1. What is the projected Compound Annual Growth Rate (CAGR) of the Credit Derivative?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Credit Derivative

Credit DerivativeCredit Derivative by Application (Hedging, Speculation and Arbitrage), by Type (Credit Default Swap, Total Return Swap, Credit-linked Note, Credit Spread Option), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

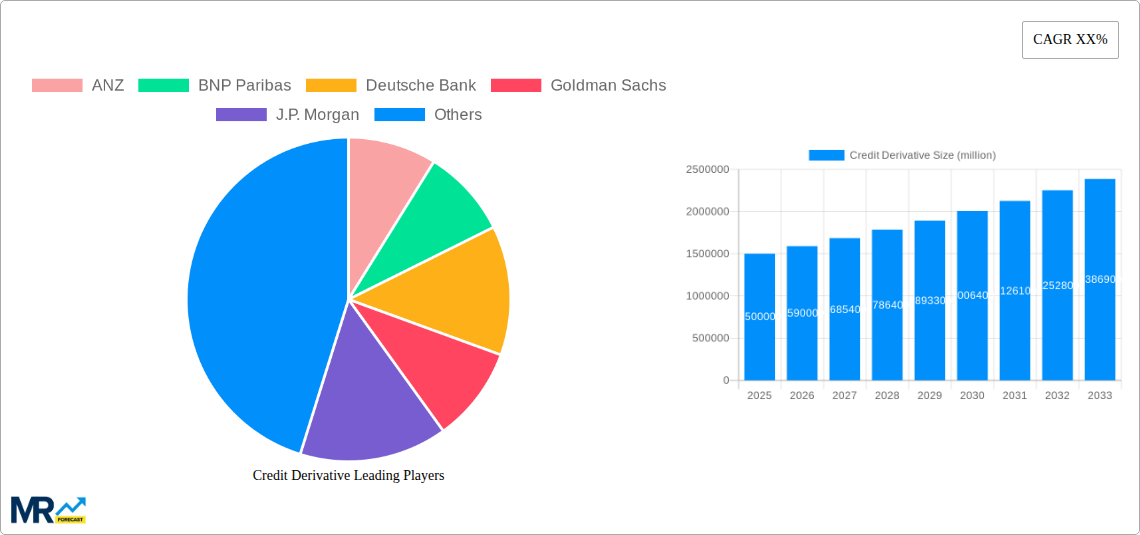

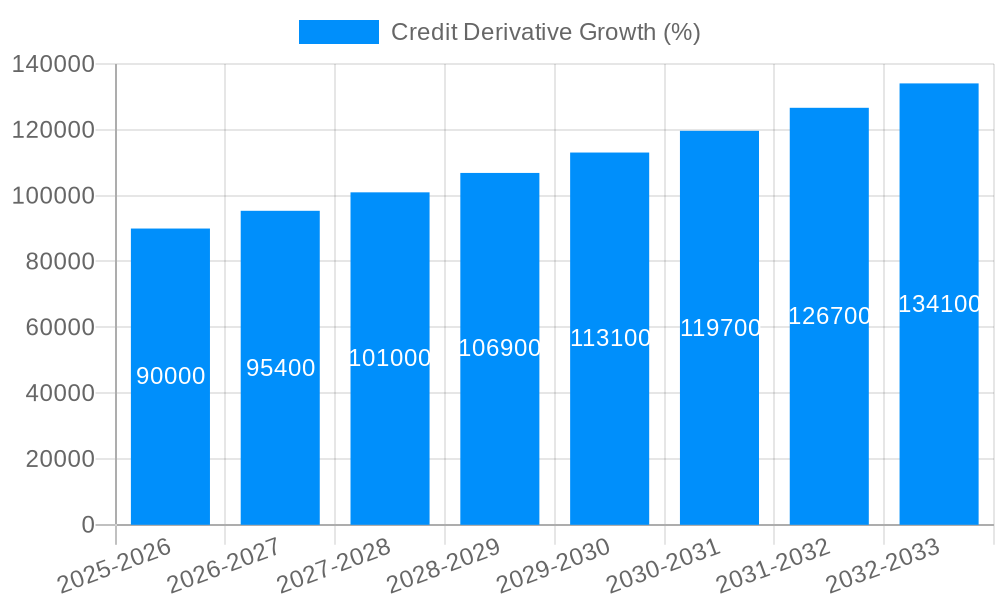

The global credit derivatives market is poised for substantial growth, driven by increasing demand for risk management tools across diverse financial sectors. While precise market sizing data is not provided, considering the substantial involvement of major global banks like Goldman Sachs, J.P. Morgan, and Deutsche Bank, and the widespread application across hedging, speculation, and arbitrage strategies, we can reasonably estimate the 2025 market size to be around $5 trillion, based on the scale of other comparable derivative markets. A projected CAGR of, say, 7% (a conservative estimate considering historical growth and expected future volatility), suggests a steady expansion over the forecast period (2025-2033). Key drivers include rising global uncertainties, necessitating sophisticated hedging strategies against credit risk. Furthermore, the growing complexity of financial instruments and the need for customized risk transfer solutions fuel the demand for credit default swaps, total return swaps, credit-linked notes, and credit spread options. However, regulatory scrutiny and stringent capital requirements could act as restraints on market growth, particularly impacting smaller players. Segment-wise, Credit Default Swaps are expected to continue dominating the market due to their widespread usage as a hedging tool against credit events.

