1. What is the projected Compound Annual Growth Rate (CAGR) of the Tyres for Electric Vehicle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tyres for Electric Vehicle

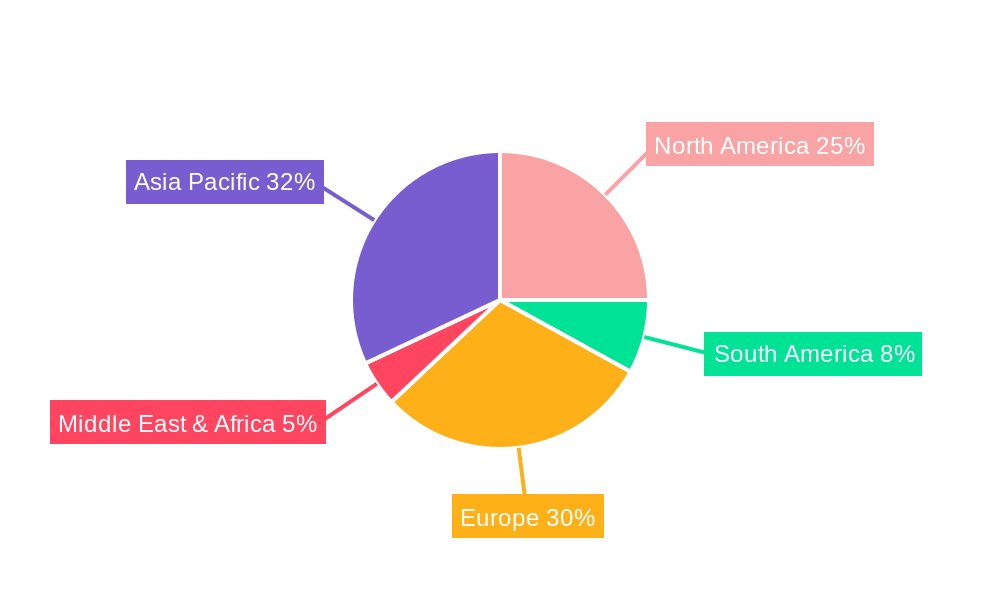

Tyres for Electric VehicleTyres for Electric Vehicle by Type (Radial Tyre, Bias Tyre), by Application (OEM, Aftermarket), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

