1. What is the projected Compound Annual Growth Rate (CAGR) of the Calcium Plastic Box?

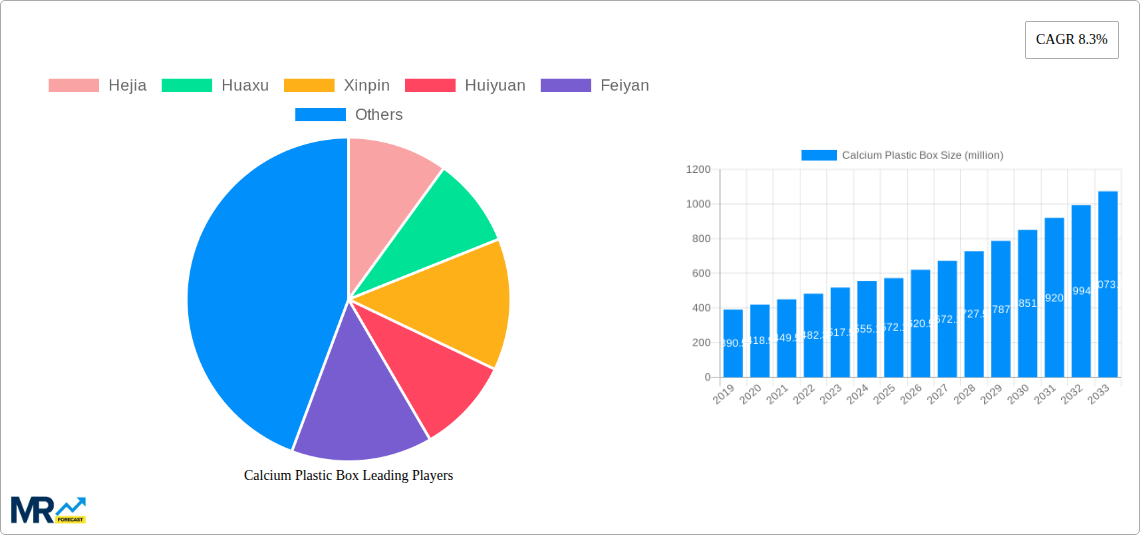

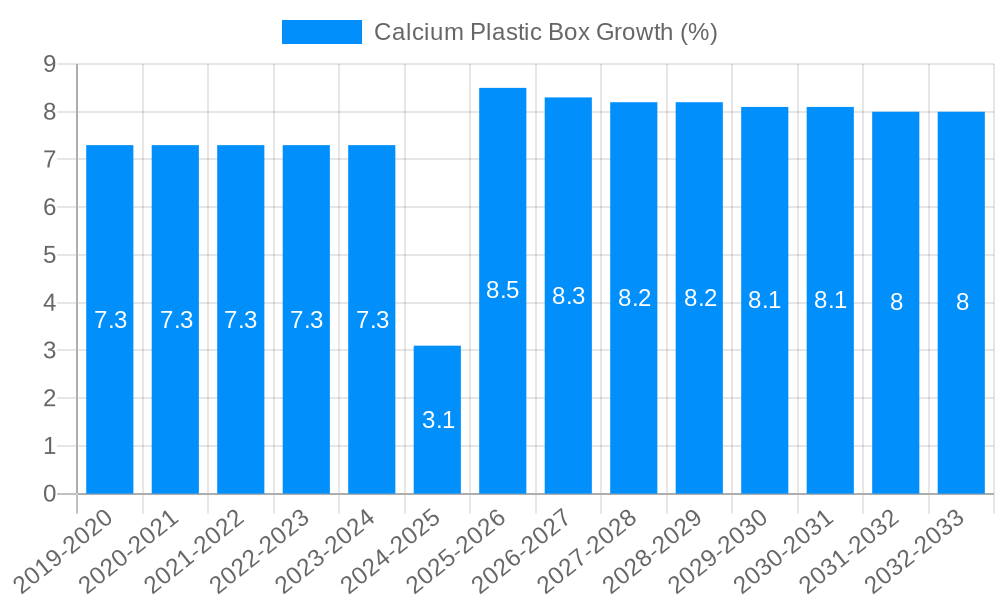

The projected CAGR is approximately 8.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Calcium Plastic Box

