1. What is the projected Compound Annual Growth Rate (CAGR) of the Credit Derivative?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Credit Derivative

Credit DerivativeCredit Derivative by Type (Credit Default Swap, Total Return Swap, Credit-linked Note, Credit Spread Option), by Application (Hedging, Speculation and Arbitrage), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

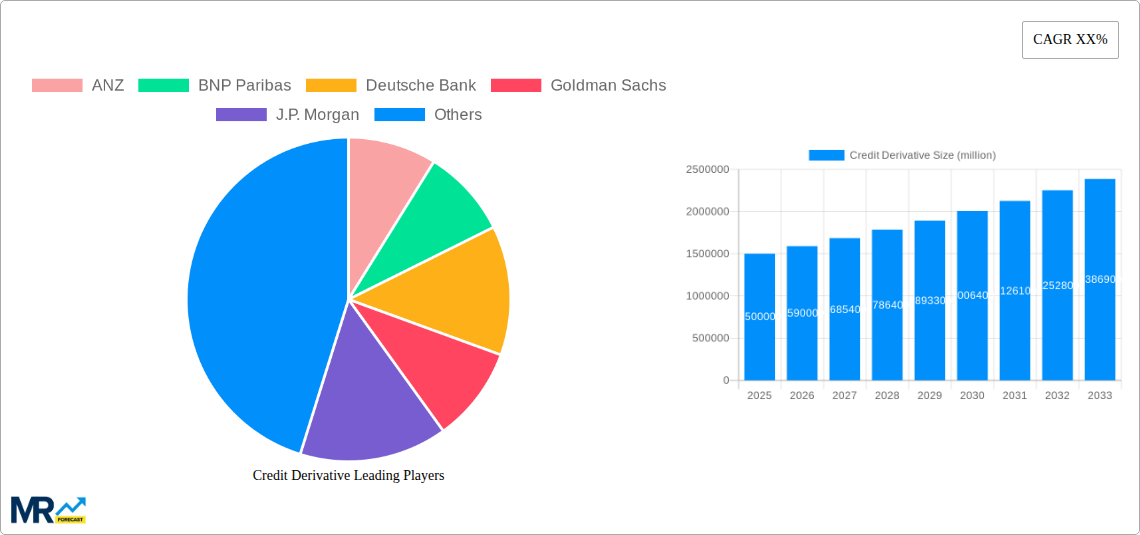

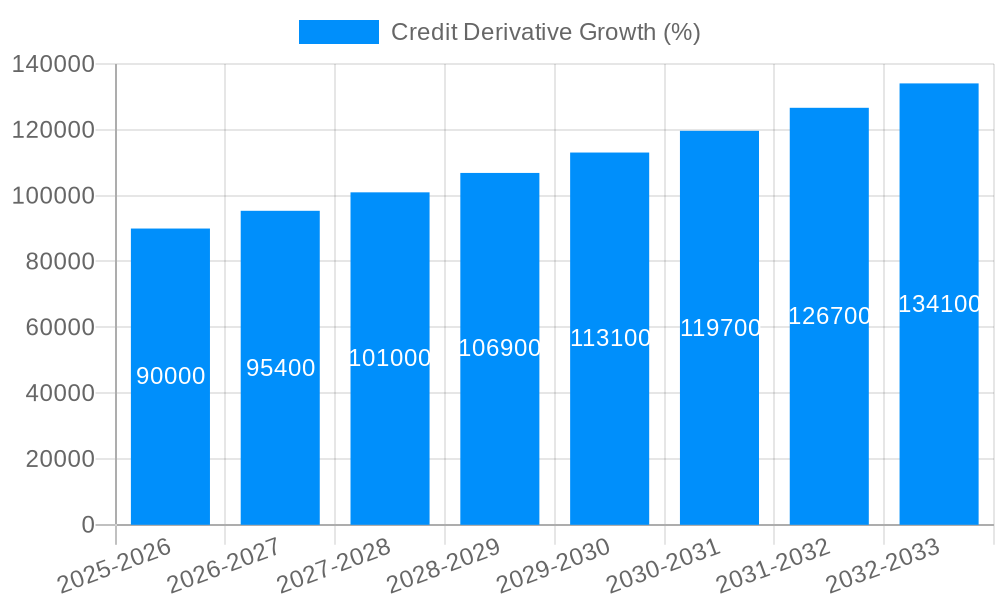

The global credit derivative market is experiencing robust growth, driven by increasing demand for risk management tools across diverse financial sectors. The market's expansion is fueled by factors such as rising complexities in financial markets, heightened regulatory scrutiny demanding robust risk mitigation strategies, and the growing prevalence of sophisticated hedging techniques employed by corporations and financial institutions. While precise market sizing data was not provided, based on common industry growth rates and the substantial involvement of major global financial players like Goldman Sachs and J.P. Morgan, a reasonable estimate places the 2025 market value at approximately $150 billion USD. This figure is projected to experience a compound annual growth rate (CAGR) of around 7-8% over the forecast period (2025-2033), reaching an estimated $275 billion to $300 billion by 2033. The significant presence of major banks globally across all regions indicates a well-established market with substantial international participation and a robust infrastructure.

