1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Real Estate Investment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Real Estate Investment

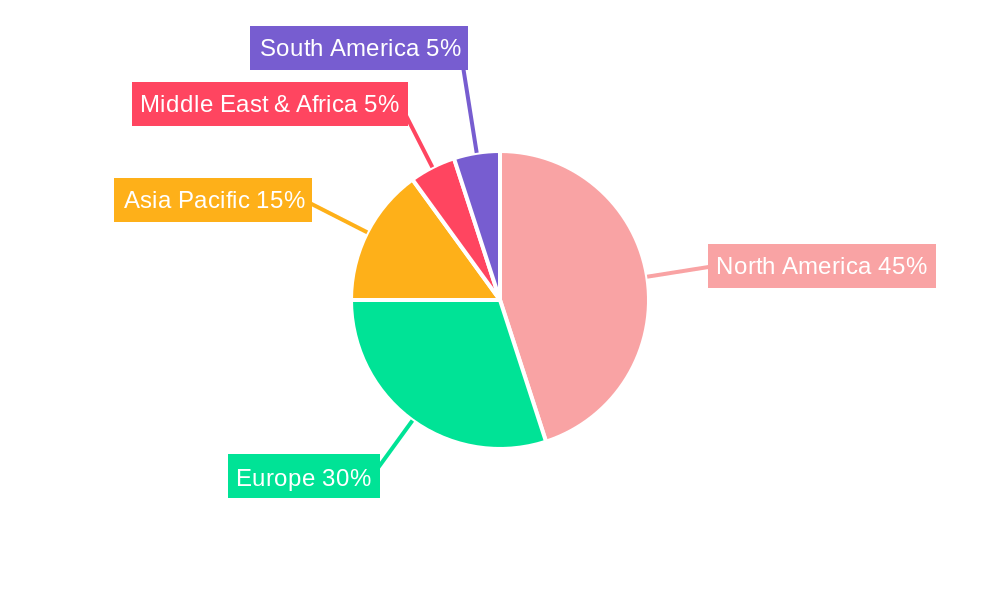

Commercial Real Estate InvestmentCommercial Real Estate Investment by Type (Financing Services, Investment Services, Consultation Service, Other), by Application (Large Enterprise, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

