1. What is the projected Compound Annual Growth Rate (CAGR) of the Waste or Garbage Collection Vehicle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Waste or Garbage Collection Vehicle

Waste or Garbage Collection VehicleWaste or Garbage Collection Vehicle by Type (Front Loaders, Rear Loaders, Side Loaders, Grapple Trucks), by Application (Light Duty Vehicle, Medium Duty Vehicle, Heavy Duty Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

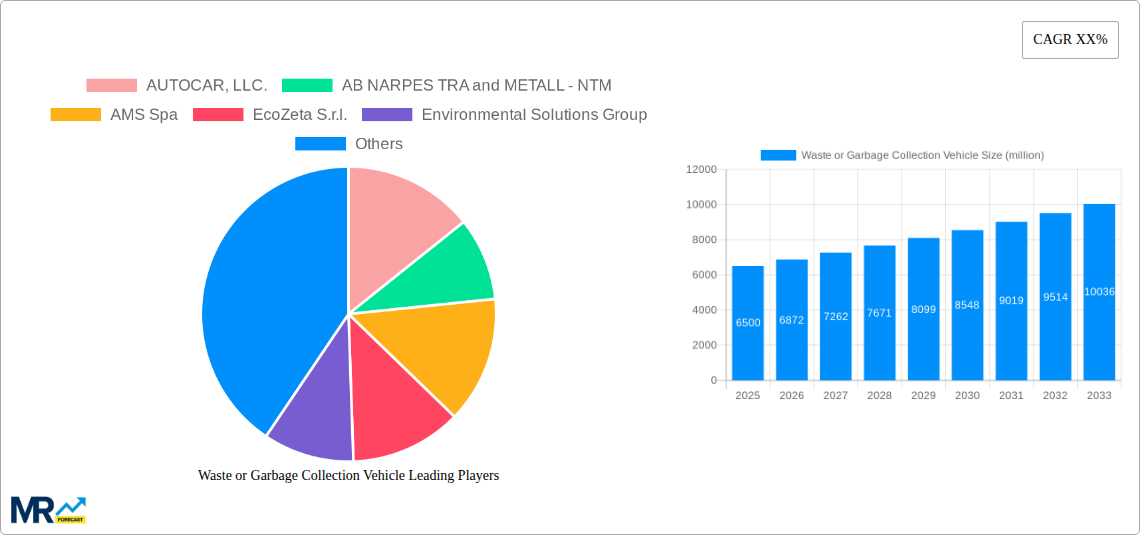

The global Waste or Garbage Collection Vehicle market is poised for significant expansion, with an estimated market size of $6,500 million in 2025 and projected to reach $9,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period (2025-2033). This growth is primarily propelled by the escalating global waste generation, driven by rapid urbanization, population growth, and increased consumption patterns. Stringent environmental regulations and a growing emphasis on sustainable waste management practices are further catalyzing the demand for advanced and efficient collection vehicles. The market is witnessing a notable trend towards the adoption of technologically sophisticated vehicles, including those equipped with automated loading systems, GPS tracking for optimized route planning, and enhanced fuel efficiency to reduce operational costs and environmental impact. The increasing focus on smart city initiatives and integrated waste management solutions is also contributing to market acceleration.

Key market drivers include the ongoing need for modernizing aging fleets, the implementation of stricter emission standards, and the growing municipal and private sector investments in waste management infrastructure. However, high initial capital expenditure for advanced vehicles and potential challenges in adopting new technologies in certain regions present as market restraints. Geographically, North America and Europe currently dominate the market due to established waste management frameworks and significant investments in infrastructure. The Asia Pacific region, however, is expected to witness the fastest growth, fueled by increasing waste volumes, government initiatives to improve sanitation, and a burgeoning manufacturing base for these specialized vehicles. The market is segmented into various types such as Front Loaders, Rear Loaders, Side Loaders, and Grapple Trucks, catering to diverse collection needs across Light Duty, Medium Duty, and Heavy Duty vehicle applications.

This comprehensive report provides an in-depth analysis of the global Waste or Garbage Collection Vehicle market, offering a detailed outlook for the period spanning 2019 to 2033. The study leverages a robust methodology, with 2025 serving as both the Base Year and Estimated Year for key market evaluations. The Forecast Period extends from 2025 to 2033, building upon an extensive Historical Period from 2019 to 2024.

