1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Telemedicine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Veterinary Telemedicine

Veterinary TelemedicineVeterinary Telemedicine by Application (/> Radiographic Reporting, CT Reporting, X-Ray & PACS Advice, MRI Reporting, Other), by Type (/> By Telephone, By Internet, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

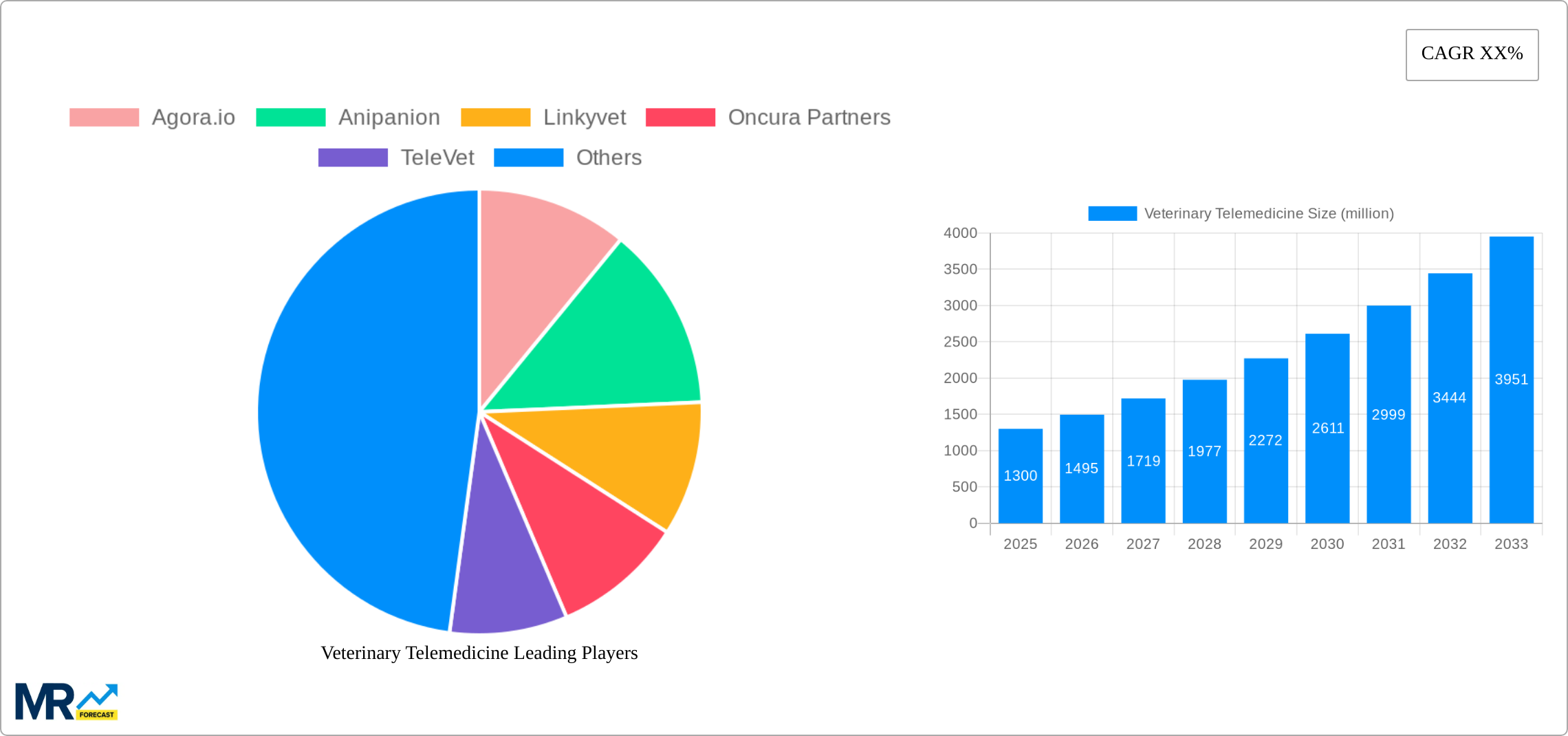

The veterinary telemedicine market is experiencing robust growth, driven by increasing pet ownership, rising veterinary costs, and advancements in technology enabling remote consultations. The convenience and accessibility offered by telemedicine platforms are particularly attractive to pet owners in rural areas or those with limited mobility. The market segmentation reveals a strong demand across various applications, including radiographic reporting, CT reporting, and general advice, with internet-based consultations leading the way in terms of delivery method. While the precise market size for 2025 is unavailable, a reasonable estimation, considering a plausible CAGR of 15% (a common growth rate for rapidly expanding tech-enabled healthcare sectors) and a hypothetical 2019 market size of $500 million, would place the 2025 market value at approximately $1.3 billion. This projection accounts for factors such as increased adoption, technological improvements, and expanding geographical reach. The forecast period of 2025-2033 suggests continued substantial expansion, likely driven by further technological advancements, wider insurance coverage for telemedicine services, and increasing awareness among both pet owners and veterinary professionals.