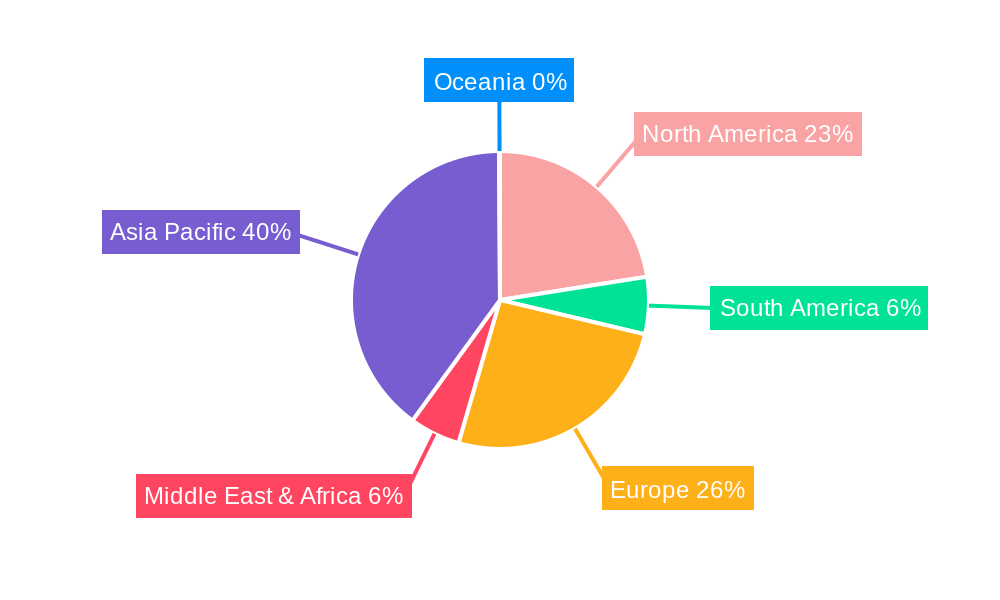

Calcium Plastic BoxCalcium Plastic Box by Type (Folding Calcium-Plastic Box, Skeleton Type Calcium Plastic Box), by Application (Electron, Hardware, Vegetable Packing Box, Pesticide Box, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Calcium Plastic Box market is poised for substantial growth, projected to reach a market size of $572.1 million by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 8.3% through 2033. This upward trajectory is primarily fueled by the increasing demand for durable, lightweight, and cost-effective packaging solutions across diverse industries. The electronics sector, in particular, presents a significant driver as manufacturers seek secure and protective packaging for sensitive components. Similarly, the hardware industry's reliance on robust containers for tools and parts contributes to market expansion. Furthermore, the growing consumer awareness regarding food safety and preservation is driving the adoption of specialized calcium plastic boxes for vegetable packaging, ensuring freshness and extending shelf life. The pesticide box segment also contributes to market growth, driven by agricultural advancements and the need for secure containment of chemical products.

The market's expansion is further bolstered by technological advancements in material science, leading to the development of more sustainable and high-performance calcium plastic variants. Innovations in manufacturing processes are also contributing to cost efficiencies, making these packaging solutions more accessible to a wider range of businesses. While the market exhibits strong growth potential, certain restraints may influence its pace. Stringent environmental regulations concerning plastic usage and disposal, coupled with the increasing availability of alternative eco-friendly packaging materials, pose challenges. However, the inherent advantages of calcium plastic boxes, such as their excellent barrier properties, resistance to chemicals and moisture, and reusability, are expected to mitigate these challenges. The market is characterized by a competitive landscape with key players like Hejia, Huaxu, and Xinpin investing in product innovation and strategic partnerships to capture market share. Regionally, the Asia Pacific, led by China and India, is expected to dominate the market due to its rapidly industrializing economy and burgeoning manufacturing sector, followed by North America and Europe.

This comprehensive report delves into the intricate dynamics of the Calcium Plastic Box market, spanning the historical period from 2019 to 2024, the base and estimated year of 2025, and projecting future trends through 2033. With an estimated market size in the millions of units, this analysis provides a granular view of market segmentation, key player strategies, and emerging industry developments.

XXX: The Calcium Plastic Box market is poised for significant evolution, driven by a confluence of technological advancements, shifting consumer preferences, and expanding application verticals. During the Historical Period (2019-2024), the market witnessed steady growth, primarily fueled by the robust demand from the electronics and hardware sectors. The increasing complexity and value of electronic components necessitated more durable and protective packaging solutions, making calcium plastic boxes a preferred choice due to their inherent strength, chemical resistance, and customizable designs. Similarly, the hardware industry, encompassing everything from tools to automotive parts, relied on these boxes for secure transit and storage.

