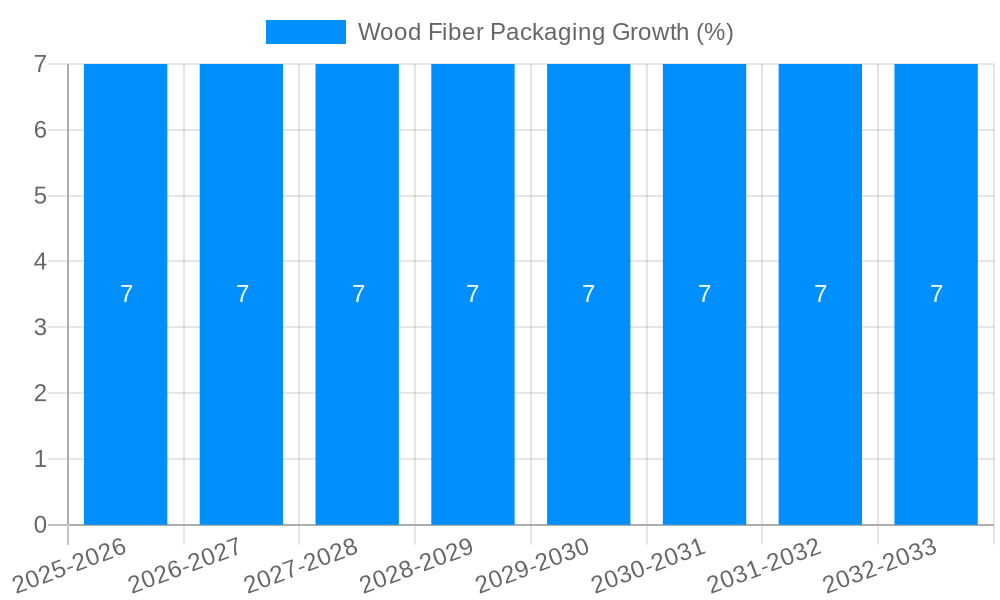

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wood Fiber Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Wood Fiber Packaging

Wood Fiber PackagingWood Fiber Packaging by Type (/> Trays, Boxes, Clamshell Containers, End Caps, Others), by Application (/> Food, Electronics, Healthcare, Industrial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

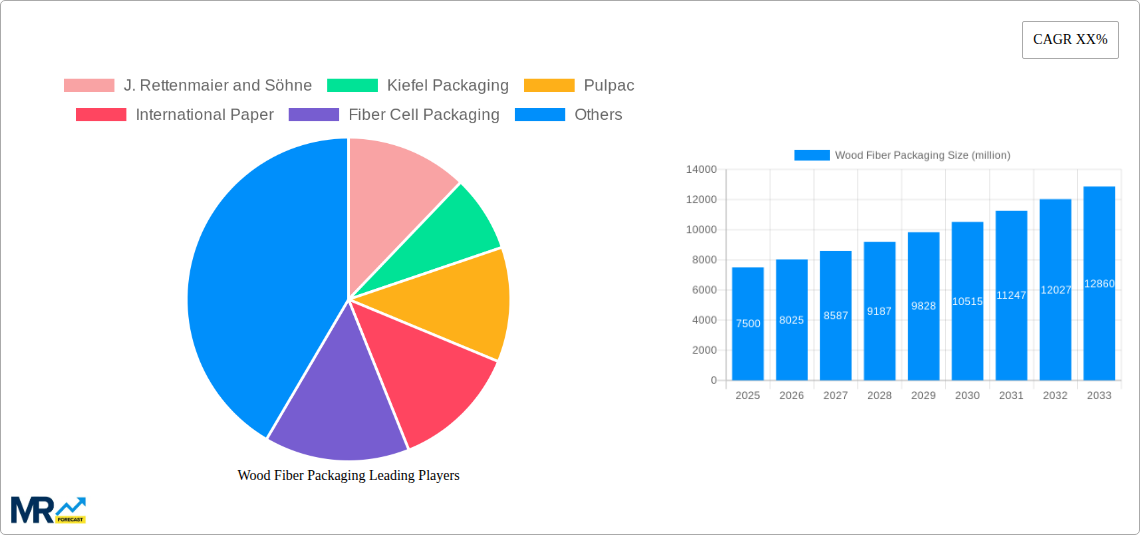

The global wood fiber packaging market is experiencing robust growth, projected to reach a substantial market size by 2025, driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2019 to 2033, reflecting a strong shift away from traditional plastic-based packaging. This surge is primarily fueled by stringent environmental regulations worldwide, encouraging the adoption of biodegradable and recyclable materials like wood fiber. Key applications within the food and beverage sector are leading the charge, with consumers increasingly prioritizing sustainably packaged products. The healthcare industry also presents significant opportunities, as wood fiber packaging offers excellent protective qualities for sensitive medical supplies and pharmaceuticals, while also aligning with the sector's growing focus on environmental responsibility. Innovations in molding and processing technologies are further enhancing the versatility and cost-effectiveness of wood fiber packaging, enabling its use in a wider range of applications.

