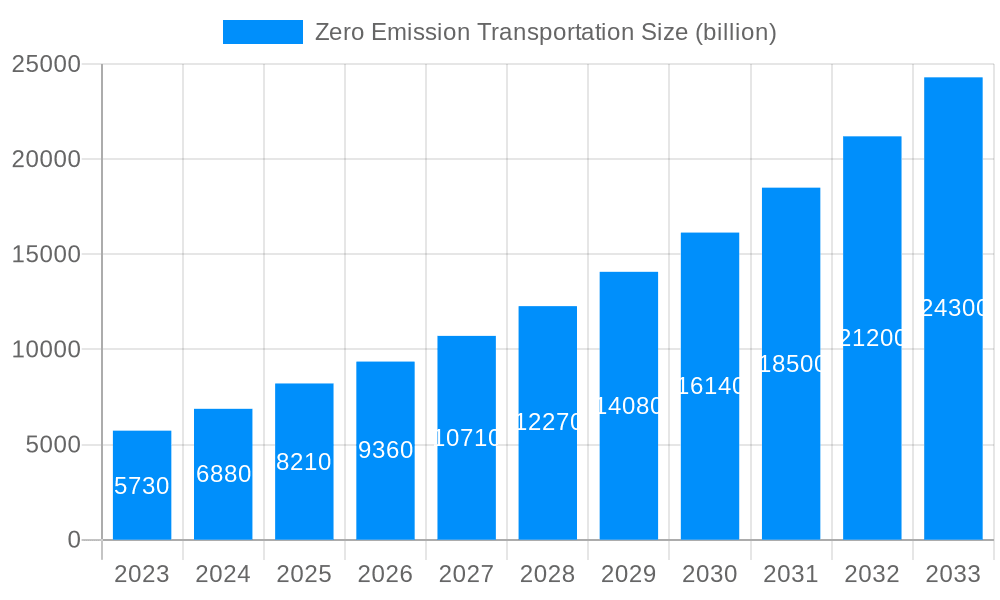

1. What is the projected Compound Annual Growth Rate (CAGR) of the Zero Emission Transportation?

The projected CAGR is approximately 14.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Zero Emission Transportation

Zero Emission TransportationZero Emission Transportation by Type (Zero Emission Vehicles, Zero-Emission Rail Train), by Application (Family, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Zero Emission Transportation market is experiencing phenomenal growth, projected to reach a substantial $8.21 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 14.4% expected to persist through 2033. This rapid expansion is fueled by a confluence of powerful drivers, including increasingly stringent government regulations aimed at curbing carbon emissions, growing consumer awareness and demand for sustainable mobility solutions, and significant advancements in battery technology and charging infrastructure. The transition from internal combustion engines to electric and hydrogen-powered alternatives is no longer a distant vision but a present-day imperative. Innovations in electric vehicle (EV) powertrains, longer battery ranges, and faster charging times are making zero-emission options increasingly practical and attractive for both individual consumers and commercial fleet operators. Furthermore, supportive government policies such as subsidies, tax credits, and investments in public charging networks are accelerating adoption rates across various segments.