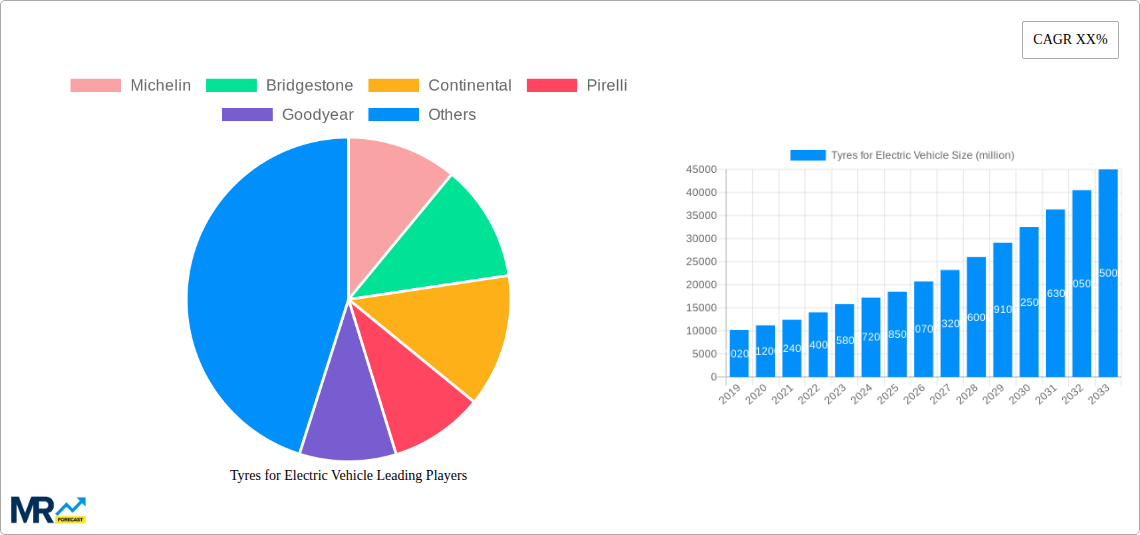

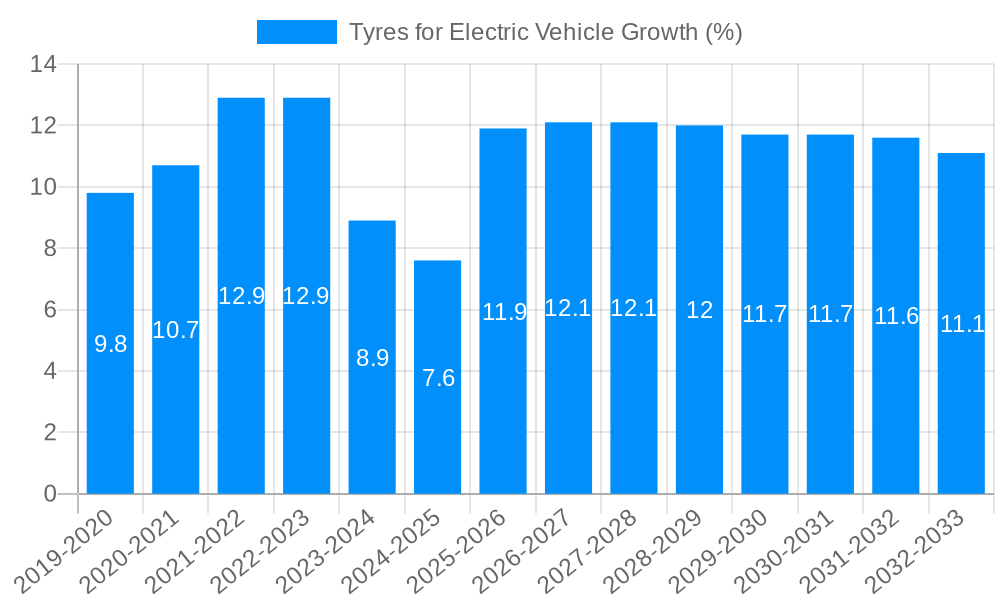

The Electric Vehicle (EV) tyres market is experiencing robust expansion, projected to reach a substantial market size of $18,500 million by 2025. This growth is propelled by a remarkable Compound Annual Growth Rate (CAGR) of 12.5%, indicating a sustained upward trajectory throughout the forecast period ending in 2033. The increasing global adoption of electric vehicles, driven by government incentives, environmental consciousness, and advancements in battery technology, directly translates into a surging demand for specialized EV tyres. These tyres are engineered to meet the unique requirements of EVs, including lower rolling resistance for extended range, enhanced load-bearing capacity due to battery weight, and superior grip for instant torque delivery. The market is segmented into Radial Tyre and Bias Tyre, with Radial tyres dominating due to their performance advantages in modern EVs. Furthermore, the application segment is bifurcated into Original Equipment Manufacturer (OEM) and Aftermarket. The OEM segment is experiencing rapid growth as EV manufacturers integrate these specialized tyres from the outset of vehicle production, while the aftermarket is set to grow as the EV fleet matures and tyre replacement needs arise.

Key market drivers include the accelerating production of new electric vehicle models across all segments, from passenger cars to commercial vehicles, and the growing consumer preference for sustainable transportation solutions. Advancements in tyre technology, such as the development of noise-reduction features and lighter, more durable materials, are also fueling market growth. However, the market faces restraints such as the relatively higher cost of specialized EV tyres compared to conventional tyres, and the challenge of developing tyre compounds that effectively balance durability, performance, and energy efficiency. Emerging trends include a strong focus on sustainability, with manufacturers investing in eco-friendly materials and production processes, and the integration of smart tyre technologies for real-time performance monitoring and predictive maintenance. Prominent players like Michelin, Bridgestone, Continental, Pirelli, and Goodyear are actively investing in R&D to capture a larger share of this dynamic and evolving market, with significant regional contributions expected from Asia Pacific, Europe, and North America.

