1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Plastic Packaging Coating?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Flexible Plastic Packaging Coating

Flexible Plastic Packaging CoatingFlexible Plastic Packaging Coating by Type (Epoxies Coatings, Acrylics Coatings, Urethane & Polyurethane Coatings, Lacquer Coatings, Plasma Coatings, Polyesters Coatings, Phenolic Coatings, Others, World Flexible Plastic Packaging Coating Production ), by Application (Food & Beverage Packaging, Pharmaceutical Packaging, Cosmetics & Personal Care Packaging, Chemical Packaging, Consumer Durables Electronic Goods Packaging, Automotive & Allied Packaging, Others, World Flexible Plastic Packaging Coating Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

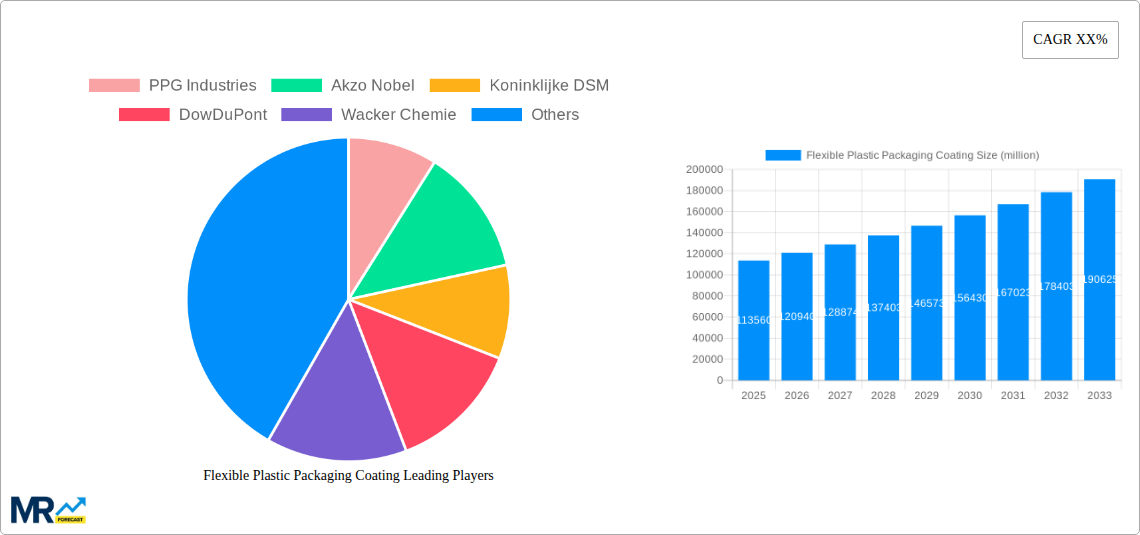

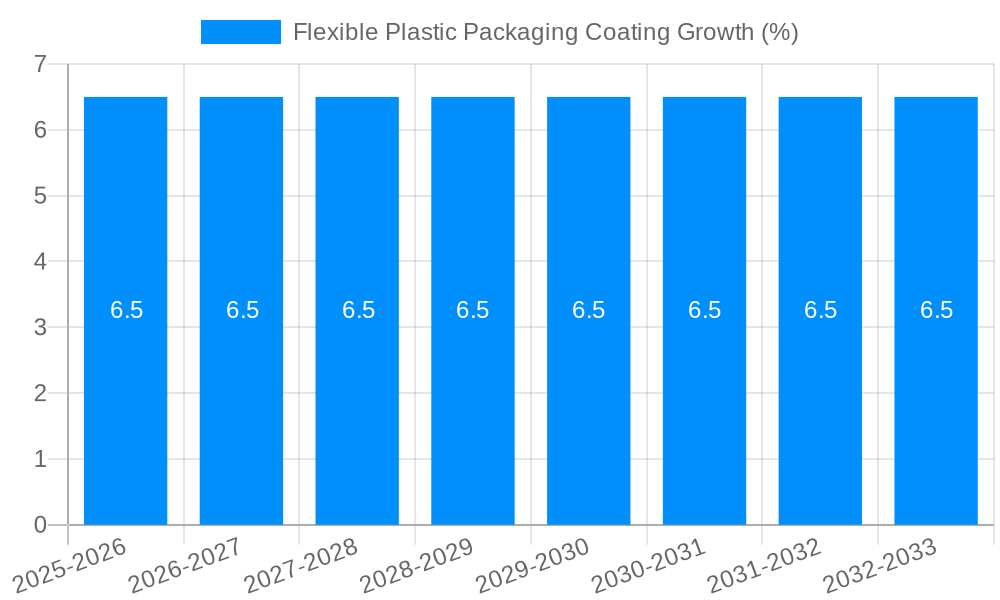

The global Flexible Plastic Packaging Coating market is poised for significant expansion, projected to reach an estimated USD 113,560 million by 2025. This robust growth is fueled by an accelerating Compound Annual Growth Rate (CAGR) of approximately 6.5%, indicating a dynamic and expanding industry. Key drivers underpinning this surge include the escalating demand for enhanced barrier properties in packaging to preserve product freshness and extend shelf life, particularly within the burgeoning food & beverage sector. The increasing consumer preference for convenient, lightweight, and aesthetically appealing packaging solutions further bolsters market demand. Advancements in coating technologies, offering improved recyclability and sustainability, are also playing a crucial role in shaping market dynamics, addressing growing environmental concerns.

The market is characterized by a diverse range of coating types, with Epoxies, Acrylics, and Urethane & Polyurethane coatings dominating the landscape due to their excellent performance characteristics and wide applicability. The application segment is heavily influenced by the Food & Beverage Packaging and Pharmaceutical Packaging sectors, driven by stringent regulatory requirements for product safety and integrity. Emerging trends such as the development of bio-based and biodegradable coatings, alongside the adoption of advanced application techniques like plasma coating for superior adhesion and performance, are set to redefine the market's future trajectory. Despite the positive outlook, potential restraints such as fluctuating raw material prices and the need for significant investment in R&D for sustainable solutions may present challenges. However, the overall market sentiment remains strongly optimistic, supported by continuous innovation and an expanding application base.