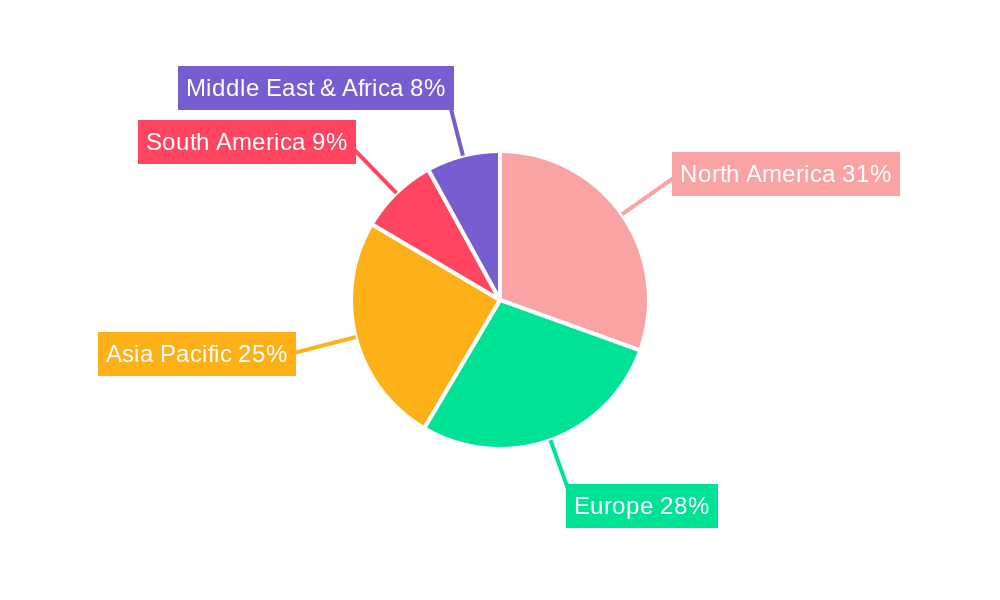

The market's growth trajectory is further bolstered by rising environmental consciousness and the circular economy initiatives being championed by governments and corporations alike. Companies are actively investing in research and development to improve the performance characteristics of wood fiber packaging, such as moisture resistance and structural integrity, to compete effectively with conventional materials. Key market restraints include the initial capital investment required for advanced manufacturing and potential limitations in specific end-use applications where extreme durability or barrier properties are paramount. However, ongoing technological advancements and the development of specialized coatings and treatments are steadily addressing these challenges. Geographically, North America and Europe are expected to remain dominant regions due to strong regulatory frameworks and a well-established demand for sustainable products. Asia Pacific, however, is poised for the fastest growth, driven by rapid industrialization, increasing disposable incomes, and a growing awareness of environmental issues. The competitive landscape is characterized by a mix of established players and emerging innovators, all vying to capture market share through product differentiation and strategic partnerships.

This report provides an in-depth analysis of the global Wood Fiber Packaging market, offering a comprehensive outlook on its growth trajectory, market dynamics, and competitive landscape. The study encompasses a detailed examination of market trends, driving forces, challenges, and future opportunities from the historical period of 2019-2024 to the forecast period of 2025-2033, with a base year of 2025. We anticipate the market to reach an estimated value of XX million units by the end of 2025 and project a significant expansion to YY million units by 2033.

The global Wood Fiber Packaging market is experiencing a paradigm shift driven by an increasing consumer and regulatory demand for sustainable and eco-friendly packaging solutions. Traditional plastic packaging, long dominant across various sectors, is facing intense scrutiny due to its persistent environmental impact, including landfill accumulation and microplastic pollution. This has created a fertile ground for wood fiber-based alternatives, which offer a compelling combination of biodegradability, recyclability, and a significantly lower carbon footprint. A key trend observed is the innovative application of wood fiber in diverse product formats. Beyond conventional pulp molded packaging, advancements in fiber engineering are leading to the development of high-performance materials capable of replacing plastics in more demanding applications. This includes the creation of moisture-resistant, grease-resistant, and even structural packaging components. The Food segment, in particular, is witnessing a rapid adoption of wood fiber packaging for trays, clamshell containers, and boxes, driven by the "clean label" movement and a desire to align with consumer values. Furthermore, the Electronics and Healthcare sectors are increasingly exploring wood fiber solutions for protective packaging and internal cushioning, recognizing their ability to offer robust protection while minimizing environmental impact. The growing emphasis on circular economy principles is also bolstering the wood fiber packaging market, as these materials are readily reintegrated into biological or material cycles. The development of advanced pulping and molding technologies is continuously enhancing the aesthetic appeal and functional performance of wood fiber packaging, making it a more viable and attractive alternative to conventional materials. For instance, innovative surface treatments are improving barrier properties, while advanced molding techniques allow for intricate designs and precise forms, catering to brand differentiation needs. The market is also seeing a rise in composite wood fiber materials, which blend virgin wood fiber with recycled fibers or other natural additives to achieve specific performance characteristics and reduce raw material costs. This trend towards material innovation and diversification is a cornerstone of the wood fiber packaging revolution.

