1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Rocker Panel?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Vehicle Rocker Panel

Vehicle Rocker PanelVehicle Rocker Panel by Type (Single, Double, Others, World Vehicle Rocker Panel Production ), by Application (Passenger Vehicle, Commercial Vehicle, World Vehicle Rocker Panel Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

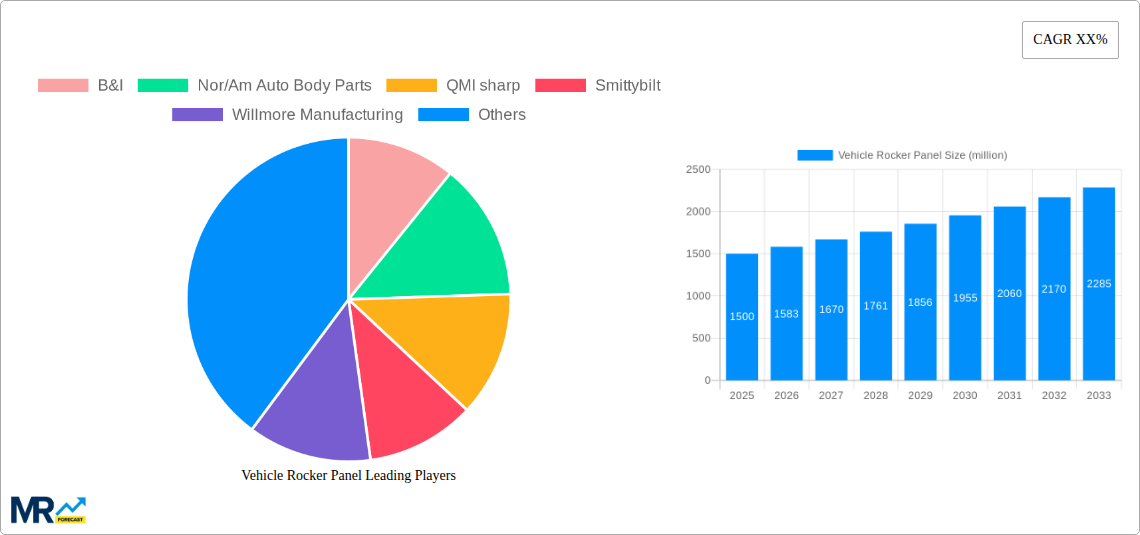

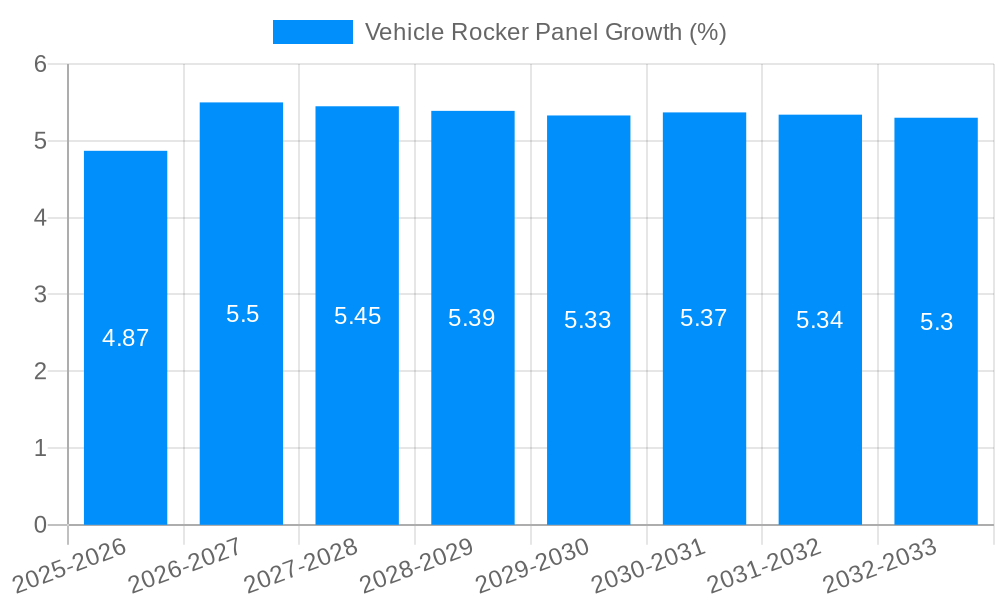

The global Vehicle Rocker Panel market is poised for significant expansion, projected to reach an estimated market size of approximately $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of roughly 5.5% through 2033. This upward trajectory is primarily fueled by the increasing production of both passenger and commercial vehicles worldwide, necessitating a continuous demand for rocker panels as crucial structural and protective components. The growing emphasis on vehicle aesthetics and customization further contributes to market growth, as aftermarket rocker panels offer enhanced visual appeal and off-road ruggedness. Key drivers include rising disposable incomes in emerging economies, leading to increased vehicle ownership, and advancements in manufacturing technologies that allow for more durable and cost-effective rocker panel production. The market is segmented into single, double, and other types, with single rocker panels likely dominating due to their widespread application in standard vehicle designs.

However, the market faces certain restraints, including the fluctuating prices of raw materials like steel and aluminum, which can impact manufacturing costs. The increasing adoption of lighter, composite materials in vehicle construction, while offering benefits, could also present a challenge for traditional metal rocker panel manufacturers if they fail to adapt. Furthermore, stringent automotive safety regulations, while promoting overall vehicle integrity, may necessitate specific design and material considerations for rocker panels, potentially increasing development costs. Despite these challenges, the overarching trend towards greater vehicle personalization, coupled with the essential role of rocker panels in protecting against road debris and enhancing chassis rigidity, ensures a sustained and healthy growth outlook for the market. Key players like B&I, Nor/Am Auto Body Parts, and Smittybilt are actively innovating and expanding their product portfolios to cater to evolving consumer demands and market dynamics.

