1. What is the projected Compound Annual Growth Rate (CAGR) of the Wrapping and Packaging Machines?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wrapping and Packaging Machines

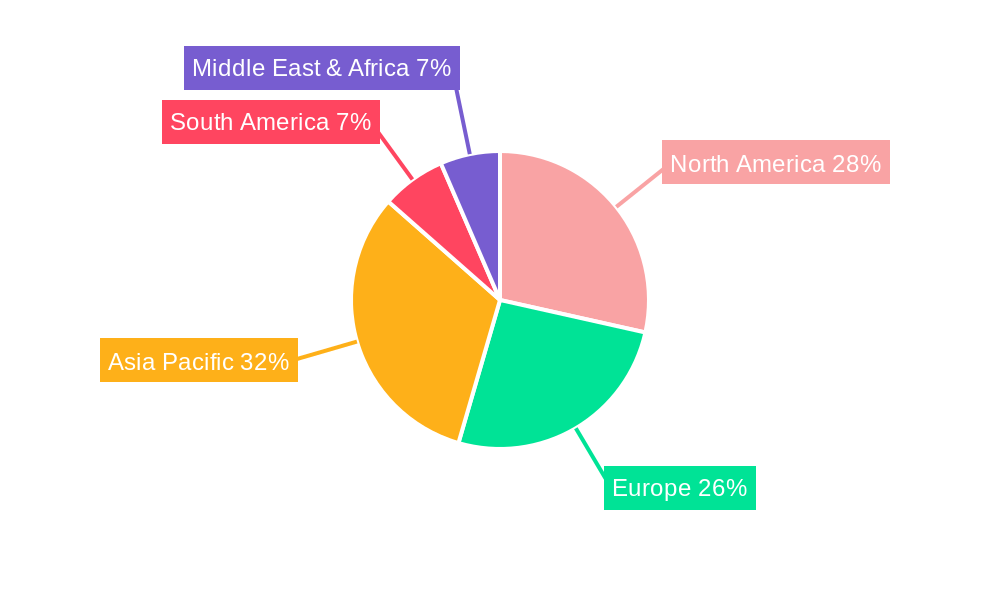

Wrapping and Packaging MachinesWrapping and Packaging Machines by Type (Horizontal, Vertical), by Application (Food & Beverages, Pharmaceuticals, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

