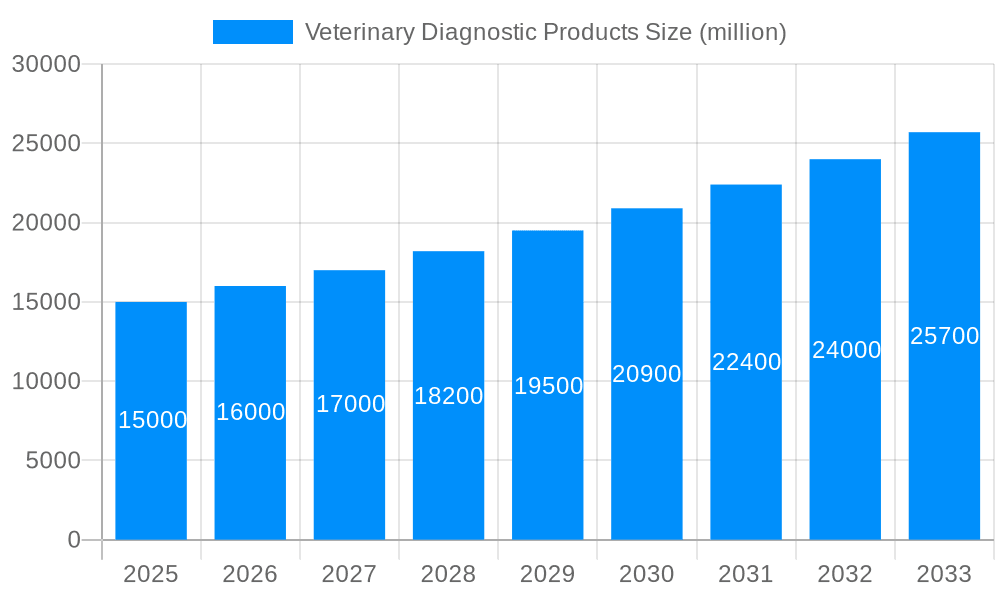

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Diagnostic Products?

The projected CAGR is approximately 7.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Veterinary Diagnostic Products

Veterinary Diagnostic ProductsVeterinary Diagnostic Products by Type (/> Instruments, Diagnostic Reagents, Consumables, Others), by Application (/> Veterinary Hospitals, Veterinary Clinics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global veterinary diagnostic products market is poised for significant expansion, driven by escalating pet adoption rates, heightened awareness of animal health, and continuous innovation in diagnostic technologies. This growth is underpinned by an increasing demand for swift, precise, and economical diagnostic solutions for a broad spectrum of animal ailments, encompassing infectious diseases, genetic predispositions, and other health concerns in companion animals, livestock, and poultry. Leading entities such as IDEXX Laboratories, Zoetis, and Thermo Fisher Scientific are instrumental in this market's upward trajectory through ongoing advancements, strategic product introductions, and key acquisitions. The market is delineated by product categories including diagnostic kits, instruments, and reagents; animal types such as companion animals, livestock, and poultry; and diagnostic technologies like molecular diagnostics, immunodiagnostics, and clinical chemistry. The rising incidence of zoonotic diseases, transferable between animals and humans, further underscores the critical need for sophisticated and accessible diagnostic infrastructure, propelling market growth.

Technological breakthroughs, including the integration of artificial intelligence and machine learning into diagnostic instruments, are markedly enhancing disease detection's speed, accuracy, and efficiency, thereby fostering superior disease management and animal welfare. Nevertheless, market growth is moderated by the high investment required for advanced diagnostic technologies and a shortage of veterinary professionals in certain geographies. Despite these constraints, the veterinary diagnostic products market projects a favorable long-term outlook, anticipating sustained growth fueled by the aforementioned drivers. The expanding adoption of point-of-care diagnostics within veterinary practices is optimizing diagnostic workflows and improving access to immediate diagnostic services. Furthermore, the market is observing a growing emphasis on personalized medicine for animals, tailoring diagnostic approaches to the specific requirements of individual animals and breeds.