This comprehensive report offers an in-depth analysis of the global Tyres for Electric Vehicle market, providing a detailed examination of trends, drivers, challenges, regional dynamics, and the competitive landscape. Spanning the historical period of 2019-2024, with a base year of 2025 and an extensive forecast period up to 2033, this study will equip stakeholders with actionable insights to navigate this rapidly evolving sector. We project the market to reach 250 million units by 2028, demonstrating a robust compound annual growth rate driven by the accelerating adoption of electric vehicles worldwide.

The global Tyres for Electric Vehicle market is experiencing a transformative surge, characterized by a confluence of technological advancements and shifting consumer preferences. As the automotive industry pivots towards electrification, the demand for specialized EV tyres has become paramount, reshaping traditional tyre manufacturing paradigms. A key trend is the increasing focus on low rolling resistance tyres, designed to optimize energy efficiency and extend the driving range of electric vehicles. This is critical for addressing range anxiety, a significant barrier to EV adoption. Manufacturers are investing heavily in innovative compounds and tread designs to minimize energy loss, contributing to a projected market size of 300 million units by 2030. Another significant development is the emergence of noise reduction technology in EV tyres. The quieter operation of electric powertrains amplifies tire noise, making acoustic comfort a crucial differentiator. Companies are developing specialized tread patterns and internal damping technologies to mitigate this, enhancing the overall driving experience. The report will delve into the nuances of these trends, highlighting how they are influencing product development and market competition, with specific attention paid to the increasing preference for radial tyres over bias tyres due to their superior performance characteristics. The projected volume for radial tyres within the EV segment is estimated to reach 220 million units by 2032, signifying a clear market dominance. Furthermore, the integration of smart tire technologies, incorporating sensors for real-time monitoring of pressure, temperature, and wear, is gaining traction. These intelligent tyres offer predictive maintenance capabilities and enhanced safety features, paving the way for a more connected and autonomous driving future. The OEM segment is expected to lead this integration, accounting for an estimated 75% of EV tyre sales by 2031, as automakers prioritize these advanced solutions for their new electric models. The aftermarket is also catching up, with a projected growth of 15% annually in smart tyre adoption, aiming to provide existing EV owners with upgrade options that enhance performance and safety. The market is also witnessing a geographical shift, with Asia-Pacific emerging as a dominant force in both production and consumption, fueled by government incentives and a burgeoning EV manufacturing base. This region is anticipated to contribute over 40% of the global EV tyre market volume by 2033.

The global surge in electric vehicle adoption is the primary engine propelling the growth of the Tyres for Electric Vehicle market. Governments worldwide are implementing stringent emission regulations and offering substantial incentives for EV purchases, creating a favorable ecosystem for electric mobility. This, in turn, directly translates into a burgeoning demand for specialized EV tyres. Beyond policy, consumer awareness regarding environmental sustainability and the long-term cost savings associated with EVs are increasingly influencing purchasing decisions, further accelerating the transition. As the EV fleet expands, the need for tyres engineered to meet the unique demands of electric powertrains becomes critical. These demands include higher torque, instant acceleration, heavier vehicle weight due to battery packs, and the imperative for extended range and reduced rolling resistance. Consequently, tyre manufacturers are compelled to innovate, investing significantly in research and development to produce tyres that can withstand these stresses while optimizing performance and efficiency. The projected demand for specialized EV tyres is substantial, with estimates suggesting the market will surpass 280 million units by 2032. This growth is not solely reliant on new vehicle sales; a growing aftermarket for replacement EV tyres also plays a crucial role. As the installed base of EVs increases, so does the need for maintenance and replacement parts, including tyres. The aftermarket segment is projected to contribute significantly to overall market volume, reaching approximately 70 million units by 2033. The inherent characteristics of EVs, such as their quiet operation, necessitate tyres that minimize road noise. This has become a key purchasing criterion for EV owners, driving the development of acoustic-optimized tyre solutions and contributing to the market's expansion.

