1. What is the projected Compound Annual Growth Rate (CAGR) of the Upper Limb Orthotic Systems?

The projected CAGR is approximately 4.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Upper Limb Orthotic Systems

Upper Limb Orthotic SystemsUpper Limb Orthotic Systems by Type (Soft Brace, Rigid Brace), by Application (Medical Supplies Store, Clinic, Hospital, Online Store), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

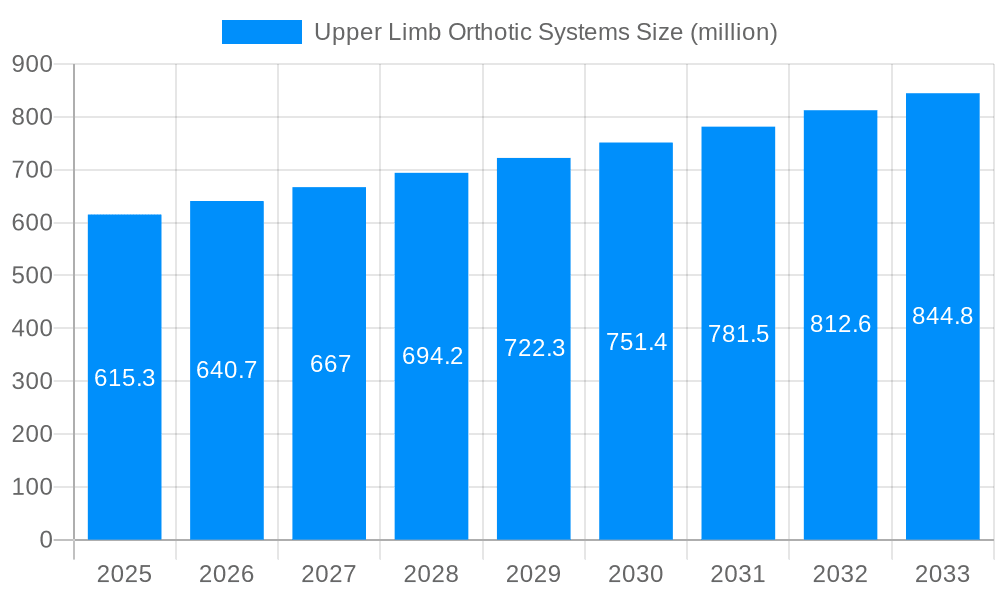

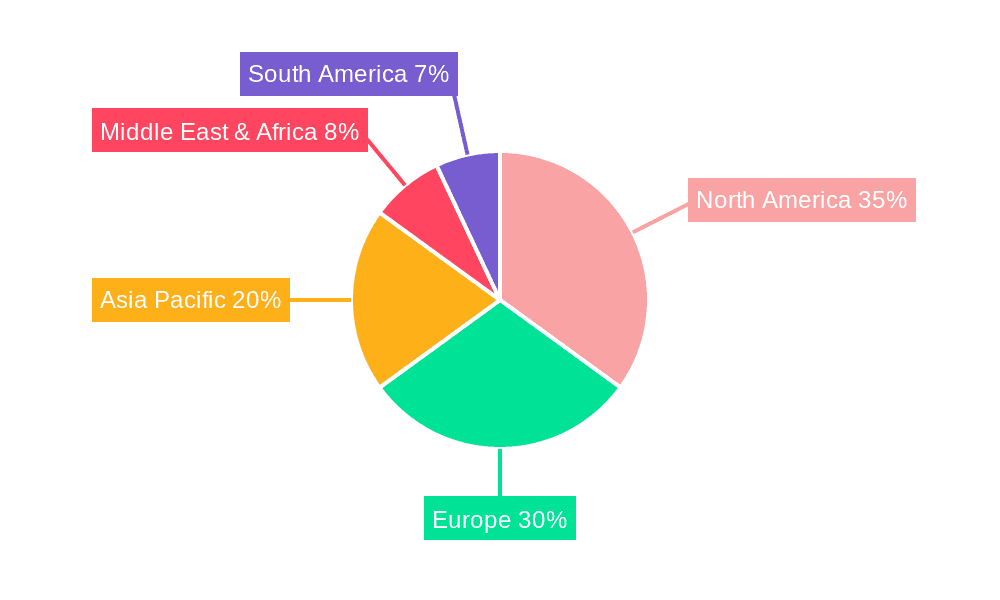

The global Upper Limb Orthotic Systems market is poised for significant expansion, projected to reach an estimated USD 615.3 million in 2025. Driven by an aging global population, a rising incidence of chronic conditions such as arthritis and neurological disorders, and an increasing demand for personalized and advanced orthotic solutions, the market is expected to witness a Compound Annual Growth Rate (CAGR) of 4.1% throughout the forecast period of 2025-2033. Advancements in material science leading to lighter and more comfortable orthoses, coupled with the growing adoption of robotic-assisted rehabilitation and digital health technologies, are further propelling market growth. The increasing awareness among healthcare professionals and patients regarding the benefits of orthotic interventions in restoring function, reducing pain, and improving the quality of life for individuals with upper limb