The veterinary diagnostic products market is experiencing robust growth, driven by several key factors. The increasing pet ownership globally, coupled with rising pet humanization, is significantly boosting demand for advanced diagnostic tools. Owners are increasingly willing to invest in their pets' health, leading to a surge in veterinary visits and the utilization of sophisticated diagnostic tests. Technological advancements within the sector are also pivotal. The development of rapid, point-of-care diagnostics, molecular diagnostics, and advanced imaging technologies are enhancing diagnostic accuracy, speed, and efficiency. This is particularly crucial for early disease detection and timely intervention, improving animal welfare and overall treatment outcomes. Furthermore, the expanding veterinary services sector, with an increasing number of specialized veterinary clinics and hospitals, necessitates a wider range of diagnostic products to meet the evolving needs of practitioners. The market is witnessing a shift towards integrated diagnostic solutions, providing veterinarians with comprehensive platforms to manage and analyze data efficiently, improving workflow and providing better patient care. The rising prevalence of zoonotic diseases, diseases transmissible from animals to humans, is also increasing the focus on advanced diagnostic capabilities to prevent outbreaks and protect public health. This trend is fueling further investment in research and development within the veterinary diagnostic field. In the period 2019-2024, the market witnessed a substantial growth, exceeding 100 million units, setting the stage for continued expansion in the forecast period (2025-2033). The estimated market size in 2025 is projected to be over 150 million units, reflecting this upward trajectory.

Several key factors are propelling the growth of the veterinary diagnostic products market. The rising pet ownership rates worldwide, especially in developing economies, is a primary driver. As more people adopt pets, the demand for veterinary services, including diagnostic testing, increases proportionally. Simultaneously, the increasing humanization of pets, where pets are treated more like family members, leads to greater investment in their healthcare, stimulating demand for advanced diagnostic tools. Technological advancements are significantly shaping the market. The development of faster, more accurate, and portable diagnostic tools, such as point-of-care tests and molecular diagnostics, is increasing accessibility and efficiency. These innovations streamline workflows in veterinary clinics and provide quicker diagnostic results, facilitating prompt treatment interventions. Furthermore, the growing prevalence of chronic diseases in animals, mirroring human health trends, fuels demand for advanced diagnostics for early detection and management. The expansion of the veterinary profession, with more specialized clinics and hospitals, also supports the market's growth, creating a wider need for a diverse range of diagnostic tools. Government initiatives and regulations aimed at improving animal health and safety further contribute to market expansion by promoting the adoption of advanced diagnostic technologies.

Despite significant growth potential, the veterinary diagnostic products market faces several challenges. High costs associated with advanced diagnostic equipment and technologies can pose a barrier to adoption, particularly for smaller veterinary practices with limited budgets. The regulatory landscape for veterinary diagnostics varies across different countries, creating complexities for manufacturers in navigating approval processes and ensuring compliance. Competition among established players and the emergence of new entrants in the market can also intensify price pressures and affect profit margins. Maintaining the accuracy and reliability of diagnostic results is crucial, and any inaccuracies can have significant implications for animal health and treatment decisions. Therefore, stringent quality control and assurance measures are necessary, adding to operational costs. Additionally, the need for skilled personnel to operate and interpret results from advanced diagnostic equipment can create a demand-supply gap in certain regions, limiting the accessibility of certain technologies. Finally, the ongoing global economic uncertainties can impact veterinary healthcare spending, potentially affecting the market’s growth trajectory.