This report offers an in-depth analysis of the global flexible plastic packaging coating market, providing crucial insights for stakeholders. The study encompasses a comprehensive historical overview from 2019 to 2024, a detailed examination of the base year 2025, and an extensive forecast period from 2025 to 2033. Projections for World Flexible Plastic Packaging Coating Production are meticulously detailed, with figures presented in millions of units. The report meticulously investigates the various types of coatings, their applications across diverse industries, and the key players driving innovation and market expansion.

XXX The global flexible plastic packaging coating market is poised for significant and dynamic growth, driven by an escalating demand for enhanced product protection, improved shelf appeal, and specialized functionalities. From 2019 to 2024, the market demonstrated consistent upward momentum, a trend projected to accelerate through the forecast period of 2025-2033. A key insight is the growing preference for high-performance coatings that offer superior barrier properties against moisture, oxygen, and light, thereby extending the shelf life of packaged goods and minimizing product spoilage. This demand is particularly pronounced in the Food & Beverage Packaging segment, which is expected to continue its dominance, driven by evolving consumer lifestyles, increasing global food trade, and the need for convenient, on-the-go packaging solutions. The intricate balance between cost-effectiveness and advanced functionalities is a central theme shaping the market. Manufacturers are continuously seeking coatings that not only protect the contents but also contribute to brand differentiation through enhanced aesthetics, such as matte finishes, high-gloss effects, and advanced printing capabilities. Furthermore, the increasing focus on sustainability is fostering innovation in eco-friendly coating solutions, including water-based formulations and biodegradable options, which are gaining traction as regulatory pressures and consumer awareness intensify. The Pharmaceutical Packaging sector is another significant driver, where stringent regulatory requirements for product integrity and safety necessitate the use of specialized, high-barrier coatings. The growing prevalence of chronic diseases and the expansion of generic drug markets are contributing to the demand for robust and reliable packaging solutions. Emerging trends also include the development of smart coatings that can indicate product freshness or tampering, adding an extra layer of value and safety. The market is characterized by a growing adoption of advanced application techniques, such as gravure and flexographic printing, which enable precise and efficient coating application, thereby optimizing material usage and reducing waste. The global World Flexible Plastic Packaging Coating Production volume is anticipated to witness a substantial increase, reflecting these overarching trends and the increasing reliance on flexible packaging across various industries. The interplay between technological advancements in coating formulations and application processes, coupled with the evolving needs of end-use industries, will continue to shape the trajectory of this vital market segment.

