1. What is the projected Compound Annual Growth Rate (CAGR) of the Compostable Label?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Compostable Label

Compostable LabelCompostable Label by Type (White, Transparent), by Application (Food, Cosmetics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

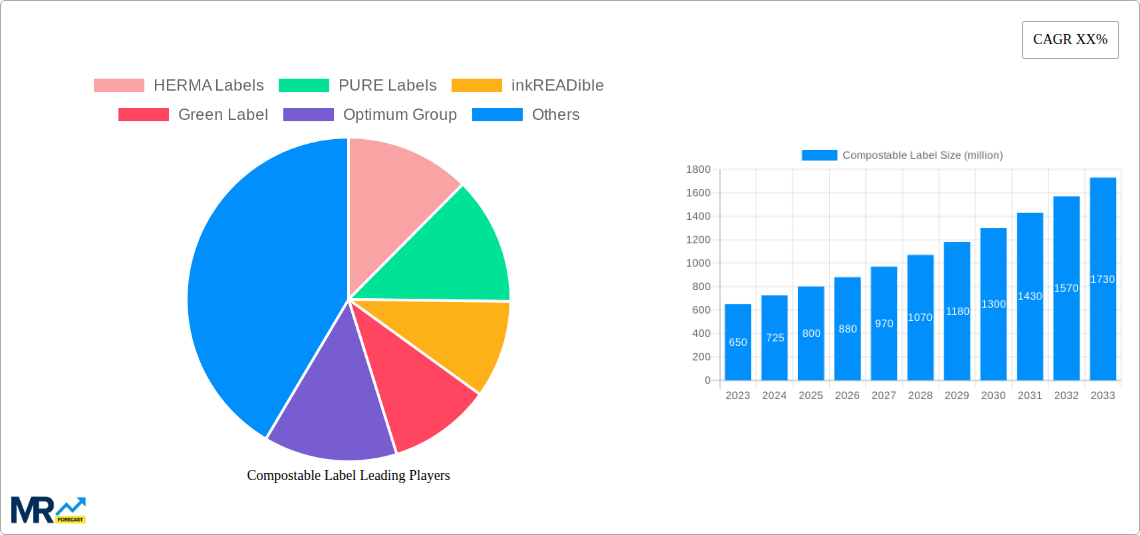

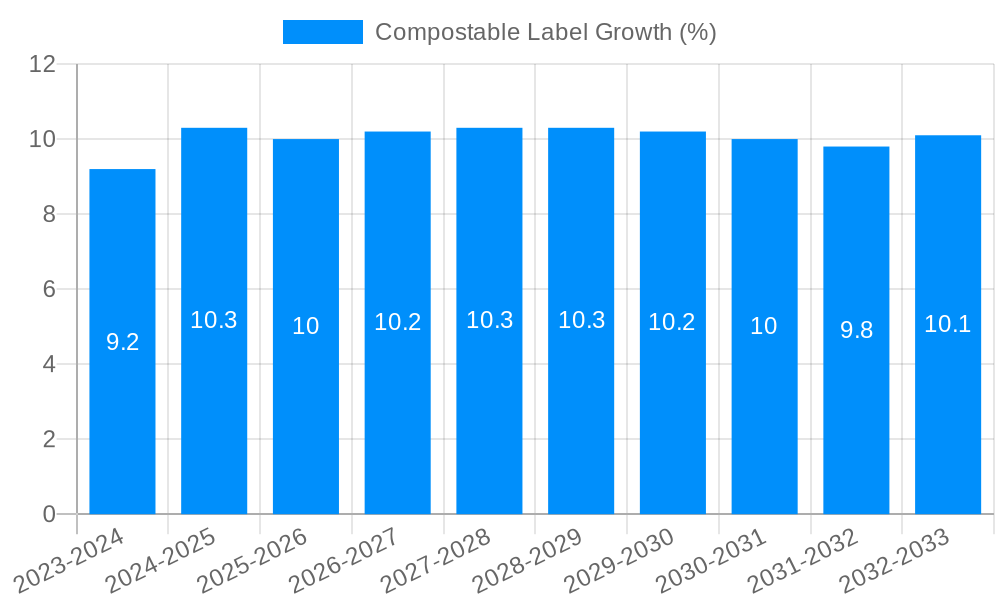

The compostable label market is experiencing significant expansion, projected to reach a substantial market size of approximately $800 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 9%. This growth is fueled by a confluence of escalating environmental consciousness among consumers and increasingly stringent governmental regulations mandating sustainable packaging solutions. Businesses across various sectors are actively seeking eco-friendly alternatives to traditional plastic and paper labels to reduce their ecological footprint and appeal to a growing segment of environmentally aware buyers. The demand for compostable labels is particularly pronounced in the food and beverage industry, where product lifecycle and disposal are critical considerations, as well as in the cosmetics sector, which is increasingly prioritizing sustainable branding.

Key drivers for this market surge include the development of advanced compostable materials that offer comparable performance to conventional options in terms of durability, printability, and adhesion. Innovations in bio-based adhesives and inks further enhance the compostable nature of these labels, ensuring they break down completely without leaving harmful residues. Despite the promising outlook, certain restraints exist, such as the potentially higher initial cost compared to traditional labels, which can be a barrier for smaller enterprises. Furthermore, the need for consumer education on proper disposal methods and the availability of industrial composting facilities in specific regions can also influence adoption rates. Nevertheless, the overarching trend towards a circular economy and the continuous push for sustainable supply chains are poised to propel the compostable label market forward, creating significant opportunities for both established players and new entrants.

This report delves into the dynamic and rapidly expanding global compostable label market, offering in-depth analysis and future projections. Spanning a comprehensive study period of 2019-2033, with a base year and estimated year of 2025, and a detailed forecast period of 2025-2033, the report leverages robust data from the historical period of 2019-2024 to paint a clear picture of market evolution. We will explore market trends, driving forces, challenges, dominant segments and regions, growth catalysts, leading players, and significant industry developments, providing actionable insights for stakeholders. The projected market size is estimated to reach $X million by 2033, showcasing a significant upward trajectory driven by increasing environmental consciousness and regulatory pressures.