Several interconnected factors are fueling the remarkable growth of the wood fiber packaging market. Foremost among these is the escalating global awareness and concern surrounding plastic pollution and its detrimental effects on ecosystems and human health. Governments worldwide are enacting stringent regulations and policies aimed at reducing single-use plastics and promoting the adoption of sustainable packaging alternatives. This regulatory push, coupled with a growing consumer preference for environmentally responsible brands, is creating a powerful market pull for wood fiber-based solutions. Companies are actively seeking to enhance their corporate social responsibility (CSR) profiles and meet consumer demand for greener products, making wood fiber packaging an attractive choice. Furthermore, the inherent sustainability attributes of wood fiber, including its renewability, biodegradability, and compostability, are significant drivers. As a renewable resource, wood can be sustainably managed, ensuring a continuous supply chain. The ability of wood fiber packaging to decompose naturally reduces landfill waste and greenhouse gas emissions associated with conventional packaging disposal. The ongoing advancements in pulp molding technologies and fiber processing are also playing a crucial role. Innovations in machinery, material science, and design are enabling the production of high-quality, versatile, and cost-effective wood fiber packaging solutions that can compete with, and often outperform, traditional materials in terms of functionality and aesthetics. This technological progress is expanding the application scope of wood fiber packaging across diverse industries, from food and beverage to electronics and healthcare.

Despite its robust growth prospects, the wood fiber packaging market encounters several challenges and restraints that need to be addressed for its full potential to be realized. One significant hurdle is the cost competitiveness compared to established plastic packaging. While prices are decreasing with increased production volumes and technological advancements, the initial investment in new manufacturing infrastructure and the raw material costs can still be higher for some wood fiber-based solutions, particularly for niche applications. Performance limitations in certain areas also pose a challenge. While wood fiber packaging is improving, it may not always match the barrier properties, such as extreme moisture or grease resistance, offered by some specialized plastics. This can limit its suitability for specific food products or industrial applications where high barrier protection is paramount. Consumer perception and education remain crucial. While awareness of sustainability is growing, some consumers may still associate wood fiber packaging with lower quality or durability compared to plastics, especially for certain product types. Educating consumers about the benefits and performance of modern wood fiber packaging is essential. Supply chain complexities and scalability can also be a concern. The rapid increase in demand might strain the availability of sustainably sourced wood fiber in certain regions. Ensuring a consistent and reliable supply of high-quality raw materials and scaling up production capacity to meet global demand can present logistical and operational challenges for manufacturers. Finally, developing standardized recycling and composting infrastructure at a global level is vital to fully realize the circularity of wood fiber packaging and prevent it from ending up in landfills.

The dominance of specific regions and segments within the global Wood Fiber Packaging market is a dynamic interplay of regulatory support, consumer demand, and industrial presence.

Dominant Regions/Countries:

Dominant Segments:

Several key catalysts are driving the accelerated growth within the wood fiber packaging industry. A primary catalyst is the intensifying global regulatory pressure to curb plastic waste and promote sustainable alternatives, leading to favorable government policies and incentives. Simultaneously, a significant shift in consumer behavior towards eco-conscious purchasing decisions is creating a strong market demand for environmentally friendly packaging. Technological advancements in pulp molding, fiber processing, and material science are continuously improving the performance, functionality, and cost-effectiveness of wood fiber packaging, expanding its applicability. The growing emphasis on circular economy principles, advocating for resource efficiency and waste reduction, further positions wood fiber as a preferred material.

This report provides an exhaustive analysis of the Wood Fiber Packaging market, offering a 360-degree view of its present state and future potential. It delves into the intricate market dynamics, including detailed trend analysis, identification of key drivers and restraints, and a thorough examination of the competitive landscape. The report segments the market by product type, application, and region, providing precise market size estimations and forecasts, measured in millions of units. It meticulously analyzes the historical performance from 2019-2024 and projects future growth from 2025-2033, with 2025 as the base year. Furthermore, the report highlights significant industry developments and identifies the leading players contributing to the market's evolution, offering actionable insights for stakeholders to navigate and capitalize on opportunities within this rapidly expanding sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include J. Rettenmaier and Söhne, Kiefel Packaging, Pulpac, International Paper, Fiber Cell Packaging, Brødrene Hartmann, Huhtamäki Oyj, Paptic, Metsä Group, Stora Enso, Eco-Products, Henry Molded Products, Sonoco Products Company, Nippon Mold Industry Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Wood Fiber Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Wood Fiber Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.