1. What is the projected Compound Annual Growth Rate (CAGR) of the Video Gastroscope?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Video Gastroscope

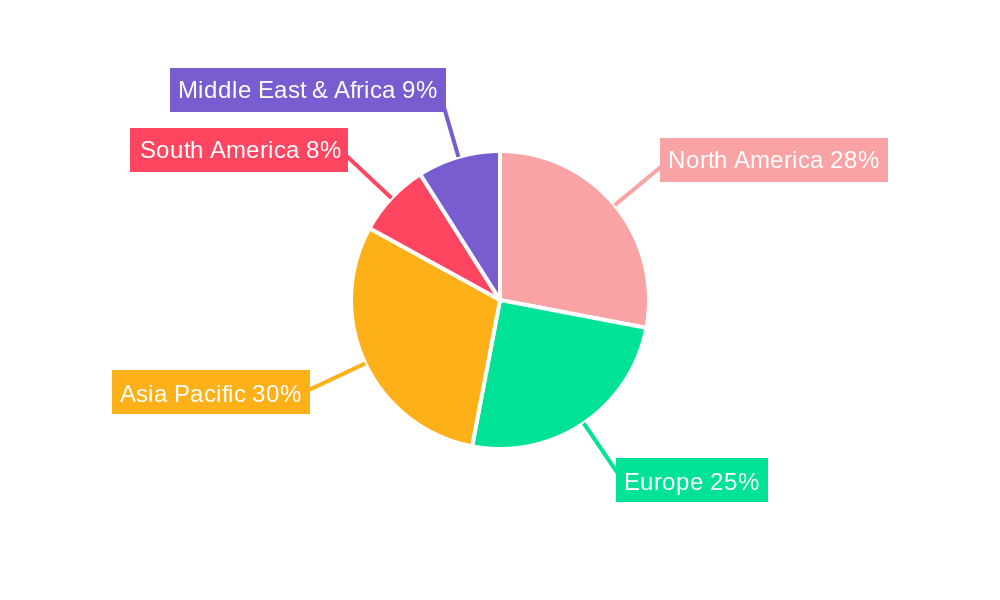

Video GastroscopeVideo Gastroscope by Type (Adult, Pediatric), by Application (Hospital, Clinic, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

