1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Real Estate Investment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Commercial Real Estate Investment

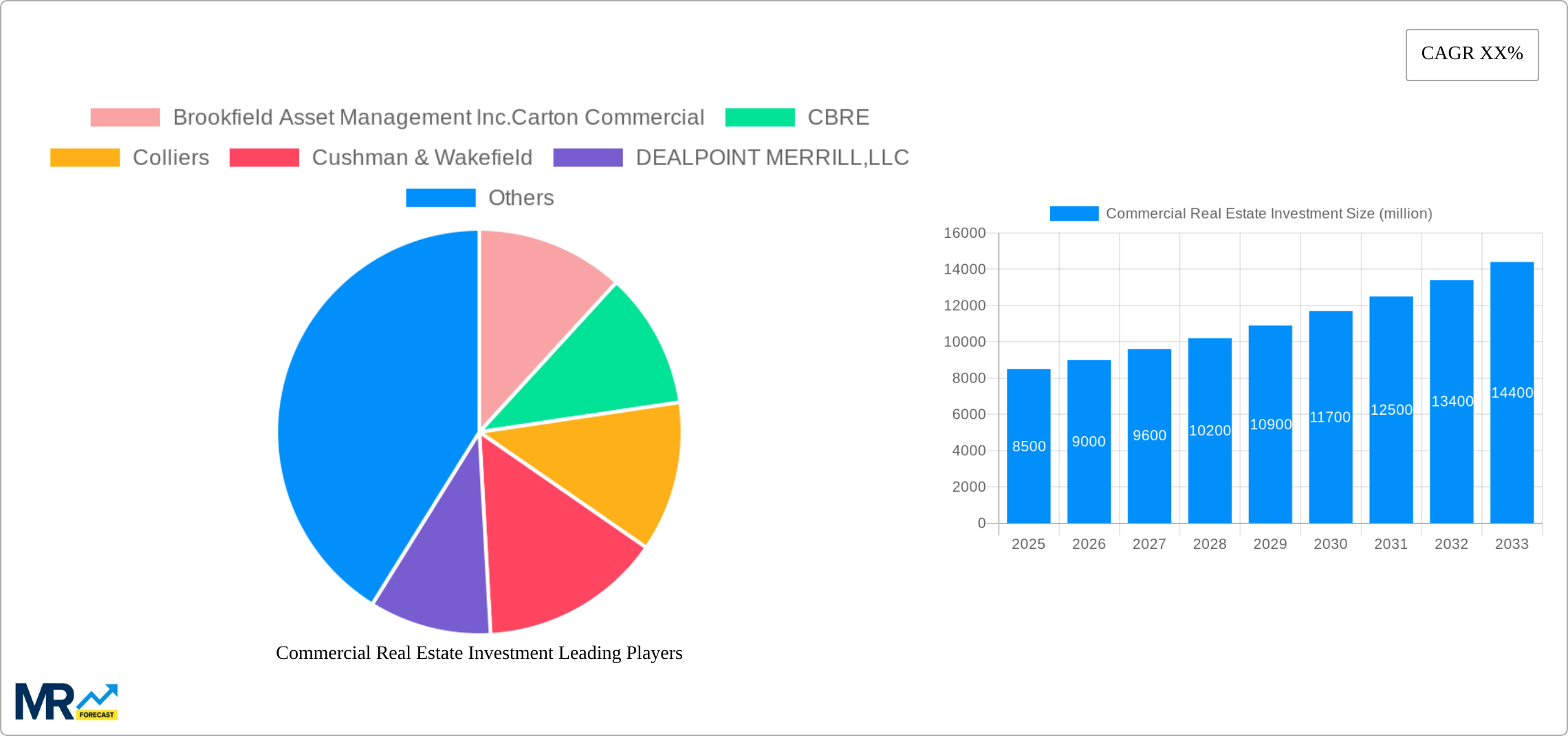

Commercial Real Estate InvestmentCommercial Real Estate Investment by Type (Financing Services, Investment Services, Consultation Service, Other), by Application (Large Enterprise, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

