1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle On-Board Diagnostics System?

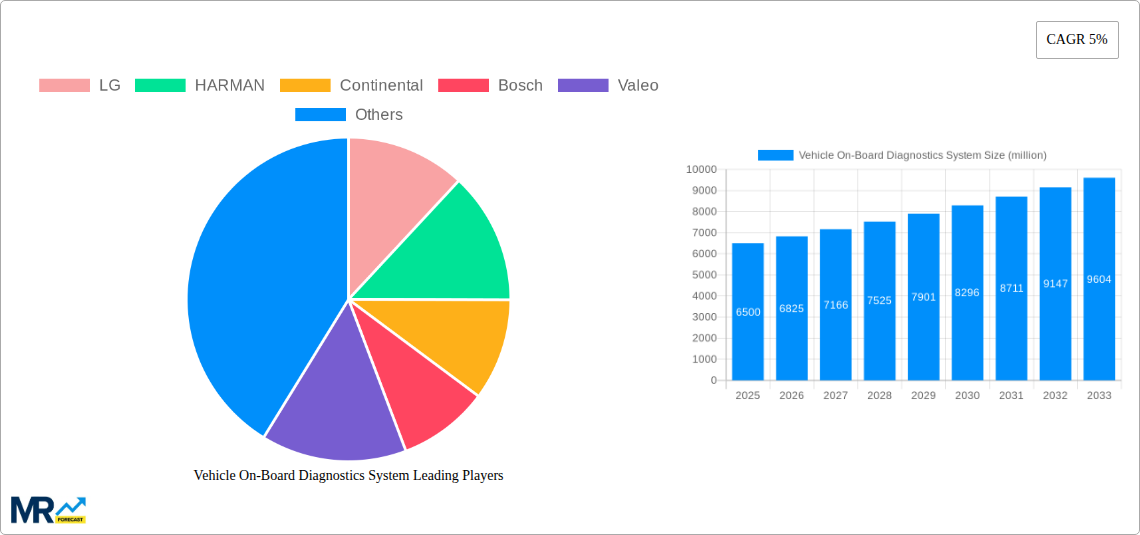

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Vehicle On-Board Diagnostics System

Vehicle On-Board Diagnostics SystemVehicle On-Board Diagnostics System by Type (2G/3G, 4G/5G, World Vehicle On-Board Diagnostics System Production ), by Application (Passenger Car, Commercial Vehicle, World Vehicle On-Board Diagnostics System Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Vehicle On-Board Diagnostics (OBD) System market is poised for significant expansion, projected to reach approximately $8,500 million by 2033, driven by a Compound Annual Growth Rate (CAGR) of 5% from 2019 to 2033. This robust growth is primarily fueled by increasingly stringent automotive emission regulations worldwide, compelling manufacturers to integrate advanced OBD systems for real-time monitoring and reporting of vehicle performance and environmental impact. The escalating demand for connected vehicles, coupled with the proliferation of advanced driver-assistance systems (ADAS) and the growing complexity of vehicle electronics, further propels the market. Furthermore, the widespread adoption of 4G/5G connectivity in vehicles is unlocking new opportunities for remote diagnostics, predictive maintenance, and enhanced data analytics, making OBD systems an indispensable component for both passenger and commercial vehicles. The market is segmented into 2G/3G and 4G/5G types, with the latter experiencing accelerated adoption due to its superior data transmission capabilities. Applications span across passenger cars and commercial vehicles, both of which are benefiting from improved diagnostics for safety and efficiency.

Key market restraints include the initial high cost of implementing sophisticated OBD systems and the need for continuous software updates to keep pace with evolving technologies and regulations. Cybersecurity concerns associated with connected vehicle data also present a challenge. However, these are being addressed through ongoing research and development and strategic collaborations among industry players. Major companies like LG, HARMAN, Continental, Bosch, Valeo, Denso, Marelli, Visteon, Actia, Ficosa, Flaircomm Microelectronics, Xiamen Yaxon Network, and Huawei are actively investing in innovation and expanding their product portfolios to capture a larger market share. The Asia Pacific region, particularly China and India, is expected to witness the highest growth owing to rapid vehicle sales and increasing government initiatives promoting vehicle emissions control and smart mobility. North America and Europe, with their established automotive industries and strong regulatory frameworks, will continue to be significant markets.

The global Vehicle On-Board Diagnostics (OBD) System market is poised for substantial growth, with projections indicating a market size of over $35,000 million by 2033. This expansion is driven by a confluence of factors, including increasing regulatory mandates for vehicle emissions and safety, a growing global vehicle parc, and the accelerating integration of advanced technologies within vehicles. The Study Period of 2019-2033 encompasses a dynamic evolution of OBD systems, from foundational diagnostic capabilities to sophisticated, connected platforms. The Base Year of 2025 serves as a critical pivot point, reflecting the current landscape shaped by ongoing technological advancements and evolving consumer expectations. The Estimated Year of 2025 further solidifies this baseline, while the Forecast Period of 2025-2033 will witness the most significant shifts. Historical data from 2019-2024 provides essential context, illustrating the foundational growth trajectory and early adoption of digital diagnostic solutions. A key trend observed is the transition from reactive diagnostics to proactive and predictive maintenance. Modern OBD systems are no longer solely about fault detection; they are increasingly leveraged for real-time performance monitoring, remote diagnostics, and personalized driver insights. The increasing complexity of vehicle architectures, particularly with the advent of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), necessitates more robust and interconnected OBD solutions. This complexity, while presenting a challenge, also acts as a significant driver for innovation. The market is witnessing a diversification of OBD solutions, catering to different vehicle types and end-user needs. From basic fault code readers to comprehensive fleet management platforms, the scope of OBD applications is broadening considerably. The integration of telematics and cloud-based data analytics is transforming how vehicle data is collected, processed, and utilized, paving the way for a more intelligent and efficient automotive ecosystem. Furthermore, the increasing demand for over-the-air (OTA) updates and remote vehicle diagnostics is a significant trend, allowing for software updates and fault resolution without the need for physical dealership visits. This shift not only enhances customer convenience but also reduces operational costs for manufacturers and service providers. The growing emphasis on cybersecurity within connected vehicles is also influencing OBD system design, ensuring the integrity and security of the diagnostic data transmitted. The evolution of OBD standards, such as OBD-II and emerging advancements, further shapes market dynamics, ensuring interoperability and consistent diagnostic capabilities across diverse vehicle makes and models.

