1. What is the projected Compound Annual Growth Rate (CAGR) of the Financial Derivatives?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Financial Derivatives

Financial DerivativesFinancial Derivatives by Type (Forward, Future, Option, Swap), by Application (Hedging, Speculative Arbitrage, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

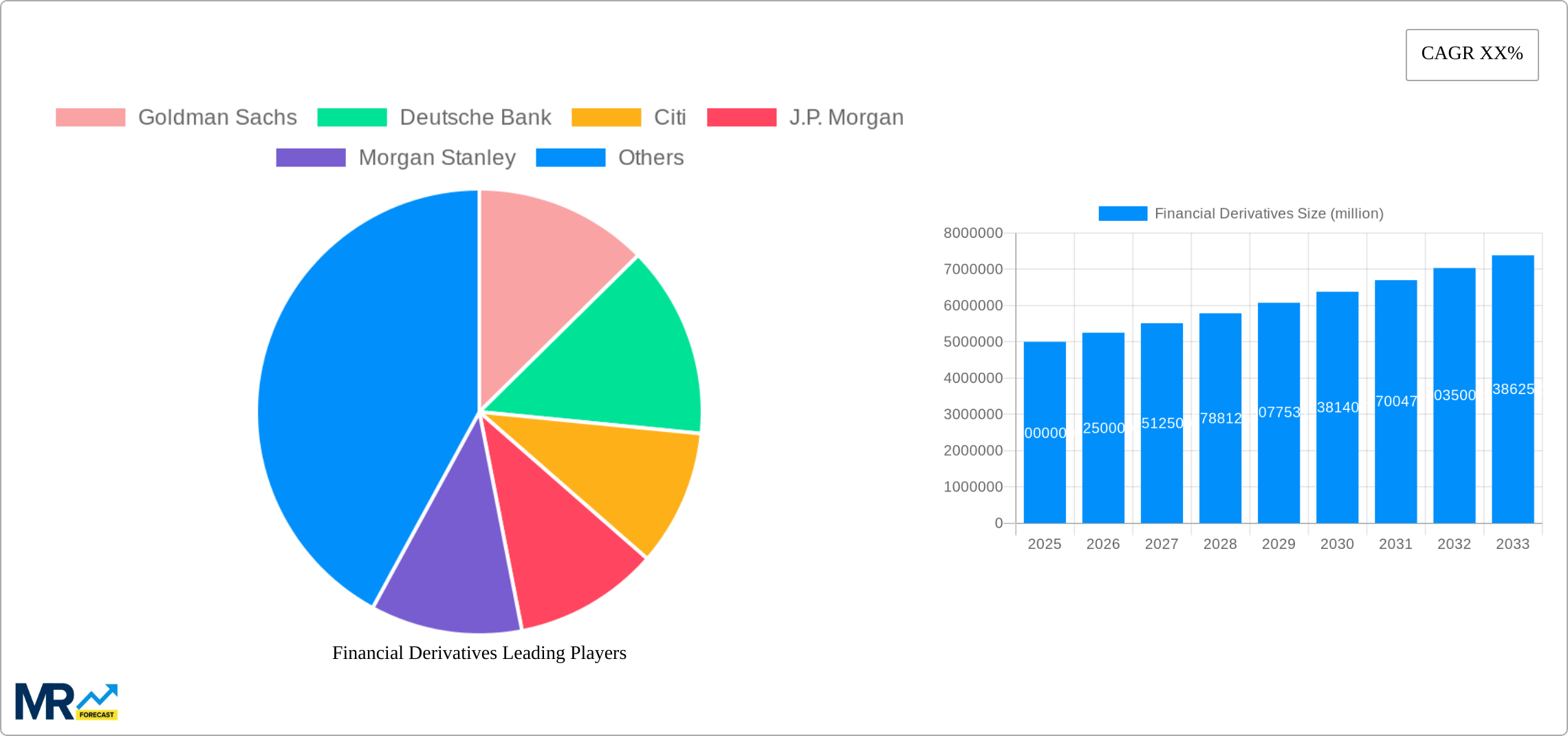

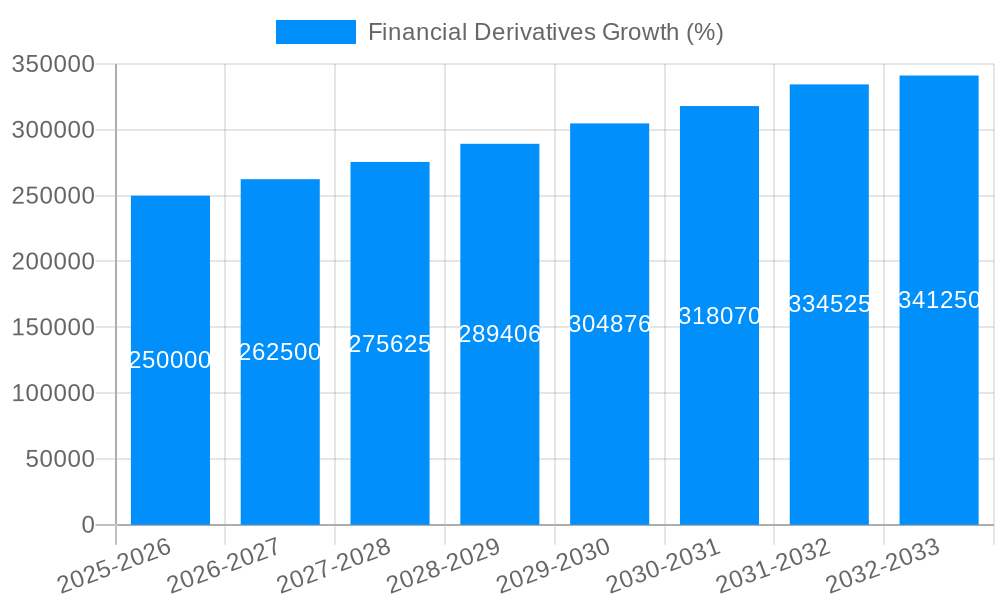

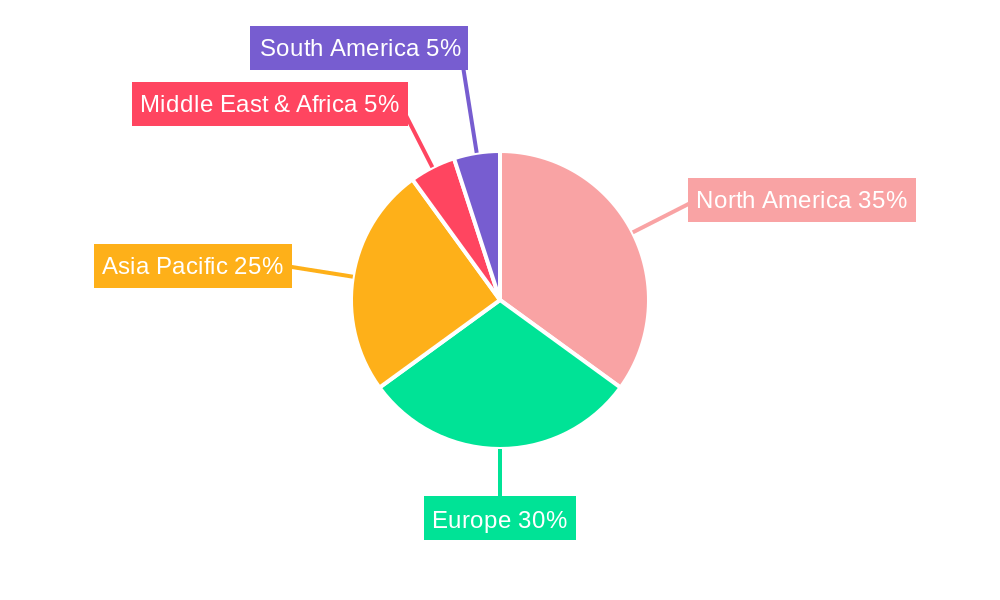

The global financial derivatives market is experiencing robust growth, driven by increasing market volatility, the need for sophisticated risk management tools, and the expansion of investment opportunities across diverse asset classes. The market, encompassing forwards, futures, options, and swaps used for hedging, speculative arbitrage, and other purposes, is projected to maintain a healthy Compound Annual Growth Rate (CAGR). While precise figures for market size and CAGR are not provided, a reasonable estimation based on industry reports and observed market trends suggests a substantial market value, likely in the hundreds of billions or even trillions of dollars, depending on the chosen valuation methodology (e.g., notional value vs. market value of outstanding contracts). Key drivers include the growing complexity of global financial markets, regulatory changes demanding more robust risk mitigation strategies, and the increasing adoption of algorithmic trading and high-frequency trading, which rely heavily on derivative instruments. Geographic growth is uneven, with North America and Europe currently holding significant market share, while Asia-Pacific shows considerable potential for future expansion due to increasing financial market sophistication and economic growth in emerging economies like China and India.