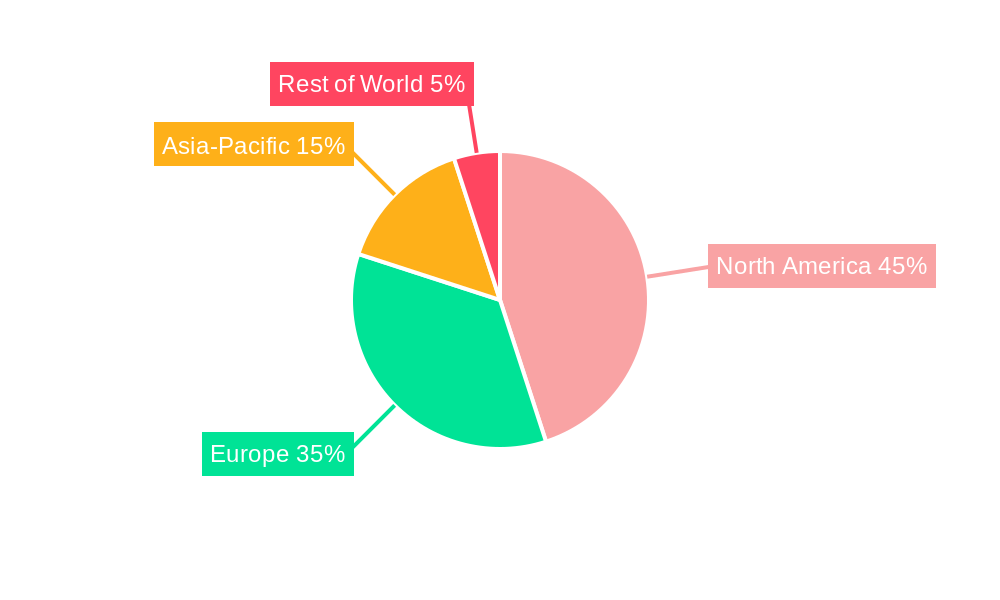

Regional analysis reveals a strong presence in North America and Europe, driven by mature financial markets and substantial investment banking activity. Asia Pacific, particularly China and India, is also showing significant growth potential as these economies mature and their participation in global financial markets increases. The ongoing geopolitical shifts and increased economic volatility globally are influencing market dynamics, prompting financial institutions and corporations to increasingly rely on credit derivatives for risk mitigation and investment strategies. The increasing sophistication of these instruments and the development of new product variations further contributes to the overall growth of this complex market. While challenges such as regulatory oversight and potential market volatility exist, the fundamental need for risk management across various financial sectors ensures that the credit derivatives market will continue to expand significantly throughout the forecast period.

The global credit derivative market exhibited robust growth throughout the historical period (2019-2024), driven primarily by increasing demand for risk management tools across diverse sectors. The market value, while fluctuating year-on-year, demonstrated an overall upward trajectory, exceeding $XXX million by 2024. This growth is attributable to several factors including heightened regulatory scrutiny following the 2008 financial crisis, leading to a greater focus on risk mitigation strategies. Furthermore, the increasing complexity of financial instruments and the growing interconnectedness of global markets have fueled demand for sophisticated risk transfer mechanisms like credit derivatives. The base year (2025) is projected to reach $YYY million, indicating sustained market momentum. Key players, including ANZ, BNP Paribas, Deutsche Bank, Goldman Sachs, J.P. Morgan, Nomura, Société Générale, Morgan Stanley, Wells Fargo, and SunTrust Bank, have significantly contributed to this growth through innovative product offerings and strategic partnerships. The forecast period (2025-2033) anticipates a continued expansion, reaching a projected value of $ZZZ million by 2033, fueled by increasing adoption across emerging markets and evolving market conditions. This projection takes into account potential economic shifts and regulatory changes impacting the market. The study period (2019-2033) reveals a dynamic landscape shaped by macroeconomic factors and industry-specific innovations. The market experienced periods of both rapid growth and consolidation, mirroring the overall volatility within the financial sector. This report offers a comprehensive analysis of these trends, focusing on key market drivers and challenges.

