1. What is the projected Compound Annual Growth Rate (CAGR) of the Cryogenic Ampoules?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cryogenic Ampoules

Cryogenic AmpoulesCryogenic Ampoules by Type (Upto 1ml, 2ml to 5ml, Above 5ml, World Cryogenic Ampoules Production ), by Application (Pharmaceutical Companies, Research Organization, Healthcare Institution, World Cryogenic Ampoules Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

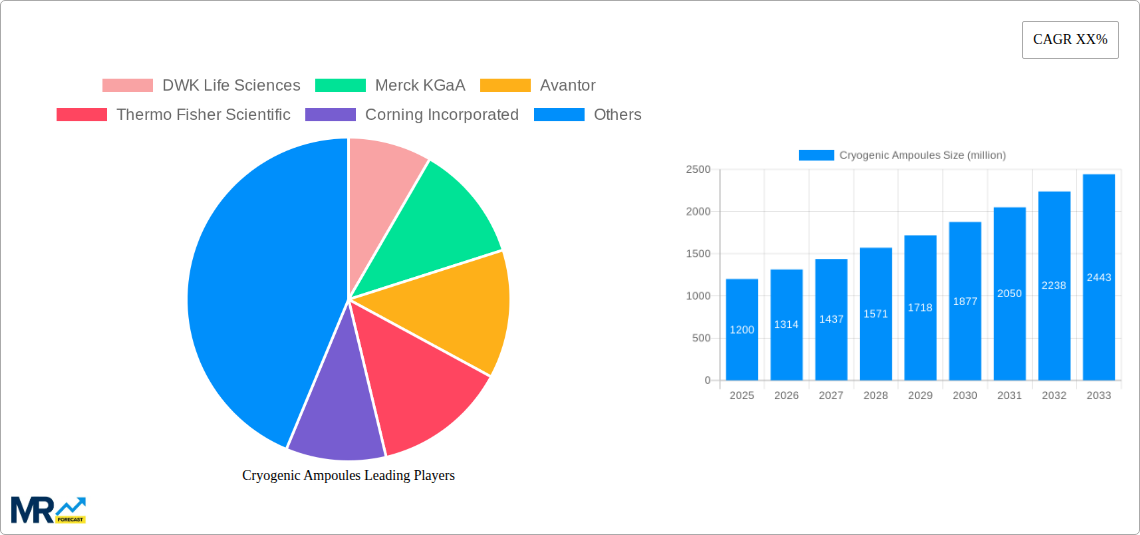

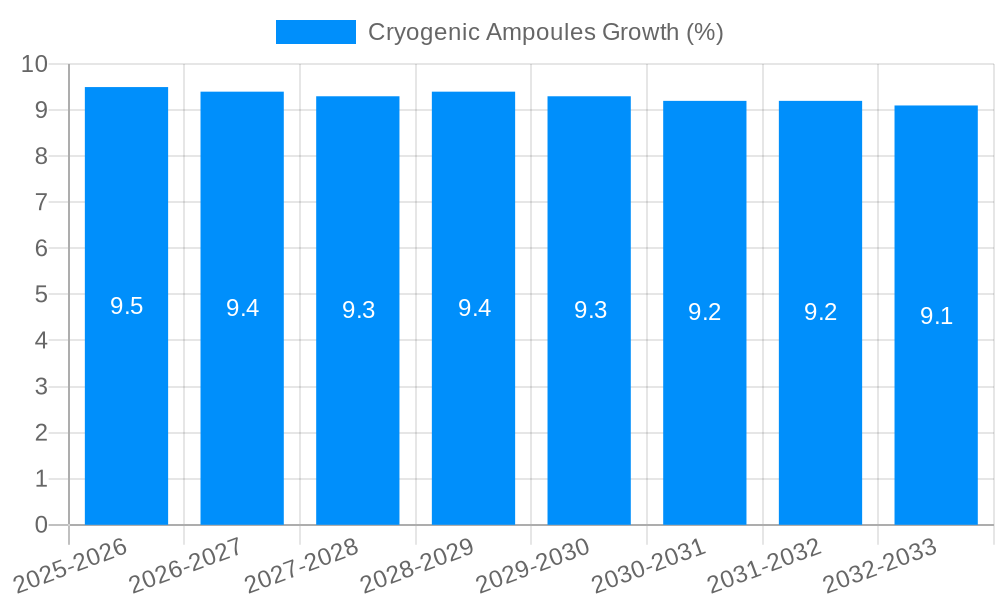

The global cryogenic ampoules market is poised for significant expansion, projected to reach a valuation of approximately $1,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.5% anticipated over the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for reliable sample preservation solutions across the pharmaceutical, biotechnology, and healthcare sectors. The increasing prevalence of chronic diseases, coupled with advancements in genomics, proteomics, and personalized medicine, necessitates sophisticated cryogenic storage to maintain the integrity of biological samples. Furthermore, the burgeoning research activities in academic institutions and governmental organizations are significant contributors to this market's upward trajectory. Key