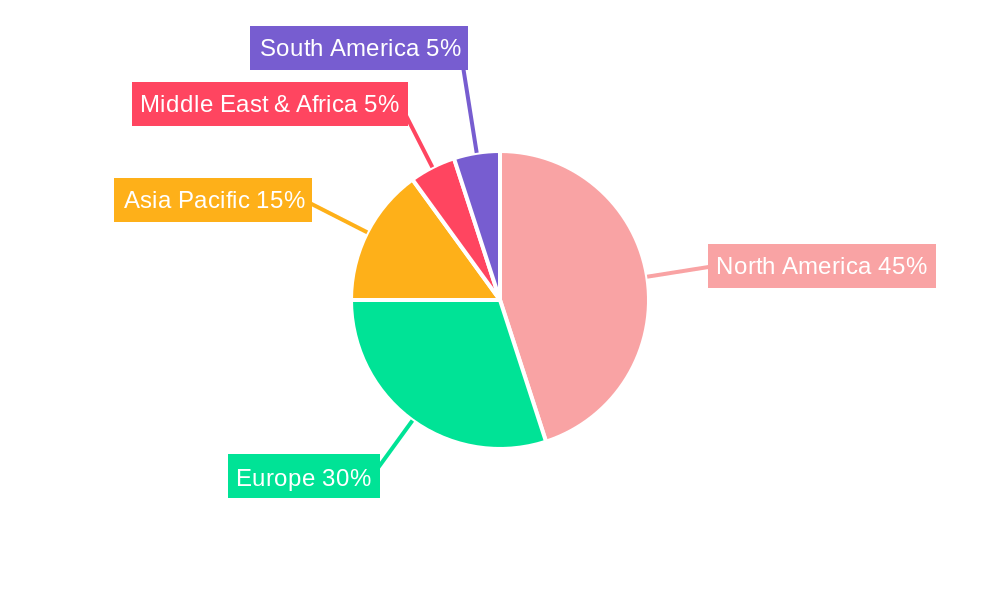

The commercial real estate (CRE) investment market is experiencing robust growth, driven by several key factors. A steadily increasing global population, coupled with urbanization and the expansion of businesses, fuels a consistent demand for commercial properties. Technological advancements, such as proptech solutions improving efficiency and transparency in transactions, are further accelerating market expansion. While interest rate fluctuations and economic uncertainties present challenges, the long-term outlook remains positive. The market is segmented by service type (financing, investment, consultation, and other) and by the size of the client (large enterprises and SMEs). Large enterprises typically drive a larger portion of the investment volume due to their significant capital resources and infrastructural needs. However, the SME segment shows considerable potential for growth, particularly with the increasing availability of tailored financing options and government initiatives supporting small business development. Geographically, North America and Europe currently dominate the market share, but Asia-Pacific is emerging as a significant growth engine due to rapid economic development and infrastructural investments in key regions like China and India. Competition is fierce, with established players like Brookfield Asset Management, CBRE, Cushman & Wakefield, and Jones Lang LaSalle vying for market leadership alongside a growing number of specialized firms. The sustained growth trajectory suggests a considerable opportunity for investment and expansion within the CRE sector over the next decade. The continuing digital transformation will play an increasingly significant role in shaping market dynamics, influencing transaction methods and data analysis capabilities.

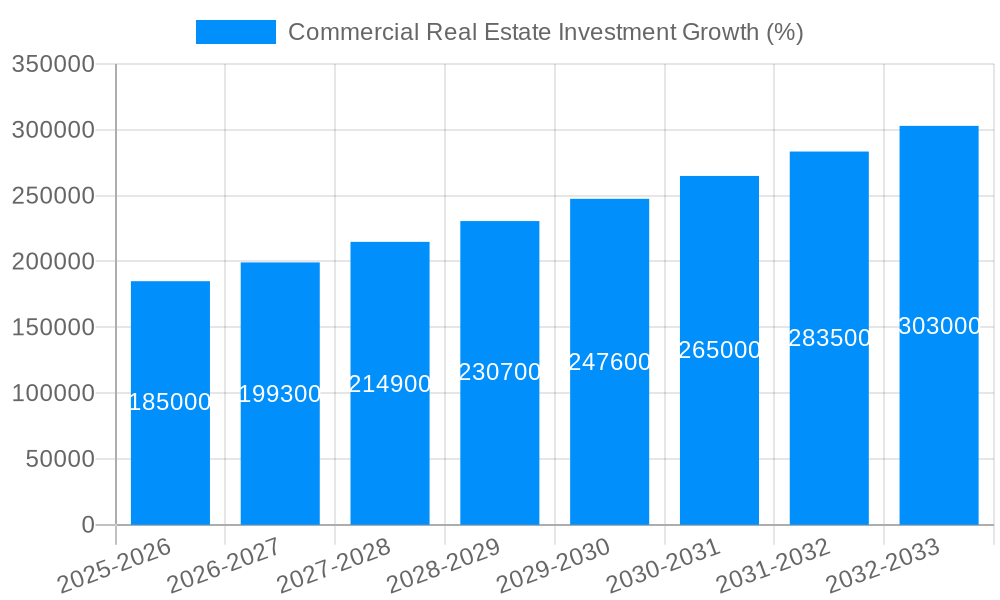

The forecast for the commercial real estate investment market through 2033 is optimistic, anticipating sustained growth fueled by ongoing urbanization, technological advancements, and favorable economic conditions in key regions. However, potential headwinds include global economic instability, inflation, and shifts in government regulations. Strategic acquisitions, mergers, and the development of innovative financial products will be crucial for companies to maintain a competitive edge. The market will likely see a continued shift towards sustainable and environmentally friendly commercial real estate projects, driven by growing investor and consumer awareness. Furthermore, expect to see a greater emphasis on data-driven decision-making and the utilization of advanced analytics to assess risk and optimize investment strategies. The diversification of investment strategies across various property types and geographic locations will also become increasingly important to mitigate risk and maximize returns.

