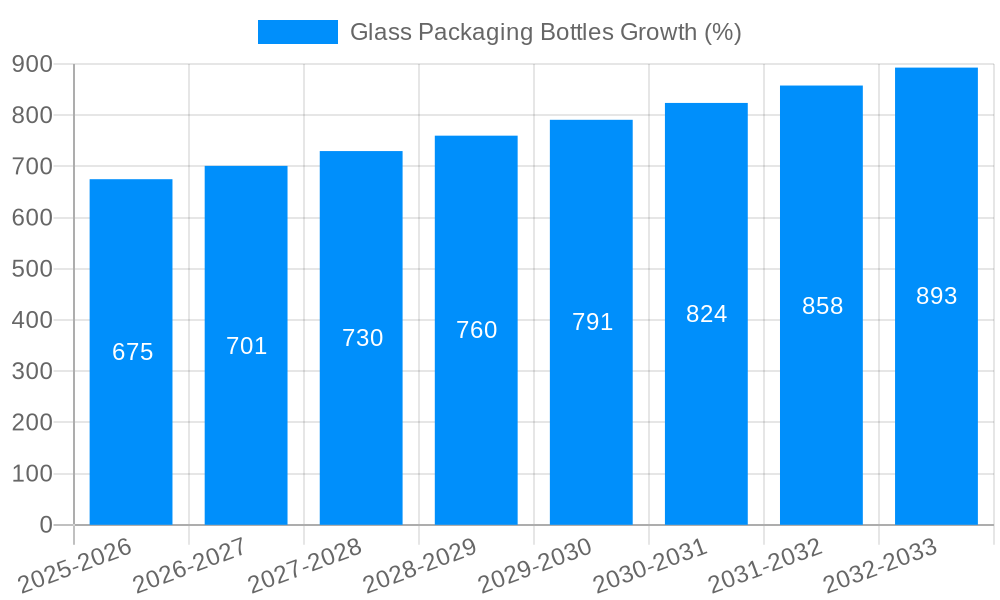

Glass Packaging BottlesGlass Packaging Bottles by Type (≤ 10ml, 10-200ml, 200-500ml, 500-1000ml, > 1000ml, World Glass Packaging Bottles Production ), by Application (Liquor and Wine Bottles, Daily Packaging Glass Bottles, Condiment Bottles, Glass Jars for Canning, Medicine Bottles, Chemical Reagent Bottles, Others, World Glass Packaging Bottles Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global glass packaging bottles market is a substantial and growing sector, exhibiting a robust expansion trajectory. While precise figures for market size and CAGR aren't provided, industry analyses consistently point to a multi-billion dollar market experiencing steady growth fueled by several key drivers. The increasing demand for sustainable and eco-friendly packaging solutions is a primary catalyst, with glass offering a recyclable and inert alternative to plastics. Growth is further propelled by the flourishing food and beverage industry, particularly segments like premium liquors, wines, and craft beers, which often utilize glass for its aesthetic appeal and perceived quality enhancement. The expanding pharmaceutical and cosmetic sectors also contribute significantly to market demand, leveraging glass for its barrier properties and ability to protect sensitive products. Market segmentation reveals a varied landscape, with larger bottles (500ml-1000ml and >1000ml) potentially commanding higher value due to applications in bulk food and chemical storage. However, smaller containers (≤10ml and 10-200ml) are likely to contribute a larger volume due to their widespread use in pharmaceuticals, cosmetics, and condiments. Geographical distribution shows a concentration of manufacturing and consumption in developed regions like North America and Europe, but emerging economies in Asia-Pacific, particularly China and India, are demonstrating rapid growth, driven by rising disposable incomes and urbanization.

Challenges exist, primarily concerning the higher cost and fragility of glass compared to alternative materials. Fluctuations in raw material prices (sand, soda ash, limestone) and energy costs also impact profitability. However, ongoing innovation in manufacturing processes and recycling technologies are mitigating some of these constraints. Leading players in the glass packaging bottles market are strategically expanding their production capacities, investing in advanced technologies, and exploring new applications to maintain a competitive edge. The industry's future growth will be shaped by consumer preference shifts towards sustainable packaging, evolving regulatory landscapes regarding plastic use, and the successful integration of automation and digitalization within manufacturing processes. The long-term outlook remains optimistic, suggesting continued expansion and consolidation within this critical packaging segment.

