1. What is the projected Compound Annual Growth Rate (CAGR) of the Frozen Food Packaging Bag?

The projected CAGR is approximately 5.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Frozen Food Packaging Bag

Frozen Food Packaging BagFrozen Food Packaging Bag by Type (Polyethylene Packaging Bag, Polypropylene Packaging Bag, Laminated Film Packaging Bag), by Application (Meat, Seafood, Food Semi-Finished Products, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

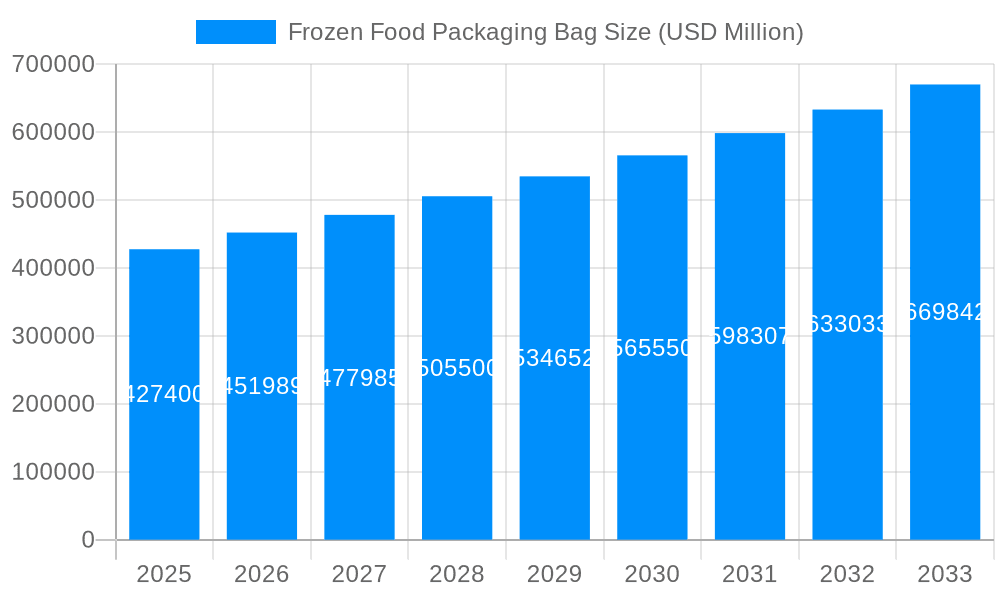

The global frozen food packaging bag market is poised for significant expansion, projected to reach approximately $427.4 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 5.7% through 2033. This robust growth is fueled by evolving consumer preferences for convenience, the increasing demand for frozen food products across diverse categories, and the expanding retail infrastructure globally. As consumers increasingly seek ready-to-eat and easy-to-prepare meals, the role of effective and protective frozen food packaging becomes paramount. Manufacturers are responding by innovating with materials that offer superior barrier properties, extended shelf life, and enhanced visual appeal, directly contributing to the market's upward trajectory. Key drivers include the growing popularity of frozen fruits, vegetables, ready meals, and ice cream, alongside advancements in freezing technologies that preserve food quality for longer periods.

