1. What is the projected Compound Annual Growth Rate (CAGR) of the Folded Corrugated Paper?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Folded Corrugated Paper

Folded Corrugated PaperFolded Corrugated Paper by Type (Single-walled, Double-walled, Triple-walled, World Folded Corrugated Paper Production ), by Application (Online Sales, Offline Sales, World Folded Corrugated Paper Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

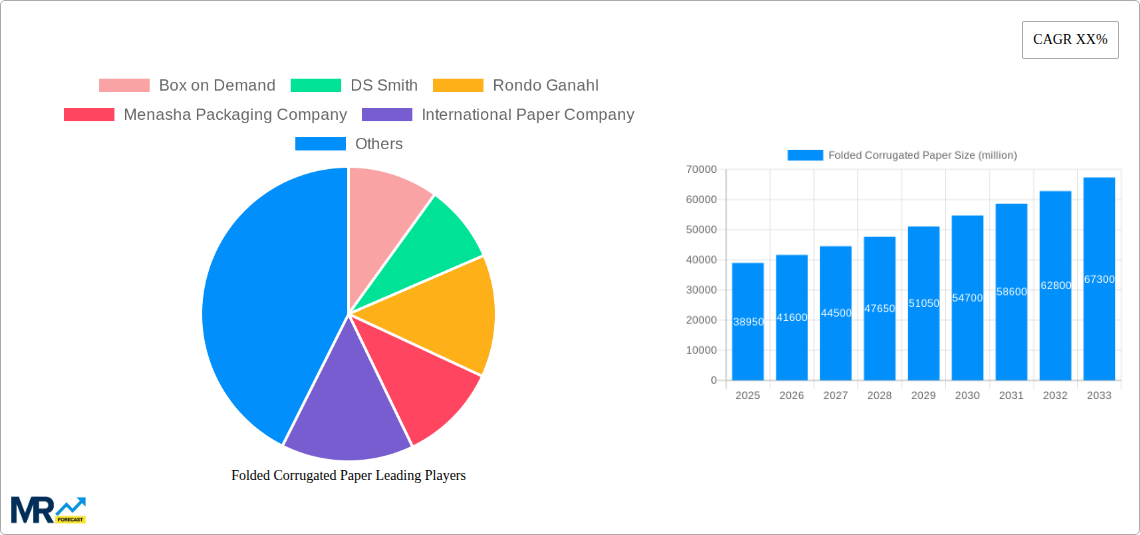

The global Folded Corrugated Paper market is poised for significant expansion, projected to reach an estimated USD 38,950 million by 2025. This robust growth is fueled by the escalating demand for sustainable and cost-effective packaging solutions across a multitude of industries. The e-commerce boom, with its relentless surge in online sales, stands as a primary driver, necessitating strong, reliable, and adaptable packaging to ensure product integrity during transit. Furthermore, the increasing emphasis on circular economy principles and the recyclability of paper-based packaging are boosting its adoption over traditional plastic alternatives. The market's growth trajectory is also influenced by advancements in paper production technologies, leading to more resilient and specialized corrugated paper products, such as single-walled, double-walled, and triple-walled options tailored for specific packaging needs.