The compostable label market is experiencing a profound transformation, characterized by a growing demand for sustainable packaging solutions across diverse industries. Driven by a global shift towards eco-friendly alternatives and an increasing awareness of plastic pollution's detrimental effects, consumers and businesses alike are actively seeking products that align with their environmental values. This trend is not merely a fleeting phenomenon but a fundamental reorientation of the packaging industry, with compostable labels emerging as a crucial component of a circular economy. The market is witnessing a surge in innovation, with manufacturers developing advanced compostable materials that offer comparable performance to conventional labels in terms of durability, printability, and adhesion, while ensuring complete biodegradability under industrial and, in some cases, home composting conditions. The White compostable label segment, in particular, is projected to maintain its dominance due to its versatility and widespread application across various product categories, offering a clean and professional aesthetic. Furthermore, the Food application segment is a significant driver, as stringent regulations and consumer demand for sustainable food packaging necessitate the adoption of compostable labeling solutions. The market is also seeing a gradual but steady adoption of transparent compostable labels, catering to premium products and brands that wish to showcase their contents. The overall market growth is further buoyed by increasing investments in research and development, leading to the creation of novel compostable substrates and adhesive technologies that address existing limitations and expand the applicability of these eco-friendly labels. The increasing availability of certifications like BPI, TÜV AUSTRIA, and Seedling further builds consumer trust and encourages wider adoption. As supply chains become more streamlined and production scales increase, the cost of compostable labels is also expected to become more competitive, further accelerating their market penetration. The projected market value is expected to witness a CAGR of approximately XX% between 2025 and 2033, reaching an estimated $Y million by the end of the forecast period.

