1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Product Shell?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electronic Product Shell

Electronic Product ShellElectronic Product Shell by Type (Plastic, Alloy), by Application (Computer, TV, Cell Phone), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

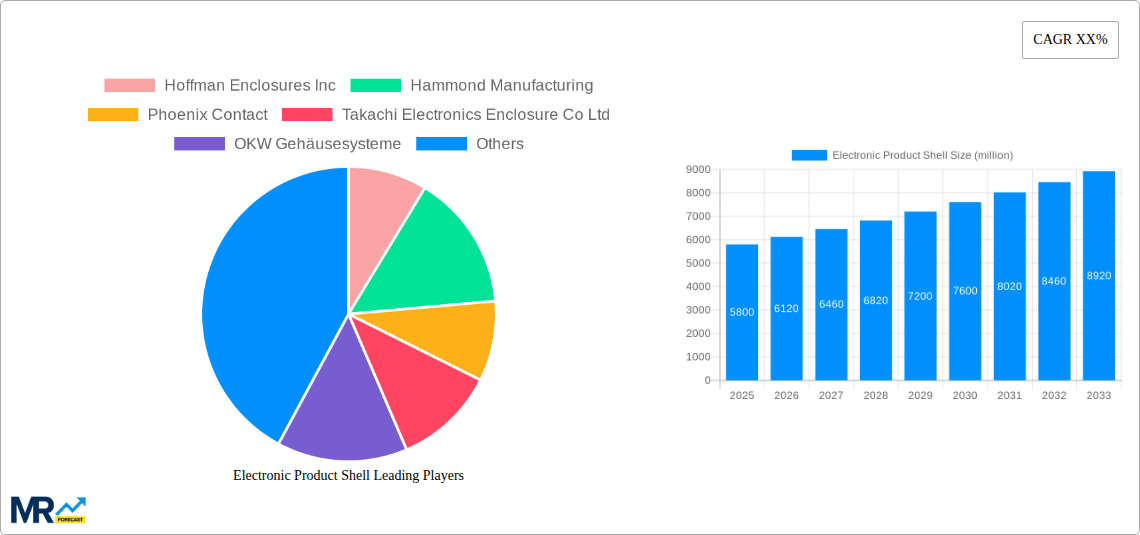

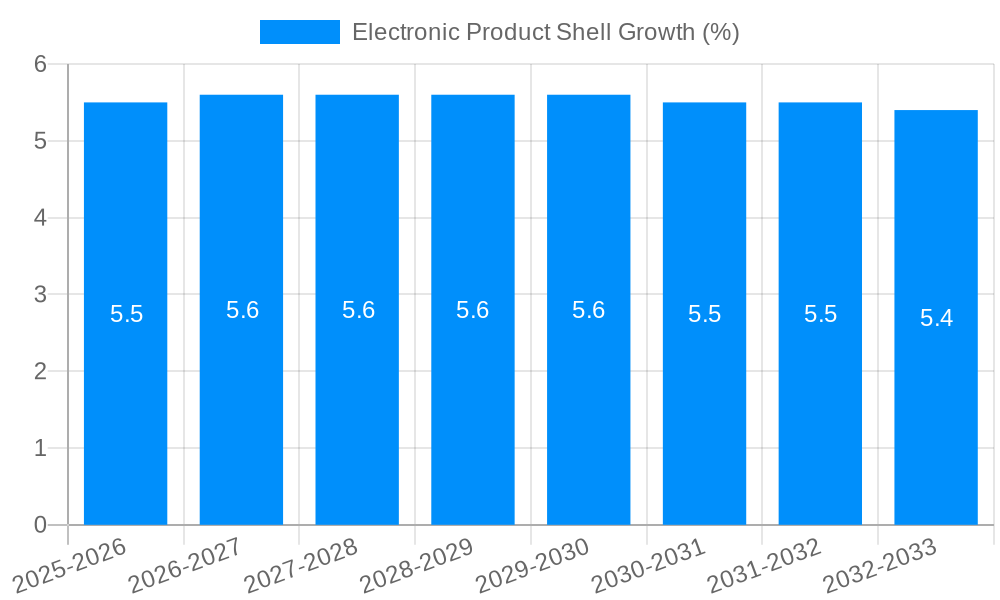

The global Electronic Product Shell market is poised for significant expansion, projected to reach approximately $5,800 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 5.5% anticipated throughout the forecast period extending to 2033. This dynamic growth is propelled by a confluence of factors, including the ever-increasing demand for consumer electronics such as smartphones, laptops, and televisions, each requiring specialized and protective shells. The burgeoning adoption of smart home devices and the continuous innovation in wearable technology further fuel this demand. Furthermore, the increasing sophistication of electronic devices necessitates advanced materials and designs for their casings, driving the market for both plastic and alloy shells. Key market drivers include the relentless pace of technological advancement, the growing disposable incomes in emerging economies, and a strong consumer preference for sleek, durable, and aesthetically pleasing electronic enclosures. The market's trajectory is also influenced by ongoing research and development in material science, leading to the introduction of lighter, stronger, and more sustainable shell solutions.