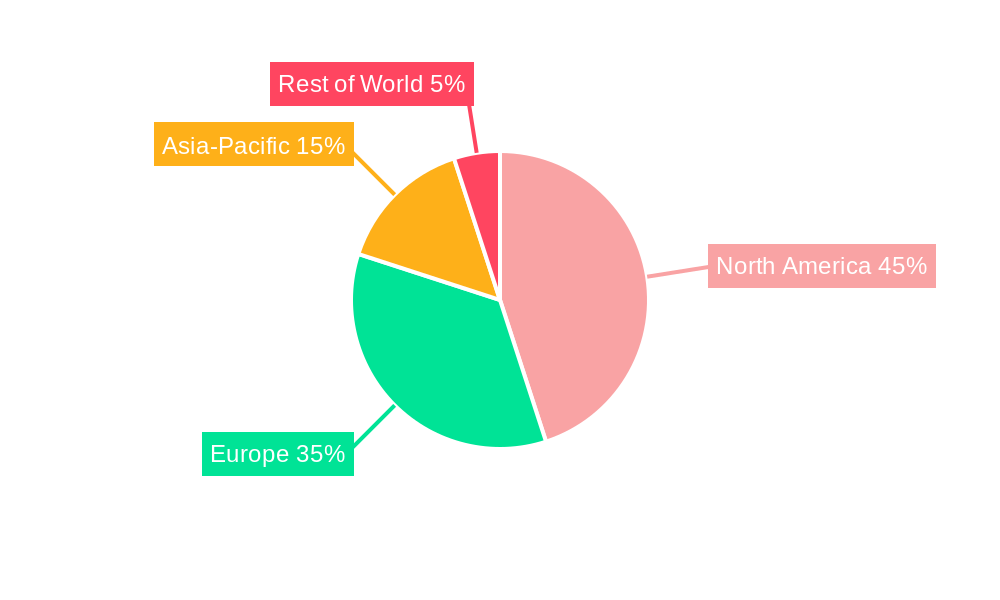

Market segmentation reveals substantial activity across various derivative types, including Credit Default Swaps (CDS), Total Return Swaps (TRS), Credit-Linked Notes (CLN), and Credit Spread Options. These instruments cater to diverse needs, ranging from hedging against credit risk to engaging in speculative trading and arbitrage. Regional analysis suggests a concentrated market share in North America and Europe, reflecting the dominance of established financial centers and the high concentration of major financial institutions. However, emerging markets in Asia-Pacific and certain regions of the Middle East and Africa are showing promising growth potential, indicating future expansion possibilities. Despite the substantial growth potential, challenges such as regulatory uncertainties and potential market volatility pose constraints on the market's trajectory. Nevertheless, the continuing demand for effective risk mitigation strategies within a complex financial landscape ensures the credit derivative market's continued importance and sustained growth in the long term.

The global credit derivative market, valued at $XXX million in 2024, is projected to experience significant growth, reaching $YYY million by 2033, exhibiting a CAGR of ZZZ% during the forecast period (2025-2033). This robust expansion is fueled by a confluence of factors, including increasing market volatility, the growing need for sophisticated risk management tools, and the diversification of investment strategies among institutional investors. The historical period (2019-2024) witnessed a period of moderate growth, punctuated by periods of both expansion and contraction reflecting global economic conditions and regulatory changes. The base year 2025 marks a pivotal point, with several key trends shaping the market's trajectory. The rise of sophisticated algorithmic trading strategies has led to increased liquidity and trading volumes in credit derivatives, particularly in Credit Default Swaps (CDS). However, regulatory scrutiny, particularly post-2008 financial crisis, continues to influence market activity, pushing towards greater transparency and risk mitigation measures. The increasing complexity of financial instruments also necessitates a highly skilled workforce, leading to increased demand for specialized expertise in credit derivative valuation, trading, and risk management. This demand, in turn, drives innovation in analytical tools and software used for pricing and risk modeling. The ongoing evolution of market infrastructure is also crucial, with improvements in clearing and settlement processes contributing to enhanced market efficiency and reduced counterparty risk. Finally, the increasing integration of credit derivatives into broader risk management frameworks employed by financial institutions underlines their increasing importance within the financial ecosystem. The shift towards more data-driven approaches, leveraging advanced analytics and machine learning, is transforming market participant’s understanding of credit risk and enhancing their ability to manage it effectively.