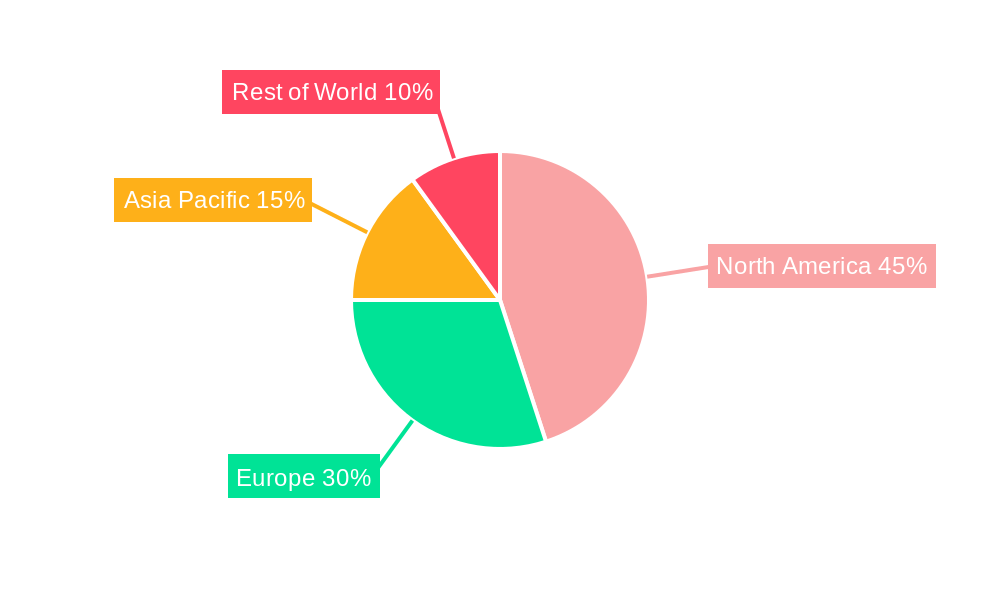

However, challenges remain. Restraints to market growth might include regulatory hurdles surrounding the legal framework for remote veterinary care, concerns regarding diagnostic accuracy limitations compared to in-person examinations, and the digital literacy gap among some pet owners and veterinarians. Nonetheless, the overall trend points towards significant and sustained market expansion. The leading companies mentioned—Agora.io, Anipanion, Linkyvet, Oncura Partners, TeleVet, Vetchat, VetCT, Vetoclock, and WellHaven Pet Health—are well-positioned to benefit from this growth, but competition is likely to intensify as more players enter the market. The regional breakdown will likely show North America and Europe as dominant markets initially, but Asia Pacific is projected to exhibit substantial growth potential due to its burgeoning pet ownership and increasing internet penetration.