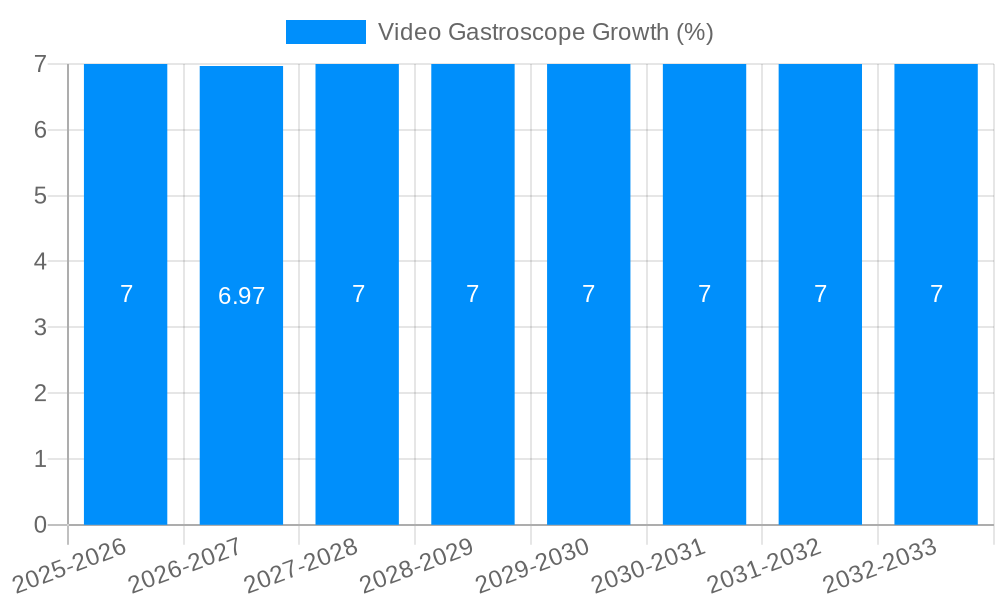

The global Video Gastroscope market is experiencing robust growth, projected to reach a significant valuation of approximately $3,500 million by 2025. This upward trajectory is fueled by a Compound Annual Growth Rate (CAGR) of around 7.5% throughout the forecast period of 2025-2033. A primary driver for this expansion is the increasing prevalence of gastrointestinal disorders, including GERD, peptic ulcers, and H. pylori infections, necessitating advanced diagnostic and therapeutic interventions. The growing adoption of minimally invasive procedures, coupled with the rising demand for early disease detection and personalized treatment plans, further propels the market forward. Furthermore, technological advancements in video gastroscopy, such as enhanced imaging resolution, miniaturization of scopes, and integration of artificial intelligence for polyp detection and characterization, are significantly contributing to market expansion by improving diagnostic accuracy and patient comfort.

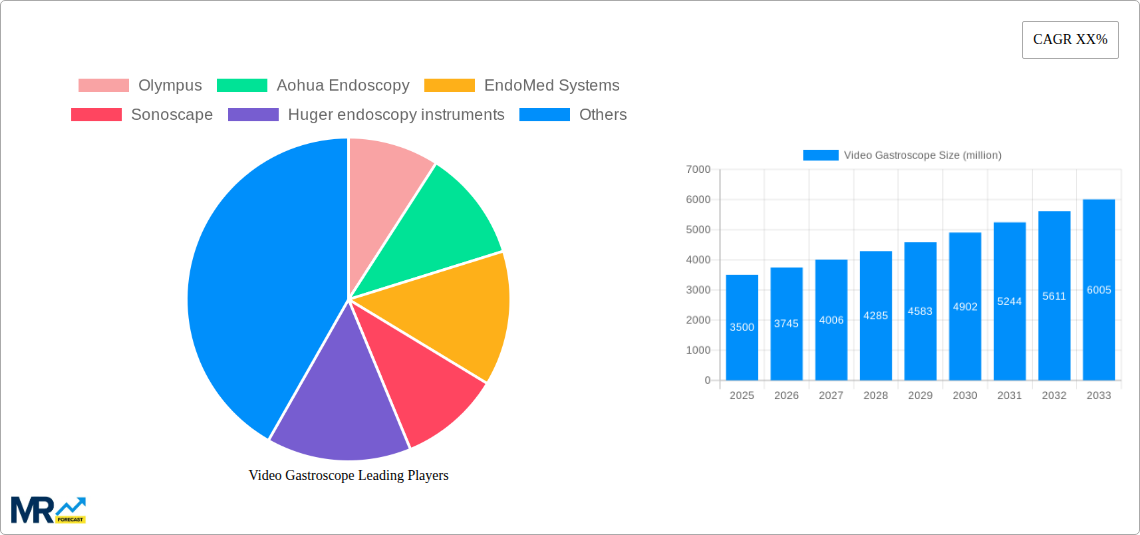

The market is segmented by type, with the adult segment dominating due to the higher incidence of gastrointestinal issues in this demographic. However, the pediatric segment is witnessing steady growth driven by increasing awareness and improved diagnostic capabilities for childhood gastrointestinal ailments. Application-wise, hospitals are the largest consumers of video gastroscopes owing to their comprehensive facilities and higher patient volumes, followed by clinics, which are increasingly investing in these advanced diagnostic tools to offer outpatient endoscopic services. Key market players like Olympus, Aohua Endoscopy, and SonoScape are investing heavily in research and development to introduce innovative products and expand their geographical reach, contributing to market competitiveness and innovation. Despite significant growth, restraints such as the high initial cost of advanced video gastroscope systems and the need for specialized training for endoscopists can pose challenges to widespread adoption in resource-limited settings.