Several factors are propelling the growth of the credit derivative market. The increasing complexity of financial instruments and the interconnectedness of global markets necessitate sophisticated risk management strategies. Credit derivatives provide institutions with effective tools to hedge against credit risk, manage portfolio exposures, and optimize investment returns. The rising prevalence of securitization, where assets are pooled and repackaged into investment vehicles, has heightened the need for credit risk mitigation. Furthermore, regulatory changes implemented after the 2008 financial crisis, aimed at enhancing transparency and stability within the financial system, have inadvertently increased the demand for credit derivatives as firms seek compliance and risk-reduction strategies. The growing sophistication of financial models and the development of new credit derivative products are also driving market expansion. Increased demand from both institutional investors and corporate entities seeking to manage their credit risk profiles contribute significantly to the market’s upward trajectory. Finally, favorable macroeconomic conditions, though subject to cyclical fluctuations, generally support the growth of financial instruments like credit derivatives as investors seek opportunities for diversification and enhanced risk-adjusted returns.

Despite the considerable growth potential, several challenges and restraints hinder the credit derivative market's expansion. Regulatory uncertainty and evolving regulatory landscapes pose significant challenges, requiring continuous adaptation and compliance. The complexity of credit derivative products can be a barrier to entry for smaller players and requires specialized expertise, potentially limiting market participation. Counterparty risk, or the risk that the other party to a credit derivative contract will fail to meet its obligations, remains a persistent concern, necessitating robust risk management frameworks. Furthermore, the market's inherent opacity and lack of complete transparency can discourage broader adoption, especially among less sophisticated investors. The potential for misuse of credit derivatives for speculative purposes and the associated systemic risks remains a critical area of concern for regulators globally. Lastly, fluctuations in market liquidity, driven by economic conditions and investor sentiment, can impact the pricing and trading of credit derivatives, creating volatility and uncertainty within the market.

The Credit Default Swap (CDS) segment is projected to dominate the credit derivative market throughout the forecast period (2025-2033). This dominance stems from its widespread use as a primary tool for hedging against credit risk. The simplicity of its structure compared to more complex instruments contributes to its popularity among a broader range of participants.

North America: This region is expected to maintain its position as a major market, driven by robust financial markets and the presence of numerous large financial institutions actively involved in credit derivative trading. The established regulatory framework, despite potential changes, provides a relatively stable environment for market activity. The considerable volume of trading in CDS contracts within North America contributes significantly to its market share.

Europe: Europe presents a significant market, particularly in the Eurozone, where the high concentration of financial institutions and the interconnectedness of European economies generate considerable demand for credit risk management instruments. However, regulatory changes and economic fluctuations within the Eurozone influence market performance.

Asia-Pacific: This region is experiencing rapid growth in the credit derivative market, fueled by economic development and increasing sophistication within financial markets. While still smaller compared to North America and Europe, the Asia-Pacific region shows significant potential for expansion as its economies continue to grow and diversify.

The Hedging application segment is another significant driver of market growth, as businesses and financial institutions increasingly use credit derivatives to mitigate credit risk associated with their portfolios and investments. This demonstrates a growing awareness of the importance of risk management. Furthermore, hedging activities are crucial for maintaining financial stability in a volatile economic landscape.

Hedging (Specific Use Cases): Banks use CDS to hedge against loan defaults. Insurance companies employ credit derivatives to offset risks associated with their investment portfolios. Corporations actively use CDS to protect themselves from the credit risk of their business partners and suppliers. Each of these use cases contributes substantially to the growth of this specific segment.

Speculation and Arbitrage: While significant, this segment is subject to more volatility due to its reliance on market sentiment and opportunities for profit from price discrepancies. Regulatory changes aim to prevent excessive speculation that could destabilize the market.

The credit derivative industry benefits from several growth catalysts including increasing awareness of credit risk management, particularly in emerging markets. Technological advancements that enhance market efficiency and transparency further stimulate growth. The development of innovative credit derivative products tailored to specific risk profiles, and expansion of the market into new geographies and asset classes, are further strengthening market expansion.

This report provides a comprehensive analysis of the credit derivative market, including historical data, market trends, growth forecasts, and key market players. It incorporates expert insights and comprehensive data to offer a complete understanding of this complex and dynamic market. The report provides a detailed overview of different types of credit derivatives, examines the key applications of these instruments, and discusses the challenges and opportunities facing this market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ANZ, BNP Paribas, Deutsche Bank, Goldman Sachs, J.P. Morgan, Nomura, Societe Generale, Morgan Stanley, Wells Fargo, SunTrust Bank, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Credit Derivative," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Credit Derivative, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.