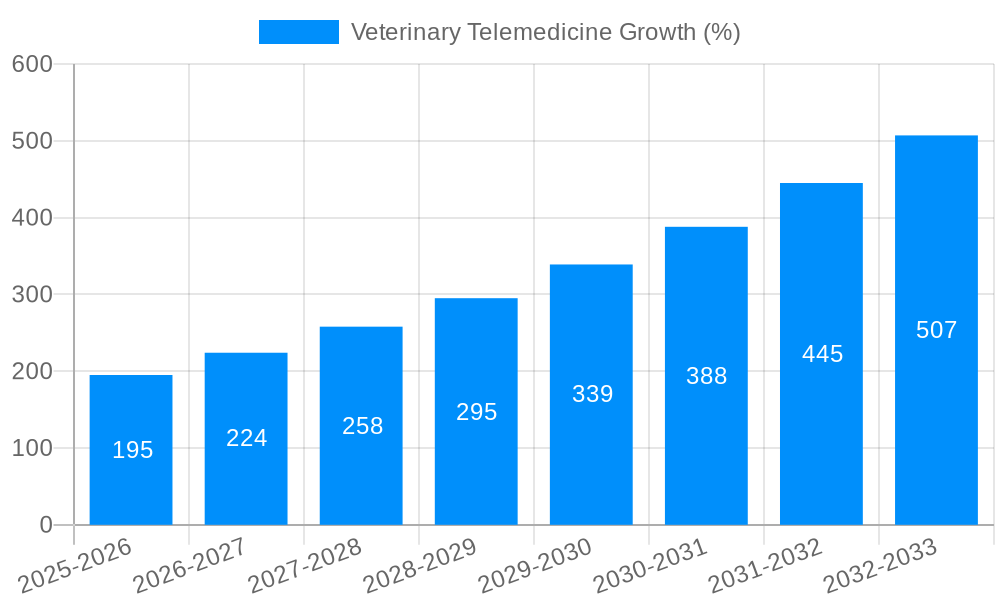

The veterinary telemedicine market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Our study, covering the period 2019-2033 with a base year of 2025, reveals a significant upward trajectory. Key market insights point towards a dramatic shift in how veterinary care is delivered, driven by increasing pet ownership, advancements in technology, and a growing demand for convenient and accessible healthcare options. The estimated market value in 2025 is already in the hundreds of millions, and the forecast period (2025-2033) anticipates consistent expansion fueled by several factors. The historical period (2019-2024) shows a clear trend of increasing adoption, setting the stage for substantial future growth. This growth is not uniform across all segments; some, such as internet-based consultations, are experiencing faster growth than others. The integration of telemedicine into existing veterinary practices is also a significant trend, with many clinics adopting it as a supplementary service rather than a complete replacement for in-person visits. Furthermore, the development of specialized telemedicine platforms tailored to the specific needs of veterinary professionals is creating a more streamlined and efficient workflow. This includes improved image sharing capabilities for radiographic and other diagnostic reports, leading to faster diagnosis and treatment. The market is also witnessing the emergence of innovative business models, including subscription services and partnerships between telemedicine providers and traditional veterinary clinics, further accelerating market expansion.

Several factors are converging to propel the remarkable growth of the veterinary telemedicine market. The rising number of companion animals globally, coupled with increasing pet owner disposable income, fuels demand for readily available veterinary services. Pet owners are increasingly tech-savvy and comfortable using digital platforms for various needs; this technological familiarity translates into a ready acceptance of telemedicine. The convenience factor is paramount; telemedicine offers consultations at any time and from anywhere, eliminating travel time and costs, particularly beneficial for pet owners in rural areas or those with mobility challenges. Cost-effectiveness also plays a significant role. While not always cheaper than in-person visits, telemedicine can reduce overall costs by minimizing travel expenses and potentially reducing the need for unnecessary in-person visits. Furthermore, the advancements in technology, including high-resolution video conferencing, secure data transmission, and sophisticated remote diagnostic tools, enhance the quality and reliability of telemedicine services. Finally, regulatory support and a growing awareness of the benefits of telemedicine among veterinary professionals are further strengthening the market's growth trajectory.

Despite the significant growth potential, the veterinary telemedicine market faces challenges. One major hurdle is the regulatory landscape, which varies considerably across different regions and countries. Navigating licensing requirements and ensuring compliance with data privacy regulations can be complex and costly for providers. The reliability of remote diagnostics remains a concern, as some conditions require hands-on physical examination for accurate diagnosis. Concerns regarding the quality of the patient-vet interaction in a remote setting, the potential for misdiagnosis due to a lack of physical examination, and limitations in performing certain procedures remotely also need to be addressed. Furthermore, ensuring adequate security and maintaining patient data privacy in a digital environment is crucial to build and maintain trust. Digital literacy among both pet owners and some veterinary professionals could also hinder adoption rates. Finally, the integration of telemedicine into established veterinary practices can present logistical and technological challenges requiring significant investment and training.

The North American market, specifically the United States, is expected to dominate the veterinary telemedicine market in the forecast period (2025-2033). This is primarily due to high pet ownership rates, increased technological adoption, and a robust healthcare infrastructure. However, European markets are showing significant growth, driven by increasing pet ownership and rising demand for convenient healthcare solutions.

Dominant Application Segment: The "Other" application segment, encompassing a wide range of telemedicine uses beyond imaging, is projected to capture a significant market share. This includes general consultations, behavioral advice, medication refills, and post-operative monitoring. The increasing demand for remote monitoring of chronic conditions in pets is also driving this segment's growth. Radiographic reporting and other imaging applications are also growing rapidly, propelled by advancements in digital imaging technologies and the ability to securely transmit high-quality images for remote interpretation.

Dominant Type Segment: Internet-based telemedicine is expected to be the dominant type, due to its widespread accessibility and flexibility. This includes video conferencing platforms, secure messaging systems, and online portals for scheduling appointments and accessing medical records. While telephone consultations still hold a niche, the internet offers a richer, more interactive experience.

In summary: The combination of high pet ownership, technological advancements, and convenience factors contributes significantly to the market share of North America (specifically the US), propelled primarily by the "Other" application segment and internet-based type of telemedicine. The forecast suggests that this dominance will continue throughout the forecast period.

Several key factors are accelerating the growth of the veterinary telemedicine industry. These include the rising prevalence of pet ownership, increased pet owner spending on pet healthcare, growing adoption of telemedicine amongst veterinarians, and significant technological advancements such as improved video conferencing, remote diagnostic tools, and secure data transmission capabilities. Furthermore, increasing awareness among pet owners about the convenience and affordability of telemedicine is also boosting market growth.

This report provides a comprehensive analysis of the veterinary telemedicine market, offering insights into market trends, growth drivers, challenges, and key players. The report covers both historical data (2019-2024) and future projections (2025-2033), providing a detailed understanding of the market's evolution and its future potential. It also segments the market by application, type, and geography, offering granular analysis for strategic decision-making. The report's data-driven approach is valuable for investors, veterinary professionals, technology providers, and anyone interested in this rapidly expanding field.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Agora.io, Anipanion, Linkyvet, Oncura Partners, TeleVet, Vetchat, VetCT, Vetoclock, WellHaven Pet Health, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Veterinary Telemedicine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Veterinary Telemedicine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.