1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle High-precision Positioning?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Vehicle High-precision Positioning

Vehicle High-precision PositioningVehicle High-precision Positioning by Type (5G Positioning, UWB Positioning, Hybrid Positioning, World Vehicle High-precision Positioning Production ), by Application (Passenger Car, Commercial Vehicle, World Vehicle High-precision Positioning Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

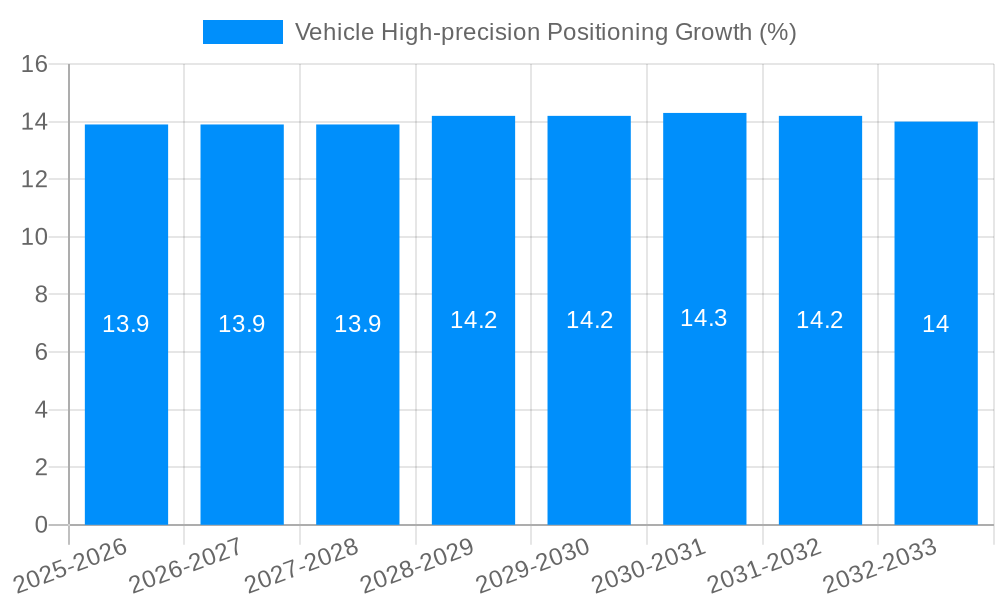

The global Vehicle High-precision Positioning market is poised for substantial expansion, projected to reach an estimated market size of $2620.5 million by 2025. This growth is primarily fueled by the escalating demand for advanced driver-assistance systems (ADAS) and the increasing adoption of autonomous driving technologies across both passenger and commercial vehicles. The integration of sophisticated navigation and location-aware services is no longer a luxury but a necessity for enhancing vehicle safety, efficiency, and user experience. Key drivers include regulatory mandates for safety features, the continuous innovation in sensor fusion and positioning algorithms, and the burgeoning automotive industry's focus on connected car ecosystems. Emerging trends like the convergence of 5G and Ultra-Wideband (UWB) technologies for centimeter-level accuracy, alongside the development of robust indoor and outdoor positioning solutions, are shaping the competitive landscape and opening new avenues for market players. The ability to provide highly accurate and reliable positioning data is critical for the successful deployment of autonomous functionalities, making this market a pivotal area of development in the automotive sector.