Despite the robust growth trajectory, the Tyres for Electric Vehicle market is not without its hurdles. A significant challenge lies in the higher cost of specialized EV tyres compared to conventional tyres. The advanced materials, complex manufacturing processes, and R&D investments required to develop tyres with low rolling resistance, enhanced durability, and noise reduction technologies contribute to this premium pricing. This can act as a restraint, particularly for price-sensitive consumers and in developing markets where EV adoption is still in its nascent stages. Another considerable challenge is the limited lifespan and increased wear rate observed in some EV tyres. The high torque and instantaneous acceleration of EVs exert greater stress on tyre treads, potentially leading to faster wear and requiring more frequent replacements. This necessitates the development of more durable compounds and reinforced structures, which further adds to manufacturing costs. The lack of widespread standardization in EV tyre specifications presents a challenge for both manufacturers and consumers. As the technology evolves, different EV models and manufacturers may have unique requirements, making it difficult to establish universally compatible tyre solutions. This fragmentation can hinder economies of scale and complicate inventory management for tyre suppliers, particularly in the aftermarket. Furthermore, recycling and disposal of EV batteries raise environmental concerns, which indirectly impact the tyre industry as the focus shifts towards sustainable solutions across the entire EV lifecycle. While not a direct restraint on tyre sales, it influences consumer perception and regulatory scrutiny on the sustainability of the entire EV ecosystem. The supply chain complexities for specialized materials used in EV tyres can also pose a challenge, especially given global geopolitical uncertainties and potential disruptions, impacting production volumes and lead times, thereby affecting the timely availability of tyres in key markets, projected to impact availability by 5-10% in certain regions during peak demand periods.

The global Tyres for Electric Vehicle market is witnessing a significant geographical and segment-specific dominance, driven by a combination of policy, infrastructure, and market adoption rates.

Dominant Regions/Countries:

Dominant Segments:

The Tyres for Electric Vehicle industry is experiencing a significant growth spurt fueled by several key catalysts. Foremost among these is the escalating global adoption of electric vehicles, driven by environmental concerns and favorable government policies. As more EVs hit the road, the inherent demand for specialized tyres capable of handling their unique performance characteristics—such as higher torque, heavier weight, and the need for enhanced range efficiency—becomes a powerful growth driver. Furthermore, continuous innovation in tyre technology, focusing on reducing rolling resistance, improving durability, and minimizing noise, directly addresses consumer pain points and enhances the EV ownership experience, thereby stimulating demand.

This report provides unparalleled coverage of the Tyres for Electric Vehicle market, offering a holistic view from historical performance to future projections. We meticulously analyze the impact of evolving EV technology on tyre design, performance, and longevity. The study delves into the intricate interplay of market drivers, including government regulations, consumer preferences for sustainability, and advancements in battery technology, all of which contribute to the projected market growth of over 300 million units by 2033. Furthermore, the report scrutinizes the challenges faced by the industry, such as the cost implications of specialized materials and the need for enhanced tyre durability. Our comprehensive analysis includes detailed segmentation by tyre type (Radial vs. Bias), application (OEM vs. Aftermarket), and regional market dynamics. We also provide in-depth profiles of leading manufacturers, their strategic initiatives, and their contributions to market innovation, ensuring a thorough understanding of the competitive landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Michelin, Bridgestone, Continental, Pirelli, Goodyear, Shanghai Huayi, Sumitomo Rubber Industries, ZC Rubber, Yokohama, Nokian Tyres, Hankook, Maxxis, Triangle Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tyres for Electric Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tyres for Electric Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.