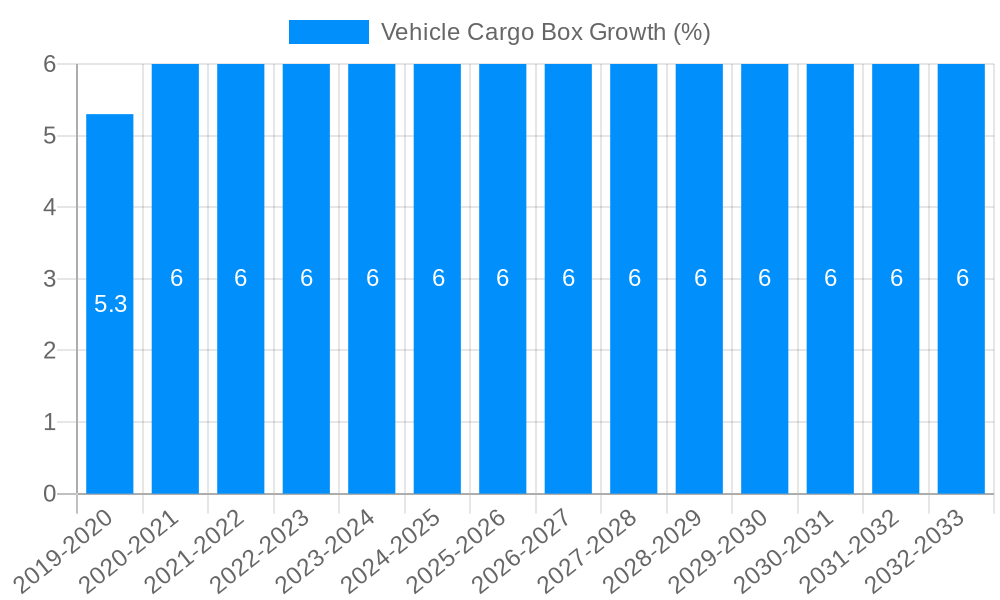

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Cargo Box?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Vehicle Cargo Box