Several key factors are driving the growth of the credit derivative market. Firstly, the inherent volatility in global financial markets necessitates sophisticated risk management tools. Credit derivatives provide institutions with a means to hedge against credit risk, protecting their portfolios from potential losses arising from defaults on debt obligations. Secondly, the increasing sophistication of investment strategies, particularly among hedge funds and institutional investors, has fueled demand for credit derivatives as instruments for speculation and arbitrage. The ability to gain exposure to credit risk without directly holding the underlying debt instruments provides investors with increased flexibility and leverage. Thirdly, regulatory changes, while sometimes imposing constraints, also drive innovation and increased standardization within the market, leading to greater transparency and reduced systemic risk. Finally, technological advancements in data analytics, modeling, and trading platforms are contributing to increased efficiency and reduced transaction costs, making credit derivatives more accessible and attractive to a wider range of market participants. The ongoing development and improvement of these technologies continue to attract investment and drive market expansion. This interplay of factors positions the credit derivative market for sustained growth in the coming years.

Despite its growth potential, the credit derivative market faces several challenges. Firstly, regulatory oversight remains a significant factor. Regulations aimed at mitigating systemic risk, such as increased capital requirements and stricter reporting standards, can increase compliance costs and potentially reduce market liquidity. Secondly, the complexity of credit derivative instruments can lead to a lack of transparency and difficulty in pricing and valuation, potentially increasing the risk of mispricing and market manipulation. Thirdly, counterparty risk, the risk that the other party in a derivative transaction might default, remains a concern. This is especially relevant for over-the-counter (OTC) derivatives, where trading often occurs outside of centralized exchanges. Furthermore, the inherent leverage involved in credit derivative transactions can amplify both gains and losses, increasing the potential for significant losses during periods of market stress. Finally, the market's dependence on accurate and timely credit information highlights the importance of robust data infrastructure and sophisticated credit rating methodologies. Any inaccuracies or biases in this data can have significant implications for market pricing and overall stability.

The Credit Default Swap (CDS) segment is expected to dominate the credit derivative market throughout the forecast period, owing to its widespread use for hedging credit risk. This segment is projected to reach $XXX million by 2033, driven by the increasing demand for credit risk mitigation across various industries.

North America: This region will likely retain its leading position due to the high concentration of financial institutions and sophisticated investors in the US. The established regulatory framework and the availability of advanced risk management tools contribute to this dominance. The region's deep and liquid markets will support high trading volumes in CDS and other credit derivatives. Projected value: $XXX million by 2033.

Europe: While facing regulatory challenges, Europe's significant financial center status, particularly in London and Frankfurt, will ensure a considerable market share for credit derivatives. The region's robust banking sector and active trading in CDS will support continued growth. Projected value: $YYY million by 2033.

Asia-Pacific: This region is experiencing rapid growth, fueled by increasing financial market sophistication and the development of local financial markets. Though less mature than North America and Europe, this region is set for considerable expansion in credit derivatives, particularly in emerging economies. Projected value: $ZZZ million by 2033.

The Hedging application segment will also dominate the market, with a projected value of $XXX million by 2033. This is because the primary motivation behind credit derivative usage is to mitigate credit risk, a key concern for financial institutions and corporations alike. The increasing global uncertainty and economic volatility will further boost this segment.

The credit derivative industry is poised for significant growth due to several catalysts. Increasing market volatility fuels demand for effective risk management tools, with credit derivatives providing a crucial hedging mechanism. Furthermore, the growing sophistication of investment strategies among institutional investors creates opportunities for speculative and arbitrage-based trades. The ongoing development of innovative products and technological advancements improves market efficiency and accessibility. These factors, coupled with the increasing integration of credit derivatives into broader risk management frameworks, will continue to propel market expansion.

This report provides a comprehensive overview of the credit derivative market, analyzing historical trends, current market dynamics, and future growth projections. It covers various types of credit derivatives, their applications, key market players, and significant industry developments. The report also identifies key challenges and growth catalysts, offering insights into the future direction of this complex and dynamic market. A thorough understanding of this market is crucial for investors, financial institutions, and regulators navigating the complexities of modern finance.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ANZ, BNP Paribas, Deutsche Bank, Goldman Sachs, J.P. Morgan, Nomura, Societe Generale, Morgan Stanley, Wells Fargo, SunTrust Bank, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Credit Derivative," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Credit Derivative, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.