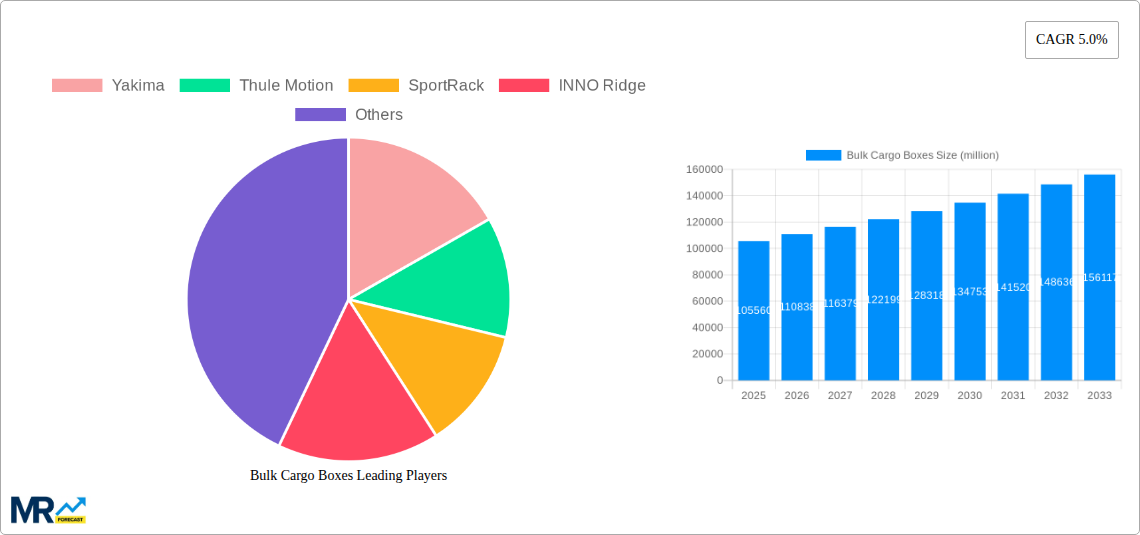

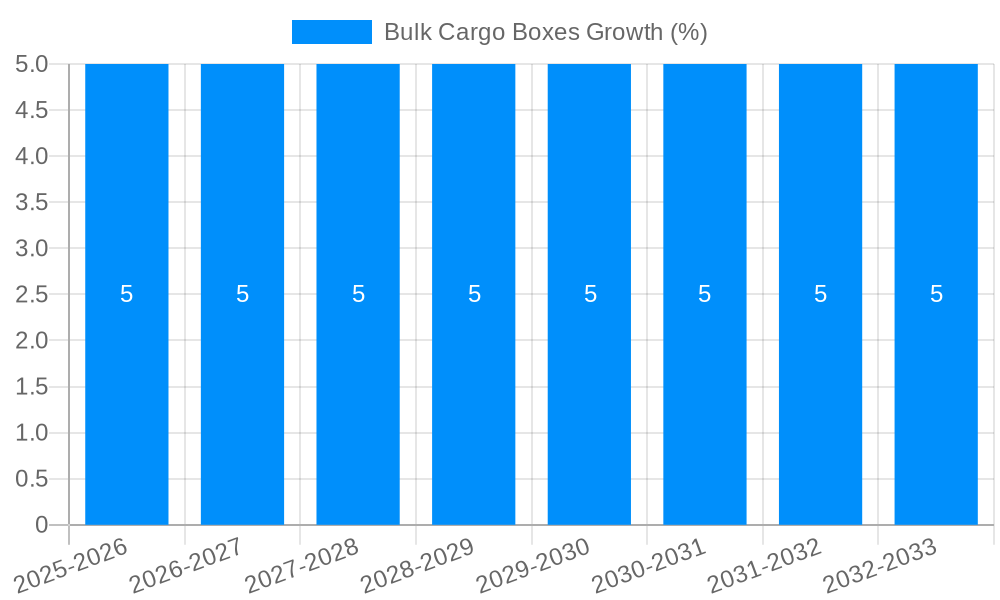

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bulk Cargo Boxes?

