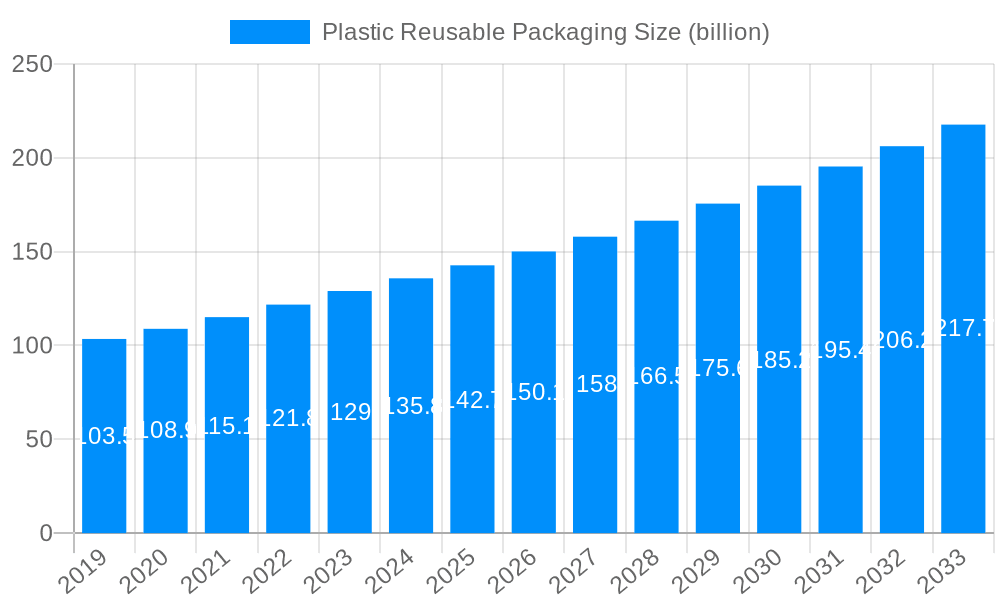

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Reusable Packaging?

The projected CAGR is approximately 6.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plastic Reusable Packaging

Plastic Reusable PackagingPlastic Reusable Packaging by Type (Plastic Barrel, Plastic Box, Plastic Bottle, World Plastic Reusable Packaging Production ), by Application (Food and Beverage, Automotive, FMCG, Retail and Wholesale, Industrial, Healthcare and Pharma, Others, World Plastic Reusable Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global plastic reusable packaging market is poised for robust expansion, projected to reach approximately $142.7 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.1% anticipated to sustain its trajectory through 2033. This sustained growth is underpinned by a confluence of powerful market drivers, primarily the escalating demand for sustainable and eco-friendly packaging solutions driven by increasing environmental consciousness among consumers and stringent government regulations promoting circular economy principles. Businesses across diverse sectors are actively transitioning to reusable packaging to mitigate waste generation, reduce their carbon footprint, and achieve long-term cost savings associated with single-use alternatives. The food and beverage sector, a significant consumer of packaging, is leading this shift, driven by the need for hygienic, durable, and cost-effective transport and storage solutions. Similarly, the automotive industry's emphasis on supply chain efficiency and the fast-moving consumer goods (FMCG) sector's focus on brand image and sustainability are also contributing significantly to market uptake.

Further fueling this market's dynamism are evolving trends such as the integration of smart technologies, including RFID and IoT sensors, into reusable packaging for enhanced tracking, inventory management, and supply chain visibility. This technological advancement not only improves operational efficiency but also enhances product integrity and reduces loss. The increasing adoption of advanced plastic materials that offer superior durability, chemical resistance, and recyclability further bolsters the market's appeal. Key segments like plastic barrels and boxes are experiencing heightened demand due to their versatility in industrial and retail applications. While the market enjoys strong growth, potential restraints include the initial capital investment required for reusable packaging systems and the logistical complexities of reverse logistics and cleaning processes. However, the long-term economic and environmental benefits significantly outweigh these challenges, positioning plastic reusable packaging as a cornerstone of modern, sustainable supply chains.

This comprehensive report delves into the dynamic global market for Plastic Reusable Packaging, offering an in-depth analysis of its trajectory from 2019 to 2033. With a base year of 2025, the study meticulously examines historical trends, current market conditions, and future projections, providing invaluable insights for stakeholders across the value chain. The report leverages extensive primary and secondary research to present a data-driven perspective on this rapidly evolving sector.