Looking ahead to the Estimated Year (2025), projections indicate a continued upward trajectory. The Base Year (2025) serves as a crucial benchmark for assessing current market standing. The Forecast Period (2025-2033) is expected to be characterized by a diversification of applications. While electronics and hardware will remain dominant, the vegetable packing box segment is anticipated to experience a substantial surge. Growing consumer awareness regarding food safety, the need for extended shelf life, and the drive for sustainable packaging alternatives are compelling manufacturers to explore calcium plastic boxes for their produce. Their inherent properties, such as moisture resistance and non-reactivity with food products, make them an attractive option. Furthermore, the pesticide box application, while subject to stringent regulatory frameworks, will continue to be a niche but consistent market, driven by the agricultural sector's ongoing need for safe and secure containment of potentially hazardous chemicals.

Emerging trends also include a growing emphasis on eco-friendly manufacturing processes and materials within the calcium plastic box industry. While the term "plastic" might evoke environmental concerns, advancements in material science are leading to the development of more sustainable calcium plastic formulations and increased recyclability. This focus on sustainability is crucial for long-term market viability. The market is also seeing innovation in structural design, with the Folding Calcium-Plastic Box type gaining traction due to its space-saving advantages during storage and transportation, contributing to reduced logistical costs. The Skeleton Type Calcium Plastic Box, offering enhanced structural integrity for heavier or more sensitive items, will also continue to hold its ground in specialized applications. Overall, the Calcium Plastic Box market presents a dynamic landscape with evolving demands and opportunities.

The Calcium Plastic Box market is experiencing robust growth propelled by several key driving forces that are reshaping its landscape. Foremost among these is the escalating demand for enhanced product protection and durability across various industries. As supply chains become increasingly complex and globalized, the need for packaging that can withstand rigorous handling, fluctuating environmental conditions, and potential impacts during transit is paramount. Calcium plastic boxes, with their inherent strength, resistance to chemicals, and moisture-impermeability, offer a superior level of protection compared to conventional packaging materials, thereby reducing product damage and associated economic losses. This inherent resilience makes them indispensable for high-value items like sensitive electronic components and intricate hardware.

Furthermore, the growing emphasis on product safety and regulatory compliance is a significant catalyst. Industries such as agriculture, which utilizes these boxes for pesticide containment, are bound by strict regulations regarding the safe storage and transportation of potentially hazardous materials. Calcium plastic boxes meet these stringent requirements due to their inert nature and robust construction, ensuring the containment of harmful substances and preventing environmental contamination. This adherence to safety standards opens up and sustains significant market share within these regulated sectors. Coupled with this is the evolving consumer preference for convenience and reusability. As businesses strive to offer enhanced customer experiences, packaging that is easy to open, close, and store, or even reuse, becomes increasingly attractive. The design flexibility of calcium plastic boxes allows for features that cater to these evolving consumer needs, further cementing their market position.

Despite the promising growth trajectory, the Calcium Plastic Box market is not without its challenges and restraints that could potentially impede its expansion. A primary concern revolves around the fluctuating costs of raw materials, particularly calcium carbonate and various plastic resins. Global supply chain disruptions, geopolitical events, and shifts in commodity prices can significantly impact the production costs of calcium plastic boxes, leading to price volatility for end-users. This unpredictability can deter potential customers and force manufacturers to absorb higher costs, squeezing profit margins. Moreover, while calcium plastic offers several advantages, the perception of plastics as environmentally unfriendly materials continues to be a significant hurdle. Growing environmental consciousness and stricter regulations concerning plastic waste management, particularly in developed economies, are pushing industries to seek more sustainable and biodegradable alternatives. This can lead to a reluctance in adopting or expanding the use of calcium plastic boxes, especially in applications where greener options are readily available or mandated.

Another restraint lies in the capital investment required for specialized manufacturing equipment. The production of high-quality calcium plastic boxes, especially those with intricate designs or specific structural properties, necessitates advanced machinery and technology. For smaller manufacturers or those entering the market, the initial capital outlay can be a substantial barrier to entry, limiting the number of players and potentially stifling competition. Additionally, competition from alternative packaging materials presents a constant challenge. While calcium plastic boxes excel in certain areas, other materials like high-density polyethylene (HDPE), cardboard, or specialized metal containers may offer comparable or even superior performance in specific applications at a potentially lower cost or with a better environmental profile. The availability and continuous innovation in these alternative materials require calcium plastic box manufacturers to remain competitive through cost optimization and superior product differentiation.