The commercial real estate (CRE) investment market experienced significant shifts between 2019 and 2024, primarily driven by macroeconomic factors and evolving investor preferences. The historical period (2019-2024) saw robust growth, fueled by low interest rates and a strong economy. However, the onset of the COVID-19 pandemic in 2020 introduced unprecedented volatility. While certain sectors like e-commerce warehousing thrived, others, such as office and retail, faced considerable headwinds due to remote work adoption and shifting consumer behavior. The base year, 2025, marks a period of transition, with lingering pandemic effects gradually receding and a renewed focus on sustainability and technological integration within the CRE landscape. The forecast period (2025-2033) projects continued growth, albeit at a potentially moderated pace compared to the pre-pandemic era. Investors are increasingly seeking diversification, focusing on resilient asset classes and properties with strong environmental, social, and governance (ESG) credentials. This trend is expected to drive innovation in areas such as green building technologies, smart building solutions, and data-driven investment strategies. The total market value is estimated to be in the tens of billions of dollars in 2025, with projections of steady growth throughout the forecast period, potentially reaching hundreds of billions by 2033. This growth will be fueled by various factors including increasing urbanization, population growth in key markets, and the ongoing need for modern and efficient commercial spaces. Furthermore, the increasing demand for flexible workspaces and the adoption of technology within the real estate sector will also contribute to this growth. The market is expected to see continued consolidation, with larger players acquiring smaller firms and expanding their market share. This trend is likely to further enhance efficiency and scale within the industry.

Several key factors are driving the commercial real estate investment market. Low interest rates, prevalent in the earlier years of the study period, significantly reduced borrowing costs, making CRE investments more attractive. Simultaneously, a robust economy fostered high occupancy rates and increased rental income, incentivizing further investment. However, the pandemic altered the landscape. While the initial shock caused a downturn, the subsequent recovery highlighted the resilience of certain sectors. The e-commerce boom fueled the demand for warehouse and logistics facilities, creating a highly sought-after asset class. Furthermore, the growing focus on sustainability and ESG considerations is shaping investor decisions, with a rising preference for energy-efficient and environmentally responsible buildings. Technological advancements, such as property technology (PropTech) solutions, are streamlining processes, enhancing efficiency, and providing data-driven insights for better investment decisions. Finally, demographic trends, such as urbanization and population growth in key markets, continue to drive demand for commercial spaces, reinforcing the long-term growth potential of the CRE investment sector. This convergence of economic, technological, and demographic forces indicates a dynamic and evolving market landscape in the years to come.

Despite the growth potential, the CRE investment market faces several challenges. Economic uncertainty, including inflation and interest rate fluctuations, creates volatility and impacts investor confidence. Geopolitical events and global economic downturns can significantly influence investment decisions. The pandemic highlighted the vulnerability of certain sectors, especially office and retail, to sudden shifts in consumer behavior and working patterns. Adapting to these changes requires strategic repositioning and innovative solutions. Furthermore, increasing regulatory scrutiny and stricter environmental regulations add complexity and cost to development projects. Competition for prime assets remains fierce, pushing up prices and potentially impacting returns. Finally, access to capital and financing can be a constraint, particularly for smaller investors or projects in less developed markets. Successfully navigating these challenges necessitates a combination of strategic foresight, risk management capabilities, and adaptability to the evolving market dynamics.

The commercial real estate investment market is geographically diverse, with several key regions and segments expected to experience significant growth. While specific market share data requires proprietary research, certain trends are discernible.

Key Regions:

Dominant Segments:

(Further detailed analysis would require market-specific data, which is beyond the scope of this report description.)

Several factors will fuel the growth of the commercial real estate investment industry. Firstly, the ongoing recovery from the pandemic's impact, combined with sustained economic growth in many regions, will boost investor confidence and stimulate demand for commercial properties. Secondly, technological advancements, particularly in areas like PropTech and smart building technologies, will enhance efficiency, reduce operational costs, and improve asset management. Finally, the growing emphasis on sustainability and ESG criteria will drive investment in green buildings and environmentally responsible developments, creating a new wave of opportunity within the CRE sector. These catalysts, together, create a positive outlook for the future of commercial real estate investment.

This report offers a comprehensive analysis of the commercial real estate investment market, covering historical trends, current market dynamics, future projections, and key players. It provides in-depth insights into growth catalysts, challenges, and opportunities within the sector, enabling investors and stakeholders to make informed decisions and navigate the evolving landscape of commercial real estate. The detailed examination of various market segments, geographical regions, and leading companies equips readers with a thorough understanding of the current state and future trajectory of this dynamic industry. The comprehensive data sets and insightful analysis aim to provide valuable guidance for strategic planning and investment strategies.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Brookfield Asset Management lnc.Carton Commercial, CBRE, Colliers, Cushman & Wakefield, DEALPOINT MERRILL,LLC, Jones Lang LaSalle IP,Inc., Lee & Associates Licensing and Administration Co.,LP, Marcus & Millichap, NEWMARK, The Flynn Company, Transwestern, West,Lane & Schlager, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Commercial Real Estate Investment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Commercial Real Estate Investment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.