XXX: The global Plastic Reusable Packaging market is undergoing a significant transformation, driven by an escalating demand for sustainable and cost-effective supply chain solutions. The historical period from 2019 to 2024 witnessed a steady growth trajectory, as companies began to recognize the environmental and economic benefits of shifting away from single-use plastics. This trend is projected to accelerate considerably between the base year of 2025 and the forecast period extending to 2033. Key market insights reveal a substantial increase in the adoption of reusable plastic containers, pallets, and crates across various industries. The market size, which is expected to be in the hundreds of billions of units by 2025, is anticipated to experience a compound annual growth rate (CAGR) that will significantly expand its overall volume and value. A pivotal trend is the increasing focus on circular economy principles, encouraging the design, manufacture, and reuse of plastic packaging to minimize waste and resource depletion. This is further amplified by stringent government regulations and corporate sustainability mandates that penalize excessive waste generation and promote the adoption of environmentally friendly alternatives. Furthermore, advancements in material science are leading to the development of more durable, lighter, and food-grade compliant reusable plastic packaging, expanding its applicability into sensitive sectors like healthcare and pharmaceuticals. The integration of smart technologies, such as RFID and IoT sensors, into reusable packaging is also gaining traction, enabling better tracking, inventory management, and optimized logistics, thereby enhancing operational efficiency and reducing losses. The Food and Beverage segment, currently a dominant force, is expected to continue its leadership, driven by the need for hygienic and efficient transport of perishable goods. However, the Automotive, FMCG, Retail and Wholesale, Industrial, and Healthcare and Pharma sectors are all poised for substantial growth as they increasingly embrace the benefits of reusable packaging solutions. The continuous innovation in product design, coupled with strategic collaborations and mergers & acquisitions among key players, will further shape the market landscape in the coming years.

The growth of the plastic reusable packaging market is primarily propelled by a confluence of powerful economic, environmental, and regulatory forces. Increasingly, businesses are recognizing the long-term cost savings associated with reusable packaging compared to the recurring expenses of single-use alternatives, encompassing procurement, waste disposal, and labor. This economic advantage, coupled with the growing corporate emphasis on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) goals, is a significant driver. Consumers are also becoming more environmentally conscious, demanding sustainable practices from the brands they patronize, thereby incentivizing companies to adopt eco-friendly packaging solutions. Furthermore, government regulations worldwide are becoming more stringent regarding plastic waste reduction and the promotion of sustainable packaging. Policies such as extended producer responsibility (EPR) schemes, bans on certain single-use plastics, and incentives for reusable systems are directly influencing market adoption. The inherent durability and lifespan of plastic reusable packaging also contribute to its appeal, offering a more robust and reliable solution for product protection during transit and storage. This translates to reduced product damage and fewer returns, further enhancing the economic viability for businesses.

Despite its burgeoning growth, the plastic reusable packaging market faces several challenges and restraints that could temper its expansion. The initial upfront investment required for acquiring reusable packaging can be a significant barrier for smaller businesses with limited capital. While the long-term cost savings are undeniable, the initial outlay can be prohibitive. The logistics of managing and sanitizing reusable packaging fleets also presents a hurdle. Establishing efficient return, cleaning, and redistribution systems requires substantial infrastructure and operational planning, which can be complex and costly to implement, especially for businesses operating across vast geographical areas. The risk of contamination, particularly in sectors like healthcare and pharmaceuticals, necessitates stringent cleaning protocols and robust quality control measures, adding to operational expenses and complexity. Furthermore, consumer behavior and cultural inertia can also act as restraints. A lack of awareness or ingrained preference for convenience associated with single-use packaging can slow down adoption rates. Lastly, the availability and cost of virgin plastic, the primary raw material, can fluctuate, impacting the production costs of new reusable packaging. Concerns regarding the end-of-life management of reusable plastic packaging, although a smaller issue than with single-use plastics, still need to be addressed through effective recycling and repurposing initiatives to maintain a truly circular approach.

