1. What is the projected Compound Annual Growth Rate (CAGR) of the Bubble Wrapping?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bubble Wrapping

Bubble WrappingBubble Wrapping by Application (Medical, Electronic Components, Others, World Bubble Wrapping Production ), by Type (Polyethylene(PE), Polyamide(PA), Polyethylene Terephthalate(PET), Others, World Bubble Wrapping Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

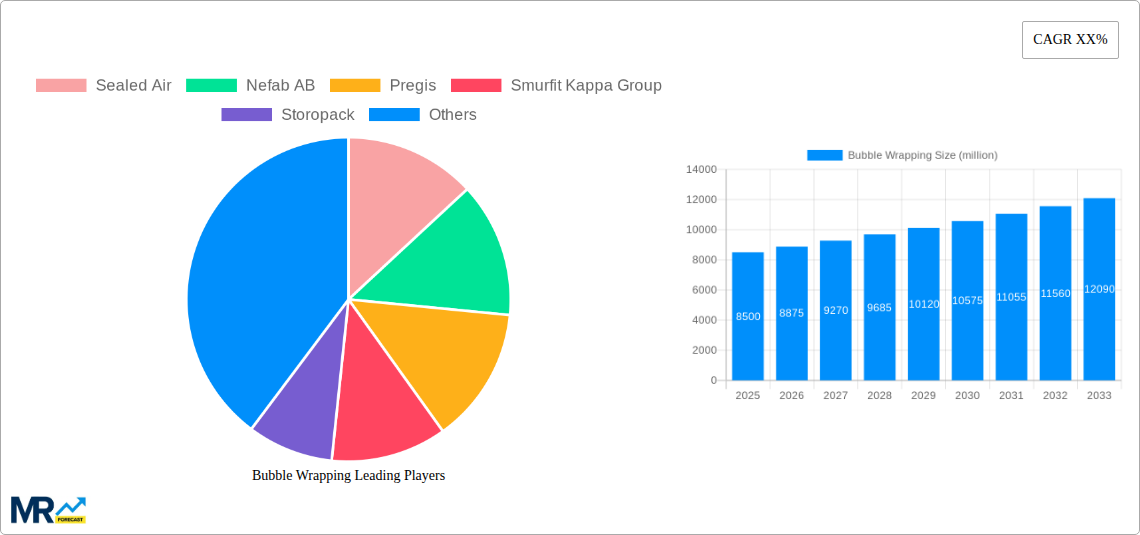

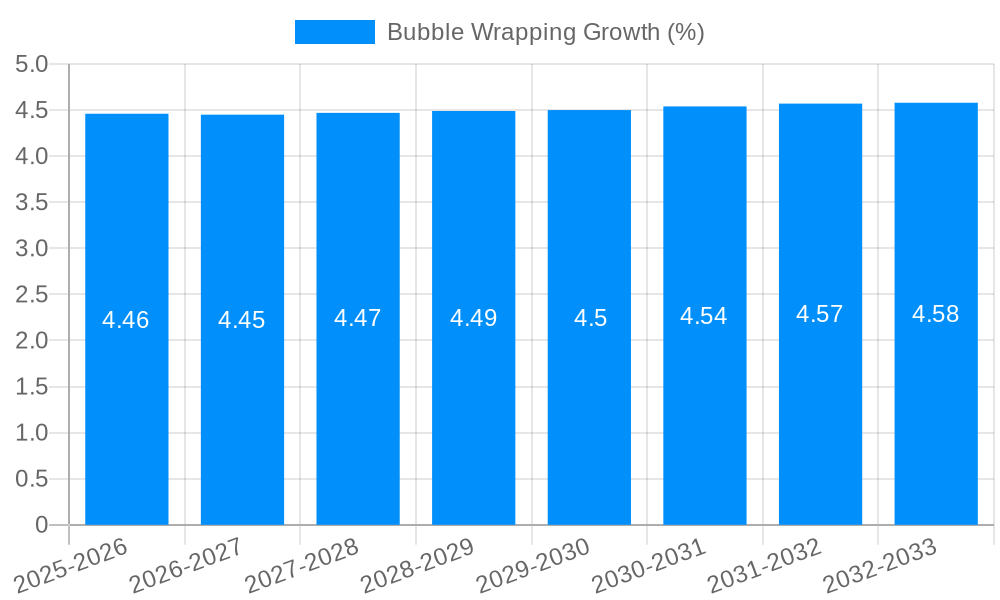

The global bubble wrapping market is projected to experience robust growth, with an estimated market size of approximately $8.5 billion in 2025. Driven by the expanding e-commerce sector and an increasing demand for protective packaging solutions across various industries, the market is poised for a Compound Annual Growth Rate (CAGR) of around 4.5% during the forecast period of 2025-2033. This growth is underpinned by the continuous need for secure and cost-effective transit packaging, particularly for fragile goods. The medical and electronics components sectors are emerging as significant application areas, benefiting from the stringent protection requirements these industries necessitate. Polyethylene (PE) remains the dominant material type due to its versatility, affordability, and excellent cushioning properties, though advancements in Polyamide (PA) and Polyethylene Terephthalate (PET) offer specialized benefits for niche applications.