This report provides an in-depth analysis of the global vehicle rocker panel market, a critical component in both structural integrity and aesthetic enhancement of automobiles. The study spans a significant period, from 2019-2033, with a Base Year of 2025 and an Estimated Year also of 2025. The comprehensive Forecast Period extends from 2025-2033, building upon the Historical Period of 2019-2024. We project the World Vehicle Rocker Panel Production to reach $2,500 million in 2025, with robust growth anticipated throughout the forecast period. This multi-million dollar market is characterized by evolving automotive design, increasing demand for vehicle customization, and stringent safety regulations, all of which are meticulously examined within this report.

XXX The global vehicle rocker panel market is experiencing dynamic shifts driven by a confluence of technological advancements, evolving consumer preferences, and stringent regulatory landscapes. In the Base Year of 2025, the market is valued at an impressive $2,500 million and is poised for substantial expansion through 2033. A significant trend is the increasing adoption of advanced materials, moving beyond traditional steel to incorporate lightweight yet durable composites, high-strength plastics, and even aluminum alloys. This shift is directly influenced by the automotive industry's relentless pursuit of fuel efficiency and reduced emissions, where weight reduction plays a pivotal role. Furthermore, the aesthetic aspect of rocker panels is gaining prominence. Manufacturers are increasingly offering a wider range of designs, finishes, and customization options to cater to the growing demand for personalized vehicles. This includes the proliferation of aftermarket rocker panels designed for enhanced visual appeal, off-road protection, and aerodynamic improvements. The evolution of manufacturing techniques, such as advanced stamping, robotic welding, and precise injection molding, is also contributing to higher production volumes and improved quality, further bolstering the market's growth trajectory. The World Vehicle Rocker Panel Production is expected to see a CAGR of approximately 5.8% from 2025 to 2033. The increasing complexity of vehicle designs, with integrated side skirts and aerodynamic elements, necessitates sophisticated rocker panel solutions that seamlessly blend functionality and form. This intricate interplay between structural necessity and design aspiration is defining the current and future landscape of the vehicle rocker panel market. Consumer demand for enhanced vehicle durability and protection against road debris and minor impacts is also a key driver, pushing the development of more robust and impact-resistant rocker panel designs. The aftermarket segment, in particular, is a hotbed of innovation, offering solutions that not only protect but also elevate the visual appeal of a wide range of vehicle types, from rugged SUVs to sleek sedans. The report also delves into regional variations, highlighting the distinct market dynamics shaping the adoption of various rocker panel technologies and designs across different geographical territories, all contributing to the global market's multi-million dollar valuation.