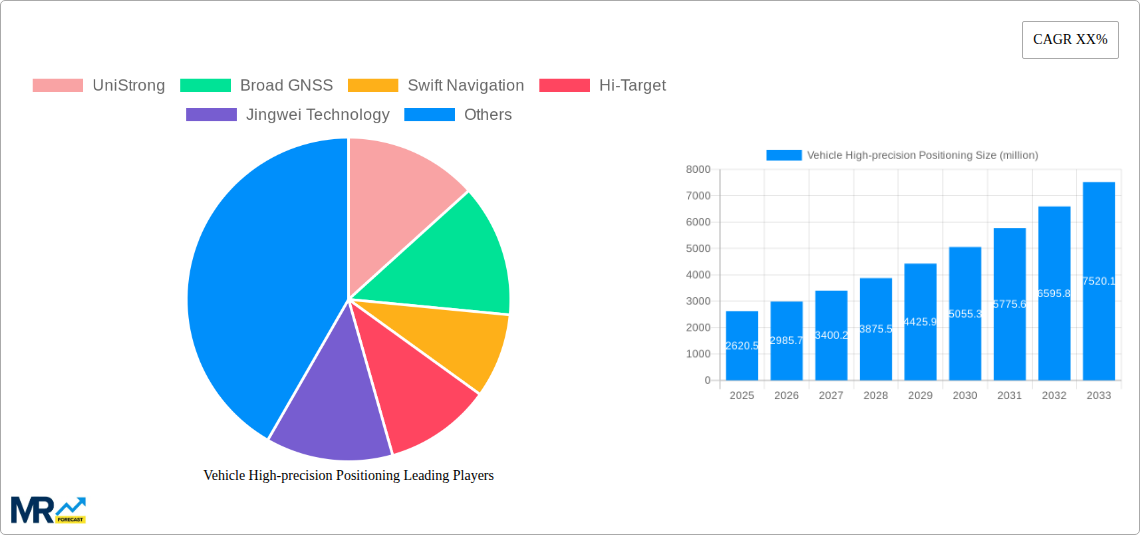

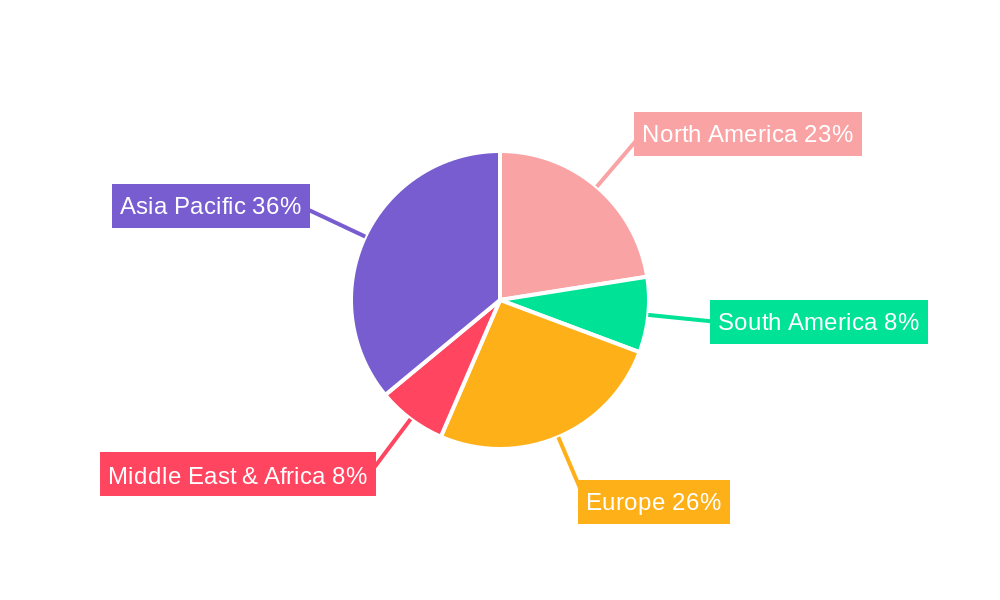

The market's trajectory indicates a strong Compound Annual Growth Rate (CAGR) through the forecast period of 2025-2033, driven by continued technological advancements and wider market penetration. While the adoption of hybrid positioning solutions is gaining traction due to their enhanced reliability and accuracy, challenges such as the cost of implementation for certain advanced technologies and the need for standardized infrastructure may present some restraints. However, these are expected to be largely overcome by ongoing research and development and strategic partnerships between technology providers and automotive manufacturers. The diverse application across passenger cars and commercial vehicles underscores the broad market appeal. Geographically, the Asia Pacific region, particularly China, is expected to be a significant growth engine due to its large automotive production base and rapid technological adoption. North America and Europe will also remain crucial markets, driven by stringent safety regulations and a strong emphasis on innovation in autonomous driving. The competitive environment is characterized by established players and emerging innovators, all vying to capture market share through product differentiation and strategic collaborations.

This comprehensive report delves into the dynamic landscape of Vehicle High-precision Positioning, offering an in-depth analysis of market trends, driving forces, challenges, and key players. The study encompasses a broad scope, covering the period from 2019 to 2033, with a particular focus on the base and estimated year of 2025, and a detailed forecast for 2025-2033. The historical performance from 2019-2024 is also meticulously examined. With a projected World Vehicle High-precision Positioning Production valued in the millions, the report provides valuable insights for stakeholders seeking to navigate this rapidly evolving sector. The analysis extends to various segments, including 5G Positioning, UWB Positioning, and Hybrid Positioning technologies, and their application across Passenger Cars and Commercial Vehicles. Furthermore, the report investigates crucial industry developments and their impact on the market's trajectory.

