1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Testing Equipment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Veterinary Testing Equipment

Veterinary Testing EquipmentVeterinary Testing Equipment by Type (Diagnostic Equipment, Monitoring Equipment, Surgical Equipment, Beauty Equipment, Others), by Application (Animal Hospital, Pet Shop, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

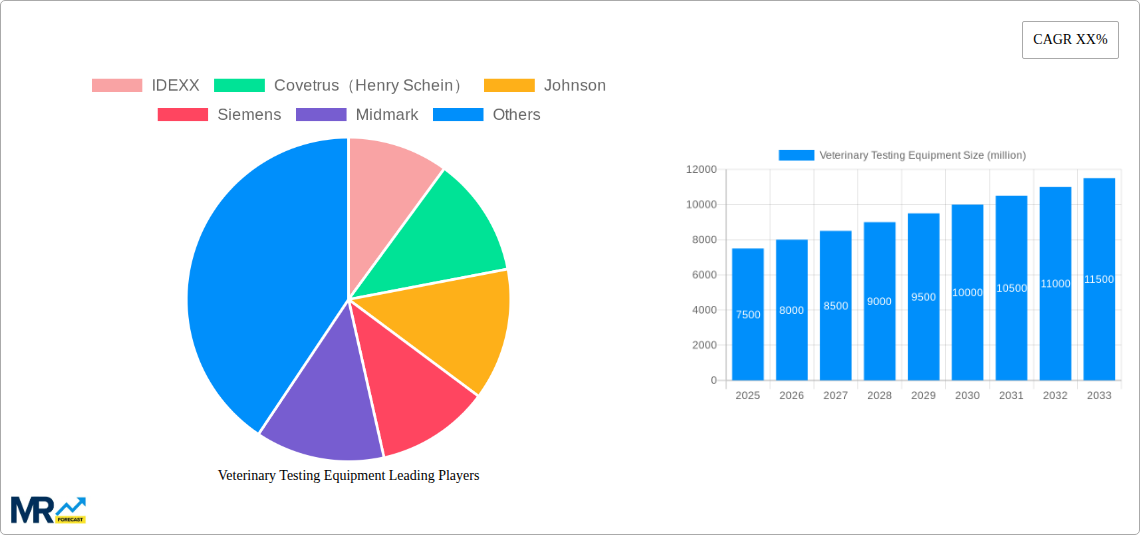

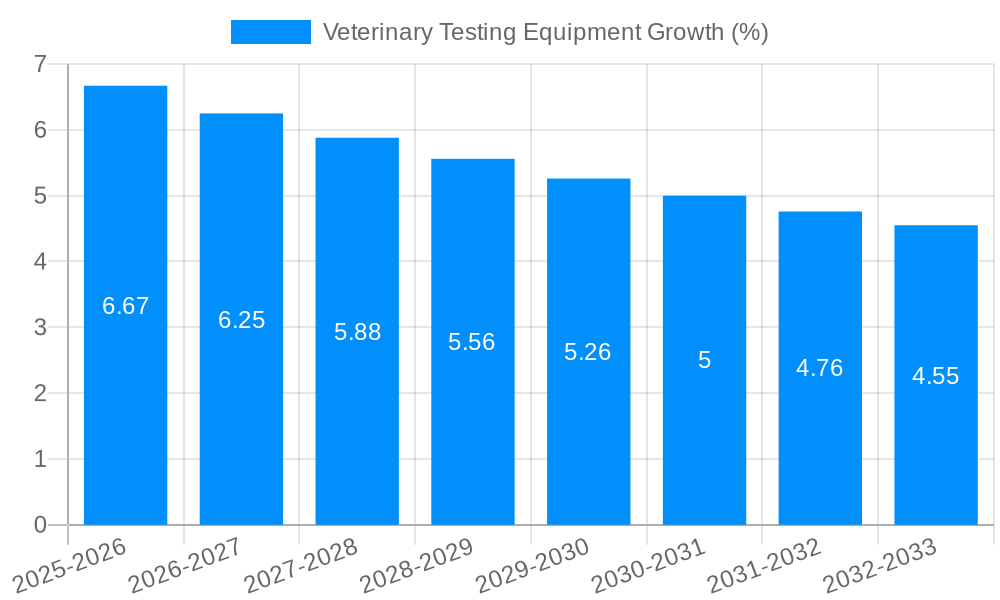

The global veterinary testing equipment market is poised for significant expansion, projected to reach approximately $7,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.5% over the forecast period of 2025-2033. This robust growth is primarily fueled by the increasing humanization of pets, leading to a greater willingness among pet owners to invest in advanced healthcare for their animals. The rising incidence of zoonotic diseases also necessitates sophisticated diagnostic tools for early detection and management, further bolstering market demand. Technological advancements, including the development of portable and user-friendly testing devices, coupled with the growing adoption of