1. What is the projected Compound Annual Growth Rate (CAGR) of the UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System

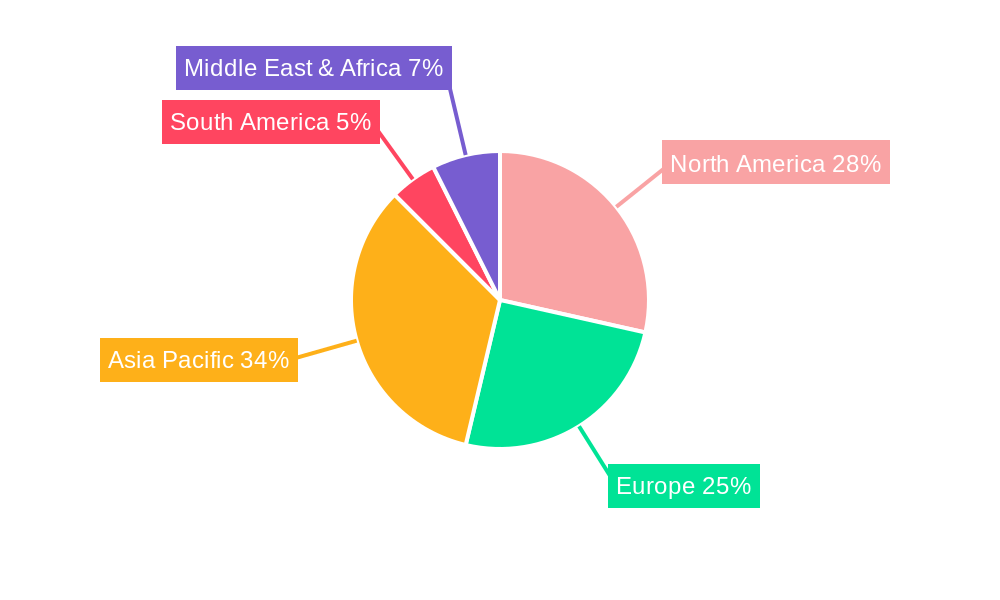

UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring SystemUAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System by Type (Basic System, Intelligent System, Multi-Sensor Integrated System, Emergency Response System, World UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System Production ), by Application (Nuclear Industry, Customs, Port, Industrial Applications, Medical Use, World UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