The global Vehicle On-Board Diagnostics (OBD) System market's upward trajectory is primarily propelled by a multifaceted set of driving forces. Foremost among these is the stringent and ever-evolving regulatory landscape concerning vehicle emissions and safety standards worldwide. Governments are increasingly mandating sophisticated diagnostic capabilities to ensure vehicles comply with environmental regulations and to promote road safety. This drives demand for advanced OBD systems that can accurately monitor and report critical parameters. Coupled with this is the sheer volume of vehicles on the road. The global vehicle parc continues to expand, particularly in emerging economies, creating a vast installed base for both new OBD system installations and aftermarket services. As vehicles become more complex, with sophisticated electronic control units (ECUs) and integrated systems like ADAS and powertrains, the need for effective diagnostic tools to maintain their optimal performance and identify issues early becomes paramount. This technological advancement within vehicles themselves directly fuels the demand for more advanced OBD solutions. Furthermore, the growing awareness among vehicle owners and fleet managers about the benefits of proactive maintenance – such as reduced downtime, lower repair costs, and extended vehicle lifespan – is a significant driver. OBD systems facilitate this by enabling early detection of potential problems, thereby preventing more severe and expensive breakdowns. The expansion of the connected car ecosystem, with its emphasis on data collection and remote services, also plays a crucial role. OBD systems are the gateway to much of this vehicle data, enabling applications like predictive maintenance, remote diagnostics, and personalized driver feedback, thus further solidifying their importance in the modern automotive industry.

Despite the robust growth prospects, the Vehicle On-Board Diagnostics (OBD) System market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the increasing complexity and fragmentation of vehicle architectures. With the rise of diverse powertrain technologies, including EVs and hybrids, and the integration of numerous ECUs, developing a universal OBD solution that seamlessly communicates with all systems can be a substantial technical challenge. This complexity also leads to higher development costs for manufacturers. Another restraint is the evolving nature of data security and privacy concerns. As OBD systems collect and transmit sensitive vehicle data, ensuring robust cybersecurity measures to prevent unauthorized access and data breaches is critical. Any major security lapse could erode consumer trust and lead to significant regulatory scrutiny. Furthermore, the cost of implementing and upgrading advanced OBD systems can be a barrier, especially for older vehicle models or in price-sensitive markets. The upfront investment required for sophisticated diagnostic hardware and software, coupled with ongoing maintenance and calibration costs, can deter some consumers and fleet operators. The global shortage of skilled technicians capable of interpreting and utilizing the data from advanced OBD systems also presents a challenge. Proper training and upskilling of the automotive workforce are essential to fully leverage the potential of these systems. Finally, the lack of standardization in certain regions or for specific vehicle types can lead to interoperability issues, hindering seamless data exchange and diagnostic processes, thus creating a fragmented market landscape that requires continuous effort towards harmonization.

The global Vehicle On-Board Diagnostics (OBD) System market is anticipated to witness significant dominance from North America and Asia Pacific regions, driven by distinct yet complementary factors.

North America:

Asia Pacific:

Dominant Segments:

Among the various segments within the Vehicle On-Board Diagnostics System market, the 4G/5G type and the Passenger Car application segment are poised for significant dominance, driven by technological advancements and market demand respectively.

Type: 4G/5G

Application: Passenger Car

Several key growth catalysts are fueling the expansion of the Vehicle On-Board Diagnostics (OBD) System industry. The increasing stringency of global emissions and safety regulations is a primary driver, compelling manufacturers to integrate more advanced diagnostic capabilities into their vehicles. Furthermore, the accelerating integration of connected car technologies and the proliferation of telematics are creating a demand for systems that can collect, transmit, and analyze vast amounts of vehicle data, enabling services like predictive maintenance and remote diagnostics. The growing global vehicle parc, especially in emerging economies, provides a substantial market base, while a rising consumer awareness of the benefits of proactive vehicle maintenance and the desire for improved vehicle performance and longevity further contribute to market growth.

This report provides a comprehensive analysis of the global Vehicle On-Board Diagnostics (OBD) System market, delving into intricate details of its growth trajectory and future potential. It offers in-depth insights into market trends, identifying key drivers such as evolving regulatory mandates and the burgeoning connected car ecosystem. The report meticulously examines the challenges and restraints, including the increasing complexity of vehicle architectures and data security concerns, offering strategic perspectives on navigating these obstacles. With detailed regional and segment analyses, it highlights the dominant markets and application areas, providing actionable intelligence for stakeholders. The report also identifies crucial growth catalysts and leading players, painting a holistic picture of the competitive landscape and future opportunities within the industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include LG, HARMAN, Continental, Bosch, Valeo, Denso, Marelli, Visteon, Actia, Ficosa, Flaircomm Microelectronics, Xiamen Yaxon Network, Huawei, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Vehicle On-Board Diagnostics System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vehicle On-Board Diagnostics System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.