The global Waste or Garbage Collection Vehicle market is experiencing a significant transformation driven by a confluence of factors, including increasing urbanization, evolving waste management regulations, and a growing emphasis on environmental sustainability. During the Study Period (2019-2033), a notable trend is the increasing adoption of technologically advanced collection vehicles designed to enhance efficiency and reduce operational costs. The market is witnessing a surge in demand for vehicles equipped with advanced features such as GPS tracking, automated loading systems, and real-time waste level monitoring. These innovations are not only optimizing collection routes and reducing fuel consumption but also improving the safety of collection personnel. The shift towards more sustainable waste management practices is also fueling the demand for eco-friendly vehicles, including those powered by alternative fuels like natural gas, electricity, and hydrogen. This trend is further propelled by government initiatives and incentives aimed at reducing carbon emissions and promoting cleaner technologies within the waste management sector. The Base Year (2025) serves as a crucial benchmark for evaluating the current market landscape, highlighting the established presence of traditional vehicle types while signaling the growing influence of newer, more sustainable alternatives. The Forecast Period (2025-2033) is expected to witness a more pronounced acceleration in the adoption of smart and electric waste collection vehicles, driven by stricter environmental regulations and growing public awareness regarding the impact of waste on the environment. The market is also seeing an increasing focus on modular vehicle designs, allowing for greater adaptability to different waste types and collection scenarios. This flexibility, coupled with enhanced durability and lower maintenance requirements, is making these vehicles a more attractive investment for municipalities and private waste management companies alike. The global market is estimated to reach values in the millions of units, reflecting the substantial scale of operations and the ongoing investment in modernizing waste collection infrastructure. The Historical Period (2019-2024) has laid the groundwork for these evolving trends, showcasing a steady increase in demand and a gradual integration of technological advancements.

Several key drivers are significantly propelling the growth of the Waste or Garbage Collection Vehicle market. Foremost among these is the escalating global population and the resultant increase in waste generation. As urban centers expand and living standards rise, the volume of municipal solid waste (MSW) continues to grow, necessitating more efficient and robust collection systems. This directly translates into a higher demand for specialized vehicles capable of handling diverse waste streams. Furthermore, stringent environmental regulations and policies enacted by governments worldwide are a powerful impetus. These regulations often mandate improved waste segregation, recycling, and the reduction of landfill dependency, which in turn requires more sophisticated and specialized collection vehicles. The push towards cleaner technologies and reduced carbon footprints is also a major driver, encouraging the adoption of electric and alternative fuel-powered waste collection vehicles. Municipalities and private operators are increasingly investing in these greener alternatives to comply with emissions standards and enhance their corporate social responsibility. Advancements in technology, such as smart sensors, GPS navigation, and automated loading mechanisms, are enhancing the operational efficiency of these vehicles, leading to cost savings in terms of fuel, labor, and maintenance. This technological evolution is making waste collection more streamlined, predictable, and cost-effective, thereby driving further investment and market expansion. The growing emphasis on public health and sanitation, especially in developing economies, also plays a crucial role. Effective waste collection is paramount to preventing the spread of diseases and maintaining hygienic urban environments, thus underpinning the consistent demand for these essential vehicles.

Despite the robust growth trajectory, the Waste or Garbage Collection Vehicle market is not without its challenges and restraints. One significant hurdle is the high initial cost associated with advanced and technologically sophisticated vehicles, particularly those powered by electricity or alternative fuels. The upfront investment required for these units can be substantial, posing a financial challenge for smaller municipalities or waste management companies with limited budgets. The maintenance and repair infrastructure for these newer technologies can also be less developed in certain regions, leading to higher operational costs and potential downtime. Another challenge stems from the varying regulatory landscapes across different countries and regions. Inconsistent or less stringent environmental regulations in some areas can slow down the adoption of advanced and eco-friendly waste collection solutions. Furthermore, the availability and cost of alternative fuels, such as compressed natural gas (CNG) or electricity, can fluctuate, impacting the long-term economic viability of specialized vehicles. The operational complexity of managing a mixed fleet, comprising both traditional and advanced vehicles, can also present challenges for logistics and maintenance planning. Public perception and acceptance of different collection methods or vehicle types, while generally positive, can sometimes lead to resistance in specific communities, requiring extensive public outreach and education campaigns. Lastly, the economic downturns or budgetary constraints faced by government entities can lead to delays or cancellations of planned fleet upgrades, thereby impacting market demand in the short to medium term.

The global Waste or Garbage Collection Vehicle market is characterized by diverse regional dynamics and segment dominance. North America, particularly the United States, is projected to be a leading market due to its strong emphasis on efficient waste management infrastructure, stringent environmental regulations, and significant investment in advanced collection technologies. Municipalities in this region are actively replacing older fleets with newer, more automated, and environmentally compliant vehicles. The high adoption rate of technologies like GPS tracking, route optimization software, and sophisticated onboard diagnostic systems contributes to the dominance of this region.