The vehicle rocker panel market is propelled by a synergistic interplay of several key factors. Foremost among these is the ever-increasing global automotive production volume. As more passenger and commercial vehicles roll off assembly lines, the inherent demand for rocker panels, a fundamental structural and protective component, escalates proportionally. The ongoing emphasis on vehicle safety and crashworthiness further bolsters this demand. Rocker panels play a crucial role in absorbing impact energy during side collisions and protecting the vehicle's undercarriage, making them indispensable for meeting stringent safety regulations worldwide. Moreover, the burgeoning aftermarket sector, driven by consumer desire for vehicle customization and personalization, acts as a significant growth catalyst. Owners are increasingly investing in aftermarket rocker panels that enhance aesthetics, provide off-road protection, or improve aerodynamic efficiency, thereby contributing significantly to the World Vehicle Rocker Panel Production. The report estimates this segment to contribute an additional $700 million to the market by 2033. The growing popularity of Sports Utility Vehicles (SUVs) and pickup trucks, which often feature more robust and visually prominent rocker panels for rugged terrain and aesthetic appeal, also contributes to market expansion. The continuous innovation in material science, leading to the development of lighter, stronger, and more corrosion-resistant materials, is enabling manufacturers to produce more efficient and aesthetically pleasing rocker panels, further fueling market growth.

Despite the promising growth trajectory, the vehicle rocker panel market faces certain challenges and restraints that could temper its expansion. The fluctuating raw material costs, particularly for metals like steel and aluminum, can significantly impact manufacturing expenses and profitability. Volatility in these prices, influenced by global commodity markets and geopolitical factors, poses a continuous challenge for manufacturers in maintaining stable pricing and profit margins. Furthermore, the increasing complexity of vehicle designs and the integration of advanced technologies, such as sensor arrays and active aerodynamics, can lead to more intricate rocker panel designs. This complexity may necessitate specialized tooling and manufacturing processes, potentially increasing production costs and lead times. The stringent and evolving safety and environmental regulations across different regions can also present a hurdle. Manufacturers must continuously invest in research and development to ensure their rocker panel solutions meet these ever-changing standards, adding to operational expenses. The competitive landscape, with a large number of established players and emerging manufacturers, can also lead to price wars and pressure on margins, especially in the highly commoditized segments. The historical data from 2019-2024 indicates a trend of consolidation in this space, as smaller players struggle to compete on price and scale. Additionally, the rise of electric vehicles (EVs) presents a unique challenge and opportunity. While EVs still require rocker panels for structural integrity, the design considerations might differ due to battery pack integration and different chassis architectures, requiring manufacturers to adapt their offerings. The global market for rocker panels for EVs is projected to reach $450 million by 2033, representing a significant, albeit evolving, segment.

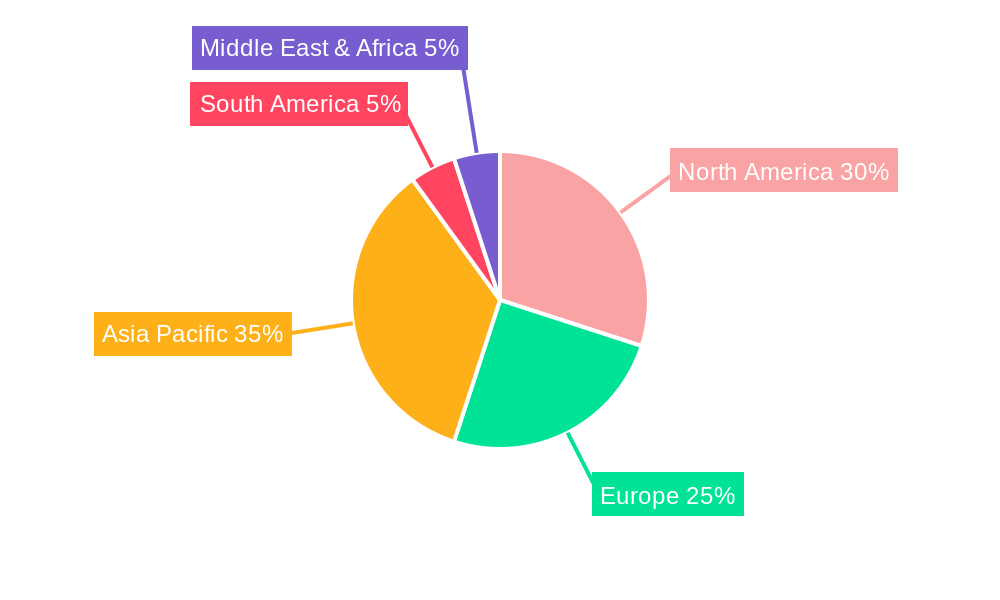

The global vehicle rocker panel market is a dynamic landscape, with certain regions and segments poised to lead its expansion.