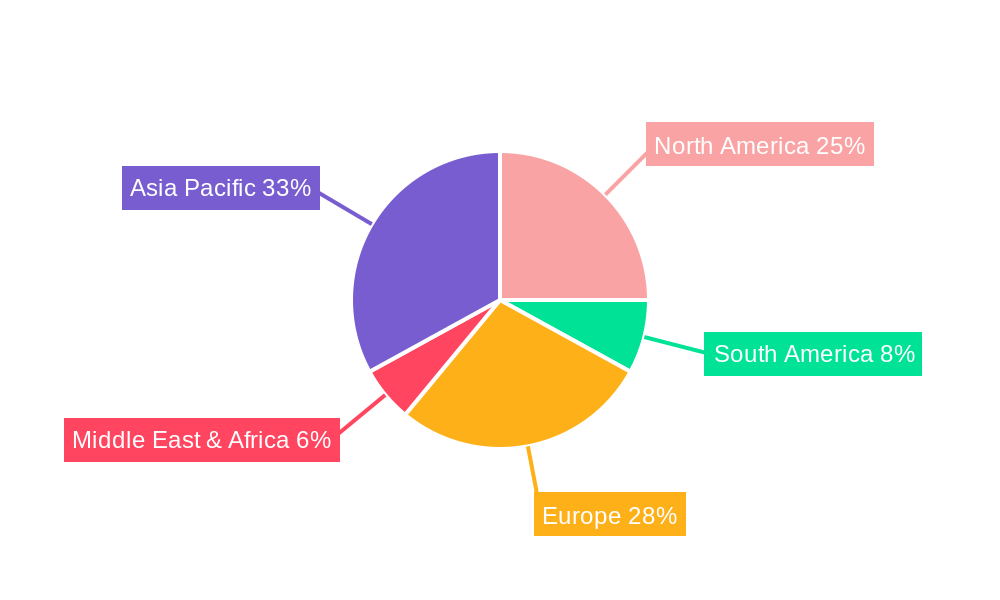

The market landscape for Electronic Product Shells is characterized by a diversified range of applications, spanning computers, televisions, and mobile phones, with increasing penetration in the Internet of Things (IoT) and automotive electronics sectors. While the widespread adoption of plastic shells, owing to their cost-effectiveness and design flexibility, dominates a significant portion of the market, the demand for premium alloy shells is on the rise, particularly for high-end devices where durability and a premium feel are paramount. However, the market faces certain restraints, including fluctuating raw material prices, particularly for plastics and specialized alloys, which can impact manufacturing costs and profit margins. Intense competition among numerous manufacturers, both established and emerging, also exerts pressure on pricing. Geographically, the Asia Pacific region, led by China and India, is expected to be the largest and fastest-growing market, driven by its massive manufacturing base and burgeoning consumer electronics market. North America and Europe remain significant markets, characterized by high adoption rates of advanced electronics and a strong focus on product innovation and sustainability.