The flexible plastic packaging coating market is experiencing robust expansion due to a confluence of powerful driving forces. Foremost among these is the burgeoning global demand for convenient and shelf-stable food and beverage products, a trend amplified by urbanization, busy lifestyles, and the growth of e-commerce. Flexible packaging, with its lightweight nature and superior barrier properties facilitated by coatings, offers an ideal solution for protecting perishable goods during transit and storage, thereby reducing food waste. This directly fuels the need for advanced coatings that can provide extended shelf life and maintain product quality. The increasing global population and the rising disposable incomes in emerging economies further contribute to this demand, as consumers increasingly opt for packaged goods. Furthermore, the pharmaceutical industry's stringent requirements for product integrity and safety are a significant impetus for the adoption of high-performance flexible plastic packaging coatings. These coatings act as crucial barriers against moisture, oxygen, and contaminants, ensuring the efficacy and safety of sensitive medications. The pharmaceutical sector’s continuous innovation and the expanding market for both prescription and over-the-counter drugs directly translate into a heightened demand for specialized packaging solutions. The cosmetic and personal care industries also play a vital role, where aesthetic appeal and brand differentiation are paramount. Coatings that enhance visual appeal, offer tactile sensations, and protect delicate formulations are highly sought after, driving innovation in this segment. The growing emphasis on sustainability, while presenting challenges, is also a powerful driver for the development of eco-friendly coating technologies, such as water-based and compostable options, as companies strive to meet regulatory demands and consumer preferences for greener packaging solutions.

Despite its impressive growth trajectory, the flexible plastic packaging coating market faces several notable challenges and restraints that temper its expansion. A primary concern is the escalating cost of raw materials, particularly petrochemical-based resins and additives that form the backbone of many coating formulations. Volatility in crude oil prices and supply chain disruptions can lead to significant cost pressures for coating manufacturers, which are often passed on to end-users, potentially impacting demand, especially in price-sensitive segments. Environmental regulations, while driving innovation, also present a significant hurdle. Increasingly stringent rules regarding VOC emissions, the use of hazardous chemicals, and the end-of-life management of plastic packaging necessitate substantial investment in research and development to create compliant and sustainable coating solutions. The transition to more environmentally friendly alternatives, such as water-based or bio-based coatings, can be complex and costly, requiring extensive reformulation and testing to match the performance characteristics of traditional solvent-based systems. Furthermore, the inherent recyclability challenges associated with multi-layer flexible plastic packaging, which often incorporates different types of plastics and barrier materials, pose a significant restraint. Coatings can sometimes complicate the recycling process, leading to a demand for coatings that are more compatible with existing recycling streams or that enable easier de-inking and material separation. Consumer perception and awareness regarding the environmental impact of plastic packaging also play a role, influencing purchasing decisions and creating pressure on brands to adopt more sustainable packaging strategies, which can sometimes lead to a preference for alternative packaging formats over those requiring extensive coatings. Finally, the complex application processes required for certain high-performance coatings, coupled with the need for specialized equipment and skilled labor, can represent a barrier to entry for smaller manufacturers and limit widespread adoption in certain regions.