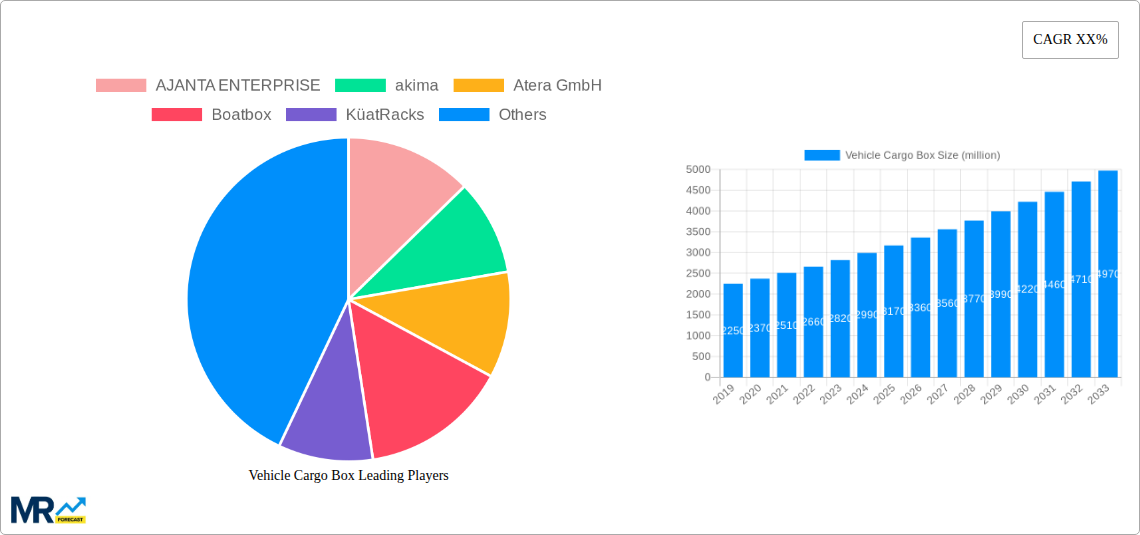

Vehicle Cargo BoxVehicle Cargo Box by Type (Roundness, Square, World Vehicle Cargo Box Production ), by Application (Commercial Car, Passenger Car, World Vehicle Cargo Box Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The vehicle cargo box market, encompassing roof-mounted, hitch-mounted, and other cargo carriers, is experiencing robust growth, driven by the increasing popularity of outdoor recreational activities like camping, skiing, and road trips. Consumers are seeking convenient and secure solutions to transport oversized gear, sports equipment, and luggage, fueling demand for these versatile storage solutions. The market is segmented by type (rooftop, hitch-mounted, etc.), material (plastic, aluminum, etc.), and price point, catering to diverse consumer needs and budgets. Key players like Thule, Yakima, and Rhino-Rack are leading the innovation with advanced designs, improved aerodynamics, and enhanced security features, continuously attracting a wider customer base. The market's growth is also influenced by rising disposable incomes in developing economies and the increasing adoption of SUVs and crossovers, which provide ideal platforms for cargo box installation. While the market faces potential restraints from fluctuating raw material prices and economic downturns, the overall outlook remains positive, projecting continued expansion over the forecast period.

Technological advancements are playing a significant role in shaping market trends. Manufacturers are incorporating lighter-weight materials to improve fuel efficiency, and advanced locking mechanisms and integrated lighting are enhancing safety and usability. The trend toward customization and personalization is also evident, with consumers increasingly seeking cargo boxes that match their vehicle aesthetics and specific storage requirements. The online retail channel is playing a crucial role in expanding market reach and facilitating direct-to-consumer sales, while partnerships between manufacturers and vehicle brands are strengthening distribution networks and improving brand awareness. This comprehensive approach is expected to further drive the growth of the vehicle cargo box market in the coming years.

The global vehicle cargo box market is experiencing robust growth, projected to surpass XXX million units by 2033. This expansion is fueled by a confluence of factors, including the rising popularity of outdoor recreational activities like camping, skiing, and cycling, which necessitate safe and convenient transportation of gear. The increasing ownership of SUVs and crossovers, vehicles well-suited for cargo box integration, further contributes to market expansion. Consumers are increasingly seeking solutions that enhance vehicle storage capacity without compromising fuel efficiency or vehicle aesthetics, driving demand for innovative, aerodynamically designed cargo boxes. The market's growth is also supported by technological advancements, with manufacturers incorporating features like improved locking mechanisms, integrated lighting, and even solar panels to enhance both security and functionality. Furthermore, the increasing disposable income in developing economies is creating a new segment of consumers who can afford these convenience products, while in developed economies, the trend towards "experiential travel" is directly impacting purchasing decisions. The historical period (2019-2024) saw steady growth, laying a solid foundation for the impressive forecast (2025-2033). The estimated market size in 2025, based on our analysis, indicates a significant jump from previous years, reflecting the market's current trajectory. This trend is expected to continue, driven by both established and emerging market dynamics. The competitive landscape is dynamic, with established players focusing on innovation and expansion strategies, while new entrants leverage technological advancements to carve a niche for themselves. This dynamic combination of consumer demand, technological innovation, and competitive market forces ensures the continuing growth of the vehicle cargo box market in the coming years.

Several key factors are propelling the growth of the vehicle cargo box market. Firstly, the burgeoning popularity of outdoor recreational activities is a significant driver. Activities such as camping, hiking, skiing, and water sports necessitate the transportation of bulky equipment, and vehicle cargo boxes provide a safe, convenient, and weather-protected solution. Secondly, the rising ownership of SUVs and crossovers, vehicles ideally suited for cargo box installation, significantly expands the market's addressable consumer base. These vehicles are frequently chosen for their practicality and ability to accommodate larger families and more equipment. Thirdly, advancements in cargo box design and technology are enhancing their appeal. Features such as aerodynamic shapes to minimize fuel consumption, enhanced security systems, and integrated lighting improve overall usability and consumer satisfaction. Finally, the shift towards experiential travel and a growing emphasis on outdoor adventures further fuels the demand for cargo boxes, as individuals seek convenient ways to transport their gear for various outdoor pursuits. This combination of factors ensures that the vehicle cargo box market will continue its upward trajectory in the coming years.

Despite the robust growth, several challenges and restraints hinder the vehicle cargo box market. Firstly, price sensitivity remains a considerable factor. The relatively high cost of premium cargo boxes can deter some price-conscious consumers, particularly in emerging markets. Secondly, the market is subject to cyclical fluctuations, influenced by economic conditions and the overall demand for recreational vehicles. Periods of economic downturn can lead to decreased consumer spending, impacting sales. Thirdly, competition from alternative storage solutions, such as roof racks and trailers, presents a challenge. These alternatives offer potentially more affordable options, though often with compromises in convenience and security. Furthermore, concerns about vehicle aerodynamics and fuel efficiency, particularly at higher speeds, can influence purchasing decisions. While manufacturers are addressing aerodynamic design, misconceptions about fuel consumption can still deter potential buyers. Lastly, regulations concerning vehicle dimensions and weight restrictions in certain regions can impact the design and use of cargo boxes, posing both design and logistical challenges for manufacturers.