impairments is a crucial catalyst. Geographically, North America is expected to lead the market, owing to a well-established healthcare infrastructure, high disposable incomes, and early adoption of innovative medical devices.

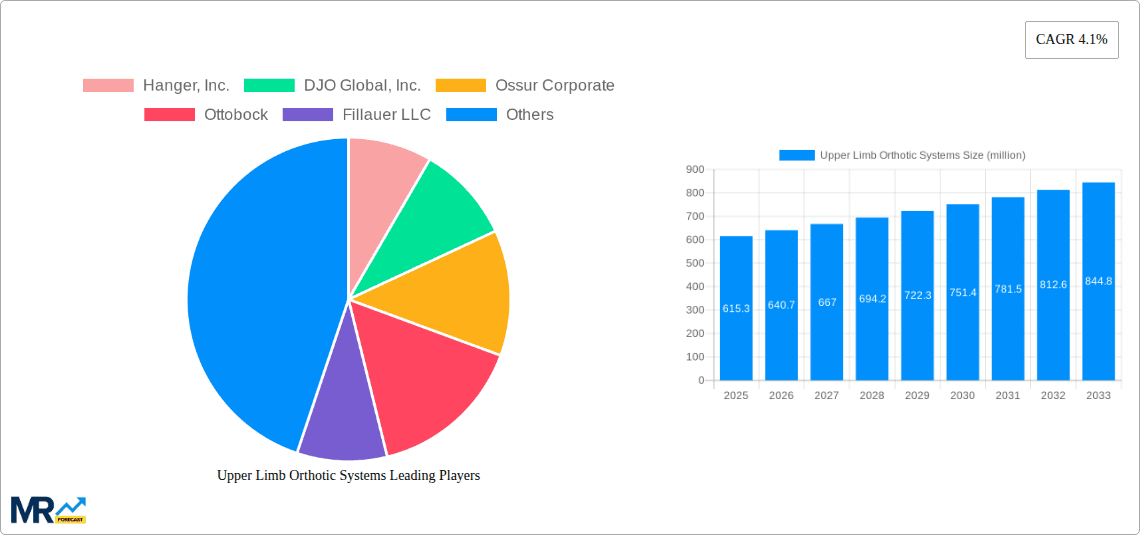

The market segmentation reveals a dynamic landscape, with the "Soft Brace" segment anticipated to garner a substantial share due to its comfort, ease of use, and application in managing less severe conditions or for post-operative support. "Medical Supplies Stores" and "Hospitals" are expected to dominate the application segments, reflecting the primary channels for orthotic device distribution and professional fitting. However, the "Online Store" segment is experiencing rapid growth, driven by increased e-commerce penetration and the convenience it offers to consumers. Key players such as Hanger, Inc., DJO Global, Inc., and Össur Corporate are actively investing in research and development to introduce innovative products and expand their global presence. Despite the positive outlook, market restraints such as the high cost of certain advanced orthotic devices and limited reimbursement policies in some regions could pose challenges. Nevertheless, the overarching trend towards preventative healthcare and the increasing focus on improving patient outcomes in rehabilitation underscore a robust future for the Upper Limb Orthotic Systems market.