North America: This region is a dominant force, driven by a high concentration of automotive manufacturing and a robust aftermarket culture. The strong consumer preference for SUVs and trucks, coupled with a well-established automotive repair and customization industry, ensures a consistent demand for high-quality rocker panels. The market in North America for passenger vehicles alone is projected to reach $900 million by 2033. Companies like Smittybilt and Rugged Ridge have a significant presence here, catering to the off-road and performance modification segments.

Asia-Pacific: This region represents the fastest-growing market, fueled by the sheer volume of automotive production in countries like China, Japan, South Korea, and India. The expanding middle class and increasing disposable incomes are leading to higher vehicle ownership rates, consequently driving the demand for both original equipment (OE) and aftermarket rocker panels. The commercial vehicle segment in this region is also seeing substantial growth, with a need for durable and protective rocker panels. The market for commercial vehicles in Asia-Pacific is estimated to grow at a CAGR of 6.5% from 2025-2033.

Europe: While a mature market, Europe continues to be a significant contributor, particularly with its stringent safety standards and a focus on innovative materials and aerodynamic designs. The increasing adoption of electric vehicles in Europe also presents new opportunities and design considerations for rocker panel manufacturers. The demand for "Others" type rocker panels, incorporating advanced features and materials, is particularly strong in this region.

Application: Passenger Vehicle: This segment consistently holds the largest market share due to the sheer volume of passenger cars produced globally. The demand for aesthetically pleasing and functional rocker panels for everyday use drives continuous innovation and production in this area. The Passenger Vehicle segment is estimated to constitute 65% of the total World Vehicle Rocker Panel Production in 2025.

Type: Single Rocker Panels: While double rocker panels offer enhanced protection, the widespread adoption and cost-effectiveness of single rocker panels make them the most prevalent type, particularly for mass-produced passenger vehicles. Their simplicity in design and manufacturing contributes to their market dominance.

The interplay between these regions and segments creates a complex but ultimately growth-oriented market. The World Vehicle Rocker Panel Production is anticipated to reach $4,000 million by 2033, with North America and Asia-Pacific spearheading this growth, supported by strong demand in the passenger vehicle and single rocker panel segments.

The vehicle rocker panel industry is experiencing significant growth, fueled by several key catalysts. The continuous advancements in automotive design and the increasing demand for vehicle personalization are primary drivers. Consumers are looking for rocker panels that not only provide protection but also enhance the vehicle's aesthetic appeal, leading to greater demand for custom and aftermarket solutions. Furthermore, the growing global automotive production, particularly in emerging economies, directly translates into a larger market for all vehicle components, including rocker panels. The increasing emphasis on vehicle safety and the need to comply with evolving crashworthiness standards also contribute to consistent demand for robust rocker panel designs. The development of lightweight and durable materials is another significant catalyst, allowing for improved fuel efficiency and enhanced performance, which aligns with current automotive trends.

This report offers unparalleled comprehensive coverage of the vehicle rocker panel market, providing a detailed roadmap for stakeholders. It delves into the intricate market dynamics, from the historical performance of the 2019-2024 period to the projected growth through 2033, with a keen focus on the Base Year of 2025 where the market is valued at $2,500 million. The analysis meticulously segments the market by Type (Single, Double, Others) and Application (Passenger Vehicle, Commercial Vehicle), offering granular insights into the performance and potential of each category. Furthermore, it thoroughly examines the World Vehicle Rocker Panel Production landscape, identifying key players like B&I and Smittybilt and their strategic contributions. The report's strength lies in its holistic approach, dissecting the driving forces, challenges, regional dominance, and significant developments shaping this vital automotive segment, making it an indispensable resource for informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include B&I, Nor/Am Auto Body Parts, QMI sharp, Smittybilt, Willmore Manufacturing, Auto Metal Direct, C2C Fabrication, Innovative Creations, Putco, Rugged Ridge, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Vehicle Rocker Panel," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vehicle Rocker Panel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.