However, the market also faces certain restraints. These include stringent regulatory oversight aimed at mitigating systemic risk, which can increase compliance costs and limit certain trading strategies. Furthermore, the inherent complexity of many derivatives products requires specialized expertise, potentially limiting accessibility for smaller investors and businesses. Market fluctuations and unforeseen global events (e.g., geopolitical instability, economic recessions) can impact market sentiment and trading volumes. The competitive landscape is highly concentrated, with major global investment banks and specialized financial institutions dominating the market. However, the increasing adoption of fintech solutions and the emergence of new market participants, especially in the areas of exchange-traded derivatives and over-the-counter (OTC) markets, are likely to reshape the market dynamics over the forecast period. The segmentation by derivative type (forwards, futures, options, swaps) and application (hedging, speculative arbitrage, others) provides a granular view of market dynamics, enabling strategic decision-making for businesses operating within this dynamic sector.

The global financial derivatives market exhibited robust growth between 2019 and 2024, reaching an estimated value of $XXX million in 2025. This expansion is projected to continue throughout the forecast period (2025-2033), driven by several key factors discussed later in this report. The historical period (2019-2024) saw increasing adoption of derivatives across diverse sectors, fueled by the need for risk management, particularly in response to market volatility. The rise of sophisticated trading strategies and technological advancements, such as algorithmic trading and high-frequency trading, have significantly impacted market dynamics. Key players, including Goldman Sachs, JP Morgan Chase, and Deutsche Bank, have maintained substantial market share, leveraging their expertise and vast networks to cater to the growing demand for complex derivative products. However, regulatory changes and increasing scrutiny of risk management