The rapid ascent of the compostable label market is fueled by a confluence of potent drivers. Paramount among these is the escalating global consumer demand for sustainable and environmentally responsible products. As awareness of plastic waste and its ecological impact intensifies, consumers are increasingly scrutinizing product packaging and gravitating towards brands that demonstrate a commitment to sustainability. This conscious consumerism translates directly into market demand for compostable labels, which offer a tangible solution to reduce landfill waste and promote circular economy principles. Regulatory bodies worldwide are also playing a pivotal role by implementing stricter legislation and mandates aimed at curbing single-use plastics and promoting biodegradable alternatives. These regulations, often in the form of extended producer responsibility schemes or outright bans on certain conventional packaging materials, are compelling businesses to explore and adopt compostable labeling solutions. Furthermore, the corporate social responsibility (CSR) initiatives undertaken by many companies are a significant propellant. Brands are recognizing the reputational benefits and market differentiation that come with embracing sustainable practices, and compostable labels are an accessible and impactful way to demonstrate this commitment. The growing availability of innovative compostable materials and advanced manufacturing technologies, coupled with a desire for brands to align with positive environmental narratives, are creating a fertile ground for sustained market growth. The Food and Cosmetics applications, in particular, are experiencing a strong pull due to their direct consumer interaction and the increasing emphasis on natural and ethical sourcing, where compostable labels can reinforce these brand values.

Despite the promising growth trajectory, the compostable label market is not without its hurdles. A primary challenge lies in the cost factor. Currently, compostable labels often come with a higher price tag compared to their conventional counterparts, which can be a significant deterrent for price-sensitive businesses, particularly small and medium-sized enterprises (SMEs). This cost differential is largely attributable to the specialized manufacturing processes and the often higher raw material costs associated with compostable polymers. Another critical challenge revolves around consumer and infrastructure awareness. While awareness of sustainability is growing, a lack of widespread understanding regarding the proper disposal methods for compostable labels can lead to contamination of recycling streams or incorrect disposal in landfills, negating their environmental benefits. Effective industrial composting facilities are not universally accessible, and a lack of standardized labeling for compostability can cause confusion among end-users. Furthermore, performance limitations in certain applications can also act as a restraint. While significant advancements have been made, some compostable labels may not yet offer the same level of heat resistance, moisture barrier properties, or adhesion under extreme conditions as traditional labels, limiting their applicability in niche or demanding environments. Ensuring consistent quality and performance across different compostable materials and manufacturers also presents an ongoing challenge for market players. The perception of compostable labels as a "greenwashing" tactic by some consumers, without sufficient evidence of their actual biodegradability and end-of-life management, can also hinder widespread adoption.