point-of-care diagnostics in veterinary practices, are key drivers. Furthermore, the expanding veterinary infrastructure, particularly in emerging economies, and a growing emphasis on preventive healthcare for animals are contributing to this positive market trajectory.

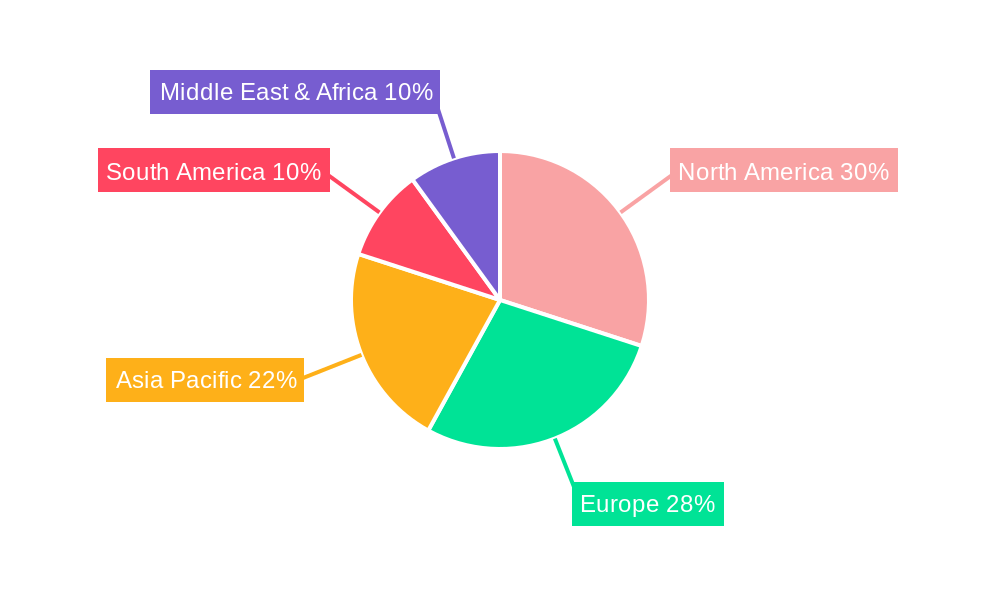

The market is segmented into diagnostic, monitoring, and surgical equipment, with diagnostic equipment holding the largest share due to its essential role in disease identification and treatment planning. Animal hospitals represent the dominant application segment, reflecting the primary setting for advanced veterinary care. Geographically, North America and Europe currently lead the market due to established veterinary healthcare systems and high pet ownership rates. However, the Asia Pacific region is expected to witness the fastest growth, driven by increasing disposable incomes, a rising pet population, and growing awareness about animal welfare. Key players are focusing on strategic collaborations, mergers, and acquisitions to expand their product portfolios and geographical reach, aiming to capitalize on the burgeoning opportunities within this dynamic market.