Here's a unique report description on Upper Limb Orthotic Systems, incorporating your specified elements:

The global Upper Limb Orthotic Systems market is poised for substantial growth, with an estimated valuation reaching USD 5,200 million in the base year of 2025. Projections indicate a continued upward trajectory, with the market expected to expand to USD 7,800 million by the end of the forecast period in 2033, demonstrating a robust compound annual growth rate (CAGR) of approximately 4.3% during 2025-2033. This expansion is fueled by an increasing prevalence of upper limb musculoskeletal disorders, an aging global population requiring assistive devices, and advancements in material science and manufacturing technologies. The historical period from 2019-2024 laid the groundwork for this anticipated surge, characterized by steady adoption rates and initial investments in research and development. Key market insights reveal a growing preference for personalized and customizable orthotic solutions, driven by the demand for enhanced patient comfort and functional recovery. The integration of digital technologies, such as 3D scanning and printing, is revolutionizing the design and production of these devices, leading to more precise fits and improved patient outcomes. Furthermore, a heightened awareness among healthcare professionals and patients regarding the benefits of early intervention and non-invasive treatment options is contributing significantly to market penetration. The market is witnessing a shift towards lightweight, breathable, and durable materials, enhancing patient compliance and overall therapeutic effectiveness. The increasing incidence of sports-related injuries and work-related repetitive strain injuries is also creating a sustained demand for effective orthotic management. Emerging economies present untapped potential, with improving healthcare infrastructure and increasing disposable incomes facilitating greater access to these advanced medical devices. The competitive landscape is dynamic, with established players investing in innovation and strategic collaborations to capture market share. The interplay between technological advancements and evolving patient needs will continue to shape the market dynamics throughout the study period.

Several compelling factors are acting as powerful engines driving the expansion of the Upper Limb Orthotic Systems market. Foremost among these is the escalating global burden of musculoskeletal disorders affecting the upper extremities. Conditions such as carpal tunnel syndrome, tendinitis, arthritis, and fractures are becoming more prevalent, largely attributed to sedentary lifestyles, increased screen time, and an aging demographic. As individuals live longer, the incidence of age-related degenerative conditions that impact arm and hand function also rises, necessitating effective orthotic interventions for pain management, stability, and mobility. Furthermore, a significant catalyst is the continuous evolution of technological innovation within the orthotics sector. Companies are investing heavily in the development of advanced materials, such as carbon fiber composites and high-performance polymers, which offer superior strength-to-weight ratios, enhanced durability, and improved patient comfort. The integration of smart technologies, including embedded sensors for monitoring patient adherence and progress, is another transformative trend. This data-driven approach allows for more personalized treatment plans and proactive adjustments to orthotic devices, leading to better therapeutic outcomes. The increasing focus on rehabilitation and recovery post-injury or surgery is also playing a crucial role. Orthotic systems are being recognized not just as supportive devices but as integral components of comprehensive rehabilitation programs, aiding in regaining strength, coordination, and functional independence, thereby driving demand across various healthcare settings.