practices are shaping the competitive landscape. The estimated year 2025 shows a significant jump in the market size compared to the previous years, indicating a positive outlook for the industry's future growth. This growth is not uniform across all derivative types or applications; certain segments, as detailed later, are experiencing faster expansion than others. The increasing interconnectedness of global financial markets further enhances the role and importance of financial derivatives in managing risk and accessing investment opportunities. Competition among market participants is intensifying, leading to innovative product development and a greater focus on efficiency and cost optimization.

Several factors contribute to the growth of the financial derivatives market. Firstly, the inherent need for risk mitigation across various sectors, including agriculture, energy, and finance, drives demand for hedging instruments like futures and options. Companies use these to protect against unfavorable price fluctuations in commodities and other assets. Secondly, the increasing complexity and volatility of global financial markets encourage the use of sophisticated derivative strategies for speculative trading and arbitrage opportunities. The quest for higher returns in low-interest-rate environments pushes investors towards more complex derivative strategies, even with higher risks. Technological advancements, including improved trading platforms and analytical tools, are also driving growth by enabling more efficient and complex derivative trading. Finally, the continuous evolution of regulatory frameworks, while introducing challenges, simultaneously fosters greater transparency and trust within the market, thus encouraging wider participation. The expanding global economy and the increasing interconnectedness of financial markets are additional catalysts, leading to a higher demand for instruments that can effectively manage cross-border risks.