Key market drivers include the escalating volume of online retail sales, which necessitates efficient and reliable packaging to minimize damage during shipping. Furthermore, the increasing global manufacturing output, especially in Asia Pacific, contributes to a higher demand for protective wrapping. The market is also influenced by a growing awareness among businesses regarding the importance of product integrity and customer satisfaction, directly linked to the quality of packaging used. However, the market faces restraints such as the rising cost of raw materials, particularly petroleum-based plastics, and increasing environmental concerns related to plastic waste. Innovations in sustainable and recyclable bubble wrap alternatives are gaining traction, representing a significant trend that could reshape market dynamics in the long term. Leading companies like Sealed Air, Pregis, and Smurfit Kappa Group are actively investing in research and development to address these challenges and capitalize on emerging opportunities.

This report offers a deep dive into the global bubble wrapping market, spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, and an extended forecast period from 2025 to 2033, building upon historical data from 2019 to 2024. The market for bubble wrapping, a ubiquitous protective packaging solution, is projected to witness substantial growth, driven by evolving industrial needs and technological advancements. With an estimated global production value in the hundreds of millions of dollars by 2025, the report meticulously analyzes market dynamics, key players, and future trajectories. It explores the intricate interplay of various factors, from the demand generated by critical application segments like medical supplies and sensitive electronic components to the material innovations shaping product types. The report aims to equip stakeholders with actionable insights to navigate this dynamic landscape, identify emerging opportunities, and mitigate potential risks.

The global bubble wrapping market is experiencing a significant evolutionary phase, marked by a growing emphasis on enhanced protection, sustainability, and tailored solutions. XXX, the market is witnessing a discernible shift towards specialized bubble wrap products designed to meet the stringent demands of specific industries. For instance, the Medical application segment is increasingly requiring bubble wrap with advanced cushioning properties to safeguard high-value, sensitive medical devices and pharmaceuticals during transit. This translates into a greater demand for bubble wrap with tailored air retention capabilities and anti-static properties to prevent electrostatic discharge damage. Similarly, the Electronic Components sector continues to be a powerhouse for bubble wrap consumption, with the ongoing miniaturization and increasing complexity of electronics necessitating superior shock absorption and vibration dampening. The sheer volume of electronic goods manufactured and distributed globally, valued in the tens of millions of dollars annually, directly fuels this demand. Beyond these established segments, the "Others" category, encompassing diverse applications from household goods to industrial equipment, also contributes significantly to market volume, often seeking cost-effective yet reliable protective solutions.

The material composition of bubble wrap is also undergoing transformation. While Polyethylene (PE) remains the dominant material due to its cost-effectiveness and widespread availability, there is a burgeoning interest in alternative materials such as Polyamide (PA) and Polyethylene Terephthalate (PET) for applications demanding enhanced strength, barrier properties, or improved recyclability. The drive towards a circular economy is prompting manufacturers to explore bio-based and recycled content in bubble wrap production, although widespread adoption is still in its nascent stages. Furthermore, the adoption of smart packaging technologies, though nascent in the traditional bubble wrap market, presents an intriguing future trend. Imagine bubble wrap integrated with sensors to monitor temperature or humidity, providing real-time data for sensitive shipments. This technological convergence, while currently niche, holds the potential to redefine protective packaging paradigms. The global production of bubble wrap, estimated to reach hundreds of millions of dollars in value, is therefore not just about volume but also about the increasing sophistication and specialization of the product offerings to cater to a discerning market. The forecast period (2025-2033) is expected to see a consolidation of these trends, with innovation in material science and application-specific designs at the forefront.

The remarkable growth trajectory of the bubble wrapping market is underpinned by a confluence of powerful driving forces, predominantly stemming from the exponential expansion of global e-commerce and the ever-increasing fragility of modern products. The surge in online retail has fundamentally reshaped supply chains, leading to a proliferation of direct-to-consumer shipments and an amplified need for robust protective packaging. Each package shipped requires effective cushioning to withstand the rigors of transit, from automated sorting facilities to last-mile delivery. This relentless volume of e-commerce transactions, representing billions of dollars in consumer spending, directly translates into a sustained demand for bubble wrap.