applications include the storage of cell lines, tissues, blood, and other biological materials, underscoring the critical role of cryogenic ampoules in scientific discovery and clinical diagnostics.

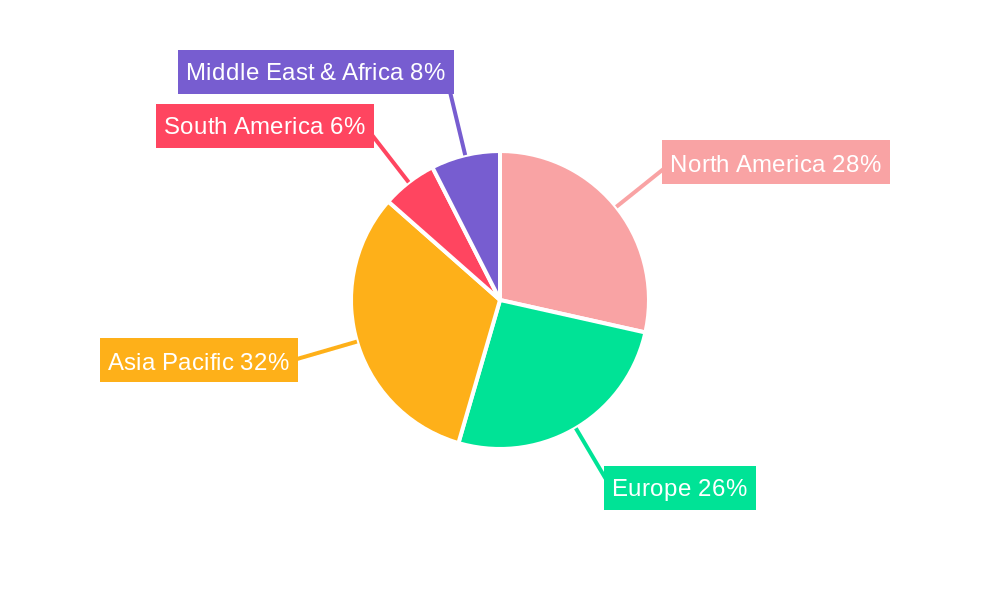

The market is segmented by type, with a pronounced demand for ampoules in the "2ml to 5ml" capacity range, driven by their versatility in handling a broad spectrum of biological samples. The "Above 5ml" segment is also witnessing steady growth, catering to larger volume storage needs. Geographically, Asia Pacific is expected to emerge as a dominant region, propelled by rapid industrialization, increasing healthcare investments, and a growing number of research facilities, particularly in China and India. North America and Europe remain substantial markets due to their well-established life sciences ecosystems and high R&D spending. However, the market faces certain restraints, including the high initial cost of cryogenic storage infrastructure and the stringent regulatory requirements for sample handling and storage. Nonetheless, continuous innovation in materials science and design, leading to enhanced durability and user-friendliness of cryogenic ampoules, is expected to mitigate these challenges and propel market growth.