The global glass packaging bottles market is experiencing robust growth, driven by increasing consumer demand for sustainable and premium packaging solutions. The study period of 2019-2033 reveals a significant upward trajectory, with the market estimated to reach several billion units by 2025. This growth is particularly pronounced in certain segments. For instance, the demand for larger capacity bottles (500-1000ml and >1000ml) is rising steadily due to the increasing popularity of bulk purchases and larger household sizes. Simultaneously, the premiumization of packaged goods is boosting demand for high-quality glass bottles, especially in sectors like liquor and wine, where aesthetics and perceived product quality are crucial selling points. This trend is further fueled by the growing awareness among consumers regarding the environmental impact of packaging materials, leading them to favor recyclable and reusable glass over other alternatives. The shift towards sustainable practices by key market players is also contributing to this positive growth trend. The report indicates a substantial increase in the production of glass packaging bottles across various applications, with projections suggesting continued expansion throughout the forecast period (2025-2033). This trend is further amplified by ongoing innovations in glass manufacturing, resulting in lighter, more durable, and more aesthetically pleasing bottles. The historical period (2019-2024) serves as a strong foundation for these positive projections, highlighting a consistent growth pattern. The market's success hinges on the ongoing interplay between consumer preferences, environmental consciousness, and industry innovations.

Several key factors are driving the expansion of the glass packaging bottles market. The increasing preference for eco-friendly packaging options is a major catalyst. Consumers are increasingly aware of the environmental consequences of plastic and other non-renewable packaging materials, leading to a significant shift towards reusable and recyclable glass. This aligns perfectly with the growing global sustainability movement and corporate social responsibility (CSR) initiatives, pressuring businesses to adopt more eco-conscious packaging practices. Furthermore, the inherent properties of glass, such as its inertness, transparency, and ability to protect product quality, make it an attractive choice across a wide range of applications, from food and beverages to pharmaceuticals and cosmetics. This inherent quality translates into a premium perception among consumers, boosting sales of products packaged in glass. The growth of the e-commerce sector is also positively impacting the market, as consumers increasingly purchase goods online and require secure, visually appealing packaging for delivery. Finally, ongoing innovations in glass manufacturing processes, leading to improved efficiency, cost reduction, and the development of new bottle designs, further contribute to the market's positive growth trajectory.

Despite the favorable market trends, several challenges hinder the growth of the glass packaging bottles market. The fragility of glass is a significant limitation. Compared to plastic or metal containers, glass bottles are more susceptible to breakage during transportation and handling, increasing costs associated with damage and replacements. This fragility impacts efficiency and increases the overall carbon footprint due to increased transportation and material waste. The high production costs and energy consumption associated with glass manufacturing are another constraint. These factors can make glass less cost-competitive compared to alternative materials, particularly in price-sensitive markets. The weight of glass bottles can also increase shipping costs, posing a further challenge to producers and consumers. Finally, fluctuating raw material prices, particularly those of silica sand, soda ash, and limestone, introduce significant variability and uncertainty into the manufacturing process, potentially impacting profitability. Addressing these challenges requires ongoing innovations in manufacturing processes and transportation logistics, along with continued efforts to promote the environmental benefits of glass packaging.