Furthermore, the continuous innovation in product design across various industries, particularly in electronics and medical devices, has resulted in increasingly delicate and high-value items. These products demand a higher level of protection to prevent damage during shipping and handling, making bubble wrap an indispensable component of their packaging strategy. The market for sophisticated medical equipment, for example, is growing, and the cost of damage to such items can be astronomical, further solidifying the need for reliable protective solutions. The global value chain for these sensitive goods, running into millions of dollars, relies heavily on the integrity provided by bubble wrap.

Moreover, a growing awareness among consumers and businesses regarding product integrity and the financial implications of damaged goods is also contributing to the sustained demand. Companies are increasingly prioritizing customer satisfaction and brand reputation, recognizing that damaged products can lead to returns, negative reviews, and ultimately, lost revenue. This focus on minimizing losses and ensuring customer delight acts as a significant impetus for the widespread adoption of effective protective packaging like bubble wrap, solidifying its position as a critical element in the modern logistics ecosystem.

Despite the robust growth, the bubble wrapping industry faces several significant challenges and restraints that could temper its expansion. Foremost among these is the escalating global focus on environmental sustainability and the growing consumer and regulatory pressure for eco-friendly packaging solutions. Traditional bubble wrap, primarily made from virgin polyethylene, is often criticized for its single-use nature and contribution to plastic waste. While advancements in recyclable and biodegradable alternatives are underway, their widespread adoption is hindered by cost, performance limitations, and established supply chain inertia. The perceived environmental impact could lead to a reduction in demand for conventional bubble wrap in certain markets or applications.

Another crucial restraint stems from the increasing adoption of alternative protective packaging solutions. Innovations in materials science have led to the development of various competing products, such as molded pulp, expanded polystyrene (EPS) foam, air pillows with improved barrier properties, and advanced void fill solutions. These alternatives may offer specific advantages in terms of cushioning, biodegradability, or cost-effectiveness for particular applications, posing a direct competitive threat to traditional bubble wrap. The ongoing research and development in these alternative materials, aiming to improve their performance and sustainability credentials, could erode the market share of bubble wrap over time.

Furthermore, volatility in raw material prices, particularly the cost of polyethylene resin, can significantly impact the profitability of bubble wrap manufacturers and influence pricing strategies. Fluctuations in crude oil prices, a key feedstock for plastic production, can lead to unpredictable cost structures. This price instability, coupled with the operational costs associated with production and logistics, can create pricing pressures and affect the overall market competitiveness of bubble wrap, especially in price-sensitive segments. These factors collectively present a complex landscape that manufacturers must navigate to ensure continued market success.

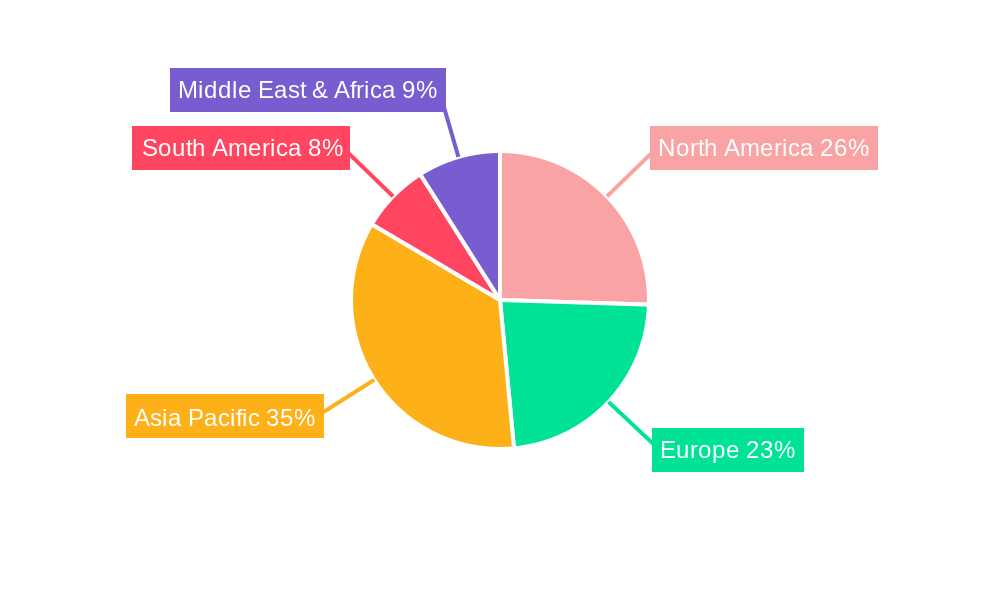

The global bubble wrapping market is characterized by regional dominance and segment-specific growth, with certain areas and applications showcasing a more pronounced impact. In terms of regional dominance, North America and Asia Pacific are projected to be the leading markets for bubble wrapping throughout the study period (2019-2033).