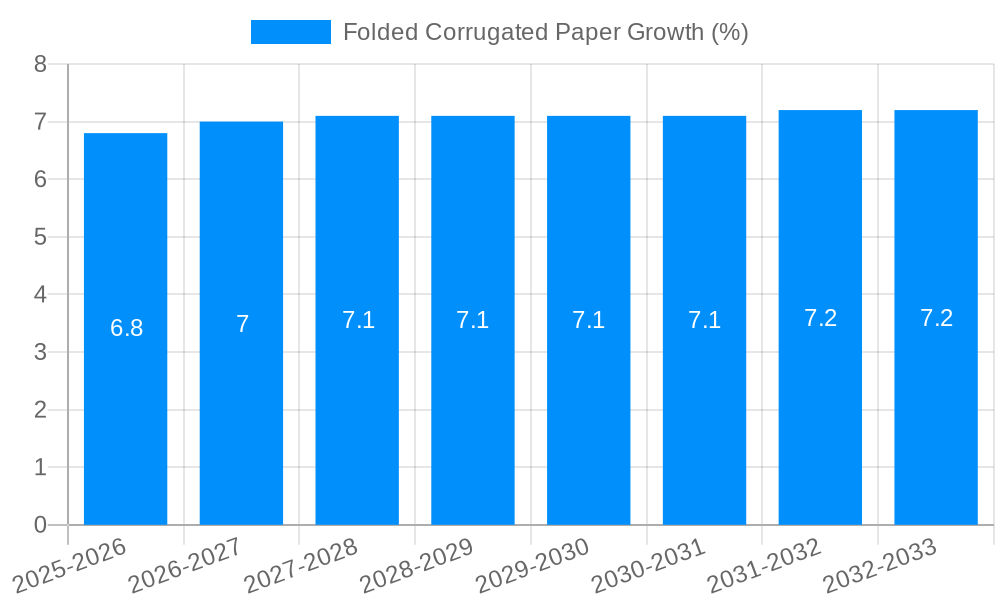

The market's trajectory is further shaped by evolving consumer preferences and regulatory landscapes that favor eco-friendly materials. While the "Online Sales" application segment is expected to dominate due to the ongoing digital transformation of retail, "Offline Sales" will continue to represent a substantial share, particularly for B2B applications and traditional retail channels. The industry is witnessing a consolidation trend with key players like Smurfit Kappa and International Paper Company investing in innovation and expanding their production capacities to cater to the burgeoning global demand. Challenges such as fluctuating raw material prices and intense competition are present, but the overall outlook remains overwhelmingly positive, driven by the inherent advantages of corrugated paper in terms of sustainability, versatility, and cost-effectiveness. The market's expansion is expected to be characterized by a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, underscoring its strong and sustained upward momentum.

Here is a unique report description on Folded Corrugated Paper, incorporating your specific instructions:

This in-depth market analysis delves into the dynamic landscape of Folded Corrugated Paper, providing a panoramic view of its evolution and future trajectory. Covering a comprehensive Study Period: 2019-2033, with a Base Year: 2025 and an Estimated Year: 2025, the report offers granular insights into historical trends (Historical Period: 2019-2024) and a robust Forecast Period: 2025-2033. We meticulously examine production volumes, market segmentation, key drivers, prevailing challenges, and the strategic initiatives of major industry players, all underpinned by a substantial World Folded Corrugated Paper Production volume estimated in the millions. This report is an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within the global folded corrugated paper market.

The folded corrugated paper market is witnessing a profound transformation, driven by an intricate interplay of evolving consumer behavior, technological advancements, and a heightened emphasis on sustainability. XXX, a key marker for market vitality, indicates a robust upward trend in demand, particularly within the Online Sales segment. The e-commerce boom, accelerated by global events and shifting retail paradigms, has cemented the role of folded corrugated paper as a primary packaging solution for a vast array of goods. Consumers, increasingly conscious of their environmental footprint, are actively seeking products with sustainable packaging, a sentiment that directly fuels the demand for corrugated paper, which is largely derived from recycled materials. This inclination towards eco-friendly alternatives is reshaping manufacturing processes and product development, pushing for lighter, stronger, and more recyclable corrugated designs. Furthermore, the report highlights the increasing sophistication of folding and interlocking mechanisms within corrugated packaging, moving beyond simple box constructions to more intricate and protective designs that minimize the need for additional protective materials like plastic inserts. Innovations in printing technology are also enhancing the aesthetic appeal and branding capabilities of folded corrugated paper, transforming it from a purely functional element to a powerful marketing tool. The pervasive influence of digitalization across the supply chain is optimizing production efficiencies and enabling greater customization, allowing manufacturers to cater to niche market demands with agility. The sheer volume of World Folded Corrugated Paper Production, projected to reach tens of millions of units, underscores its critical importance across diverse industrial applications. The report meticulously analyzes these multifaceted trends, offering predictive insights and strategic recommendations for businesses to thrive in this evolving marketplace.