The global veterinary testing equipment market is poised for substantial expansion, driven by a confluence of escalating pet ownership, increasing veterinary healthcare expenditure, and a growing emphasis on preventive care for animals. Our comprehensive study, spanning from 2019 to 2033 with a base year of 2025, highlights a dynamic landscape characterized by technological advancements and evolving market demands. Throughout the historical period (2019-2024), the market witnessed steady growth, fueled by increased awareness of animal welfare and the professionalization of veterinary services. The estimated year of 2025 sets the stage for accelerated growth, with projections indicating a robust CAGR during the forecast period of 2025-2033. This growth is intrinsically linked to the development of more sophisticated diagnostic tools, enabling earlier and more accurate detection of diseases. The rising prevalence of chronic conditions in companion animals, such as diabetes, cancer, and renal diseases, necessitates advanced testing capabilities, thereby propelling the demand for sophisticated equipment. Furthermore, the increasing number of veterinary specialists and advanced veterinary clinics worldwide are also significant contributors to this trend. The integration of artificial intelligence and machine learning into diagnostic equipment is also a noteworthy trend, promising to enhance diagnostic accuracy and efficiency. The market's trajectory is further bolstered by the growing demand for point-of-care testing solutions, allowing for rapid results within the clinic setting, thereby improving patient outcomes and owner satisfaction. The increasing adoption of digital imaging technologies and advanced laboratory analyzers are also key indicators of the market's upward momentum. The global market size, estimated to be in the hundreds of millions of units, is anticipated to reach several billion dollars by the end of the forecast period, reflecting the significant investment and innovation within this sector. This growth is not only a testament to the increasing sophistication of veterinary medicine but also to the deep-seated human-animal bond that drives investment in animal health.

The veterinary testing equipment market's impressive growth trajectory is underpinned by a potent mix of interconnected driving forces. Foremost among these is the unprecedented surge in pet ownership globally. As animals become increasingly integrated into families, owners are demonstrating a greater willingness to invest in their pets' health and well-being, mirroring the healthcare standards they expect for themselves. This heightened emotional and financial commitment translates directly into increased demand for diagnostic and monitoring services. Concurrently, the global veterinary healthcare expenditure has seen a significant rise, indicating a shift towards more proactive and comprehensive medical care for animals. This includes a greater emphasis on preventive medicine, regular health check-ups, and early disease detection, all of which rely heavily on advanced testing equipment. Furthermore, the increasing availability of sophisticated diagnostic technologies, once primarily confined to human medicine, is now being adapted and made accessible for veterinary applications, thereby expanding the scope and accuracy of diagnoses. Advancements in areas such as genetic testing, advanced imaging techniques, and rapid diagnostic kits are revolutionizing how animal diseases are identified and managed. The growing number of specialized veterinary practices and referral centers also plays a crucial role, as these facilities are equipped with state-of-the-art technology to handle complex cases, further driving the demand for high-end testing equipment. The overall professionalization and expansion of the veterinary industry, coupled with a growing awareness of zoonotic diseases and the importance of animal health in public health, are collectively creating a robust environment for the sustained growth of the veterinary testing equipment market.

Despite the overwhelmingly positive outlook for the veterinary testing equipment market, several challenges and restraints have the potential to temper its growth trajectory. A significant hurdle remains the high cost associated with acquiring and maintaining advanced veterinary testing equipment. For many smaller veterinary practices, particularly in developing regions, the initial capital investment can be prohibitive, limiting their access to cutting-edge technology. This cost factor also extends to the ongoing expenses, including consumables, maintenance contracts, and calibration, which can strain the operational budgets of veterinary clinics. Another challenge lies in the availability of skilled veterinary professionals who are proficient in operating and interpreting the results from these sophisticated instruments. The rapid pace of technological advancement necessitates continuous training and education for veterinary staff, which can be resource-intensive. Regulatory hurdles and varying standards across different geographical regions can also pose complexities for manufacturers and distributors. The time and effort required to obtain regulatory approvals for new equipment can impede market entry and adoption. Furthermore, the economic sensitivity of pet owners to discretionary spending can impact the demand for non-essential diagnostic procedures, especially during economic downturns. While pet owners are increasingly invested in their animals' health, economic pressures can lead to prioritization of essential treatments over comprehensive diagnostic testing. The fragmented nature of the veterinary market, with a large number of independent practices, can also present challenges in achieving widespread adoption of standardized testing protocols and equipment. Finally, the availability and affordability of essential consumables and reagents for various testing platforms can also influence the overall accessibility and utilization of veterinary testing equipment.