The projected CAGR is approximately 5.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bulk Cargo Boxes

Bulk Cargo BoxesBulk Cargo Boxes by Type (Containers, Triple Wall Boxes), by Application (Automotive, Ship, Railway, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global market for Bulk Cargo Boxes is projected to experience robust growth, driven by increasing demand across various transportation sectors and the continuous evolution of logistics solutions. With a current market size of approximately $105.56 billion in 2025, the industry is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.0% throughout the forecast period of 2025-2033. This expansion is largely fueled by the escalating need for secure, efficient, and reusable packaging solutions for the transport of goods. Key growth drivers include the burgeoning e-commerce sector, which necessitates reliable shipping containers for both domestic and international deliveries, and the growing emphasis on supply chain optimization to reduce costs and environmental impact. Furthermore, advancements in material science leading to more durable and lighter cargo boxes, coupled with smart technology integration for tracking and inventory management, are expected to further propel market growth. The diversification of applications, from automotive parts and marine cargo to railway freight and general shipping, underscores the versatility and essential nature of these bulk cargo solutions in modern commerce.

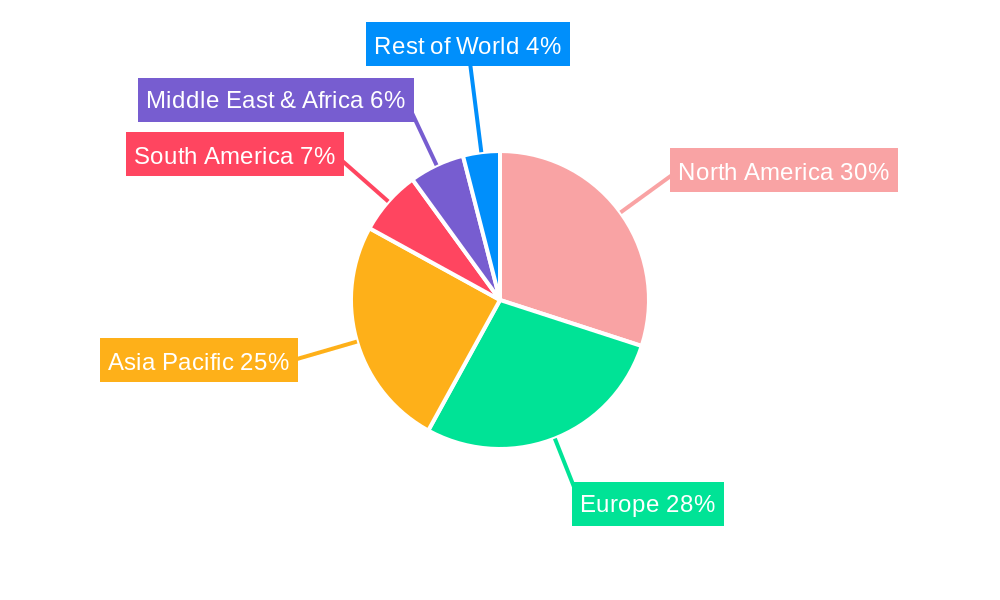

The market segmentation reveals a strong presence of "Containers" as a primary type, with "Triple Wall Boxes" emerging as a significant sub-segment due to their enhanced strength and durability. Geographically, North America and Europe currently hold substantial market shares, owing to their well-established industrial bases and advanced logistics infrastructure. However, the Asia Pacific region is poised for remarkable growth, driven by rapid industrialization, increasing manufacturing output, and expanding trade networks, particularly in China and India. Emerging economies in South America and the Middle East & Africa also present considerable untapped potential. While the market benefits from strong demand, potential restraints such as fluctuations in raw material prices and stringent regulations regarding packaging waste management could pose challenges. Nevertheless, the overarching trend towards sustainable and efficient logistics, alongside technological innovations, ensures a dynamic and promising future for the Bulk Cargo Boxes market.

This report delves into the dynamic world of Bulk Cargo Boxes, a sector experiencing significant evolution driven by shifting logistical needs and technological advancements. Our comprehensive analysis spans the Historical Period (2019-2024), the Study Period (2019-2033), and the Forecast Period (2025-2033), with a Base Year and Estimated Year of 2025. We project the market to reach significant valuations in the million units range by the end of the study period, reflecting robust growth.

The bulk cargo boxes market is characterized by a confluence of evolving demands and innovative solutions, painting a picture of steady and significant expansion. A primary trend observed during the Historical Period (2019-2024) has been the increasing adoption of advanced materials that offer enhanced durability, lighter weight, and greater sustainability. This includes a notable shift towards composite materials and reinforced plastics, moving away from traditional heavy-duty cardboard in certain applications. The Estimated Year (2025) sees this trend solidifying, with manufacturers focusing on boxes designed for multiple reuse cycles, thereby contributing to circular economy principles.