This report offers an in-depth analysis of the global cryogenic ampoule market, meticulously examining trends, drivers, challenges, and future growth prospects. The study encompasses a comprehensive historical period from 2019 to 2024, with a base year set at 2025. The forecast period extends from 2025 to 2033, providing actionable insights for stakeholders. Our analysis leverages extensive market intelligence, including production volumes in the millions and granular segmentation across various categories.

XXX The cryogenic ampoule market is experiencing a dynamic surge, driven by an escalating need for secure and reliable sample preservation across a multitude of scientific disciplines. The historical period from 2019 to 2024 has witnessed a steady increase in the demand for these specialized containers, a trend expected to accelerate in the coming years. A significant market insight points to the growing adoption of advanced materials and manufacturing techniques, leading to enhanced durability and superior cryogenic performance. The global production of cryogenic ampoules, currently valued in the millions, is projected to see substantial expansion, fueled by innovation and increasing research investments. We anticipate a shift towards more specialized ampoule designs, catering to niche applications requiring specific temperature ranges and compatibility with various biological samples. Furthermore, the integration of smart technologies, such as embedded tracking mechanisms and color-coded labeling for improved inventory management, is emerging as a key trend. The pharmaceutical sector, a major consumer, is increasingly relying on cryogenic ampoules for storing sensitive biologics, vaccines, and cell lines, underscoring the critical role of these products in drug development and manufacturing. Research organizations are also pushing the boundaries of scientific discovery, necessitating the long-term preservation of invaluable biological samples, thereby driving consistent demand. Healthcare institutions are leveraging cryogenic ampoules for storing patient-derived samples for diagnostic purposes and personalized medicine initiatives. The market's trajectory indicates a robust growth phase, with production volumes projected to reach tens of millions by the end of the forecast period. This expansion is not merely quantitative but also qualitative, with a focus on improving user experience and ensuring the utmost integrity of stored samples. The increasing stringency of regulatory requirements for sample traceability and security further bolsters the market for high-quality cryogenic ampoules. The inherent need for maintaining sample viability at extremely low temperatures, often below -80°C, positions cryogenic ampoules as indispensable tools in modern scientific endeavors. The market's evolution reflects a broader trend towards sophisticated sample management solutions, with cryogenic ampoules at the forefront of this critical infrastructure. The base year of 2025 serves as a pivotal point, marking the transition into an era of accelerated growth and technological advancements within this specialized market.

The cryogenic ampoules market is propelled by a confluence of powerful forces, each contributing to its robust growth trajectory. Foremost among these is the relentless advancement in biomedical research and development. The burgeoning fields of genomics, proteomics, and cell-based therapies necessitate the long-term, stable storage of an ever-increasing volume of biological samples. As scientific inquiry delves deeper into complex biological systems, the need for cryogenically preserved specimens for subsequent analysis and experimentation becomes paramount. Furthermore, the booming biopharmaceutical industry, with its focus on novel drug discovery and vaccine development, relies heavily on cryogenic ampoules for the preservation of critical cell lines, viral vectors, and therapeutic proteins. The global expansion of personalized medicine initiatives also plays a significant role, as patient-derived samples, such as stem cells and tissue biopsies, require cryogenic storage for future therapeutic applications. The increasing prevalence of chronic diseases and the subsequent rise in demand for advanced diagnostics and treatments further amplify the need for reliable sample preservation. The base year of 2025 is anticipated to witness a surge in investments in life sciences research, directly translating into higher demand for cryogenic ampoules. Beyond research, stringent regulatory requirements in the pharmaceutical and healthcare sectors are mandating the use of high-quality, traceable, and contamination-free sample storage solutions, with cryogenic ampoules being a cornerstone of this compliance. The continuous innovation in ampoule design, materials science, and sealing technologies also acts as a key driver, offering improved product performance and user convenience, further stimulating market adoption.