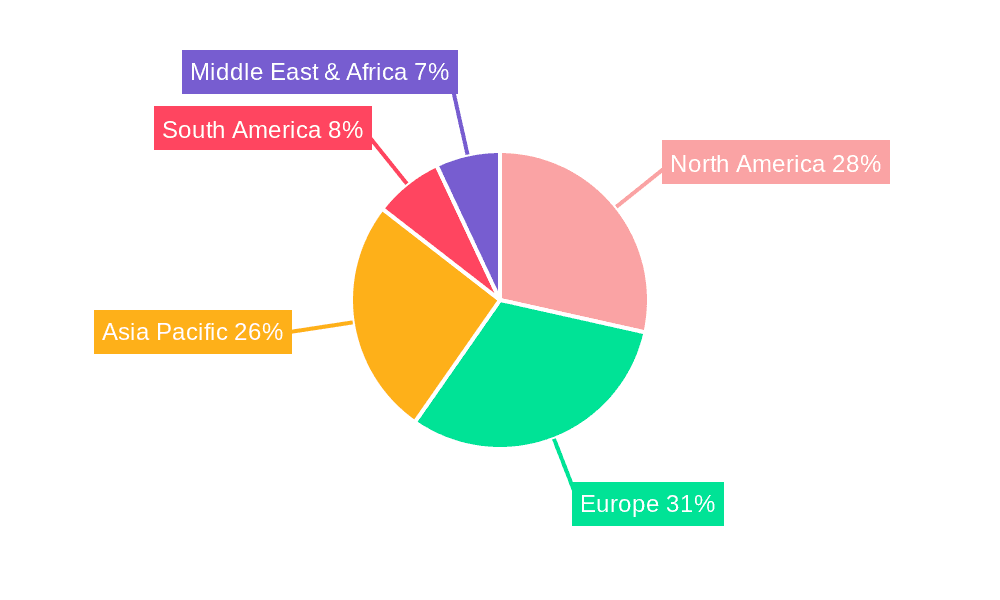

The global Plastic Reusable Packaging market is characterized by strong regional dominance and segment-specific growth, with certain areas and product categories leading the charge.

Dominant Regions/Countries:

Dominant Segments:

Several key catalysts are fueling the growth of the plastic reusable packaging industry. Growing environmental consciousness and stringent regulations against single-use plastics are compelling businesses to seek sustainable alternatives. The undeniable economic benefits, including reduced long-term costs, improved supply chain efficiency, and minimized waste disposal expenses, are major incentives for adoption. Technological advancements in material science are leading to the development of more durable, lighter, and food-grade compliant reusable packaging, expanding its applicability. Furthermore, the increasing focus on circular economy principles and the desire for enhanced brand image through sustainability initiatives are pushing companies towards reusable solutions.

This report provides unparalleled coverage of the Plastic Reusable Packaging market, offering a holistic view of its intricate dynamics. It meticulously analyzes market size, segmentation by type, application, and region, providing precise unit-based figures for production and consumption within the study period. The report details historical trends (2019-2024), current market status (estimated 2025), and robust future projections (2025-2033) with a specific focus on the estimated year of 2025. It delves into the driving forces, challenges, and growth catalysts, offering actionable insights for strategic decision-making. Furthermore, it provides a comprehensive overview of leading players and significant market developments, equipping stakeholders with the knowledge to navigate this evolving landscape effectively. The report's granular detail ensures it serves as an indispensable resource for anyone involved in the production, procurement, or utilization of plastic reusable packaging solutions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.1%.

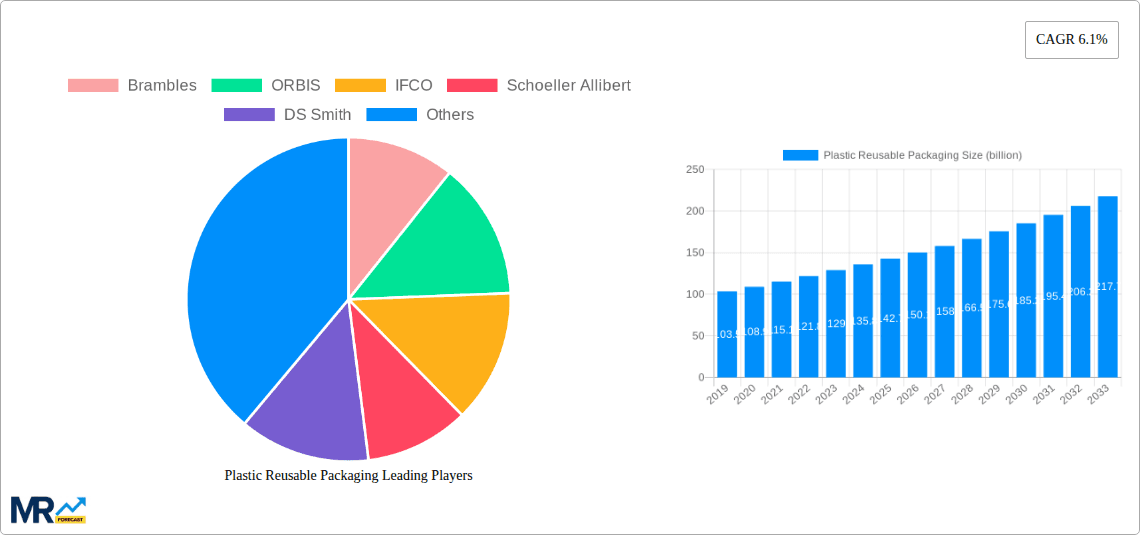

Key companies in the market include Brambles, ORBIS, IFCO, Schoeller Allibert, DS Smith, Schutz, Tosca, Cabka Group, Rehrig Pacific Company, Craemer Group, IPL Plastics, Monoflo International, LOSCAM, Greystone Logistics, HOREN Group, Mpact Limited, Buckhorn, RPP Containers, .

The market segments include Type, Application.

The market size is estimated to be USD 142.7 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Plastic Reusable Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plastic Reusable Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.