1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Real Estate?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Real Estate

Commercial Real EstateCommercial Real Estate by Application (/> Rental, Sales), by Type (/> Community Business, Commerce Center, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

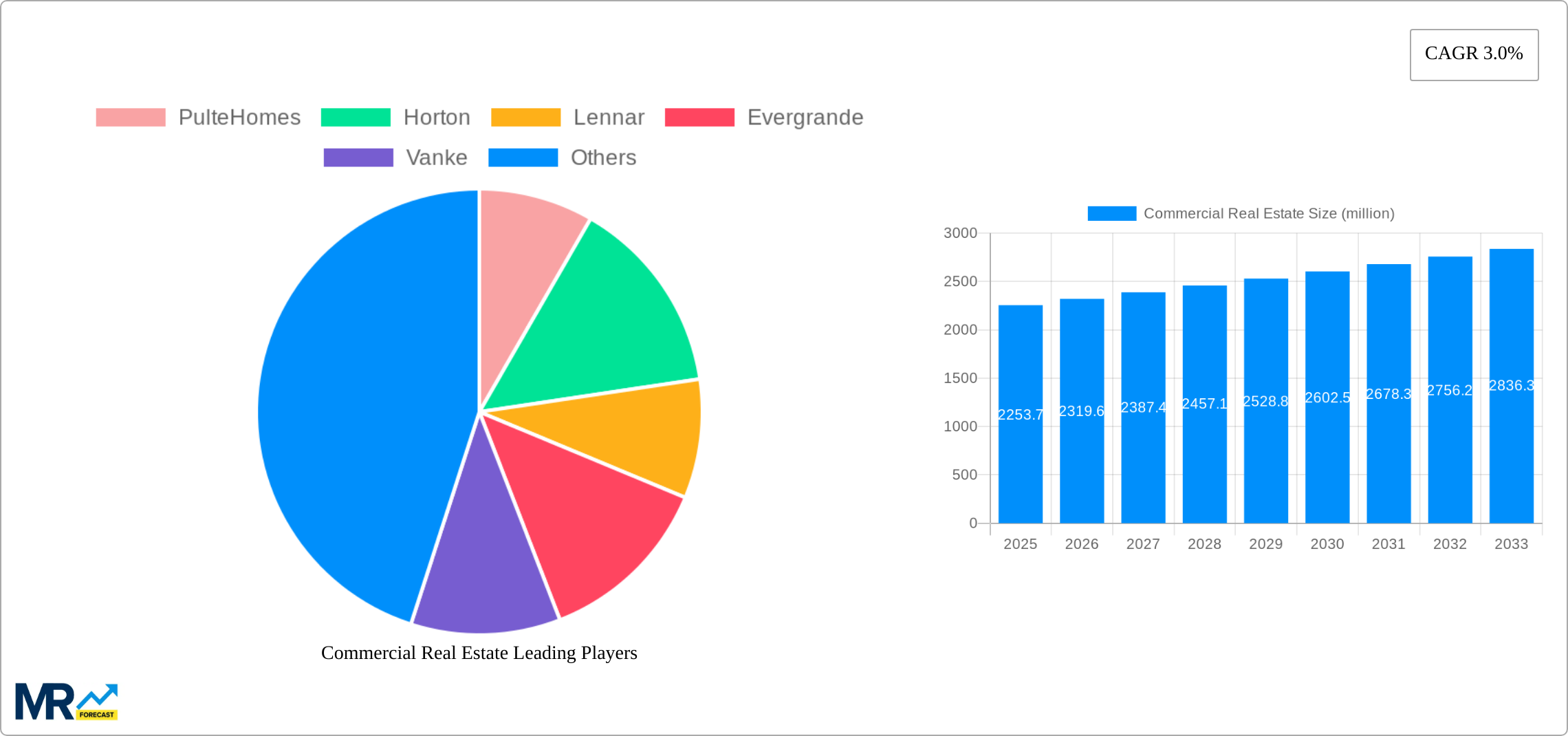

The global commercial real estate market, currently valued at $2772.7 million (2025), is poised for significant growth. While the exact CAGR is unavailable, considering the robust performance of major players like PulteHomes, Lennar, and Horton in the residential sector, and the ongoing urbanization and economic growth in key regions, a conservative estimate of a 5-7% CAGR for the forecast period (2025-2033) seems reasonable. Key drivers include increasing demand for office spaces in burgeoning tech hubs, expanding logistics infrastructure necessitated by e-commerce growth, and a continuous rise in tourism leading to higher demand for hotels and hospitality spaces. Emerging trends such as the adoption of smart building technologies, focus on sustainable practices (green buildings), and the shift towards flexible workspaces are shaping market dynamics. However, constraints like rising interest rates, economic uncertainty in certain regions, and the potential impact of future pandemics could temper growth. The market segmentation (data missing in the prompt) likely encompasses various property types such as office buildings, retail spaces, industrial warehouses, and hospitality facilities, with geographical variations in growth rates. The substantial presence of international players like Evergrande, Vanke, and Country Garden highlights the global nature of the market and underlines the competitive landscape.

The forecast for the next decade shows continued expansion, albeit potentially with fluctuations based on macroeconomic conditions. Strategic acquisitions, mergers, and joint ventures among the listed companies will likely play a significant role in shaping market share. The focus on sustainable and technologically advanced commercial properties will be crucial for success. Investors should closely monitor evolving regulations, economic indicators, and technological advancements to make informed decisions in this dynamic market. A detailed analysis of regional data, currently absent, would provide a more granular understanding of growth opportunities and market penetration strategies for individual players. The market's future will be heavily influenced by technological integration, environmental concerns, and the adaptability of businesses to changing economic landscapes.