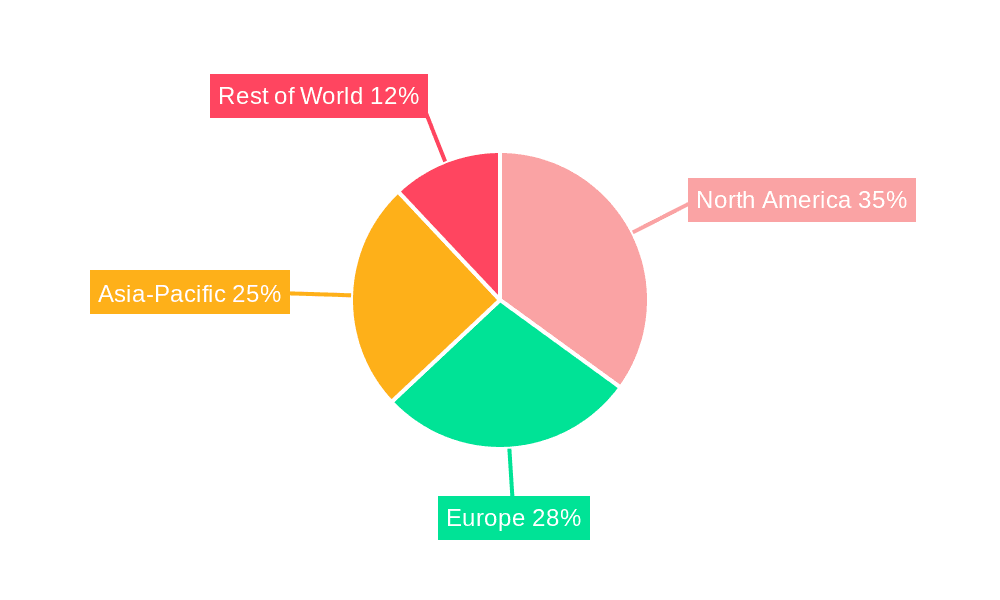

North America and Europe: These regions are expected to dominate the market due to high pet ownership rates, advanced healthcare infrastructure, and a high adoption rate of advanced diagnostic technologies. The presence of established veterinary practices and a strong regulatory framework further contributes to market expansion in these regions.

Asia-Pacific: This region is experiencing rapid growth, driven by rising pet ownership, increasing disposable incomes, and growing awareness of animal health. However, market penetration of advanced diagnostic tools is still lower compared to North America and Europe, representing a significant growth opportunity.

Segments:

The growth of these segments is fueled by the factors mentioned earlier: increased pet ownership, technological advancements, and the focus on early disease detection and preventative healthcare. The market's future success will hinge on the continuous innovation and development of affordable and accessible diagnostic tools for a wider range of veterinary practices and pet owners.

Several factors are accelerating growth within the veterinary diagnostic products industry. The increasing prevalence of zoonotic diseases necessitates rapid and accurate diagnostics for both animal and public health protection. The development of personalized medicine approaches in veterinary care, tailoring treatments to individual animal needs, necessitates more sophisticated diagnostic tools. Moreover, the rise of telemedicine and remote diagnostic capabilities is expanding access to testing in geographically remote areas or for animals with limited mobility. Finally, government investments in research and development of new diagnostic technologies are further fueling innovation and market expansion.

This report provides a comprehensive overview of the veterinary diagnostic products market, covering historical data, current market estimations, and future forecasts. The study analyzes market trends, growth drivers, challenges, key players, and significant developments. It offers detailed segmentation by product type, technology, application, and geographic region, providing a granular understanding of market dynamics. The report also includes competitive landscape analysis, highlighting key players' strategies and market positioning. This information is valuable for businesses involved in the veterinary diagnostic sector, investors, and researchers seeking an in-depth understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.8%.