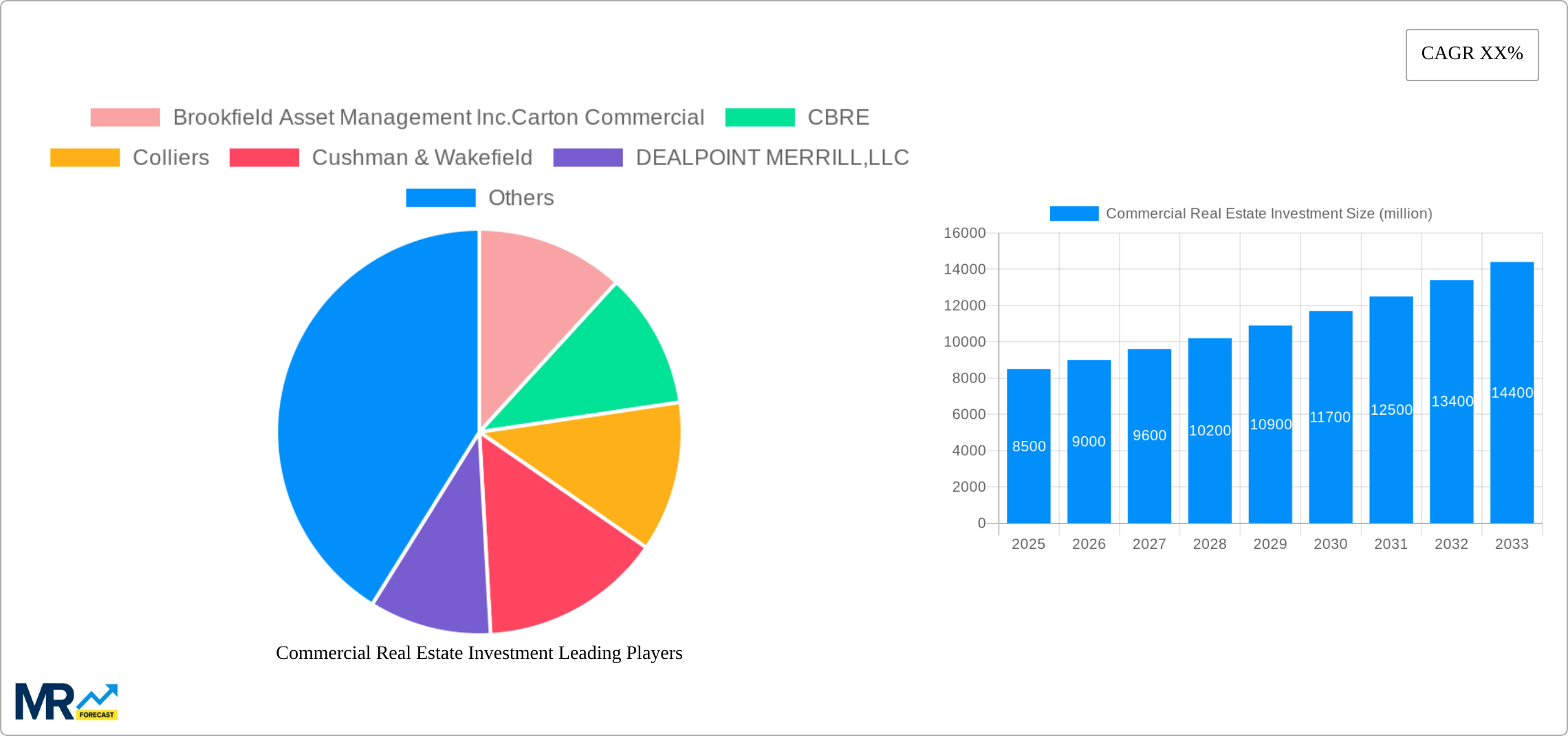

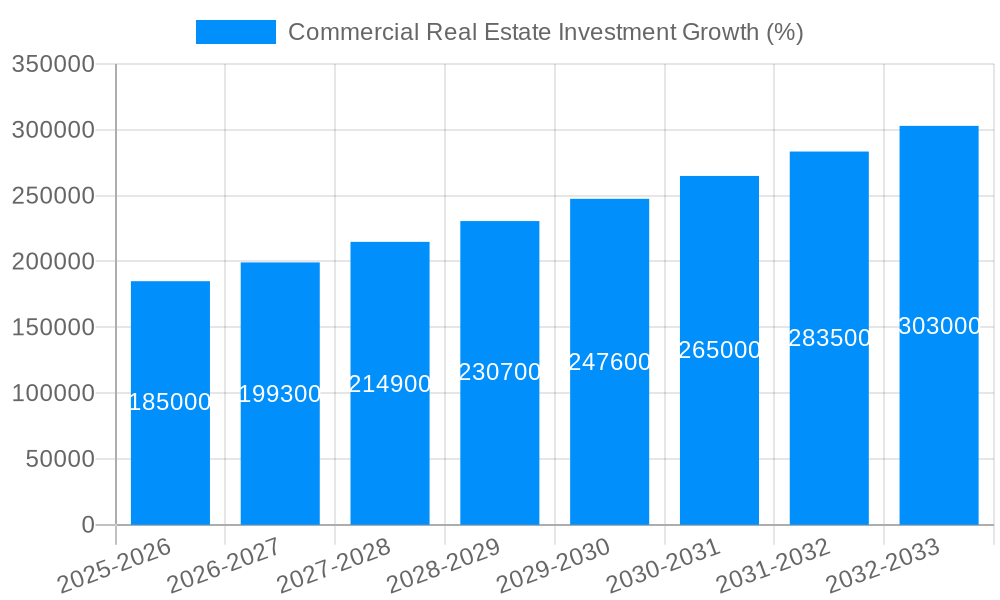

The global commercial real estate investment market is experiencing robust growth, driven by factors such as increasing urbanization, a burgeoning global economy, and a growing demand for modern office spaces and retail outlets. The market's compound annual growth rate (CAGR) is estimated to be in the range of 6-8% over the forecast period (2025-2033), indicating a substantial expansion. This growth is fueled by a diverse range of investment strategies, including both direct property acquisition and indirect investment through REITs and other financial instruments. The market is segmented by service type (financing, investment, and consultation) and by client size (large enterprises and SMEs), reflecting the diverse needs of market participants. While specific numerical market size data is unavailable, extrapolating from industry reports and average CAGR in similar sectors, a reasonable estimate for the 2025 market size would be in the range of $2.5 trillion to $3 trillion, depending on the exchange rates and various economic factors. This figure is likely to increase significantly by 2033.

Significant regional variations exist within the market. North America and Europe currently hold the largest market shares, but regions such as Asia-Pacific are witnessing rapid growth, driven by economic expansion and infrastructure development in emerging markets. Key players such as Brookfield Asset Management, CBRE, and Cushman & Wakefield are dominating the market, leveraging their expertise and global reach to capture significant market share. However, the increasing competition from smaller, agile firms specializing in niche markets presents a challenge for established players. Continued regulatory changes, global economic uncertainty, and fluctuations in interest rates pose potential restraints to market growth. Adaptability and strategic partnerships will be crucial for companies to navigate these challenges and sustain long-term growth in this dynamic market.