Dominant Segment: Vegetable Packing Box

The Vegetable Packing Box segment is poised to emerge as a significant dominator within the Calcium Plastic Box market, driven by a confluence of factors related to consumer demand, food safety concerns, and evolving agricultural practices. This segment's ascendancy is rooted in the growing global awareness and concern for food safety and quality throughout the supply chain. Consumers are increasingly demanding produce that is fresh, free from contamination, and has an extended shelf life. Calcium plastic boxes, with their inherent properties, are exceptionally well-suited to meet these demands.

Superior Protection and Shelf Life: Calcium plastic boxes offer excellent protection against physical damage during handling, transportation, and storage, minimizing bruising and spoilage of delicate vegetables. Their inherent moisture resistance prevents excessive humidity build-up, which can lead to mold and bacterial growth, thereby extending the shelf life of produce. This directly translates to reduced food waste, a critical concern for both consumers and the industry.

Chemical Inertness and Food Safety: Unlike some other packaging materials, calcium plastic is chemically inert, meaning it does not react with the contents. This ensures that no harmful chemicals leach into the vegetables, maintaining their natural taste, texture, and nutritional value. This chemical inertness is paramount for meeting stringent food safety regulations and reassuring consumers about the safety of their food.

Hygiene and Cleanliness: The non-porous surface of calcium plastic boxes makes them easy to clean and sanitize, promoting a hygienic environment for packaging vegetables. This is crucial in preventing the spread of foodborne illnesses and maintaining the integrity of the produce from farm to table.

Sustainability and Reusability Potential: While plastic often faces environmental scrutiny, advancements in calcium plastic formulations are leading to more sustainable options, including those with recycled content and improved recyclability. Furthermore, the durability of calcium plastic boxes allows for multiple reuse cycles, especially in closed-loop systems within large agricultural operations or distribution networks. This reduces the overall environmental footprint compared to single-use packaging.

Growing Agricultural Sector and Market Demand: The global agricultural sector is expanding to meet the demands of a growing population. This expansion necessitates efficient and reliable packaging solutions for harvested produce. The increasing adoption of modern farming techniques and the rise of commercial agriculture further fuel the demand for specialized packaging like calcium plastic boxes that can handle larger volumes and ensure product integrity.

Technological Advancements in Design: Innovations in the design and manufacturing of calcium plastic boxes are making them more tailored to specific vegetable types. Features such as ventilation holes, stacking capabilities, and customizable internal structures can be incorporated to optimize the packaging for different produce, further enhancing their appeal in this segment.

Geographically, while specific regional dominance would require detailed market data, it can be inferred that regions with strong agricultural outputs and a high demand for fresh produce, such as Asia-Pacific (with its large population and significant agricultural sector) and North America (with its advanced food supply chains and consumer focus on quality), are likely to exhibit substantial growth and dominance in the Vegetable Packing Box segment.

The Calcium Plastic Box industry is fueled by several key growth catalysts. The increasing global population and the subsequent rise in demand for packaged goods across electronics, hardware, and particularly fresh produce significantly propel market expansion. Furthermore, a growing emphasis on product safety and regulatory compliance, especially in sectors like pesticide containment and food packaging, necessitates the use of robust and reliable materials like calcium plastic. Technological advancements leading to improved material properties, enhanced durability, and customizable designs further contribute to their adoption. The drive towards sustainable packaging solutions, with ongoing research into eco-friendlier calcium plastic formulations and increased recyclability, also acts as a catalyst for future growth and broader market acceptance.

This report provides an exhaustive analysis of the Calcium Plastic Box market, encompassing a detailed breakdown of market size, segmentation by type and application, and regional dynamics. It delves into the historical performance from 2019-2024, establishes a baseline with the Base Year (2025), and provides projections for the Forecast Period (2025-2033). The report highlights key industry developments, identifies growth catalysts and restraints, and profiles leading manufacturers. It offers critical insights for stakeholders looking to understand market trends, competitive landscapes, and future opportunities within this evolving sector. The analysis is designed to equip businesses with the strategic intelligence needed to navigate the complexities and capitalize on the growth potential of the Calcium Plastic Box market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.3%.

Key companies in the market include Hejia, Huaxu, Xinpin, Huiyuan, Feiyan, Haiying, TG, Tiancheng, Yongyun, Jusuo, Ruipeng, Quanxin, .

The market segments include Type, Application.

The market size is estimated to be USD 572.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Calcium Plastic Box," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Calcium Plastic Box, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.