The global video gastroscope market is poised for remarkable expansion, projected to reach an estimated $3,800 million by 2025, and further surge to $6,500 million by 2033. This growth trajectory is underpinned by a confluence of factors, including the increasing prevalence of gastrointestinal disorders and the accelerating adoption of advanced endoscopic technologies. The historical period from 2019 to 2024 witnessed a steady ascent, with the market value growing from an initial $2,100 million to $3,100 million by the end of 2024. The base year of 2025 serves as a critical pivot point, with the market already establishing a strong footing at $3,800 million. Looking ahead, the forecast period of 2025-2033 anticipates a Compound Annual Growth Rate (CAGR) of approximately 6.5%, a testament to the sustained innovation and demand within this sector. A key trend observed is the shift towards higher resolution imaging, offering enhanced visualization for more accurate diagnoses and interventions. Furthermore, the integration of artificial intelligence (AI) for real-time image analysis and diagnostic support is rapidly gaining traction, promising to revolutionize gastroenterological procedures. The development of single-use gastroscopes is also a significant emerging trend, addressing concerns around infection control and reducing reprocessing costs, particularly within large hospital settings. The market is also experiencing a diversification in product offerings, catering to specialized applications and patient demographics. This includes advancements in pediatric gastroscopes, designed for improved comfort and efficacy in younger patients, and a growing demand for flexible and miniaturized instruments that facilitate less invasive procedures. The increasing investment in research and development by key players is continuously pushing the boundaries of what is possible with gastrointestinal endoscopy, leading to the introduction of novel features such as enhanced maneuverability, improved illumination, and advanced imaging modalities like fluorescence imaging. The growing awareness among healthcare professionals and patients about the benefits of early diagnosis and minimally invasive treatments for gastrointestinal conditions further fuels the demand for sophisticated video gastroscopes, positioning the market for continued robust growth.

Several potent forces are collectively propelling the video gastroscope market towards its projected significant growth. Foremost among these is the escalating global burden of gastrointestinal diseases. Conditions such as gastritis, peptic ulcers, inflammatory bowel disease, and various forms of gastrointestinal cancers are becoming increasingly prevalent, driven by factors like changing dietary habits, sedentary lifestyles, and an aging global population. This surge in disease incidence directly translates into a greater need for diagnostic and therapeutic endoscopic procedures, making video gastroscopes indispensable tools in healthcare. Complementing this is the rapid pace of technological innovation within the endoscopy sector. Manufacturers are consistently investing in research and development, leading to the introduction of gastroscopes with superior image quality, enhanced maneuverability, miniaturized designs for less invasive procedures, and integrated functionalities like AI-powered image analysis and therapeutic capabilities. This continuous technological advancement not only improves the diagnostic accuracy and therapeutic efficacy of procedures but also enhances patient comfort and safety, thereby driving adoption. The growing preference for minimally invasive procedures over traditional open surgeries by both patients and healthcare providers also plays a crucial role. Video gastroscopy offers a less invasive alternative for diagnosis and treatment, leading to shorter recovery times, reduced pain, and fewer complications. This patient-centric approach further bolsters the market demand. Moreover, increasing healthcare expenditure globally, particularly in emerging economies, and a growing emphasis on preventative healthcare strategies are creating a more conducive environment for the widespread adoption of advanced medical devices like video gastroscopes.

Despite the promising growth trajectory, the video gastroscope market is not without its hurdles. A primary challenge lies in the substantial initial investment required for acquiring high-end video gastroscope systems. These sophisticated medical devices, equipped with advanced imaging and analytical capabilities, come with a significant price tag, which can be a barrier for smaller clinics and healthcare facilities, especially in resource-constrained regions. This cost factor can hinder the widespread adoption of the latest technologies, limiting their accessibility. Furthermore, the complex nature of video gastroscope technology necessitates specialized training for healthcare professionals. Endoscopists and supporting staff require comprehensive training to effectively operate these devices, interpret the acquired images, and perform advanced procedures. The availability of adequately trained personnel can be a bottleneck, particularly in regions with a shortage of skilled medical professionals. Another significant restraint is the ongoing concern regarding infection control and reprocessing of reusable endoscopes. While manufacturers are developing innovative solutions to mitigate these risks, the potential for cross-contamination remains a persistent worry for healthcare institutions, necessitating stringent cleaning and disinfection protocols. The development and adoption of single-use gastroscopes are gaining traction, but their widespread implementation is still evolving and might face cost and logistical challenges. Moreover, regulatory hurdles and the stringent approval processes for new medical devices in various countries can also delay market entry and product commercialization, impacting the growth rate. Finally, the emergence of alternative diagnostic modalities, although not directly replacing gastrointestinal endoscopy, could pose a long-term competitive pressure, prompting continuous innovation and cost-effectiveness to maintain market dominance.