Furthermore, the integration of smart technologies into bulk cargo boxes is emerging as a pivotal trend. This encompasses the incorporation of RFID tags, GPS trackers, and even temperature and humidity sensors. This "smartification" allows for enhanced supply chain visibility, real-time monitoring of cargo conditions, and improved inventory management, which are critical for high-value or sensitive goods. The Forecast Period (2025-2033) is expected to witness a substantial surge in the adoption of these intelligent solutions, particularly within the Automotive and Ship application segments where precise tracking and condition monitoring are paramount.

The market is also seeing a bifurcation in product offerings. While the demand for large, industrial-grade containers remains strong, there's a growing niche for specialized, modular, and collapsible bulk cargo boxes. These are designed for greater flexibility in storage and transportation, catering to businesses that require adaptable solutions for varying shipment sizes and frequencies. The Study Period (2019-2033) will likely witness the expansion of this specialized segment.

Geographically, the Asia-Pacific region continues to be a dominant force due to its vast manufacturing base and extensive export activities. However, North America and Europe are demonstrating considerable growth, driven by a focus on supply chain resilience, e-commerce growth, and stringent regulations favoring sustainable packaging solutions. The Base Year (2025) reflects these established patterns, which are expected to persist and intensify throughout the forecast period. The overall market trajectory points towards a sector that is not only growing in volume but also becoming more sophisticated, efficient, and environmentally conscious.

Several powerful forces are collectively propelling the growth of the bulk cargo boxes market forward. Foremost among these is the relentless expansion of global trade and e-commerce. As businesses increasingly reach international markets and online sales continue their upward trajectory, the demand for efficient and robust shipping solutions escalates. Bulk cargo boxes, with their ability to consolidate and protect large volumes of goods, are indispensable in facilitating this global movement of products. The Study Period (2019-2033) will undoubtedly see the e-commerce boom continue to be a primary driver, with the Forecast Period (2025-2033) expected to witness a sustained increase in demand from online retailers and their logistics partners.

Another significant driver is the increasing emphasis on supply chain efficiency and resilience. In an era marked by potential disruptions, businesses are prioritizing packaging solutions that offer maximum protection, minimize damage during transit, and facilitate streamlined handling. This includes the demand for boxes that can withstand harsh environmental conditions and rough handling, thereby reducing product loss and associated costs. The Estimated Year (2025) highlights a market keen on solutions that enhance operational agility and safeguard investments.

Furthermore, a growing awareness of environmental sustainability is indirectly fueling the market. While not always the primary focus, the development of reusable and recyclable bulk cargo boxes is gaining traction. Manufacturers are investing in materials and designs that minimize environmental impact, appealing to corporations with strong Corporate Social Responsibility (CSR) initiatives. This trend is expected to gain further momentum in the Forecast Period (2025-2033) as regulations tighten and consumer preference leans towards eco-friendly products. The need for efficient logistics in sectors like Automotive and Ship, coupled with the overall growth in global commerce, creates a fertile ground for the sustained expansion of the bulk cargo boxes sector.

Despite the optimistic growth trajectory, the bulk cargo boxes market faces several significant challenges and restraints that could temper its expansion. One of the primary concerns is the fluctuating cost of raw materials. The production of bulk cargo boxes, particularly those made from plastics and composites, is heavily reliant on petrochemicals and other commodities whose prices can be volatile. Such price swings directly impact manufacturing costs and, consequently, the profitability of box producers. This volatility can also be passed on to end-users, potentially affecting purchasing decisions, especially for smaller businesses operating on tighter margins. The Study Period (2019-2033) will likely see this as an ongoing challenge.

Another considerable restraint is the increasing competition from alternative packaging solutions. While bulk cargo boxes serve a specific purpose, advancements in other areas, such as highly efficient palletized systems, flexible intermediate bulk containers (FIBCs), and specialized intermodal containers, offer viable alternatives for certain applications. The adoption of these alternatives, depending on the specific cargo and transit route, could divert demand away from traditional bulk cargo boxes. The Forecast Period (2025-2033) may witness a more pronounced shift in this regard as these alternatives mature.

Furthermore, the logistics and disposal of bulk cargo boxes themselves present challenges. For reusable boxes, efficient reverse logistics networks are required to collect, clean, and redeploy them, which can be complex and costly to establish and maintain. For disposable boxes, environmental regulations regarding waste management and recycling can add to operational expenses and compliance burdens. The industry needs to continuously innovate to address these logistical and environmental considerations effectively. The Base Year (2025) signifies a point where these operational complexities are becoming increasingly critical for market players.