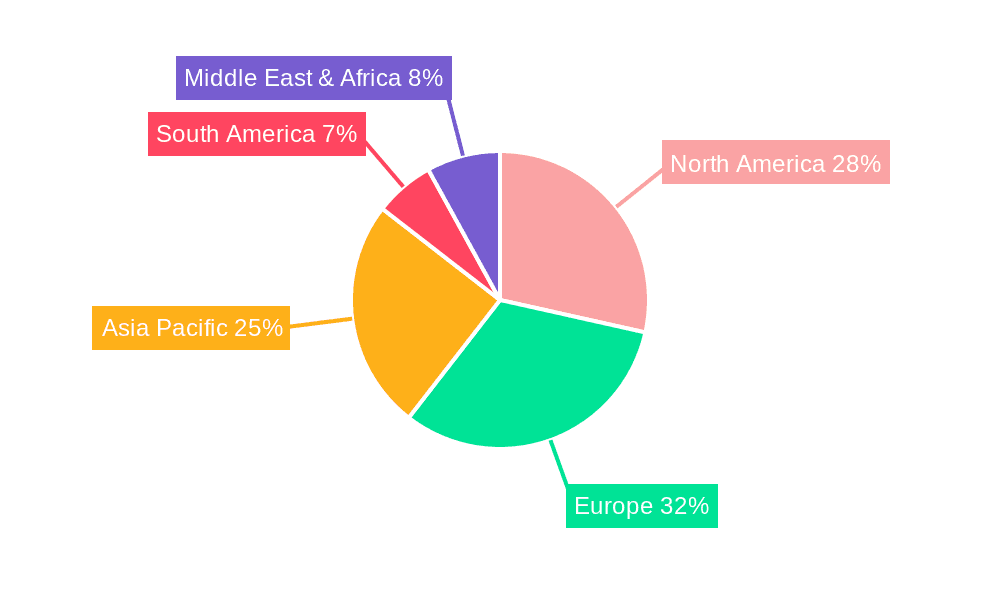

The market is segmented into diverse applications, encompassing personal family vehicles and the increasingly crucial commercial sector, which includes logistics and public transport. The emergence of Zero Emission Rail Trains further signifies the broad impact of this transformation across the entire transportation ecosystem. Leading global players such as Volvo, Tesla, Daimler, BMW, Audi, and Toyota are heavily investing in research and development and expanding their zero-emission vehicle portfolios to capture market share. Simultaneously, dedicated companies like Gaussin are innovating in specialized areas like zero-emission logistics. The market's robust growth is observed across all major regions, with North America, Europe, and Asia Pacific demonstrating significant traction, driven by a combination of policy initiatives, technological advancements, and a growing eco-conscious consumer base. The substantial investments and strategic collaborations within the industry underscore a strong commitment to a sustainable transportation future.

Here's a unique report description for Zero Emission Transportation, incorporating your specified elements:

This report provides an in-depth examination of the rapidly evolving Zero Emission Transportation sector, projecting its trajectory and identifying key market dynamics between 2019 and 2033. With a base year of 2025 and an estimated year also set at 2025, the analysis meticulously dissects the market landscape across the historical period of 2019-2024 and the forecast period of 2025-2033. We project the global market for zero-emission transportation to surge from an estimated $780 billion in 2025 to a remarkable $2.1 trillion by 2033, reflecting an impressive compound annual growth rate (CAGR) driven by a confluence of technological advancements, regulatory mandates, and shifting consumer preferences.

The Zero Emission Transportation landscape is currently experiencing an unprecedented surge, marked by rapid innovation and increasing adoption across diverse segments. This transformative period, spanning from 2019 to 2033, is characterized by a significant shift away from fossil fuel-dependent systems towards cleaner alternatives. Within the Zero Emission Vehicles segment, the market is witnessing a dramatic expansion in electric passenger cars, driven by substantial investments from major automotive manufacturers like Tesla, Daimler, BMW, and Audi. These companies are not only expanding their electric model portfolios but also investing billions in battery technology and charging infrastructure to address range anxiety and improve affordability. The commercial vehicle sector is equally dynamic, with companies like Volvo, DHL, and Gaussin leading the charge in electrifying last-mile delivery vans, heavy-duty trucks, and specialized industrial vehicles. The demand for electric buses, essential for urban public transport, is also projected to grow exponentially, supported by government subsidies and a growing awareness of the environmental and health benefits. Beyond road transport, the Zero-Emission Rail Train segment is gaining momentum, particularly in regions with well-established rail networks. Investments in hydrogen-powered trains and battery-electric locomotives are set to revolutionize freight and passenger transport, offering a sustainable alternative to conventional diesel-powered trains. The integration of renewable energy sources to power these electric trains further amplifies their environmental credentials. Furthermore, the concept of shared mobility and subscription services, epitomized by companies like LeasePlan, is evolving to embrace zero-emission options, making sustainable transportation more accessible and economically viable for both individuals and businesses. The overarching trend is a systemic decarbonization of the transportation ecosystem, moving towards a future where emissions from mobility are virtually eliminated. The projected market value for zero-emission transportation in 2025 is estimated to be around $780 billion, with significant growth anticipated, reaching approximately $2.1 trillion by 2033. This expansion underscores the profound and irreversible shift towards sustainable mobility solutions across the globe.