The global folded corrugated paper market is experiencing significant momentum, propelled by a confluence of powerful economic, environmental, and technological drivers. The relentless expansion of the e-commerce sector stands as a paramount force, driving unprecedented demand for efficient, protective, and cost-effective packaging solutions. As more consumers embrace online shopping, the need for robust corrugated boxes capable of withstanding the rigmarole of transit and delivery continues to escalate. This surge in online sales directly translates into a higher volume of World Folded Corrugated Paper Production, with an estimated demand in the millions. Concurrently, a global paradigm shift towards sustainability is acting as a significant propellant. Folded corrugated paper, being predominantly recyclable and often made from recycled content, aligns perfectly with growing consumer and regulatory pressure for environmentally responsible packaging. This eco-conscious trend is fostering innovation in material science and manufacturing, leading to the development of lighter yet stronger corrugated structures and increased utilization of post-consumer waste. Furthermore, advancements in manufacturing technologies, including sophisticated die-cutting and scoring techniques, are enabling the creation of more complex and customized folded corrugated designs, catering to the unique needs of diverse product categories. The drive for operational efficiency across industries is also a key factor, as folded corrugated paper offers excellent stackability, ease of assembly, and a favorable cost-to-performance ratio.

Despite its robust growth trajectory, the folded corrugated paper market faces a unique set of challenges and restraints that warrant careful consideration. Fluctuations in the price and availability of raw materials, particularly virgin pulp and recycled paper, can significantly impact production costs and profitability. Global supply chain disruptions, whether due to geopolitical events, natural disasters, or logistical bottlenecks, can lead to delays in raw material procurement and finished product delivery, affecting market stability. The industry is also grappling with the increasing cost of energy and labor, which are integral components of the manufacturing process. Furthermore, while corrugated paper is considered sustainable, its recycling infrastructure and rates can vary significantly by region, posing a challenge in achieving optimal circularity. Intense competition among market players, particularly in price-sensitive segments, can exert downward pressure on profit margins. Environmental regulations, while often promoting the use of corrugated paper, can also introduce compliance costs related to emissions, waste management, and product stewardship. The ongoing evolution of consumer preferences and the emergence of alternative packaging materials, such as bioplastics and advanced composite materials, also present a competitive threat that the folded corrugated paper industry must continuously address through innovation and differentiation. These factors, collectively, create a complex operating environment that necessitates strategic foresight and adaptive business models.