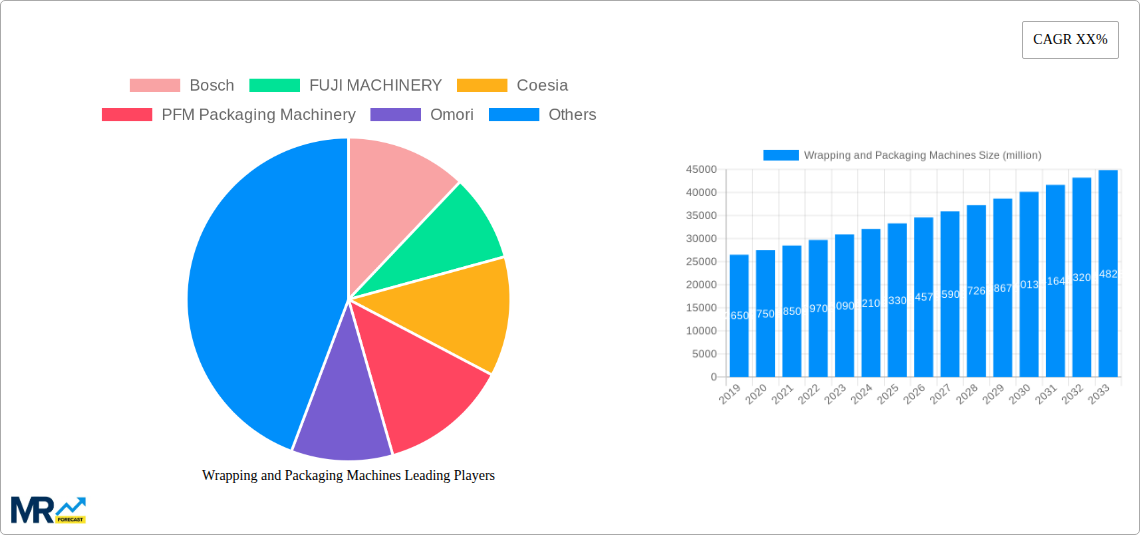

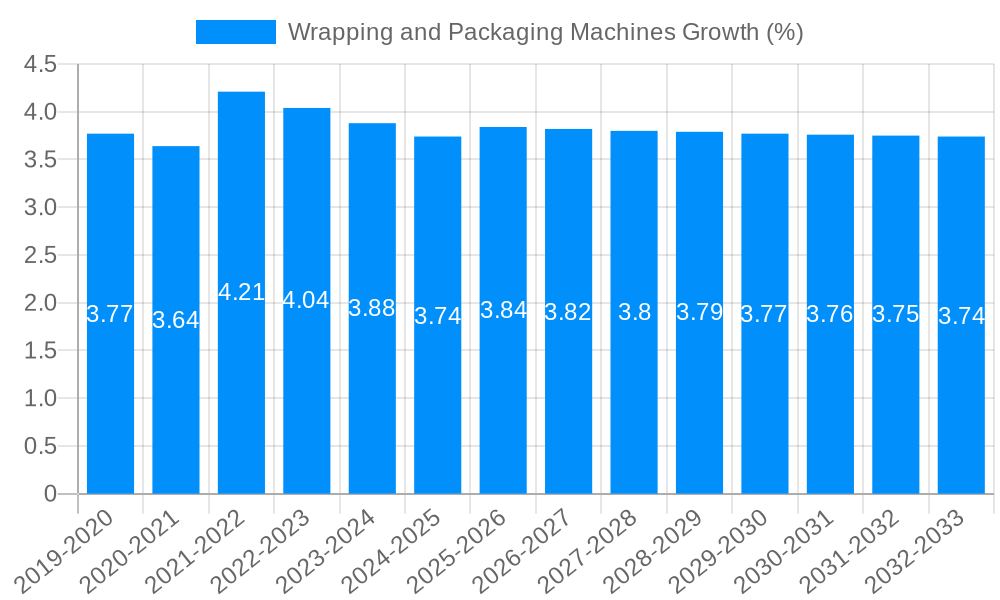

The global Wrapping and Packaging Machines market is projected for substantial growth, estimated at USD 32,500 million in 2025, with a Compound Annual Growth Rate (CAGR) of 4.5% throughout the forecast period ending in 2033. This expansion is primarily propelled by the burgeoning demand for packaged goods across diverse industries, including food & beverages and pharmaceuticals. The increasing consumer preference for convenience, coupled with stringent food safety regulations and the growing e-commerce sector, are key drivers fueling the adoption of advanced wrapping and packaging solutions. Furthermore, the continuous innovation in machine technology, focusing on automation, energy efficiency, and enhanced product protection, is also contributing significantly to market dynamism. The market's growth trajectory is further supported by the increasing sophistication of packaging designs aimed at improving shelf appeal and extending product shelf life, thereby reducing waste.

However, certain factors could temper this growth. The high initial investment cost associated with sophisticated wrapping and packaging machinery may pose a challenge for small and medium-sized enterprises. Additionally, fluctuations in raw material prices, particularly for packaging films and components, can impact operational costs for manufacturers, potentially affecting their purchasing decisions for new equipment. Despite these restraints, the market is expected to witness robust expansion driven by emerging economies and the relentless pursuit of operational efficiency and product safety by businesses worldwide. The market's segmentation into horizontal and vertical types, along with its application across key sectors like Food & Beverages and Pharmaceuticals, highlights the diverse opportunities and the specialized needs that manufacturers are catering to.

This report provides an in-depth analysis of the global wrapping and packaging machines market, encompassing a historical overview, current landscape, and future projections. Leveraging data from 2019-2033, with a base year of 2025, the study meticulously examines market dynamics, key drivers, emerging trends, and challenges, offering valuable insights for stakeholders across various industries. The report delves into the intricate workings of wrapping and packaging machinery, forecasting a significant expansion driven by evolving consumer demands and technological advancements. With a projected market size in the hundreds of millions of units by the end of the forecast period, the industry is poised for substantial growth.

XXX The wrapping and packaging machines market is undergoing a transformative phase, characterized by an increasing emphasis on automation, efficiency, and sustainability. Across the Study Period of 2019-2033, we have observed a steady ascent in the adoption of advanced technologies aimed at streamlining production processes and minimizing waste. The Base Year of 2025 serves as a pivotal point, highlighting the market's current maturity and setting the stage for accelerated growth. A key trend is the surge in demand for Horizontal Wrapping Machines, particularly within the Food & Beverages and Pharmaceuticals sectors, driven by their versatility in handling a wide array of product sizes and shapes, from single-serve snacks to bulk pharmaceutical ingredients. These machines offer unparalleled speed and precision in creating tightly sealed packages, crucial for product integrity and shelf-life extension. Furthermore, the increasing complexity of supply chains necessitates packaging solutions that can adapt to diverse logistical requirements, further bolstering the dominance of horizontal systems. Concurrently, Vertical Wrapping Machines are witnessing robust growth, especially for high-volume, low-cost products like granular goods, powders, and liquids. Their efficient use of floor space and rapid filling capabilities make them indispensable for high-throughput operations. The Application segment of Food & Beverages is a primary beneficiary of these advancements, as manufacturers strive to meet the ever-growing demand for convenience, portion control, and extended product freshness. The Pharmaceuticals sector also plays a critical role, with stringent regulatory requirements driving the need for highly accurate and tamper-evident packaging. Beyond these established applications, the "Other" segment, encompassing industries such as cosmetics, personal care, and e-commerce, is emerging as a significant growth area, demanding customized and adaptable packaging solutions. The Industry Developments section of the report will further explore how innovations in robotics, AI, and smart packaging are reshaping the competitive landscape and redefining the operational paradigms of wrapping and packaging machine manufacturers.