The global market for Vehicle High-precision Positioning is experiencing a paradigm shift, moving beyond basic navigation to enable a new era of intelligent transportation systems and autonomous driving. The historical period of 2019-2024 has witnessed a significant increase in the adoption of enhanced positioning technologies as automakers and technology providers recognized the critical need for centimeter-level accuracy and robust reliability. The estimated market value for World Vehicle High-precision Positioning Production in 2025 is poised to reach several million units, driven by the increasing sophistication of vehicle features and the growing demand for safety and efficiency. The base year of 2025 serves as a pivotal point, illustrating the current state of widespread adoption and technological maturity. Looking ahead into the forecast period of 2025-2033, the market is expected to witness exponential growth, with compound annual growth rates (CAGRs) exceeding expectations. This surge is fueled by the integration of high-precision positioning into advanced driver-assistance systems (ADAS), the development of fully autonomous vehicles, and the expansion of intelligent infrastructure. The evolution of 5G Positioning, offering enhanced latency and connectivity crucial for real-time positioning updates, is a significant trend. Simultaneously, Ultra-Wideband (UWB) Positioning is gaining traction for its ability to provide precise indoor and outdoor localization, especially within complex urban environments and parking scenarios. Hybrid Positioning, which strategically combines the strengths of GNSS (Global Navigation Satellite System) with other technologies like inertial measurement units (IMUs), Wi-Fi, and cellular data, is emerging as a dominant solution to overcome the limitations of individual technologies, particularly in challenging signal environments. The increasing investment in research and development by key players like UniStrong, Broad GNSS, Swift Navigation, and NovAtel is constantly pushing the boundaries of accuracy, integrity, and availability, paving the way for a future where precise vehicle positioning is a standard feature, not a luxury. The increasing focus on safety regulations and the pursuit of enhanced traffic management solutions further solidify the upward trajectory of this market.

Several potent forces are collectively propelling the growth of the Vehicle High-precision Positioning market. Foremost among these is the relentless pursuit of enhanced automotive safety. The integration of high-precision positioning is fundamental to the development and widespread deployment of Advanced Driver-Assistance Systems (ADAS), such as adaptive cruise control, lane-keeping assist, and automatic emergency braking. As vehicles become more sophisticated, the need for pinpoint accuracy in determining their exact location and orientation becomes paramount to ensure the correct functioning of these safety features and to prevent potential accidents. Furthermore, the burgeoning field of autonomous driving is a monumental catalyst. For self-driving vehicles to operate safely and effectively, they require an unprecedented level of positional accuracy, often down to the centimeter level. This necessitates sophisticated positioning systems that can reliably track the vehicle's position in real-time, irrespective of environmental conditions or signal availability. The expanding adoption of connected vehicle technologies, facilitated by advancements in 5G networks, is another significant driver. 5G Positioning offers lower latency and higher bandwidth, enabling real-time data exchange for critical positioning information, crucial for cooperative driving and intelligent traffic management. The growing demand for enhanced navigation experiences, including highly accurate mapping and routing in complex urban environments, also contributes to market expansion. Finally, regulatory mandates and evolving industry standards that prioritize safety and the development of autonomous capabilities are indirectly pushing for the widespread implementation of high-precision positioning solutions, ensuring a consistent and reliable performance across the automotive sector.

Despite the robust growth trajectory, the Vehicle High-precision Positioning market faces several significant challenges and restraints that warrant careful consideration. A primary obstacle is the cost of implementation. While the value of World Vehicle High-precision Positioning Production is rising, the integration of highly accurate positioning technologies, especially those involving advanced sensors and sophisticated algorithms, can significantly increase the overall cost of vehicles. This can be a deterrent for mass adoption, particularly in the cost-sensitive segments of the automotive market. Another critical challenge is accuracy degradation in challenging environments. GNSS signals, a foundational component of many positioning systems, are susceptible to interference and blockage in urban canyons, tunnels, and densely forested areas. This necessitates the reliance on more complex hybrid solutions, which can increase system complexity and cost. Cybersecurity concerns also pose a substantial threat. As positioning systems become more integrated and connected, they become potential targets for cyberattacks. Ensuring the integrity and security of positional data is paramount to prevent malicious manipulation that could lead to dangerous situations. The lack of standardization across different positioning technologies and communication protocols can also hinder interoperability and widespread adoption. Different manufacturers and technology providers may employ proprietary solutions, creating fragmentation and limiting seamless integration. Finally, regulatory hurdles and liability issues associated with autonomous driving and advanced ADAS features, which heavily rely on precise positioning, are still being defined and refined globally. The establishment of clear legal frameworks and liability models is crucial for fostering confidence and driving further investment in these technologies.

The global landscape of Vehicle High-precision Positioning is characterized by regional dominance driven by technological adoption rates, regulatory frameworks, and the presence of key industry players. Asia-Pacific, particularly China, is a significant region expected to dominate the market. This dominance stems from several intertwined factors. China's ambitious push towards intelligent transportation systems and the rapid development of its domestic automotive industry, including a strong focus on both Passenger Cars and Commercial Vehicles, has created a massive demand for advanced positioning solutions. The country’s leading role in 5G network deployment further supports the growth of 5G Positioning technologies. Companies like Jingwei Technology and China Mobile are at the forefront of developing and deploying these solutions within the region. The sheer volume of vehicle production and the government’s strategic initiatives to foster innovation in areas like autonomous driving provide a fertile ground for high-precision positioning technologies.