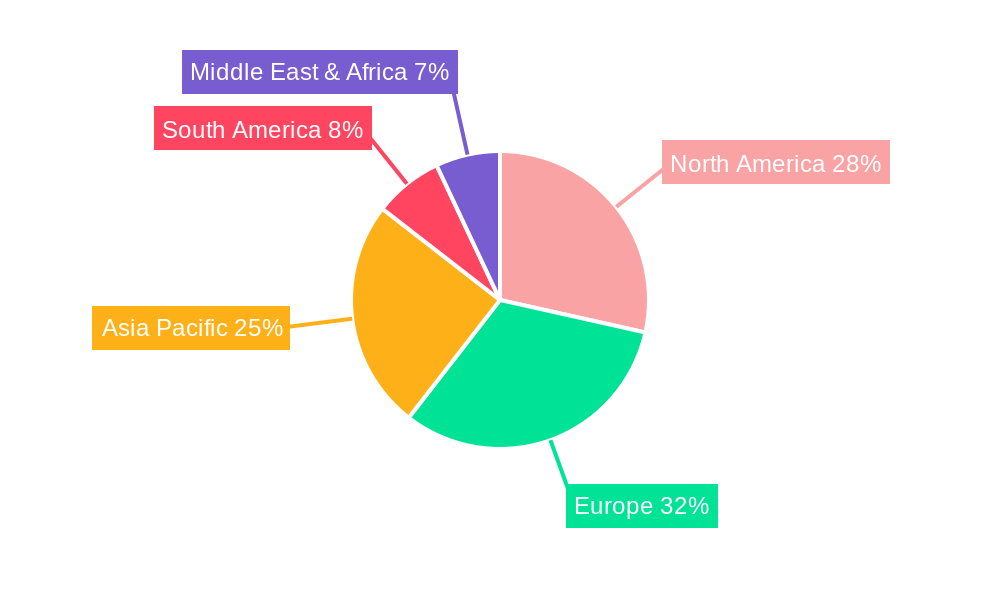

The global compostable label market is characterized by a dynamic interplay of regional adoption and segment-specific dominance. Looking at regions, Europe is poised to be a frontrunner in dominating the compostable label market. This leadership is largely attributed to stringent environmental regulations, a highly conscious consumer base, and a strong governmental push towards circular economy principles. Countries like Germany, the UK, and the Netherlands are actively implementing policies that encourage the use of sustainable packaging, including compostable labels, and are investing heavily in composting infrastructure. North America, particularly the United States and Canada, is also a significant and growing market, driven by increasing consumer demand, evolving corporate sustainability goals, and the gradual implementation of supportive legislation. Asia-Pacific, while currently lagging in widespread adoption, presents a substantial future growth opportunity, fueled by a burgeoning middle class, increasing environmental awareness, and the presence of key manufacturing hubs.

Within the market segments, the White type of compostable label is expected to maintain its leading position. Its versatility, ability to accept a wide range of printing techniques, and its suitability for almost all product categories, from food to pharmaceuticals, make it a staple choice for brands. The aesthetic appeal of white labels, offering a clean and professional look, further solidifies its dominance.

The Food application segment will undoubtedly be a powerhouse in driving market growth. The food industry is under immense pressure to reduce its environmental footprint due to direct consumer engagement and the high volume of packaging used. Regulations surrounding food safety and hygiene, coupled with the demand for packaging that aligns with natural and organic product messaging, are making compostable labels an indispensable choice. Brands are leveraging compostable labels on everything from fresh produce and baked goods to pre-packaged meals and beverages, aiming to enhance their eco-credentials.

The Cosmetics segment is another significant contributor to the market's expansion. The beauty industry is increasingly embracing sustainability, with consumers actively seeking out eco-friendly packaging for their personal care products. Compostable labels on skincare, makeup, and haircare products resonate with consumers who are conscious of their environmental impact and are drawn to brands that reflect ethical values.

The "Others" category, encompassing applications such as pharmaceuticals, e-commerce, and industrial goods, is also projected to witness substantial growth. The e-commerce boom, in particular, has created a surge in packaging waste, leading to a demand for more sustainable shipping and product labeling solutions, where compostable labels are finding increasing utility.

The compostable label industry's growth is being significantly accelerated by several key catalysts. A primary driver is the continuous innovation in material science, leading to the development of enhanced compostable substrates and adhesives that offer improved performance and cost-effectiveness. Furthermore, the increasing number of certifications and standards for compostability, such as those provided by TÜV AUSTRIA and BPI, build consumer trust and encourage wider adoption. Government incentives and favorable regulations promoting sustainable packaging are also playing a crucial role in accelerating market penetration.

The compostable label market features a mix of established packaging giants and specialized eco-friendly solution providers. Some of the key players contributing to the market's growth and innovation include:

The compostable label sector has witnessed several pivotal developments that are shaping its future trajectory:

This comprehensive report offers a holistic view of the compostable label market, providing actionable intelligence for stakeholders. It delves into the intricate details of market dynamics, from historical performance and current trends to future projections. The report aims to equip businesses with the insights needed to navigate this evolving landscape, identify opportunities, and mitigate challenges. By understanding the driving forces, restraints, and dominant segments, companies can strategically position themselves for success. The detailed analysis of key regions and segments will enable targeted market entry and expansion strategies. The report's focus on leading players and significant developments will offer valuable competitive intelligence, allowing businesses to stay ahead of the curve and capitalize on emerging opportunities within this crucial segment of the sustainable packaging industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include HERMA Labels, PURE Labels, inkREADible, Green Label, Optimum Group, A4Labels, Wedderburn, Labels Plus, Elevate Packaging, Xinxing Label, Avery Dennison, Huizhou Yito Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Compostable Label," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Compostable Label, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.