Despite the optimistic outlook, the cryogenic ampoules market encounters several challenges and restraints that could potentially temper its growth. A primary concern revolves around the high cost associated with the production of premium-grade cryogenic ampoules. The specialized materials, advanced manufacturing processes, and rigorous quality control measures required to ensure optimal performance at extremely low temperatures contribute to a higher unit cost. This can be a significant barrier for smaller research institutions or organizations with limited budgets, potentially hindering their adoption of the most advanced solutions. Another significant restraint stems from the stringent handling and storage protocols associated with cryogenic ampoules. Maintaining the integrity of samples requires specialized cryogenic storage units, such as freezers and liquid nitrogen dewars, which represent substantial capital investments and ongoing operational costs for maintenance and replenishment. Improper handling, accidental thawing, or contamination can lead to the loss of invaluable research or clinical samples, leading to significant financial and scientific setbacks. The complexity of these protocols also necessitates specialized training for personnel, adding another layer of operational challenge. Furthermore, the market faces a degree of fragmentation, with a multitude of manufacturers offering a wide range of products. This can lead to confusion for end-users when selecting the most appropriate ampoule for their specific application, potentially resulting in suboptimal choices and performance issues. The risk of counterfeiting and substandard products entering the market also poses a threat, potentially damaging the reputation of legitimate manufacturers and compromising sample integrity. Lastly, while the market is growing, the relatively niche nature of cryogenic applications, compared to broader laboratory consumables, can limit the overall scale of demand in certain regions or for specific product types, acting as a subtle restraint on exponential growth.

The cryogenic ampoules market is poised for significant regional and segmental dominance, with a clear indication of where the most substantial growth and consumption will occur.

Dominant Region: North America is projected to lead the global cryogenic ampoules market in terms of both production and consumption. This dominance is attributed to several factors:

Dominant Segment by Application: Pharmaceutical Companies are expected to be the largest consuming segment of cryogenic ampoules.

Dominant Segment by Type: While all types of cryogenic ampoules are critical, the 2ml to 5ml segment is anticipated to witness substantial dominance.

The convergence of strong R&D infrastructure, significant investment in life sciences, and the specific needs of the pharmaceutical industry, particularly for moderate sample volumes, positions North America and the pharmaceutical segment as the key drivers of the global cryogenic ampoules market in the coming years.

The cryogenic ampoules industry is propelled by several key growth catalysts. The accelerating pace of advancements in biotechnology and personalized medicine is a primary driver, necessitating the secure, long-term storage of a growing volume of diverse biological samples, from cell lines and stem cells to genetic material. The increasing global demand for vaccines and biologics further amplifies the need for robust cryogenic preservation solutions. Furthermore, stricter regulatory mandates for sample traceability, integrity, and security in the pharmaceutical and healthcare sectors are compelling organizations to invest in high-quality cryogenic ampoules and associated storage systems. Ongoing innovation in material science and manufacturing, leading to improved ampoule durability, chemical inertness, and user-friendly designs, also contributes to market expansion.

This comprehensive report delves into the intricate dynamics of the global cryogenic ampoules market. It provides a granular analysis of market size, historical trends from 2019-2024, and future projections extending to 2033, with a base year of 2025. The report meticulously examines the market segmentation by type (Upto 1ml, 2ml to 5ml, Above 5ml) and application (Pharmaceutical Companies, Research Organizations, Healthcare Institutions), offering insights into their respective growth trajectories. Furthermore, it explores the World Cryogenic Ampoules Production, identifying key regions and countries poised for market dominance, with a particular focus on North America and the burgeoning pharmaceutical sector. The analysis also scrutinizes the leading players, their market strategies, and significant industry developments, including technological advancements and regulatory impacts. This report serves as an indispensable resource for stakeholders seeking to understand the current landscape and future opportunities within the critical cryogenic ampoules sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DWK Life Sciences, Merck KGaA, Avantor, Thermo Fisher Scientific, Corning Incorporated, CAPP, Ziath Ltd, Cole-Parmer Instrument Company, Azer Scientific, BioResearch, Sumitomo Bakelite, BIOLOGIX GROUP LTD, Krishna Glass Industries, BDR Pharmaceuticals International.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cryogenic Ampoules," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cryogenic Ampoules, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.