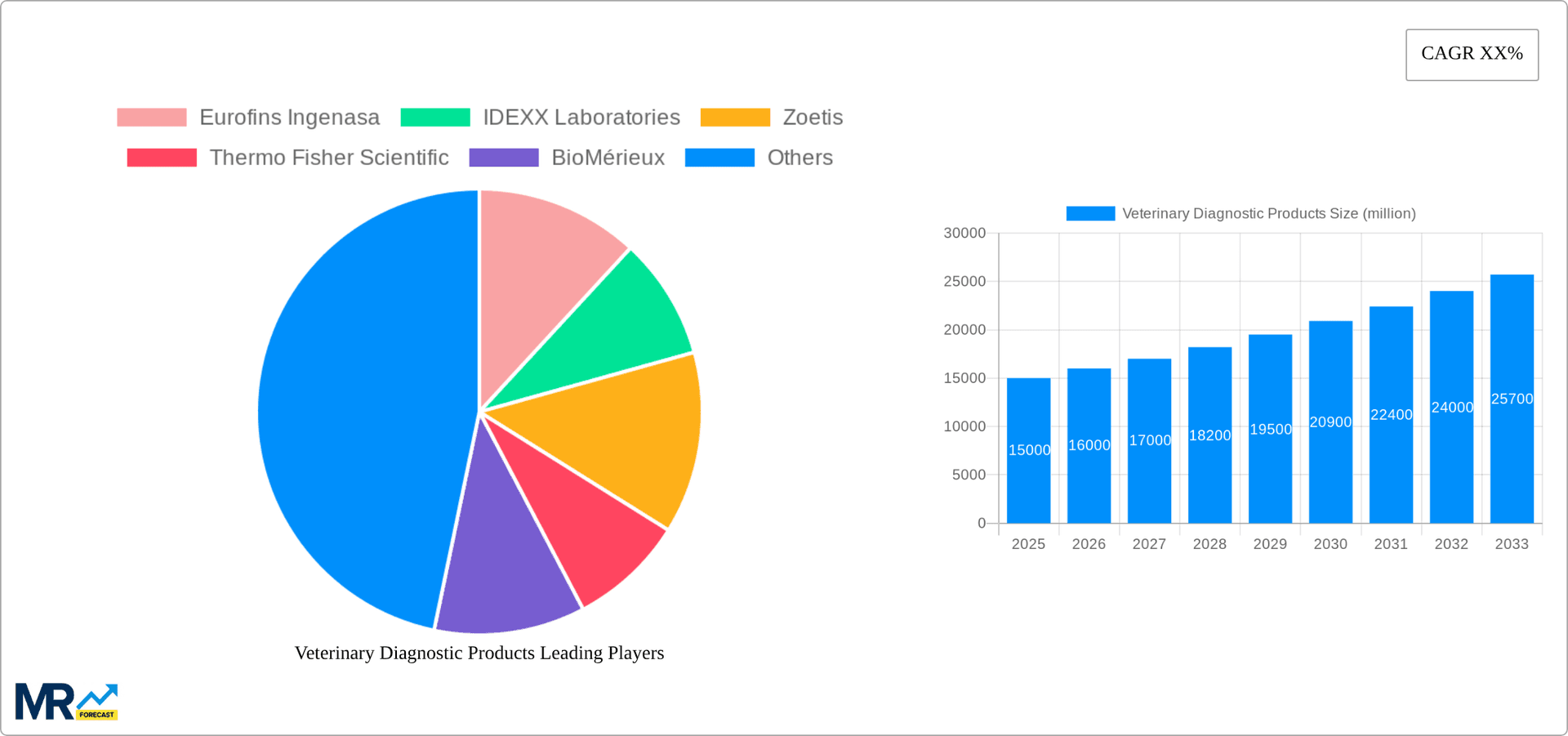

Key companies in the market include Eurofins Ingenasa, IDEXX Laboratories, Zoetis, Thermo Fisher Scientific, BioMérieux, Bio-Rad Laboratories, INDICAL BIOSCIENCE GmbH, Neogen, IDvet, Heska Corporation, Royal GD, Randox Laboratories Ltd, Virbac.

The market segments include Type, Application.

The market size is estimated to be USD 3.68 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Veterinary Diagnostic Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Veterinary Diagnostic Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.