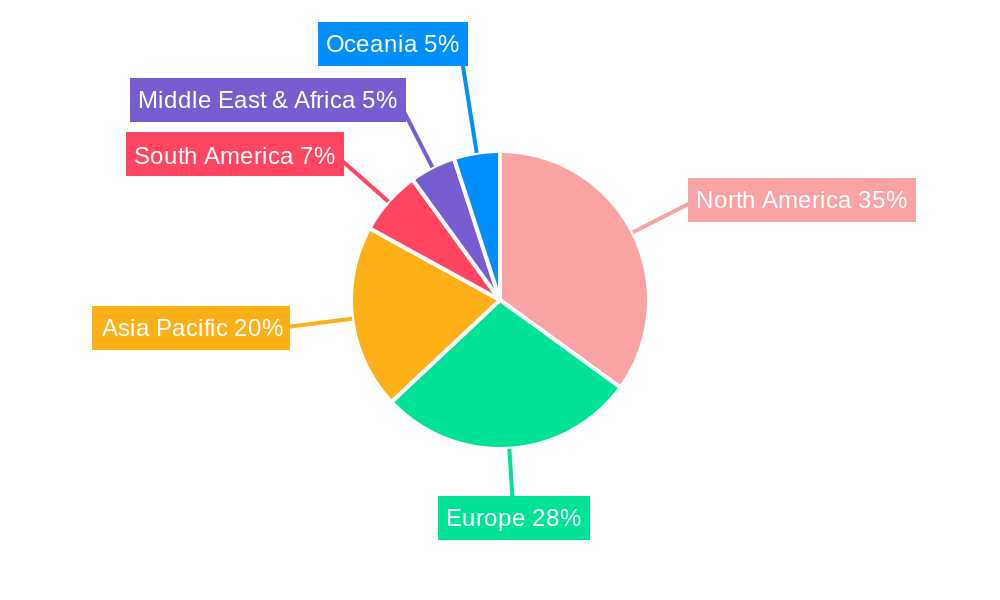

North America: The region boasts a strong automotive market with high SUV and crossover penetration rates, coupled with a flourishing outdoor recreation culture. This translates into significant demand for vehicle cargo boxes. The established presence of major players in the region further fuels market growth.

Europe: European consumers demonstrate a strong preference for premium and technologically advanced products. This makes the region a key market for high-end cargo boxes featuring innovative features. Environmental regulations and a focus on fuel efficiency are driving demand for aerodynamically optimized designs.

Asia-Pacific: While currently exhibiting lower per capita consumption, the region shows significant growth potential driven by rising disposable incomes, increased urbanization, and a burgeoning interest in outdoor recreation among a growing middle class.

Segments: The high-end segment, offering advanced features and superior materials, is expected to exhibit faster growth due to the increasing consumer preference for premium products and added functionalities. Similarly, the SUV/Crossover segment benefits greatly from the rising popularity of these vehicles, providing a natural fit for cargo box integration.

The paragraph above highlights the key regional and segmental drivers of growth. North America and Europe presently lead due to established markets and consumer preferences. However, the Asia-Pacific region holds tremendous untapped potential, promising significant expansion in the coming years. The high-end segment benefits from its superior features and target audience, mirroring global consumer trends.

The vehicle cargo box industry is poised for continued growth due to a confluence of factors. The rising popularity of outdoor recreation, increasing disposable incomes, especially in developing economies, and the growing adoption of SUVs and crossovers are all significant catalysts. Technological advancements leading to lighter, more aerodynamic, and secure cargo boxes further enhance consumer appeal. Marketing efforts focusing on convenience and the lifestyle benefits associated with cargo boxes will also play a crucial role in driving market expansion.

This report provides a comprehensive overview of the vehicle cargo box market, covering historical data (2019-2024), the current market estimate (2025), and a detailed forecast (2025-2033). It delves into key market trends, growth drivers, challenges, and regional analysis, offering valuable insights for industry stakeholders. The report also profiles leading players, examining their market strategies and competitive landscapes. This in-depth analysis equips businesses with the knowledge to make informed decisions and capitalize on market opportunities within the dynamic vehicle cargo box sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AJANTA ENTERPRISE, akima, Atera GmbH, Boatbox, KüatRacks, Magna International Inc, Malone Auto Racks, Rhino-Rack USA, RoofBag, SportRack, Thule Group, Yakima, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Vehicle Cargo Box," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Vehicle Cargo Box, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.