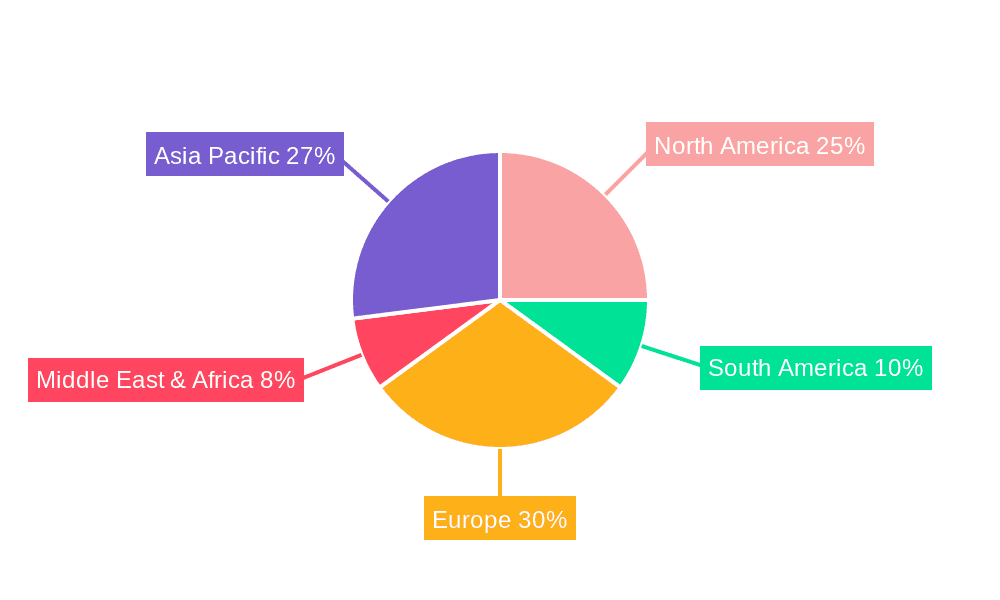

The market is segmented by type, with Polyethylene Packaging Bags and Polypropylene Packaging Bags holding substantial shares due to their cost-effectiveness and versatility. However, Laminated Film Packaging Bags are gaining traction for their advanced barrier properties, crucial for maintaining the quality and freshness of frozen foods, especially meats and seafood. Geographically, Asia Pacific is expected to emerge as a dominant region, driven by its large population, rising disposable incomes, and rapid urbanization, which are accelerating the adoption of frozen food products. North America and Europe remain significant markets, characterized by a well-established frozen food industry and a strong consumer demand for high-quality, convenient frozen meal solutions. Major players such as Berry Global, Amcor, and Sonoco are actively investing in research and development to create sustainable and innovative packaging solutions, further stimulating market growth and competition.

This comprehensive report delves into the dynamic global frozen food packaging bag market, offering an in-depth analysis of trends, drivers, challenges, and opportunities. Spanning the Study Period: 2019-2033, with a Base Year: 2025 and an Estimated Year: 2025, this research provides critical insights for stakeholders navigating the evolving landscape. The Historical Period: 2019-2024 has been thoroughly examined to establish a robust foundation, followed by an extensive Forecast Period: 2025-2033 projecting future market trajectories. The global market is anticipated to reach a significant valuation of USD 45.6 billion by 2025, with robust growth expected to propel it towards USD 68.9 billion by 2033, demonstrating a compound annual growth rate (CAGR) of 5.3% during the forecast period.

The frozen food packaging bag market is undergoing a significant transformation, driven by evolving consumer preferences and technological advancements. A key trend is the escalating demand for convenience and portion-controlled packaging, catering to increasingly busy lifestyles. Consumers are actively seeking smaller, single-serving frozen meals, which directly translates into a need for more specialized and smaller-format packaging bags. This shift is particularly evident in urban centers where household sizes are shrinking and time constraints are more prevalent. Furthermore, the pursuit of sustainable and eco-friendly packaging solutions is gaining substantial traction. As environmental consciousness rises, there's a growing preference for bags made from recyclable materials, biodegradable polymers, and those with reduced material usage. Manufacturers are responding by investing in research and development for innovative materials that offer enhanced barrier properties, extended shelf life, and a reduced environmental footprint. The integration of smart packaging technologies, such as those indicating product freshness or providing traceability information, is another emerging trend. While currently in its nascent stages, this development holds the potential to revolutionize consumer engagement and product safety. The increasing adoption of e-commerce for grocery purchases is also influencing packaging design, with a greater emphasis on durability and protection during transit to prevent damage and maintain product integrity. This includes robust sealing mechanisms and materials that can withstand fluctuating temperatures during delivery. The rise of plant-based diets and specialty frozen foods, such as gourmet ready-to-eat meals and artisanal desserts, is creating niche markets for highly specialized packaging that can maintain the unique textures and flavors of these products. This often involves advanced barrier films and unique printing capabilities to showcase product quality.

Several powerful forces are propelling the growth of the frozen food packaging bag market. Paramount among these is the sustained global increase in demand for frozen food products. Factors such as longer shelf life, convenience, and the ability to preserve nutritional value contribute to the consistent popularity of frozen items across various categories, from vegetables and fruits to meats and ready-to-eat meals. This widespread consumer adoption directly fuels the demand for packaging solutions that can effectively preserve the quality and extend the shelf life of these products during freezing, storage, and transportation. Another significant driver is the burgeoning middle class in emerging economies. As disposable incomes rise in these regions, consumers are increasingly able to afford and are adopting frozen food options, which were once considered a luxury. This expanding consumer base represents a substantial untapped market for frozen food manufacturers and, consequently, for their packaging suppliers. The continuous innovation in packaging materials and technologies is also a critical growth engine. Manufacturers are investing heavily in developing advanced films that offer superior moisture and oxygen barrier properties, crucial for preventing freezer burn and maintaining product freshness. The development of sustainable and recyclable packaging materials is also a key driving force, aligning with growing environmental concerns and regulatory pressures. Furthermore, the convenience factor inherent in frozen foods, coupled with the increasing trend of smaller household sizes and busy lifestyles, continues to stimulate the demand for individually portioned and ready-to-cook frozen meals, which in turn necessitates specialized and versatile packaging solutions.

Despite the robust growth prospects, the frozen food packaging bag market faces several significant challenges and restraints. A primary concern is the escalating cost of raw materials. The prices of key components used in the manufacturing of packaging bags, such as polyethylene and polypropylene resins, are subject to volatility due to fluctuations in crude oil prices and global supply chain disruptions. These price swings can impact the profitability of packaging manufacturers and potentially be passed on to end-users, affecting overall market growth. Furthermore, the stringent regulatory landscape governing food packaging presents another hurdle. Adherence to food safety standards and regulations regarding material composition, migration limits, and labeling requirements necessitates significant investment in research, development, and compliance by packaging companies. The disposal of plastic packaging waste is also a growing environmental concern, leading to increased pressure for sustainable alternatives and potentially impacting the long-term demand for traditional plastic-based packaging. Developing cost-effective and high-performance sustainable packaging solutions that can meet the demanding requirements of frozen food preservation remains a technical challenge for the industry. Moreover, the complex and often energy-intensive nature of the frozen food supply chain, including the need for continuous refrigeration throughout distribution, can add to the overall cost and complexity of packaging, requiring bags that can withstand extreme temperature fluctuations and maintain their integrity. Consumer perception regarding the environmental impact of single-use plastics can also act as a restraint, pushing for alternative solutions that may not yet be as widespread or cost-effective.