Despite the promising growth trajectory, the Upper Limb Orthotic Systems market faces certain inherent challenges and restraints that could temper its expansion. One significant hurdle is the high cost associated with some advanced orthotic devices and their customization. This can limit accessibility for a considerable segment of the population, particularly in developing economies or for individuals with limited healthcare insurance coverage. The reimbursement landscape for orthotic devices can also be complex and vary considerably across different regions and healthcare systems, sometimes posing a barrier to widespread adoption. Another restraint stems from the potential for patient non-compliance. Factors such as discomfort, skin irritation, difficulty in application and removal, and a lack of understanding regarding the importance of consistent use can lead to suboptimal outcomes and a perception of ineffectiveness. The need for ongoing adjustments and professional fitting adds to the overall treatment complexity and cost. Moreover, the market is subject to stringent regulatory approvals for medical devices, which can be a time-consuming and expensive process for manufacturers, potentially slowing down the introduction of novel products. The availability of skilled prosthetists and orthotists, who are essential for accurate assessment, fitting, and patient education, is also a limiting factor in certain regions, impacting the quality of care and market reach. Finally, the presence of alternative treatment modalities, such as physical therapy, medication, and surgical interventions, can sometimes divert patients away from orthotic solutions, especially in the initial stages of some conditions.

The North America region is projected to be a dominant force in the global Upper Limb Orthotic Systems market, driven by a confluence of factors including high healthcare expenditure, advanced technological adoption, and a strong awareness of orthopedic health. Within this region, the United States stands out as a primary contributor, benefiting from a well-established healthcare infrastructure, robust research and development activities, and a significant prevalence of upper limb musculoskeletal disorders. The presence of leading orthotic manufacturers and a strong network of specialized clinics and hospitals further bolster its market position.

Analyzing the market by Segment, the Rigid Brace segment is expected to hold a substantial market share due to its superior support and immobilization capabilities, crucial for managing severe injuries and post-operative recovery. These braces are often prescribed for conditions requiring significant stabilization, such as complex fractures, dislocations, and severe ligamentous injuries. Their robust design provides a higher level of functional limitation control, which is paramount in ensuring proper healing and preventing further damage. The demand for rigid braces is particularly strong in Hospital and Clinic settings, where patients with acute injuries and those undergoing surgical procedures are managed.

Conversely, the Soft Brace segment is anticipated to witness robust growth, driven by increasing demand for comfortable, lightweight, and user-friendly orthotic solutions for managing less severe conditions, chronic pain, and for everyday support. The rising awareness of the benefits of early intervention and prophylactic use of soft braces, especially among athletes and individuals engaged in repetitive manual tasks, is fueling this growth. The Online Store segment is also expected to experience significant expansion, offering a convenient platform for consumers to access both soft and, to some extent, customizable rigid braces, often with detailed product information and patient reviews.

The interplay between these segments and applications highlights the diverse needs of patients and the evolving distribution channels shaping the Upper Limb Orthotic Systems market. The dominance of North America, particularly the US, is underpinned by its advanced healthcare systems and economic capacity to embrace innovative and high-value orthotic solutions.

The Upper Limb Orthotic Systems industry is propelled by several key growth catalysts. An aging global population is leading to a higher incidence of age-related musculoskeletal conditions, driving demand for assistive devices. Furthermore, the increasing prevalence of sports-related injuries and work-related repetitive strain injuries, coupled with a growing awareness of preventive healthcare and rehabilitation, are creating sustained market opportunities. Advancements in material science and manufacturing technologies, such as 3D printing, are enabling the development of more personalized, comfortable, and effective orthotic solutions.

This comprehensive report offers an in-depth analysis of the global Upper Limb Orthotic Systems market, providing critical insights for stakeholders. It meticulously covers market dynamics, including growth trends, drivers, and challenges, with detailed segmentation by product type (soft and rigid braces) and application (medical supplies stores, clinics, hospitals, and online stores). The study includes a thorough examination of leading manufacturers and their product portfolios, alongside an assessment of key regional market performances, with a particular focus on North America's dominance. The report provides robust market forecasts from the base year 2025 through 2033, offering valuable data for strategic planning and investment decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.1%.

Key companies in the market include Hanger, Inc., DJO Global, Inc., Ossur Corporate, Ottobock, Fillauer LLC, Basko Healthcare, Bauerfeind AG, Breg, Inc., BSN medical, .

The market segments include Type, Application.

The market size is estimated to be USD 615.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Upper Limb Orthotic Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Upper Limb Orthotic Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.