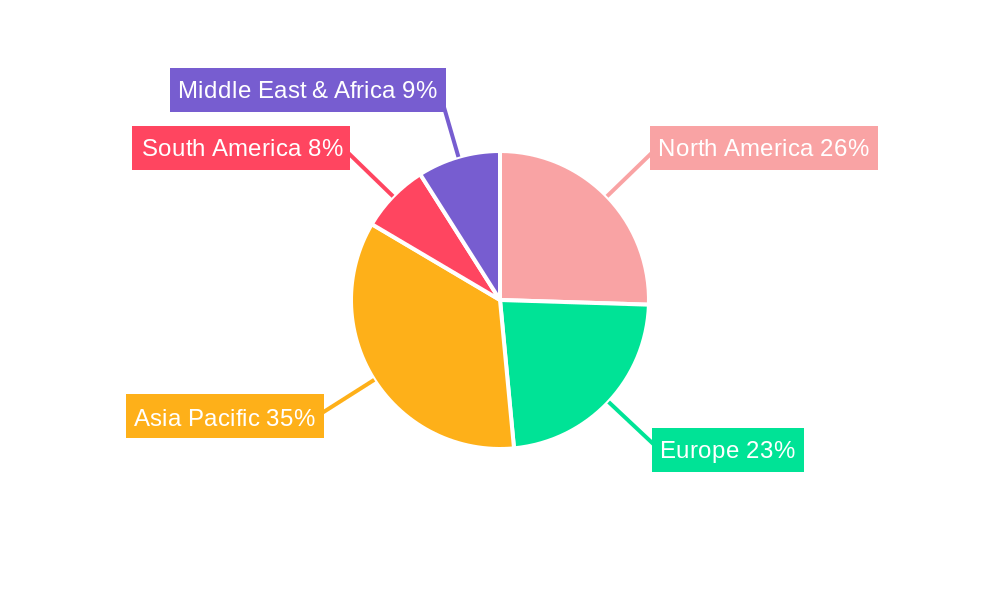

The global flexible plastic packaging coating market is characterized by significant regional variations in demand and technological adoption, with specific segments playing a pivotal role in shaping its future.

Dominant Region: Asia Pacific is poised to emerge as the dominant region in the flexible plastic packaging coating market.

Dominant Segment: Food & Beverage Packaging is expected to remain the most significant application segment, consistently driving demand for flexible plastic packaging coatings.

In terms of coating types, while Acrylics Coatings and Urethane & Polyurethane Coatings are widely adopted due to their versatility and cost-effectiveness for various applications including food and beverage, the growing emphasis on high-barrier properties will continue to drive demand for specialized solutions. Polyesters Coatings are also crucial for their strength and heat resistance, essential for retortable pouches. The segment of Plasma Coatings is also gaining traction for its ability to provide ultra-thin, high-performance barriers, contributing to material reduction and sustainability efforts.

Several key factors are acting as potent growth catalysts for the flexible plastic packaging coating industry. The escalating demand for extended shelf life and enhanced product preservation, particularly in the food and beverage sector, is a primary driver, directly boosting the need for high-barrier coatings that minimize spoilage and waste. Furthermore, the increasing consumer preference for convenience, portability, and appealing packaging aesthetics is fueling innovation in coatings that offer both functional benefits and superior visual impact. The pharmaceutical industry's stringent requirements for product safety and integrity continue to necessitate the use of advanced, protective coatings, ensuring medication efficacy. Moreover, a growing global focus on sustainability is spurring the development and adoption of eco-friendly coating solutions, such as water-based and biodegradable formulations, opening new market avenues and driving research and development investments.

This comprehensive report provides an exhaustive analysis of the global flexible plastic packaging coating market, offering deep insights into its multifaceted landscape. The study meticulously details market dynamics, including historical trends, current scenarios, and future projections, with a specific focus on World Flexible Plastic Packaging Coating Production volumes, meticulously quantified in millions of units. The report delves into the intricate interplay of various coating types, such as Epoxies, Acrylics, Urethane & Polyurethane, Lacquers, Plasma, Polyesters, and Phenolic coatings, alongside other emerging technologies. It meticulously examines their applications across critical sectors, including Food & Beverage Packaging, Pharmaceutical Packaging, Cosmetics & Personal Care Packaging, Chemical Packaging, Consumer Durables Electronic Goods Packaging, and Automotive & Allied Packaging. The report also highlights significant industry developments, key regional market assessments, and the strategic positioning of leading global players. By providing a granular view of market drivers, challenges, and growth catalysts, this report equips stakeholders with the essential knowledge to navigate this evolving industry and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PPG Industries, Akzo Nobel, Koninklijke DSM, DowDuPont, Wacker Chemie, Altana, Allnex Group, BASF, Kansai Paint, Axalta Coating Systems, Bostik, Plasmatreat, Michelman, Schmid Rhyner, Paramelt, Jamestown Coating Technologies, Sierra Coating Technologies, Glenroy, American Packaging.

The market segments include Type, Application.

The market size is estimated to be USD 113560 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Flexible Plastic Packaging Coating," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Flexible Plastic Packaging Coating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.