Within North America, Heavy Duty Vehicles are expected to command a substantial market share. This is driven by the large volumes of municipal solid waste generated in urban and suburban areas, necessitating robust and high-capacity collection vehicles. Rear Loaders and Front Loaders are particularly dominant within the Heavy Duty Vehicle segment, catering to the efficient collection of residential and commercial waste. The established infrastructure for servicing and maintaining these types of vehicles further solidifies their market position.

Europe also represents a significant and growing market, propelled by ambitious sustainability goals and a strong commitment to circular economy principles. Countries like Germany, the UK, and France are at the forefront of adopting electric waste collection vehicles and implementing smart waste management solutions. The increasing focus on reducing greenhouse gas emissions and promoting cleaner urban environments is a key catalyst for growth in this region. Similar to North America, Heavy Duty Vehicles are expected to remain dominant, with a notable surge in the adoption of Side Loaders due to their efficiency in residential collection and reduced need for manual labor. The region's well-developed aftermarket support for a wide range of vehicle types and technologies is another factor contributing to its strong market performance.

In the Asia-Pacific region, countries such as China and India are experiencing rapid urbanization and population growth, leading to a substantial increase in waste generation. This surge in waste volume is driving significant demand for waste collection vehicles across all segments. While the market is characterized by a mix of traditional and emerging technologies, there is a clear trend towards adopting more modern and efficient solutions. Medium Duty Vehicles are expected to witness considerable growth in this region, catering to the needs of both expanding urban areas and developing infrastructure. The Chinese market, in particular, is a major contributor due to its large manufacturing base and government initiatives promoting domestic production of advanced waste collection vehicles. The segment of Rear Loaders is likely to continue its strong performance in these emerging economies due to their versatility and cost-effectiveness.

The dominance of specific segments is further influenced by the application. Heavy Duty Vehicles are essential for large-scale municipal waste management, while Medium Duty Vehicles are increasingly deployed in commercial waste collection and in areas with narrower streets or less dense population. Light Duty Vehicles find application in specialized tasks such as alleyway cleaning or collecting smaller volumes of commercial waste. The continuous evolution of waste management strategies, from traditional landfilling to advanced recycling and waste-to-energy solutions, directly impacts the demand for different types of collection vehicles and their specialized features. The market is poised for significant expansion in regions where infrastructure development and waste management modernization are prioritized.

The Waste or Garbage Collection Vehicle industry is experiencing accelerated growth driven by several key catalysts. The increasing global focus on environmental sustainability and the circular economy is compelling municipalities and private entities to invest in cleaner and more efficient waste management solutions. Government initiatives, including subsidies for electric vehicles and stricter emission standards, are directly fueling the demand for eco-friendly waste collection vehicles. Technological advancements, such as the integration of IoT sensors and AI-powered route optimization, are enhancing operational efficiency, reducing costs, and improving the overall performance of these vehicles, thus acting as significant growth drivers. The continuous growth of urban populations worldwide leads to an escalating generation of municipal solid waste, creating a perpetual need for effective collection systems and, consequently, for an expanded fleet of waste collection vehicles.

This report offers a comprehensive and detailed examination of the global Waste or Garbage Collection Vehicle market, providing a holistic view of its dynamics from 2019 to 2033. The analysis delves into market segmentation by vehicle type (Front Loaders, Rear Loaders, Side Loaders, Grapple Trucks) and application (Light Duty Vehicle, Medium Duty Vehicle, Heavy Duty Vehicle). It meticulously tracks key industry developments, including technological innovations, regulatory changes, and sustainability initiatives. The report provides an in-depth exploration of the driving forces that are propelling market growth, such as urbanization and environmental concerns, while also addressing the significant challenges and restraints that the industry faces, including high initial costs and evolving infrastructure needs. The study identifies key regions and countries poised for market dominance and analyzes the specific segments within those regions that are expected to lead in terms of growth and adoption. Leading players in the market are identified and profiled, offering insights into their strategic approaches and contributions to the sector. The report concludes with a forward-looking perspective, outlining potential future trends and opportunities that will shape the Waste or Garbage Collection Vehicle market in the coming years.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AUTOCAR, LLC., AB NARPES TRA and METALL - NTM, AMS Spa, EcoZeta S.r.l., Environmental Solutions Group, EOW INTERNATIONAL COLLABORATION AND MANUFACTURING LLC, FAUN Umwelttechnik GmbH & Co. KG, Fratelli Mazzocchia Spa, GEP ECOTECH CO., LTD., Hidro-Mak, MS DORSE, Mecagil-Lebon, Nord Engineering s.r.l., TERBERG ROSROCA GROUP, Shandong Wuzheng Group Co., Ltd., XCMG Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Waste or Garbage Collection Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Waste or Garbage Collection Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.