This comprehensive report delves into the dynamic global market for electronic product shells, analyzing trends, driving forces, challenges, and future projections from 2019 to 2033. With a base year of 2025 and a forecast period extending through 2033, the study provides critical insights into market shifts, technological advancements, and regional dominance. The analysis encompasses various shell types, including Plastic and Alloy, and applications across key segments like Computer, TV, and Cell Phone. Market valuations and unit sales are presented in millions, offering a clear quantitative perspective on the industry's growth trajectory.

The electronic product shell market is experiencing a significant evolutionary phase, driven by an insatiable consumer demand for sleeker, more durable, and increasingly integrated electronic devices. In the Study Period of 2019-2033, and specifically within the Base Year of 2025, the market is witnessing a pronounced shift towards advanced materials and innovative designs. The increasing miniaturization of electronic components, coupled with the demand for robust yet lightweight enclosures, is propelling the adoption of high-performance plastics and sophisticated alloy formulations. Consumers are no longer satisfied with purely functional casings; aesthetic appeal and tactile experience are becoming equally crucial. This has led manufacturers to invest heavily in research and development for novel textures, finishes, and ergonomic designs that enhance user engagement. Furthermore, the growing emphasis on sustainability is influencing material choices, with a rising preference for recycled plastics and eco-friendly alloys. The integration of smart features within devices, such as embedded sensors and wireless charging capabilities, necessitates shells that are not only electrically insulating but also facilitate signal transmission and thermal management. Consequently, the market is seeing a surge in demand for shells with specialized properties, including electromagnetic interference (EMI) shielding and enhanced heat dissipation characteristics. The "smart home" revolution and the proliferation of Internet of Things (IoT) devices are opening up new avenues for electronic enclosures, requiring versatile designs that can blend seamlessly with diverse interior aesthetics while providing robust protection. The historical performance from 2019-2024 has laid the groundwork for this accelerated evolution, characterized by steady growth fueled by the expanding consumer electronics sector. The Estimated Year of 2025 marks a crucial inflection point, where these emerging trends are expected to gain even more traction, setting the stage for significant market expansion throughout the Forecast Period of 2025-2033. The interplay between technological innovation, consumer preferences, and environmental considerations will continue to shape the landscape of electronic product shells, making it a vibrant and dynamic market to watch.

The growth of the electronic product shell market is being significantly propelled by a confluence of powerful drivers. Foremost among these is the relentless pace of innovation in the consumer electronics sector. As new generations of smartphones, tablets, laptops, and wearable devices are launched with enhanced functionalities and improved performance, the demand for specialized and aesthetically pleasing enclosures escalates proportionally. The burgeoning Internet of Things (IoT) ecosystem is another major catalyst. With billions of interconnected devices being deployed across homes, industries, and cities, each requiring a protective and functional shell, the market for electronic enclosures is experiencing unprecedented expansion. The increasing consumer focus on product design and premium aesthetics is also a critical driver. Manufacturers recognize that the enclosure is often the first point of contact and a key determinant of perceived product quality. This has led to a greater emphasis on materials that offer durability, a superior feel, and sophisticated visual appeal, pushing innovation in plastic molding and metal fabrication techniques. Furthermore, the growing demand for ruggedized and industrial-grade electronic devices, particularly in sectors like manufacturing, healthcare, and defense, necessitates the use of highly durable and protective shells that can withstand harsh environments. This trend is particularly evident in specialized applications that require enhanced resistance to dust, water, and extreme temperatures. The ongoing advancements in material science, leading to the development of lighter, stronger, and more sustainable enclosure materials, also play a pivotal role in driving market growth by enabling new design possibilities and meeting environmental regulations.