The global wrapping and packaging machines market is experiencing a significant upswing, propelled by a confluence of powerful driving forces. The escalating global population and the subsequent rise in consumerism are fundamental to this growth, creating an ever-increasing demand for packaged goods across diverse sectors. As more products enter the market, the necessity for efficient and high-speed packaging solutions becomes paramount. Furthermore, the burgeoning Food & Beverages industry, with its constant innovation in product diversification and convenience offerings, directly translates to a higher demand for specialized wrapping and packaging machinery capable of handling a wide spectrum of food items, from fresh produce to processed goods and beverages. The Pharmaceuticals sector, driven by an aging global population and advancements in healthcare, is another significant contributor. The need for sterile, tamper-evident, and precisely packaged medications necessitates sophisticated and reliable packaging equipment. Moreover, the increasing focus on product safety, hygiene, and extended shelf life across all industries mandates advanced packaging technologies that can ensure product integrity throughout the supply chain. This has led to a surge in demand for machines offering features like gas flushing, modified atmosphere packaging (MAP), and advanced sealing techniques. The growing adoption of e-commerce and the subsequent rise in the demand for direct-to-consumer shipping are also contributing factors. These channels often require specialized packaging that can withstand the rigors of transit and maintain product quality upon arrival, thereby fueling innovation in the wrapping and packaging machines sector.

Despite the promising growth trajectory, the wrapping and packaging machines market is not without its considerable challenges and restraints. One of the most significant hurdles is the high initial capital investment required for acquiring advanced wrapping and packaging machinery. For small and medium-sized enterprises (SMEs), this cost can be prohibitive, limiting their access to state-of-the-art technologies and potentially hindering their competitiveness. The complexities of technological integration and automation also present a challenge. Implementing and maintaining sophisticated automated systems often require a skilled workforce, which may not be readily available in all regions. Furthermore, the need for continuous upgrades and maintenance of these machines adds to the operational expenditure, posing a financial burden for some manufacturers. The stringent and evolving regulatory landscape governing packaging materials and processes across different regions can also act as a restraint. Companies must constantly adapt their machinery and packaging methods to comply with new standards for food safety, environmental impact, and product labeling, which can be a time-consuming and costly endeavor. Supply chain disruptions and fluctuations in the availability and cost of raw materials for packaging itself, such as plastics and films, can also impact the demand for the machines that process them. Finally, increasing consumer awareness and demand for sustainable packaging solutions are pushing manufacturers to develop eco-friendly alternatives, which may require significant retooling or investment in new types of machinery, presenting a challenge for existing infrastructure.

The Food & Beverages segment is poised to be the dominant force in the global wrapping and packaging machines market, driven by several interconnected factors. This segment consistently represents the largest consumer of packaged goods worldwide, a trend that is expected to intensify throughout the Forecast Period of 2025-2033.

Dominance of Food & Beverages:

Regional Dominance: Asia Pacific:

The synergy between the dominant Food & Beverages segment and the rapidly growing Asia Pacific region is expected to shape the market's future. Companies like FUJI MACHINERY, Anhui Zengran, CM-OPM, and Rui Packing are strategically positioned to capitalize on this trend, with a strong presence and product offerings tailored to the specific needs of these markets. The interplay of these factors will create significant opportunities for growth and innovation within the wrapping and packaging machines industry in the coming years.

Several factors are acting as significant growth catalysts for the wrapping and packaging machines industry. The accelerating trend towards automation and Industry 4.0 is a major driver, with manufacturers investing in smart, connected, and data-driven packaging solutions that enhance efficiency and reduce operational costs. The increasing demand for sustainable and eco-friendly packaging is also spurring innovation, leading to the development of machines capable of handling biodegradable, compostable, and recyclable materials. Furthermore, the expanding e-commerce sector necessitates specialized packaging to protect products during transit and maintain their integrity, creating new avenues for growth.

This comprehensive report offers an exhaustive analysis of the wrapping and packaging machines market, providing invaluable insights for industry stakeholders. It meticulously examines the market's trajectory from 2019 to 2033, with a deep dive into the Base Year of 2025. The report delves into the intricate market dynamics, exploring key trends, emerging technologies, and regional market specificities. It identifies the primary growth catalysts, such as the increasing demand for automation and sustainable packaging solutions, and also critically assesses the challenges and restraints hindering market expansion. Furthermore, the report highlights the leading companies in the sector and their strategic initiatives, alongside a detailed overview of significant historical and projected developments, offering a complete picture of the industry's past, present, and future.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bosch, FUJI MACHINERY, Coesia, PFM Packaging Machinery, Omori, Hayssen, Wihuri, Cryovac, ULMA Packaging, KAWASHIMA, Anhui Zengran, CM-OPM, Pro Mach, Shanghai Boevan, Rui Packing, GEA, Sanguan, Xingfeipack, Pakona Engineers.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Wrapping and Packaging Machines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wrapping and Packaging Machines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.