Despite the positive outlook, several factors pose challenges to the financial derivatives market. Regulatory changes aimed at enhancing market stability and preventing systemic risks can limit certain trading activities and increase compliance costs for market participants. The complexity of derivative products and the potential for significant losses, especially for less sophisticated investors, remains a major concern. Counterparty risk, the risk of a trading partner defaulting on its obligations, is a persistent threat that requires robust risk management practices. Moreover, market manipulation and other forms of fraudulent activity represent an ongoing challenge that requires constant vigilance and improved regulatory oversight. Finally, geopolitical uncertainties and macroeconomic shocks can create significant volatility in the market, affecting trading volumes and investor sentiment. These factors necessitate careful risk management, continuous monitoring of market developments, and strong regulatory frameworks to ensure stability and integrity.

The Hedging application segment is projected to dominate the market throughout the forecast period.

High Growth in Developed Markets: North America and Europe are expected to remain key regional markets, driven by established financial infrastructure and sophisticated investor base. These regions are home to major financial institutions and highly developed derivatives markets. Their robust regulatory frameworks, while imposing some challenges, also provide greater stability and trust. The substantial trading volumes in these regions further consolidate their dominant position.

Growing Adoption in Emerging Markets: Emerging markets in Asia (e.g., China, India) are demonstrating significant growth potential, though at a potentially slower pace than developed markets. This growth is fueled by increasing financial market liberalization, economic expansion, and the need for sophisticated risk management tools. However, regulatory gaps and infrastructural limitations can act as a constraint.

Hedging's Preeminence: The hedging segment’s dominance stems from the crucial role derivatives play in mitigating risks associated with price fluctuations in underlying assets (commodities, currencies, interest rates). The ever-increasing global economic volatility reinforces the need for effective hedging strategies, making this segment the strongest performing one. The use of futures and options for hedging purposes is prevalent across diverse industries, fueling the growth of this segment.

Specific Examples: Companies such as those in the energy sector utilize derivatives to hedge against price fluctuations in crude oil and natural gas, while agricultural companies employ them to manage price risks associated with crops. Furthermore, financial institutions leverage derivatives for managing interest rate risk and currency exchange rate fluctuations. This wide-ranging application across sectors ensures the enduring demand and dominance of this application segment.

The financial derivatives industry is poised for substantial growth propelled by several factors. Increased market volatility, coupled with the ever-present need for effective risk management across diverse sectors, fuels significant demand for these instruments. Technological advancements, particularly in artificial intelligence and high-frequency trading, are streamlining operations and enabling complex trading strategies, further enhancing market growth. The rising interconnectedness of global financial markets fosters the demand for sophisticated tools to manage diverse cross-border risks. Finally, ongoing regulatory evolution, while posing certain challenges, ensures market stability and transparency, ultimately fostering growth.

This report offers a detailed analysis of the financial derivatives market, providing insights into key trends, driving forces, challenges, and growth opportunities. It includes a comprehensive overview of market segments, key players, regional dynamics, and significant industry developments. The report's forecasting model leverages historical data and expert analysis to project future market growth, offering invaluable insights for investors, market participants, and industry stakeholders navigating this complex and dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Goldman Sachs, Deutsche Bank, Citi, J.P. Morgan, Morgan Stanley, Bank of America, Credit Suisse, Nomura, ANZ, BNP Paribas, Wells Fargo, Truist, Societe Generale, Yongan Futures, CITIC Securities, Guotai Junan, Haitong Futures, Ruida Futures, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Financial Derivatives," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Financial Derivatives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.