The bulk cargo boxes market is poised for significant growth, with certain regions and segments expected to lead this expansion. Within the Type category, Containers are anticipated to remain the dominant segment, particularly those designed for intermodal transportation. These large, standardized containers, often seen in maritime shipping, are crucial for the global movement of goods and are indispensable for the Ship application. Their robust construction, reusability, and compatibility with various modes of transport (ship, rail, and road) make them a cornerstone of international logistics. The Study Period (2019-2033) will see continued high demand for these, as global trade volumes continue to rise.

The Application segment of Ship is intrinsically linked to the dominance of the Containers type. Given that a substantial portion of global trade relies on maritime shipping, the demand for specialized bulk cargo containers designed for this purpose is immense. These containers are engineered to withstand the harsh marine environment, optimize cargo space, and facilitate efficient loading and unloading operations. The Forecast Period (2025-2033) is expected to witness sustained investment in this segment, driven by the growth of international trade and the need for more efficient and sustainable shipping practices.

Geographically, Asia-Pacific is projected to continue its reign as the leading region in the bulk cargo boxes market. This dominance is fueled by several factors. Firstly, the region boasts a massive manufacturing base, producing a vast array of goods that require efficient transportation. Countries like China, India, and Southeast Asian nations are major global suppliers, leading to a consistent and high demand for bulk cargo packaging solutions. Secondly, the rapidly growing e-commerce sector within these countries further amplifies the need for robust and scalable logistics infrastructure, including bulk cargo boxes.

The Automotive application segment is also a significant contributor and is expected to see robust growth. The automotive industry, with its complex global supply chains for components and finished vehicles, relies heavily on bulk cargo solutions for secure and efficient transport. As the automotive industry continues to evolve with the rise of electric vehicles and new manufacturing paradigms, the demand for specialized and durable cargo boxes designed for automotive parts and finished cars will remain strong. This segment, in conjunction with the Ship application, forms a powerful duo driving the market.

In terms of segments to watch, Triple Wall Boxes are gaining increasing importance, especially for applications requiring exceptional strength and protection. While perhaps not as volumetrically dominant as general containers, their specialized nature caters to industries that handle extremely heavy or fragile items. Their application in sectors requiring high shock absorption and puncture resistance, which can include certain automotive components or high-value industrial goods, makes them a critical niche. The Base Year (2025) and subsequent years will see a growing appreciation for the superior protection offered by these boxes.

Therefore, the dominance of Containers in Type, the Ship application, and the Asia-Pacific region, combined with the significant growth of the Automotive segment and the rising importance of Triple Wall Boxes, will shape the bulk cargo boxes market landscape throughout the Study Period (2019-2033).

Several key factors are acting as potent growth catalysts for the bulk cargo boxes industry. The accelerating pace of globalization and the expansion of international trade are primary drivers, necessitating efficient and secure methods for transporting large volumes of goods across continents. Furthermore, the burgeoning e-commerce sector, with its ever-increasing demand for reliable delivery, fuels the need for sturdy and scalable packaging solutions. Advancements in material science, leading to the development of lighter, stronger, and more sustainable packaging materials, are also proving to be significant catalysts, enabling cost efficiencies and meeting environmental mandates. Finally, the growing emphasis on supply chain resilience and visibility is prompting the adoption of smart cargo boxes equipped with tracking and monitoring technologies, thereby enhancing operational efficiency and reducing potential losses.

This report offers an exhaustive examination of the bulk cargo boxes market, providing in-depth insights across its entire value chain. We meticulously analyze market dynamics, including key trends, drivers, and challenges, utilizing data from the Historical Period (2019-2024) and projecting future trajectories through the Forecast Period (2025-2033), with the Base Year and Estimated Year set at 2025. The report details market segmentation by product type, application, and industry, alongside regional market analyses. Leading market players like Yakima, Thule Motion, SportRack, and INNO Ridge are profiled, with a focus on their strategic initiatives and recent developments. Our comprehensive coverage aims to equip stakeholders with the essential information needed to navigate this evolving market and capitalize on emerging opportunities, ensuring a robust understanding of the market's potential measured in the million units.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.0%.

Key companies in the market include Yakima, Thule Motion, SportRack, INNO Ridge.

The market segments include Type, Application.

The market size is estimated to be USD 105560 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Bulk Cargo Boxes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bulk Cargo Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.