The global Hospital segment, particularly within Adult applications, is projected to exhibit robust dominance in the video gastroscope market throughout the study period of 2019-2033, with an estimated market value of $2,500 million by 2025. This dominance is attributed to a synergistic interplay of factors that underscore the critical role of hospitals in gastrointestinal diagnostics and therapeutics.

Hospitals as Primary Diagnostic Hubs: Hospitals, by their very nature, are equipped to handle a higher volume and complexity of gastrointestinal cases. They serve as the frontline for diagnosing a wide spectrum of gastrointestinal disorders, ranging from common conditions like acid reflux and peptic ulcers to more serious ailments such as gastrointestinal bleeding, polyps, and cancers. This inherent demand makes them the largest consumers of video gastroscopes.

Adult Application Dominance: The adult population represents the vast majority of individuals experiencing gastrointestinal issues. Age-related changes, lifestyle factors, and environmental influences contribute to a higher incidence of these conditions in adults, consequently driving the demand for adult-sized video gastroscopes. The Adult segment is estimated to contribute $3,100 million to the market value in 2025.

Technological Adoption and Infrastructure: Hospitals, particularly tertiary and quaternary care centers, are more likely to invest in and adopt the latest advancements in video gastroscope technology due to their financial capacity and the critical need for high-fidelity diagnostic tools. They are better equipped to afford the initial capital outlay for advanced systems and the ongoing costs associated with maintenance and upgrades.

Therapeutic Procedures: Beyond diagnostics, hospitals are the primary sites for performing therapeutic endoscopic procedures, such as polypectomy, stricture dilation, and stent placement. Video gastroscopes with advanced therapeutic capabilities are essential for these interventions, further cementing the hospital segment's leading position.

Focus on Early Detection and Screening Programs: With increasing awareness and government initiatives promoting early detection of gastrointestinal cancers, hospitals are at the forefront of conducting screening colonoscopies and gastroscopies. This proactive approach significantly boosts the utilization of video gastroscopes.

Regional Concentration of Advanced Healthcare: Developed regions such as North America and Europe, with their well-established healthcare infrastructure, higher disposable incomes, and robust reimbursement policies, are expected to contribute significantly to the dominance of the hospital segment. For instance, North America alone is projected to account for $1,100 million of the total market value in 2025, with a substantial portion attributed to its hospital sector. Asia Pacific, driven by rapid economic growth and improving healthcare access, is also witnessing an accelerated expansion in its hospital-based video gastroscope usage.

While Pediatric applications and Clinic settings will witness steady growth, their market share will remain comparatively smaller than the formidable Hospital segment catering to Adult patients, which is the undisputed leader in driving the global video gastroscope market value. The Others application segment, encompassing specialized research and non-clinical diagnostic purposes, is expected to grow at a CAGR of 5.8% from 2025-2033, showcasing its niche but vital contribution.

Several key catalysts are fueling the growth of the video gastroscope industry. The increasing global prevalence of gastrointestinal disorders, driven by aging populations and lifestyle changes, is a primary driver. Technological advancements, including AI integration, higher resolution imaging, and miniaturized designs, are enhancing diagnostic accuracy and patient comfort, thereby boosting adoption. Furthermore, a growing emphasis on minimally invasive procedures and early disease detection programs worldwide is creating sustained demand for sophisticated endoscopic solutions.

This comprehensive report provides an in-depth analysis of the global video gastroscope market, meticulously examining trends, driving forces, and challenges from the historical period of 2019-2024. It offers robust forecasts for the market from 2025-2033, with 2025 serving as the base and estimated year. The report delves into the dominant market segments, including Adult and Pediatric types, and applications such as Hospital, Clinic, and Others. It highlights the key regions and countries expected to lead market growth and details significant industry developments and leading company strategies. This extensive coverage ensures stakeholders have a thorough understanding of the market dynamics and future opportunities within the video gastroscope sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Olympus, Aohua Endoscopy, EndoMed Systems, Sonoscape, Huger endoscopy instruments, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Video Gastroscope," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Video Gastroscope, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.