A powerful nexus of factors is propelling the zero-emission transportation revolution. Foremost among these are stringent government regulations and ambitious climate change targets. Many nations have enacted policies aimed at phasing out internal combustion engine (ICE) vehicles and incentivizing the adoption of zero-emission alternatives, creating a robust market pull. Simultaneously, technological advancements, particularly in battery energy density, charging speeds, and powertrain efficiency, are making electric vehicles increasingly competitive and practical. Companies like Tesla have consistently pushed the boundaries of battery technology, while established automakers are rapidly investing billions in research and development to catch up and innovate. The declining cost of battery production, driven by economies of scale and improved manufacturing processes, is a critical factor, making electric vehicles more affordable for a wider consumer base. Growing environmental consciousness among consumers and businesses also plays a pivotal role. Individuals are increasingly opting for electric cars for their Family applications due to lower running costs and reduced environmental impact. Similarly, commercial enterprises, recognizing the reputational and operational benefits of sustainable logistics, are transitioning their fleets. The development of advanced charging infrastructure, supported by both public and private sector investments, is mitigating range anxiety and enhancing the user experience. Furthermore, corporate sustainability goals and the increasing demand for green supply chains are compelling businesses to adopt zero-emission solutions for their Commercial and Industry operations.

Despite the compelling growth trajectory, the zero-emission transportation sector faces several significant challenges and restraints. The most prominent is the high upfront cost of zero-emission vehicles compared to their conventional counterparts. While total cost of ownership is often lower, the initial purchase price remains a barrier for many consumers and smaller businesses. The adequacy and accessibility of charging infrastructure remain a critical concern, particularly in rural areas and for apartment dwellers. The pace of charging infrastructure deployment needs to accelerate significantly to match the growth in vehicle sales. Battery production capacity and supply chain constraints for key raw materials like lithium and cobalt pose a potential bottleneck, impacting vehicle production volumes and costs. Geopolitical factors and ethical sourcing concerns add complexity to this supply chain. Range anxiety, although diminishing with technological advancements, still influences purchasing decisions for some consumers, especially for long-distance travel. The intermittency of renewable energy sources that power charging infrastructure also raises questions about the overall sustainability of the grid, necessitating further investment in grid modernization and energy storage solutions. Finally, consumer education and awareness regarding the benefits, operation, and maintenance of zero-emission vehicles, as well as the availability of suitable vehicle models for specific applications (e.g., heavy-duty hauling for Industry), still require significant effort.

The Zero Emission Transportation market is poised for significant dominance by Zero Emission Vehicles, specifically electric passenger cars and commercial vans, driven by rapid adoption in North America and Europe. These regions are at the forefront of the transition, propelled by a confluence of aggressive government mandates, substantial financial incentives, and a highly receptive consumer base.

In North America, the United States, with its strong technological innovation hub and supportive federal and state policies, is a leading force. Companies like Tesla have established a strong foothold, and traditional automakers such as Ford, General Motors, and now even truck manufacturers are heavily investing in electric vehicle production and charging infrastructure. California, in particular, has consistently set the pace with stringent emission standards and extensive EV adoption programs, making it a benchmark for other states. The demand for Family vehicles is exceptionally high, with a growing preference for SUVs and trucks in electric variants.

Europe presents a similarly robust market, characterized by a unified push towards decarbonization under the European Union’s Green Deal. Countries like Norway, which boasts the highest per capita EV adoption rate globally, alongside Germany, the UK, and France, are leading the charge. The stringent CO2 emission targets for new vehicles, coupled with substantial subsidies and tax breaks, are compelling automakers to accelerate their electrification strategies. The presence of major automotive players like Daimler, BMW, and Audi within the region further bolsters this dominance. The Commercial application segment is witnessing significant growth, with companies like DHL and IKEA actively electrifying their delivery fleets to meet sustainability goals and reduce operational costs. The increasing availability of electric vans and trucks, coupled with the expansion of charging networks in urban and suburban areas, is facilitating this transition.

Beyond these key regions, China is a powerhouse in the Zero Emission Vehicle market, particularly in terms of production and sales volume. Its government has been instrumental in fostering the growth of its domestic EV industry through subsidies and the establishment of a comprehensive charging infrastructure. While the focus here is predominantly on passenger vehicles, the potential for commercial and industrial applications is immense.