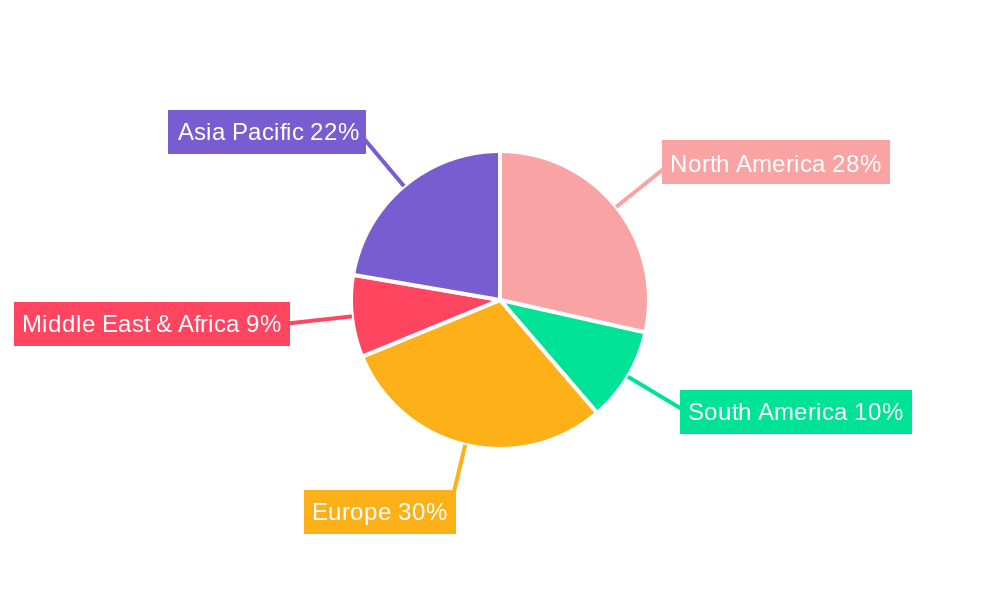

The folded corrugated paper market is characterized by distinct regional strengths and segment dominance, with Asia-Pacific poised to emerge as a powerhouse in both production and consumption. Driven by its burgeoning economies, rapidly expanding e-commerce sector, and a vast manufacturing base, the region is witnessing unparalleled growth in demand for folded corrugated paper. Countries like China, India, and Southeast Asian nations are at the forefront of this expansion, fueled by a growing middle class with increasing disposable income and a substantial shift towards online retail for everyday necessities and discretionary goods. The Online Sales application segment, in particular, is experiencing exponential growth across Asia-Pacific, directly translating into higher World Folded Corrugated Paper Production volumes. The sheer scale of this market ensures that production capacities are constantly being scaled up to meet the insatiable demand.

Within this dynamic regional landscape, the Single-walled corrugated paper segment is projected to maintain its dominance, owing to its versatility, cost-effectiveness, and widespread applicability across a broad spectrum of consumer goods and e-commerce shipments. Its balance of protection and weight makes it an ideal choice for a vast majority of packaging needs. However, the report also foresees significant growth in Double-walled and even Triple-walled corrugated paper, particularly for heavier, more fragile, or high-value items requiring enhanced protective capabilities. This trend is linked to the increasing sophistication of e-commerce logistics, where goods undergo more rigorous handling and transit phases, necessitating superior structural integrity.

North America and Europe, while mature markets, continue to represent significant demand centers for folded corrugated paper. These regions are characterized by a strong emphasis on sustainability, innovation, and premium packaging. Consequently, there is a notable demand for specialized corrugated solutions that offer enhanced branding capabilities, improved structural performance, and greater recyclability. The Offline Sales segment, though steadily growing, is increasingly being influenced by the omnichannel strategies of retailers, blurring the lines between physical and digital retail experiences. This necessitates packaging solutions that can serve both channels effectively.

Latin America and the Middle East & Africa are emerging markets with substantial untapped potential. Their growth is being spurred by increasing urbanization, rising disposable incomes, and the gradual expansion of e-commerce infrastructure. As these regions mature, the demand for folded corrugated paper is expected to witness a robust upswing, driven by both online and offline sales channels. The report will provide detailed market projections for these regions, highlighting specific growth opportunities and the segments likely to experience the most significant expansion. The overarching narrative points towards Asia-Pacific leading the charge, with the Single-walled segment retaining its prominence, while the demand for more robust corrugated structures, like Double-walled and Triple-walled, gains traction due to evolving logistical demands and product protection requirements.

The folded corrugated paper industry is fueled by several potent growth catalysts. The escalating global e-commerce penetration is a primary driver, creating an insatiable demand for reliable and cost-effective packaging solutions to facilitate online sales. Simultaneously, the growing consumer and regulatory push for sustainable packaging options is a significant catalyst, as corrugated paper's recyclability and bio-based nature make it an environmentally preferred choice. Continuous innovation in design and manufacturing processes, leading to lighter, stronger, and more customizable corrugated structures, further propels market growth by enhancing product protection and brand appeal.

This report offers a holistic view of the folded corrugated paper market, extending beyond mere statistical data. It provides a deep dive into the strategic imperatives for players seeking to navigate the evolving market dynamics. The comprehensive coverage includes an analysis of emerging consumer preferences for personalized and eco-friendly packaging, highlighting how innovation in folded corrugated paper can directly address these needs. Furthermore, the report examines the impact of evolving supply chain logistics, particularly the growth of last-mile delivery and its influence on packaging design and material choices. It also scrutinizes the role of digital technologies in optimizing the production and distribution of folded corrugated paper, paving the way for greater efficiency and responsiveness to market demands, ultimately contributing to a more sustainable and robust industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Box on Demand, DS Smith, Rondo Ganahl, Menasha Packaging Company, International Paper Company, Smurfit Kappa, Papierfabrik Palm, Braepac Packaging, Independent Corrugator, Ribble Packaging Ltd, .

The market segments include Type, Application.

The market size is estimated to be USD 38950 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Folded Corrugated Paper," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Folded Corrugated Paper, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.