The commercial real estate (CRE) investment market experienced significant fluctuations between 2019 and 2024, largely influenced by macroeconomic factors and evolving investor preferences. The historical period (2019-2024) saw a mix of robust growth in certain sectors, particularly those driven by e-commerce and data center needs, alongside periods of contraction stemming from global uncertainties like the COVID-19 pandemic. The base year of 2025 marks a point of stabilization and recovery, with a projected upward trend for the forecast period (2025-2033). Investment strategies shifted, with increased focus on diversification, sustainability, and technology integration. While traditional asset classes like office and retail faced challenges, industrial and logistics properties demonstrated remarkable resilience and strong growth. The increasing adoption of PropTech (Property Technology) solutions has streamlined processes, improved transparency, and enhanced investment decision-making. Furthermore, the evolving regulatory landscape, including environmental regulations and tax incentives, plays a crucial role in shaping investment decisions. By 2033, the market is expected to show substantial growth, driven by post-pandemic recovery, technological advancements, and changing urban landscapes. This growth will be particularly pronounced in sectors catering to the growing needs of a globalized economy and a digitally driven world, signifying a dynamic and evolving investment landscape. The total market value is estimated to reach several hundred billion dollars by 2033, representing a significant increase from its 2025 valuation (in the multi-billion dollar range). This growth will be influenced by factors such as sustainable building practices, changes in consumer behavior, and ongoing technological innovations.

Several key factors are propelling the growth of the commercial real estate investment market. Firstly, the ongoing recovery from the pandemic's economic impact is driving renewed interest in CRE investments. Businesses are adapting to hybrid work models and reevaluating their real estate needs, leading to increased demand for flexible and adaptable spaces. Secondly, historically low interest rates (though this is changing) have made borrowing more attractive for investors, fueling investment activity. Thirdly, the rise of e-commerce continues to drive demand for warehouse and logistics space, leading to significant investment in these sectors. The expansion of data centers, fueled by the growth of cloud computing and big data, also contributes significantly to CRE investment. Furthermore, the increasing focus on sustainability is influencing investor decisions, with a greater emphasis on energy-efficient buildings and environmentally friendly practices. Finally, demographic shifts and urbanization are creating new opportunities in CRE, driving the demand for mixed-use developments and residential properties in urban centers. These factors combine to create a robust and diverse market, attracting both domestic and international investors.

Despite positive growth projections, the CRE investment market faces several challenges. Inflationary pressures and rising interest rates are increasing the cost of capital, potentially dampening investment activity. Geopolitical instability and global economic uncertainties create volatility in the market, making investment decisions more complex. The increasing availability of alternative investment options competes for investor capital, potentially reducing investment in CRE. Furthermore, regulatory changes, particularly those related to environmental standards and building codes, can impact the cost and feasibility of development projects. Supply chain disruptions and material cost increases also pose challenges to the construction and development of new properties. Additionally, the shift towards remote work models affects the demand for office spaces, impacting values and investment strategies in that sector. Finally, vacancies in certain property types, especially in the retail sector, can negatively affect investment returns. Addressing these challenges requires a strategic approach, including diversification of investments and adaptation to the evolving market conditions.

The United States, particularly major metropolitan areas like New York, Los Angeles, and Chicago, is expected to remain a dominant force in the CRE investment market. However, significant growth is also projected in other regions such as Asia-Pacific (especially China, Japan, and Australia) and parts of Europe (particularly Germany and the UK). Amongst the segments, the Investment Services segment is poised for considerable growth.

Investment Services: This segment is forecast to experience significant growth driven by the increasing need for professional expertise in property acquisition, due diligence, and asset management. Several factors drive this demand:

Large Enterprises: Large enterprises are leading the charge in CRE investment, particularly in sectors like industrial and data centers. Their substantial financial resources enable them to undertake large-scale projects and drive significant market growth.

Financing Services: This segment supports the growth of all other segments by offering capital for CRE projects.

The combination of these factors points towards a substantial increase in the market size of Investment Services provided to Large Enterprises within the forecast period. This segment is projected to contribute a significant portion to the overall market value estimated to be in the hundreds of billions of dollars by 2033.

Several factors will catalyze the growth of the commercial real estate investment industry. Firstly, the ongoing recovery from the pandemic and a resurgence in economic activity will increase demand for commercial spaces. Secondly, technological advancements, particularly in PropTech, are streamlining processes and improving efficiency in the CRE sector. Thirdly, increasing awareness and focus on sustainability are driving investments in green buildings and sustainable practices, creating new opportunities. Finally, supportive government policies and incentives promoting urban regeneration and sustainable development are further stimulating investments in the CRE sector.

This report provides a comprehensive overview of the commercial real estate investment market, covering historical performance, current trends, and future projections. It analyzes key driving forces and challenges facing the industry, examines regional and segmental variations, and identifies leading players. The report incorporates both quantitative and qualitative data to offer a thorough and insightful understanding of the CRE investment landscape, serving as a valuable resource for investors, developers, and industry professionals.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Brookfield Asset Management lnc.Carton Commercial, CBRE, Colliers, Cushman & Wakefield, DEALPOINT MERRILL,LLC, Jones Lang LaSalle IP,Inc., Lee & Associates Licensing and Administration Co.,LP, Marcus & Millichap, NEWMARK, The Flynn Company, Transwestern, West,Lane & Schlager, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Commercial Real Estate Investment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Real Estate Investment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.