Within the segments, Hybrid Positioning is anticipated to hold a commanding position in terms of market share and growth. This is a direct consequence of the inherent limitations of individual positioning technologies. While GNSS offers wide-area coverage, it struggles in urban environments. UWB Positioning excels in short-range, high-accuracy localization but lacks the extensive coverage of GNSS. 5G Positioning promises enhanced real-time capabilities but relies on robust network infrastructure. Hybrid Positioning, by intelligently fusing data from multiple sources – including GNSS (from providers like Broad GNSS, NovAtel, Septentrio, ComNav Technology, and Sixents Technology), IMUs, Wi-Fi, and cellular signals – offers a robust, reliable, and highly accurate solution that can overcome the weaknesses of any single technology. This makes it indispensable for critical applications such as autonomous driving and advanced ADAS, which require continuous and dependable positional accuracy across diverse operating conditions. The ability of Hybrid Positioning to achieve centimeter-level accuracy consistently, even in challenging environments, makes it the preferred choice for automakers aiming for superior performance and safety. The increasing maturity of algorithms and sensor fusion techniques further solidifies the dominance of Hybrid Positioning.

Another segment poised for significant growth and influence is 5G Positioning. As 5G infrastructure continues to expand globally, the capabilities it offers for real-time, low-latency positioning become increasingly valuable. This is particularly relevant for Vehicle-to-Everything (V2X) communication, enabling vehicles to communicate with each other and with infrastructure, which relies heavily on precise, time-synchronized positioning. Companies like China Mobile are actively involved in this space, driving the development of 5G-based positioning solutions. The rapid evolution of autonomous driving and the need for hyper-accurate localization for advanced features will further fuel the demand for 5G-enabled positioning.

In terms of application, Passenger Cars will continue to be the largest application segment driving the demand for high-precision positioning. The increasing integration of ADAS features in mainstream passenger vehicles, along with the growing consumer interest in enhanced navigation and safety functionalities, makes this segment a primary growth engine. However, the Commercial Vehicle segment is expected to witness a more rapid growth rate. The economic benefits of enhanced efficiency, improved logistics management through precise tracking, and the potential for autonomous trucking operations are strong motivators for adopting high-precision positioning in commercial fleets. Companies like Mitsubishi Electric are investing in solutions for both passenger and commercial vehicles, recognizing the broad applicability.

The Vehicle High-precision Positioning industry is energized by several key growth catalysts. The accelerating development and adoption of autonomous driving technology represent a monumental driver, as these systems fundamentally rely on centimeter-level accuracy. Furthermore, the increasing integration of Advanced Driver-Assistance Systems (ADAS) in passenger and commercial vehicles is creating a substantial demand for more precise localization capabilities. Government initiatives and investments in smart city infrastructure and intelligent transportation systems worldwide are fostering an ecosystem where precise vehicle positioning is crucial for efficient traffic management and enhanced safety. The continuous advancements in sensor fusion techniques and the evolution of robust positioning algorithms are making high-precision solutions more reliable and cost-effective, further stimulating adoption.

This report offers a comprehensive deep dive into the Vehicle High-precision Positioning market, providing granular insights that extend from the foundational technologies to their real-world applications and future potential. It meticulously dissects the market dynamics, identifying the critical drivers that are pushing for greater adoption, such as the relentless pursuit of automotive safety and the transformative potential of autonomous driving. Concurrently, it addresses the significant challenges and restraints that need to be overcome, including cost considerations, environmental limitations, and cybersecurity concerns, offering a balanced perspective on the market's hurdles. The report further highlights the key regions and segments poised for dominance, with a particular focus on the influential role of Asia-Pacific, especially China, and the growing importance of Hybrid and 5G Positioning technologies. Detailed analysis of leading players and their recent significant developments provides a clear picture of the competitive landscape and the pace of innovation. This exhaustive coverage ensures that stakeholders are equipped with the necessary information to make informed strategic decisions in this rapidly evolving and critically important sector of the automotive industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include UniStrong, Broad GNSS, Swift Navigation, Hi-Target, Jingwei Technology, Mitsubishi Electric, China Mobile, NovAtel, Septentrio, ComNav Technology, Sixents Technology, .

The market segments include Type, Application.

The market size is estimated to be USD 2620.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Vehicle High-precision Positioning," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vehicle High-precision Positioning, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.