Within the global frozen food packaging bag market, Laminated Film Packaging Bag is poised to emerge as a dominant segment, driven by its superior performance characteristics crucial for frozen food preservation. Laminated films, typically comprising multiple layers of different polymers and potentially aluminum foil, offer exceptional barrier properties against moisture, oxygen, and light. This multi-layered construction is instrumental in preventing freezer burn, maintaining product freshness, extending shelf life, and preserving the sensory attributes (taste, texture, aroma) of frozen foods. The adaptability of laminated films to various printing techniques also allows for enhanced branding and consumer appeal, a critical factor in the competitive frozen food market. Their flexibility and strength make them suitable for a wide range of bag formats, from stand-up pouches to pillow bags, catering to diverse product types and consumer needs.

Geographically, North America is projected to maintain its dominance in the frozen food packaging bag market during the forecast period. This leadership is underpinned by several key factors. Firstly, North America boasts a mature and well-established frozen food industry with a high per capita consumption of frozen products across various categories, including vegetables, fruits, meats, poultry, seafood, and ready-to-eat meals. This consistent and substantial demand directly translates into a robust requirement for packaging solutions. Secondly, the region is characterized by a strong consumer preference for convenience, with a significant portion of the population embracing frozen foods for their time-saving benefits and year-round availability. This trend is further amplified by busy lifestyles and the prevalence of dual-income households. Thirdly, North America is at the forefront of technological innovation in packaging. Manufacturers in the region are heavily investing in research and development to create advanced, high-performance, and sustainable packaging solutions that meet the evolving demands of the frozen food sector. This includes the development of multilayered films with enhanced barrier properties, the adoption of recyclable materials, and the integration of smart packaging features. The presence of major frozen food producers and packaging manufacturers in North America further strengthens its market position. Leading companies such as Berry Global, Amcor, and Sealed Air have a significant presence and are actively contributing to market growth through product development and strategic expansions. The regulatory environment in North America, while stringent, also encourages innovation and the adoption of advanced packaging technologies that comply with food safety and environmental standards. The established retail infrastructure and sophisticated supply chains in countries like the United States and Canada facilitate the efficient distribution of frozen food products, further bolstering the demand for reliable and effective packaging.

The frozen food packaging bag industry is experiencing significant growth catalysts, primarily driven by the ever-increasing global demand for convenience and the extended shelf life offered by frozen food products. As consumer lifestyles become more hectic and household sizes continue to shrink, the appeal of pre-prepared and easily accessible frozen meals grows. Furthermore, advancements in material science have led to the development of innovative packaging that offers superior barrier properties, better temperature resistance, and enhanced product preservation, directly contributing to reduced food waste and improved consumer satisfaction. The expanding middle class in emerging economies, with rising disposable incomes and a growing adoption of Westernized dietary habits, also represents a substantial growth catalyst, opening up new markets for frozen food and, consequently, its packaging.

The global frozen food packaging bag market is characterized by the presence of several key players driving innovation and market expansion. These companies are instrumental in shaping the industry through their product portfolios, technological advancements, and strategic initiatives.

The frozen food packaging bag sector has witnessed numerous significant developments that have shaped its current trajectory and are indicative of future trends. These advancements reflect a continuous effort towards enhancing product quality, sustainability, and consumer engagement.

This report offers a comprehensive and detailed analysis of the global frozen food packaging bag market, providing an in-depth understanding of its dynamics. The research covers the intricate interplay of market trends, driving forces, and the challenges that shape the industry's landscape. It meticulously examines the key segments, including Polyethylene Packaging Bag, Polypropylene Packaging Bag, and Laminated Film Packaging Bag, across various applications such as Meat, Seafood, Food Semi-Finished Products, and Others. Industry developments and technological advancements are thoroughly investigated to identify catalysts for growth and future opportunities. The report provides a robust forecast from 2025-2033, anchored by a detailed analysis of the Base Year: 2025 and Estimated Year: 2025, built upon the Historical Period: 2019-2024. Stakeholders will gain valuable insights into the market's potential, competitive strategies of leading players, and the regional nuances that define its global reach.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.7%.

Key companies in the market include Berry Global, Amcor, Sonoco, Sealed Air, ProAmpac, International Paper, Bemis Company, Mondi Group, Winpak, LINPAC, ePac Flexibles, Pkgmaker, Pactiv, Carepac, FFP Packaging Solutions, Formel Industries, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Frozen Food Packaging Bag," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Frozen Food Packaging Bag, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.