Despite the robust growth trajectory, the electronic product shell market is not without its significant challenges and restraints. One of the primary hurdles is the escalating cost of raw materials. Fluctuations in the prices of plastics, metals, and other specialized composites can directly impact manufacturing costs and subsequently, the final price of electronic enclosures, potentially affecting market demand. Furthermore, the increasing complexity of electronic devices often necessitates intricate and precisely engineered shells. This complexity can lead to higher manufacturing costs due to specialized tooling, advanced molding techniques, and stringent quality control processes. The rapid technological obsolescence in the electronics industry presents another challenge. As devices are upgraded and new technologies emerge, the demand for shells designed for older product iterations can diminish, requiring manufacturers to constantly adapt their production lines and designs to meet evolving market needs. Environmental regulations, while driving innovation in sustainable materials, can also impose significant compliance burdens on manufacturers. Adhering to stringent regulations regarding material sourcing, recyclability, and waste management requires substantial investment in research, development, and process modifications. Intense competition within the market, particularly from low-cost manufacturing regions, can exert downward pressure on profit margins, forcing companies to optimize their operations and explore cost-effective solutions without compromising on quality. Finally, the global supply chain disruptions, as witnessed in recent years, can lead to material shortages and extended lead times, impacting production schedules and the ability to meet demand promptly.

The electronic product shell market is poised for significant growth across various regions and segments, with Asia Pacific anticipated to maintain its dominant position throughout the Study Period of 2019-2033. This dominance is underpinned by several interconnected factors, making it a crucial region for market players to focus on.

Dominant Segments and Regions:

Plastic Shells by Type: The Plastic segment is expected to continue its reign as the leading type of electronic product shell. This is primarily due to its inherent versatility, cost-effectiveness, and ease of manufacturing, which align perfectly with the mass production requirements of consumer electronics.

Cell Phone Application: The Cell Phone application segment is projected to remain the largest and fastest-growing market for electronic product shells. The sheer volume of smartphone production globally, coupled with the rapid upgrade cycles and the increasing complexity of these devices, drives continuous demand for innovative casings.

Asia Pacific Region: The Asia Pacific region, particularly countries like China, South Korea, Taiwan, and Vietnam, will continue to be the dominant geographical market for electronic product shells. This dominance is a direct consequence of its position as the global manufacturing hub for electronics.

The interplay between the cost-effectiveness and design flexibility of Plastic shells, the immense demand generated by the Cell Phone application, and the unparalleled manufacturing capabilities of the Asia Pacific region creates a formidable trifecta that is expected to drive market dominance for the foreseeable future, as indicated by projections for the Base Year 2025 and the subsequent Forecast Period 2025-2033.

The electronic product shell industry is experiencing robust growth fueled by several key catalysts. The relentless evolution of consumer electronics, with new product launches and feature enhancements across categories like smartphones, tablets, and wearables, consistently drives demand for updated enclosures. The burgeoning Internet of Things (IoT) ecosystem, encompassing smart home devices, industrial sensors, and connected infrastructure, presents a vast and expanding market for diverse electronic shells. Furthermore, the increasing consumer emphasis on aesthetics and personalization is pushing manufacturers to innovate with premium materials, unique finishes, and ergonomic designs, turning shells into design statements. The development and adoption of advanced manufacturing techniques, such as additive manufacturing (3D printing), enable greater design complexity and faster prototyping, accelerating product development cycles.

This comprehensive report offers an in-depth analysis of the global electronic product shell market, providing crucial insights for stakeholders. It meticulously examines market trends, driving forces, challenges, and future projections from 2019-2033, with a focus on the Base Year 2025 and the Forecast Period 2025-2033. The report includes detailed breakdowns by type (Plastic, Alloy) and application (Computer, TV, Cell Phone), and highlights key regional dynamics, with particular attention paid to the dominant Asia Pacific region. Market valuations and unit sales, presented in millions, offer a quantifiable understanding of market size and growth. Furthermore, the report identifies leading players and significant industry developments, providing a holistic view of the landscape. This extensive coverage empowers businesses with the knowledge to make informed strategic decisions, identify growth opportunities, and navigate the evolving market for electronic product shells.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Hoffman Enclosures Inc, Hammond Manufacturing, Phoenix Contact, Takachi Electronics Enclosure Co Ltd, OKW Gehäusesysteme, Ningbo Yinzhou Keao Plastic Mould Factory, Billion Thunder International Limited, Serpac, Bud Industries, Polycase, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electronic Product Shell," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electronic Product Shell, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.