North America, particularly the United States, benefits from a mature and extensive e-commerce infrastructure, a large manufacturing base, and a high consumer spending capacity. The presence of major e-commerce giants and a sophisticated logistics network ensures a consistent and substantial demand for protective packaging. The Medical application segment within North America is particularly strong, driven by a well-established healthcare industry, the production of advanced medical devices, and the stringent regulatory requirements for safe transportation of pharmaceuticals and biological samples. The value generated by this segment alone is in the hundreds of millions of dollars. Furthermore, the robust electronics manufacturing and consumer electronics market in the region also contributes significantly to bubble wrap consumption.

Asia Pacific, on the other hand, is expected to witness the fastest growth rate. This surge is fueled by the rapidly expanding e-commerce landscape in countries like China, India, and Southeast Asian nations, coupled with a burgeoning middle class and increasing disposable incomes. The region's status as a global manufacturing hub, especially for Electronic Components, is a primary driver of demand. The sheer volume of electronic goods produced and exported from countries like China and South Korea necessitates extensive protective packaging, making this segment a powerhouse. The production of bubble wrap in Asia Pacific is estimated to reach billions of dollars in value by the end of the forecast period, driven by both domestic consumption and export markets. The cost-effectiveness of production in many Asian countries also allows them to cater to global demand efficiently.

Within the application segments, Electronic Components and Medical are poised to dominate the market.

Electronic Components: This segment is characterized by the inherent fragility of devices, the need for anti-static protection, and the sheer volume of production and distribution globally. As electronic devices become smaller, more complex, and more expensive, the demand for superior cushioning and protection intensifies. The value of globally traded electronic components alone runs into trillions of dollars, with a significant portion requiring specialized protective packaging.

Medical: The healthcare sector's increasing reliance on specialized equipment, temperature-sensitive drugs, and sterile supplies necessitates robust and reliable protective packaging. The high-value nature of medical shipments and the critical need to maintain product integrity during transit make bubble wrap an indispensable solution. The growing global healthcare expenditure, in the trillions of dollars, underscores the importance and growth potential of this segment.

Others: While Electronic Components and Medical are key drivers, the "Others" segment, encompassing a wide array of goods from consumer products to industrial machinery, also contributes substantially to overall market volume. Its dominance will be influenced by global trade trends, manufacturing output, and the general economic health across various industries.

The dominance of these regions and segments is further reinforced by the material types, with Polyethylene (PE) continuing to be the most widely used material due to its cost-effectiveness and versatility. However, specialized applications within Medical and Electronic Components may see a higher adoption rate of Polyamide (PA) and Polyethylene Terephthalate (PET) for their enhanced properties, contributing to their segment-specific growth and value.

Several key factors are acting as potent growth catalysts for the bubble wrapping industry. The relentless expansion of global e-commerce is arguably the most significant, driving a continuous demand for protective packaging for individual shipments. Simultaneously, the increasing value and fragility of products, especially in the electronics and medical sectors, necessitate more sophisticated cushioning solutions. Furthermore, a growing awareness of the financial and reputational costs associated with product damage is prompting businesses to invest more in effective protective packaging.

This comprehensive report provides an in-depth analysis of the global bubble wrapping market, dissecting its intricate dynamics from historical trends to future projections. It delves into the driving forces propelling its growth, predominantly the booming e-commerce sector and the increasing demand for safeguarding delicate and high-value products. Simultaneously, it critically examines the challenges and restraints, such as environmental concerns surrounding plastic waste and the rise of alternative packaging solutions. The report meticulously identifies the key regions and segments poised for dominance, offering valuable insights into market opportunities within North America, Asia Pacific, and specific applications like Medical and Electronic Components, where market values reach into the millions of dollars. It further highlights the growth catalysts, including technological advancements and evolving consumer awareness regarding product integrity. Essential information on leading industry players and significant developments within the sector, spanning from material innovations to sustainability initiatives, is also meticulously presented. This holistic approach equips stakeholders with the knowledge necessary to navigate the complex bubble wrapping landscape effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sealed Air, Nefab AB, Pregis, Smurfit Kappa Group, Storopack, Intertape Polymer Group, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Bubble Wrapping," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bubble Wrapping, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.