North America is a dominant force in the global veterinary testing equipment market, driven by a combination of factors that include high pet ownership rates, substantial disposable income allocated to pet care, and a well-established network of advanced veterinary hospitals and research institutions. The United States, in particular, represents a significant market due to its mature veterinary healthcare infrastructure and a populace that views pets as integral family members, leading to a strong demand for high-quality veterinary services, including extensive diagnostic testing.

Within this region, the Diagnostic Equipment segment is poised to hold a commanding share of the market. This dominance stems from the fundamental need for accurate and timely disease detection in animals.

The application segment that primarily drives the demand for these diagnostic tools is Animal Hospitals.

The synergy between advanced diagnostic equipment and the comprehensive care provided by animal hospitals, supported by the financial capacity and pet-centric culture of North America, solidifies its leading position in the veterinary testing equipment market. The continuous innovation in diagnostic technologies, coupled with the increasing awareness among pet owners about the importance of early detection and proactive health management, will further solidify this dominance throughout the forecast period. The integration of telemedicine and remote diagnostics, while nascent, is also expected to contribute to the market's growth in this region, allowing for broader access to specialized diagnostic insights.

Several key factors are acting as significant growth catalysts for the veterinary testing equipment industry. The increasing humanization of pets, leading to higher spending on animal healthcare and a demand for advanced medical services akin to human medicine, is a primary driver. Furthermore, the growing prevalence of zoonotic diseases is spurring the need for robust diagnostic capabilities to monitor animal health and prevent transmission to humans. Technological advancements, including the development of point-of-care testing devices and AI-driven diagnostics, are enhancing accuracy, speed, and accessibility, thereby driving adoption. Finally, the expanding global veterinary workforce and the establishment of more specialized veterinary clinics are creating a greater demand for sophisticated testing instrumentation.

This report offers an exhaustive analysis of the veterinary testing equipment market, providing critical insights for stakeholders. It delves into market dynamics, including the technological advancements driving innovation, the increasing adoption of digital diagnostics, and the growing demand for integrated laboratory solutions. The report forecasts market size and growth rates across various segments and regions, enabling strategic planning and investment decisions. Furthermore, it examines the competitive landscape, identifying key players, their market share, and their strategic initiatives. The report also addresses regulatory frameworks, economic factors, and emerging trends, such as the impact of personalized medicine and the growing role of big data in veterinary diagnostics. This comprehensive coverage ensures that businesses can navigate the complexities of the veterinary testing equipment market and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include IDEXX, Covetrus(Henry Schein), Johnson, Siemens, Midmark, Smiths Medical, Olympus, Carestream Health, GE Healthcare, Nonin Medical, Yuesen Med, APK Technology, Shinova MEDICAL, ALPHATEC SCIENTIFIC, BIOLABO GROUP, Randox Laboratories, HFMED, DiaSys Diagnostic Systems GmbH, Shanghai Huifeng Medical Instrument, Shenzhen Mindray Bio-Medical Electronics, Tianjin MNCHIP Technologies, Shenzhen Dymind Biotechnology, Shenzhen Icubio Biomedical Technology, Beaconn Medical Science, MdkMed, Shenzhen Hawk Medical, Hepho, Chengdu Seamaty Technology Co., Ltd., Guangzhou Yueshen Medical Equipment, Dibaocheng (Shanghai) Medical Imaging Technology, EKF Diagnostics, Digicare Animal Health, DRE Veterinary, Grady Medical, Heska, Jorgen Kruuse, Leading Edge Veterinary Equipment, SWISSAVANS AG, Crony Instruments, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Veterinary Testing Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Veterinary Testing Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.