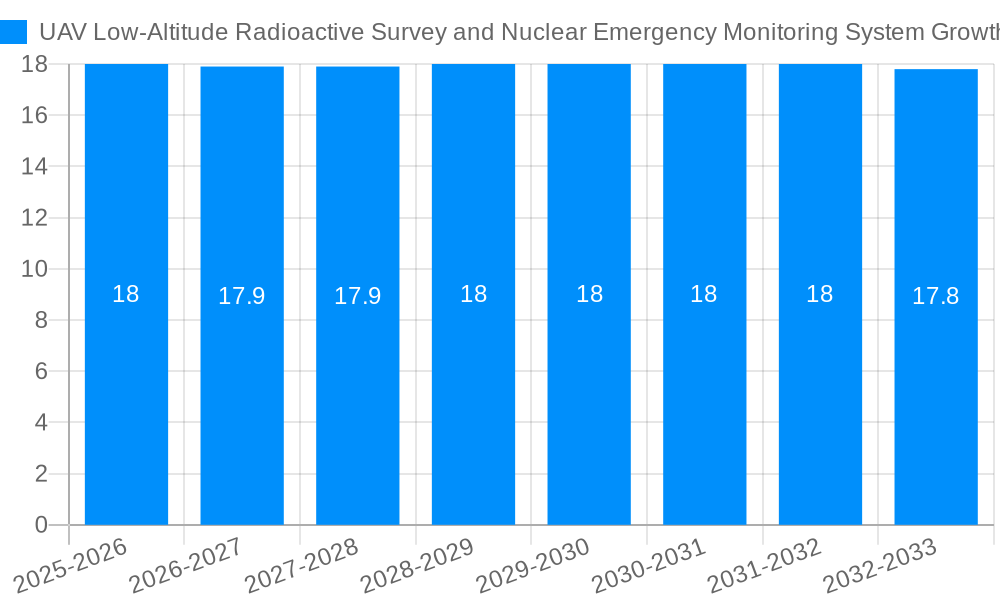

The global market for UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring Systems is poised for significant expansion, driven by escalating concerns regarding nuclear safety, the increasing deployment of nuclear facilities, and the imperative for rapid and accurate radiological assessments in various critical sectors. With an estimated market size of $1,200 million in 2025, this specialized segment of the drone industry is projected to experience a robust Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025-2033. This growth is primarily fueled by the growing adoption of intelligent and multi-sensor integrated systems, offering enhanced detection capabilities and real-time data analysis for a more comprehensive understanding of radioactive environments. The Nuclear Industry remains a cornerstone of demand, but significant growth is also anticipated from Customs and Port authorities for security screening, industrial applications requiring environmental monitoring, and burgeoning interest in Medical Use cases for specialized surveys. The development of advanced sensor technologies and improved data processing algorithms are key enablers of this market's upward trajectory.

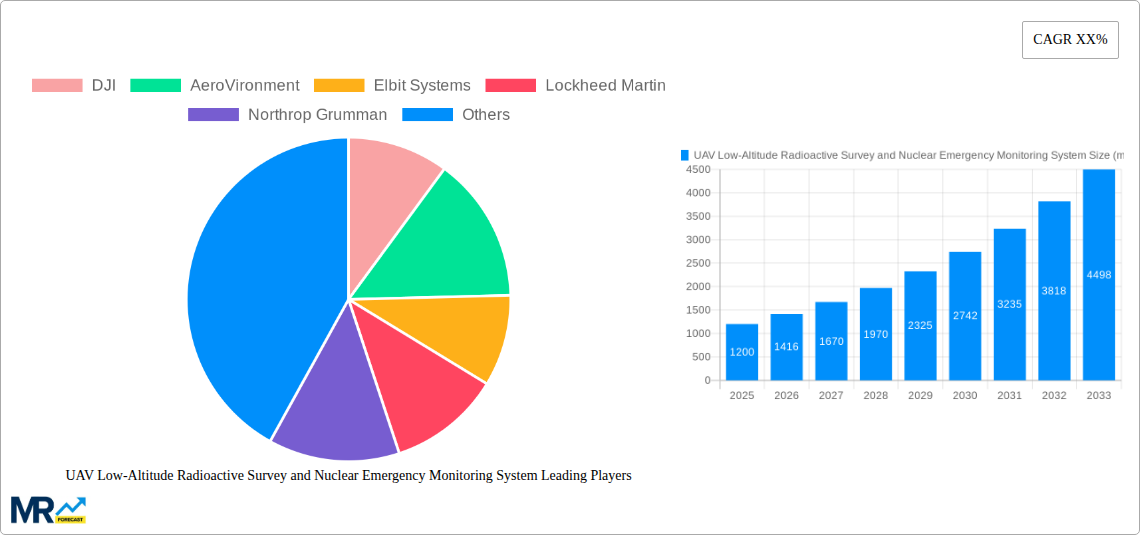

The competitive landscape is characterized by the presence of established players such as DJI, AeroVironment, and Lockheed Martin, alongside emerging innovators focusing on specialized solutions. Restraints, such as stringent regulatory frameworks and the high initial investment costs for advanced systems, are being gradually overcome by technological advancements and a growing realization of the long-term cost-effectiveness and safety benefits. The market's future is intricately linked to governmental investments in national security, emergency preparedness, and the expansion of nuclear energy programs worldwide. Asia Pacific, particularly China and India, is expected to emerge as a dominant region due to rapid industrialization and increasing investments in nuclear infrastructure. North America and Europe will continue to be significant markets, driven by existing nuclear facilities and advanced technological adoption. The evolution towards more autonomous and AI-powered systems will define the next phase of growth, further solidifying the critical role of UAVs in radioactive survey and nuclear emergency monitoring.

Here is a unique report description on the UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System, incorporating your specific requirements:

The global UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System market is poised for substantial expansion and evolution throughout the study period of 2019-2033, with the base year of 2025 serving as a critical benchmark for current market valuations. Projections indicate a market value that is expected to ascend into the tens of millions of units within the next decade, driven by an increasing recognition of the indispensable role these systems play in ensuring public safety and security around nuclear facilities and in rapid response scenarios. The trend towards more sophisticated, intelligent, and multi-sensor integrated systems is a defining characteristic, moving beyond basic detection capabilities to advanced data analysis, real-time situational awareness, and autonomous operational capabilities. This shift is fueled by advancements in drone technology, miniaturization of radiation detection equipment, and sophisticated software algorithms for processing and interpreting complex environmental data. The forecast period of 2025-2033 is anticipated to witness significant innovation, with market penetration deepening across various applications, including enhanced nuclear industry operations, more robust customs and port security measures, specialized industrial monitoring, and emerging medical use cases for localized contamination assessment. The historical period (2019-2024) laid the groundwork for this growth, characterized by initial deployments and gradual technological maturation. Looking ahead, the market will increasingly favor solutions that offer seamless integration with existing emergency response frameworks and provide actionable intelligence to decision-makers under high-pressure situations. The continuous drive for enhanced safety protocols, coupled with a proactive approach to potential radiological threats, will solidify the market's upward trajectory, ensuring its relevance and growth for years to come.

Several potent factors are driving the burgeoning growth of the UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System market. Foremost among these is the escalating global emphasis on nuclear safety and security. As the number of operational nuclear power plants and research facilities continues to expand worldwide, so does the imperative for effective, non-intrusive, and rapid methods of monitoring for potential radioactive leaks or unauthorized material. UAVs offer a distinct advantage by enabling surveys in areas that might be hazardous or difficult to access for human personnel, significantly reducing exposure risks. Furthermore, the increasing frequency and perceived severity of natural disasters and potential terrorist threats that could compromise nuclear facilities or involve radiological materials necessitate advanced monitoring capabilities. Governments and private entities are investing heavily in robust emergency preparedness and response mechanisms, where UAV-based radioactive monitoring systems are becoming a cornerstone technology. The technological advancements in drone capabilities, including extended flight times, enhanced payload capacities for sophisticated sensors, and improved navigation systems, are making these platforms more viable and cost-effective for complex monitoring tasks. This synergy of rising safety concerns and technological innovation is propelling the market forward at an impressive pace.

Despite the promising growth trajectory, the UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System market faces several significant challenges and restraints. Regulatory hurdles are a primary concern. The operation of UAVs, especially those carrying sensitive monitoring equipment for radioactive detection, is subject to stringent and often complex aviation regulations that vary considerably by region and country. Obtaining necessary permits for flight operations, particularly in restricted airspace around critical infrastructure like nuclear sites, can be a lengthy and arduous process. Public perception and privacy concerns also play a role, as widespread deployment of surveillance drones, even for safety purposes, can raise questions about data collection and the potential for misuse. Furthermore, the cost associated with acquiring and maintaining highly specialized, radiation-sensitive UAV systems can be substantial, potentially limiting adoption for smaller organizations or those with constrained budgets. The need for trained personnel to operate these sophisticated systems and interpret the collected data adds another layer of complexity and cost. Finally, the interoperability of different UAV systems and their sensor payloads with existing emergency response infrastructure can be a technical challenge that needs to be addressed for seamless integration.

The global UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System market is anticipated to witness significant dominance from specific regions and market segments, driven by a confluence of factors related to infrastructure, regulatory frameworks, and technological adoption.

Key Dominating Regions/Countries:

Key Dominating Segments:

Type: Multi-Sensor Integrated System & Emergency Response System:

Application: Nuclear Industry:

Several key growth catalysts are fueling the expansion of the UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System industry. These include increasing global investments in nuclear energy, heightened security concerns around critical infrastructure, and the continuous advancement of drone technology, leading to more sophisticated and cost-effective sensing payloads. The growing emphasis on environmental safety and preparedness for potential radiological incidents, alongside government mandates for robust monitoring, are significant drivers. Furthermore, the development of artificial intelligence and machine learning for data analysis is enhancing the value proposition of these systems, enabling faster and more accurate threat identification.

This comprehensive report provides an in-depth analysis of the global UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System market. It delves into market trends, identifies key growth drivers, and outlines the challenges and restraints impacting industry expansion. The study encompasses detailed market segmentation by system type and application, highlighting the leading players and their strategic initiatives. Furthermore, it presents detailed forecasts for the period 2025-2033, building upon a robust analysis of historical data from 2019-2024 and the base year of 2025. The report aims to equip stakeholders with actionable insights for strategic decision-making, investment planning, and understanding the evolving landscape of this critical safety and security sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DJI, AeroVironment, Elbit Systems, Lockheed Martin, Northrop Grumman, Thales Group, General Atomics Aeronautical Systems, Parrot, Insitu.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the UAV Low-Altitude Radioactive Survey and Nuclear Emergency Monitoring System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.