The Zero Emission Vehicles segment, encompassing passenger cars, light commercial vehicles, and heavy-duty trucks, is projected to account for the lion's share of the market value, estimated to reach over $1.8 trillion by 2033. This is primarily due to their widespread application in personal mobility, last-mile delivery, and increasingly, in long-haul freight transportation. The advancements in battery technology have made electric vehicles a viable and often superior alternative to their internal combustion engine counterparts, offering lower running costs, reduced maintenance, and a quieter, smoother driving experience. The continuous innovation by players like Toyota in hybrid and increasingly in full-electric powertrains, coupled with the aggressive expansion of models by other manufacturers, ensures the continued dominance of this segment.

Several key growth catalysts are propelling the Zero Emission Transportation industry forward. The most impactful is the accelerating pace of technological innovation, particularly in battery technology, which is leading to increased energy density, faster charging times, and decreasing costs. Supportive government policies, including subsidies, tax credits, and stringent emission regulations, are creating a favorable market environment. The growing corporate commitment to Environmental, Social, and Governance (ESG) principles is driving demand for sustainable logistics and fleet electrification. Furthermore, increasing consumer awareness and demand for eco-friendly transportation options are significantly influencing purchasing decisions. The expansion of charging infrastructure, both public and private, is also crucial in alleviating range anxiety and facilitating widespread adoption.

This comprehensive report offers a panoramic view of the Zero Emission Transportation market, delving into its intricate dynamics and future potential. It provides a detailed analysis of market segmentation by vehicle type, application, and technology, offering granular insights into the value chain. The report meticulously examines the competitive landscape, profiling key players and their strategic initiatives. Furthermore, it explores the regulatory frameworks and policy influences shaping the market. We also assess the impact of technological advancements and the evolving consumer preferences on market growth. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within the burgeoning zero-emission transportation ecosystem, projecting a market value of approximately $780 billion in 2025 poised for substantial growth.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.4%.

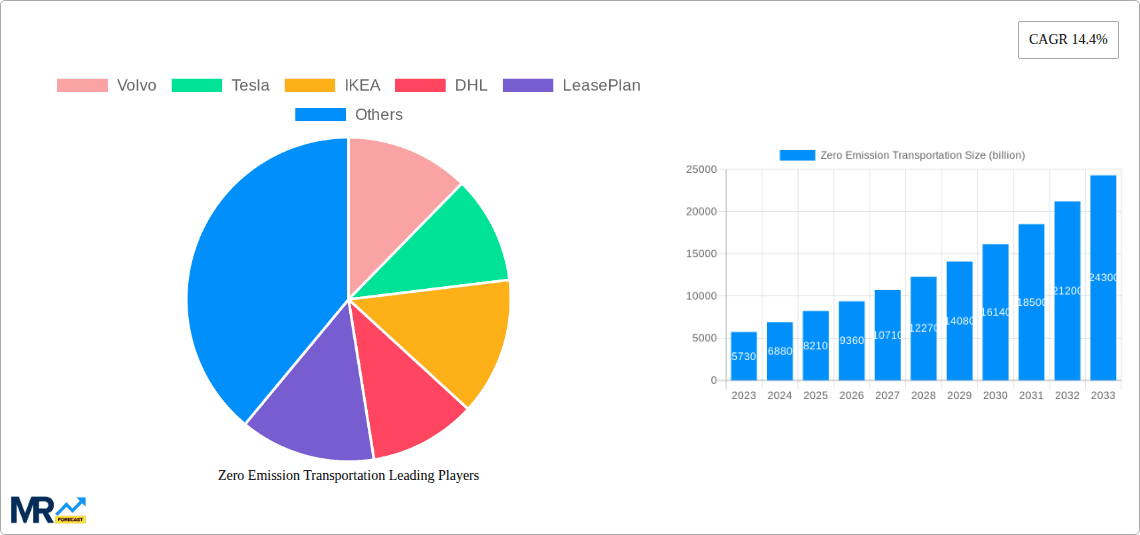

Key companies in the market include Volvo, Tesla, IKEA, DHL, LeasePlan, Daimler, BMW, Audi, Toyota, Gaussin.

The market segments include Type, Application.

The market size is estimated to be USD 8.21 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Zero Emission Transportation," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Zero Emission Transportation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.