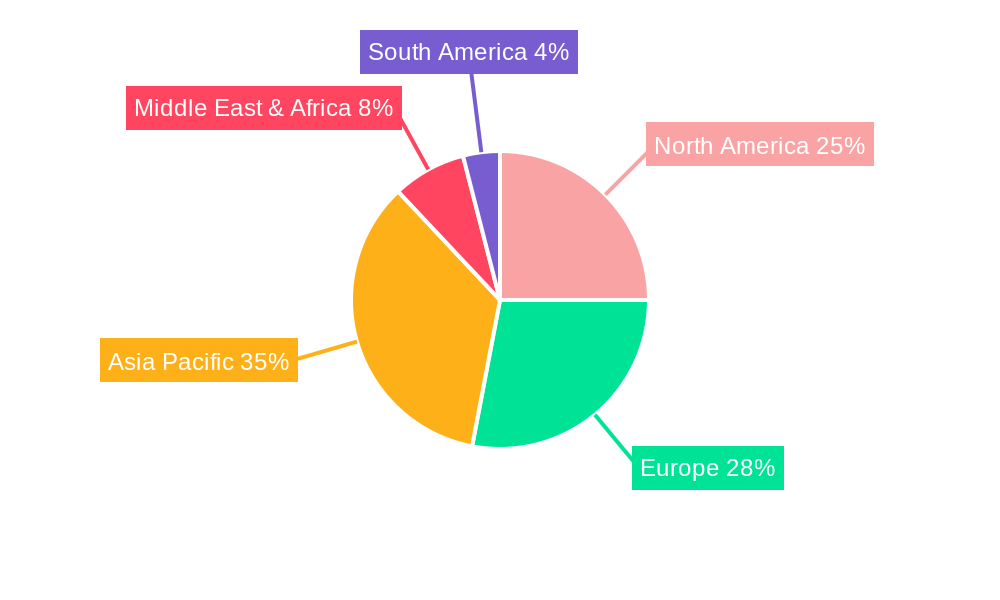

The global glass packaging bottles market presents diverse regional and segmental dynamics. While comprehensive data across all regions and segments is required for precise market share allocation, certain trends can be observed.

Regions: North America and Europe consistently demonstrate strong demand due to high consumer disposable incomes, a preference for premium products, and a strong emphasis on sustainability. Asia-Pacific, particularly China and India, are experiencing rapid growth owing to rising populations and expanding middle classes. This translates to increased consumption of packaged goods and subsequent demand for various glass packaging solutions.

Segments: The segment of >1000ml bottles displays a strong growth trajectory, driven by the bulk purchasing trends mentioned earlier. This is particularly notable in the food and beverage sectors, notably in the wine and spirits market, but also in larger container options for industrial chemical usage, where the benefits of inert glass and ease of cleaning outweigh the higher weight compared to plastics. The 'Liquor and Wine Bottles' application segment also presents an exceptional growth area, mirroring the global trend of premiumization and an appreciation for aesthetic packaging in higher value products. Daily packaging glass bottles continue to hold a substantial market share, catering to the vast consumer goods market.

The future market dominance will depend on economic growth in specific regions and the evolution of consumer preferences towards sustainability and packaging format.

The glass packaging bottles market is fueled by strong growth catalysts. Increasing consumer awareness of sustainability and the inherent recyclability of glass drive demand. Premiumization of products, particularly in the alcoholic beverage sector, fuels demand for high-quality, visually appealing glass containers. Technological advancements in manufacturing processes lead to lighter, more durable, and cost-effective glass bottles. Finally, government regulations supporting sustainable packaging are encouraging the shift from alternative materials to glass packaging solutions.

(Note: Specific details regarding company developments would need further research to provide exact dates and specifics beyond these broad examples.)

This report provides a comprehensive overview of the global glass packaging bottles market, covering key trends, driving forces, challenges, and leading players. It offers valuable insights into market segmentation, regional dynamics, and future growth projections. The report utilizes extensive data analysis and industry expertise to provide actionable intelligence for stakeholders across the value chain. The report’s robust methodology combines primary and secondary research, ensuring a deep understanding of the current market landscape and accurate predictions for future market developments.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Owens-Illinois, Vidrala, Ardagh Group, Vitro packaging, Consol Glass, Zignago Vetro Group, Vetropack Group, Guangdong Huaxing, Yucai Group, Cangzhou Xingchen Glass, Cangzhou Four Stars Glass, Shandong Huapeng Glass, HEINZ-GLAS, Piramal Glass, SAVERGLASS Group, Bormioli Luigi, Stoelzle Glass Group, Carib Glassworks Limited, Gerresheimer, Toyo Glass.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Glass Packaging Bottles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Glass Packaging Bottles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.