The global commercial real estate (CRE) market, valued at $XXX million in 2024, is poised for significant transformation over the forecast period (2025-2033). The historical period (2019-2024) witnessed fluctuating growth influenced by macroeconomic factors, technological advancements, and evolving consumer preferences. The base year, 2025, marks a pivotal point, with several trends converging to shape the market's future trajectory. Demand for flexible workspaces, driven by the rise of remote work and hybrid models, continues to reshape office space requirements. This trend is further exacerbated by the increasing adoption of technology enabling remote collaboration. Meanwhile, the e-commerce boom fuels the expansion of logistics and warehousing facilities, attracting considerable investment. The growing emphasis on sustainability and environmentally conscious construction is impacting design and construction methods, leading to a rise in green buildings and LEED-certified properties. Furthermore, the increasing focus on experiential retail is changing the landscape of shopping centers, driving developers to incorporate entertainment and lifestyle elements into their designs. Investors are also demonstrating a growing interest in alternative asset classes, such as data centers and life sciences properties, driven by long-term growth prospects in these sectors. The market is witnessing a surge in the adoption of proptech solutions, improving efficiency and transparency across the value chain. This includes advancements in property management, leasing, and investment analysis. Geopolitical factors and economic uncertainty remain important considerations, with the potential to significantly affect investment decisions and market dynamics. Overall, the CRE market is characterized by ongoing evolution, driven by technological innovation, shifts in consumer behavior, and a growing awareness of environmental and social responsibility.

Several key forces are accelerating growth within the commercial real estate sector. Firstly, robust economic growth in various regions fuels demand for office spaces, retail outlets, and industrial facilities. A burgeoning global population, coupled with urbanization trends, necessitates the development of new commercial properties to accommodate increasing demands for housing, entertainment, and commercial activities. Furthermore, low interest rates and readily available financing options incentivize investment in CRE projects, attracting both domestic and foreign investors. Technological advancements, particularly in areas like smart buildings and PropTech, are driving efficiency gains, boosting investment and value creation in the sector. The rise of e-commerce continues to transform the logistics and warehousing sectors, requiring significant investment in infrastructure and technology. Finally, growing awareness of sustainability and environmental, social, and governance (ESG) factors is influencing investment decisions, favoring projects with strong environmental credentials. These factors work in concert to create a favorable climate for substantial growth in the commercial real estate market throughout the forecast period.

Despite the positive growth outlook, several challenges and restraints could impede the expansion of the commercial real estate market. Economic downturns, inflation, and geopolitical instability represent significant headwinds, impacting investor confidence and potentially reducing investment in new projects. Rising construction costs, coupled with labor shortages, can significantly increase development costs, impacting project feasibility and profitability. Increasing regulatory hurdles and stringent environmental regulations impose additional burdens on developers, leading to delays and potentially higher development costs. The ongoing pandemic's influence on hybrid work models and changing office space requirements continue to impact the demand for traditional office buildings, particularly in major metropolitan areas. Moreover, competition from alternative investment assets, such as infrastructure and private equity, could divert capital away from the commercial real estate sector. Finally, technological disruptions and the increasing adoption of automation pose a challenge to certain commercial property types, requiring adaptation and innovation to remain competitive.

Asia-Pacific (specifically China): The region's rapid urbanization, expanding middle class, and significant foreign investment are key drivers of growth. China's massive infrastructure projects and robust economic development contribute significantly to demand across various segments, particularly in commercial and residential construction. Companies such as Evergrande, Vanke, Country Garden, Poly, SUNAC, LongFor, Greenland, R&F, CR Land, Green Town, Agile, and Wanda have played significant roles in shaping this market. However, recent regulatory changes and economic slowdowns present a degree of uncertainty for the future.

North America (United States): A robust economy, relatively stable political environment, and access to capital make the US a major CRE market. The strong performance of the US economy and a substantial level of investment into logistics and technology-related properties are expected to continue driving market growth. PulteHomes, Horton, and Lennar are major players in this market.

Segments: The logistics and warehousing segment benefits tremendously from the sustained growth of e-commerce. Data centers are also experiencing significant growth due to the increasing demand for data storage and processing capacity.

The paragraph above explains why these regions and segments are key drivers of growth. The combination of macroeconomic factors, technological shifts, and strong player presence make the Asia-Pacific region, particularly China (despite recent challenges), and North America key areas for market dominance. The logistics and warehousing sectors are positioned for continued expansion due to the unstoppable growth of e-commerce and the ever-increasing reliance on technology.

Several factors are catalyzing growth in the CRE industry. The increasing adoption of PropTech solutions is enhancing efficiency and transparency in various aspects of real estate transactions, attracting investment. The push towards sustainable and green buildings meets growing environmental concerns, attracting ESG-focused investors. Favorable government policies and infrastructure development initiatives in many regions are boosting investor confidence and driving new projects. Finally, the continuing expansion of e-commerce is continuously driving the need for more and more warehouse and logistics space.

This report provides a detailed analysis of the commercial real estate market, encompassing historical data, current market trends, and future projections. It delves into the key drivers, challenges, and opportunities shaping the industry. The report provides comprehensive insights into market segmentation, regional analysis, key players, and significant developments shaping the landscape. In short, it's a crucial resource for investors, developers, and industry professionals seeking to navigate the evolving dynamics of the commercial real estate sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PulteHomes, Horton, Lennar, Evergrande, Vanke, Country Garden, Poly, SUNAC, LongFor, Greenland, R&F, CR Land, Green Town, Agile, Wanda, Hongsin.

The market segments include Application, Type.

The market size is estimated to be USD 2772.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Commercial Real Estate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Real Estate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.