1. What is the projected Compound Annual Growth Rate (CAGR) of the Tyre Bead Wire?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tyre Bead Wire

Tyre Bead WireTyre Bead Wire by Application (Radial Tire, Bias Tire, World Tyre Bead Wire Production ), by Type (0.78-1.60 mm, 1.65-1.83 mm, Above 1.83 mm, World Tyre Bead Wire Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

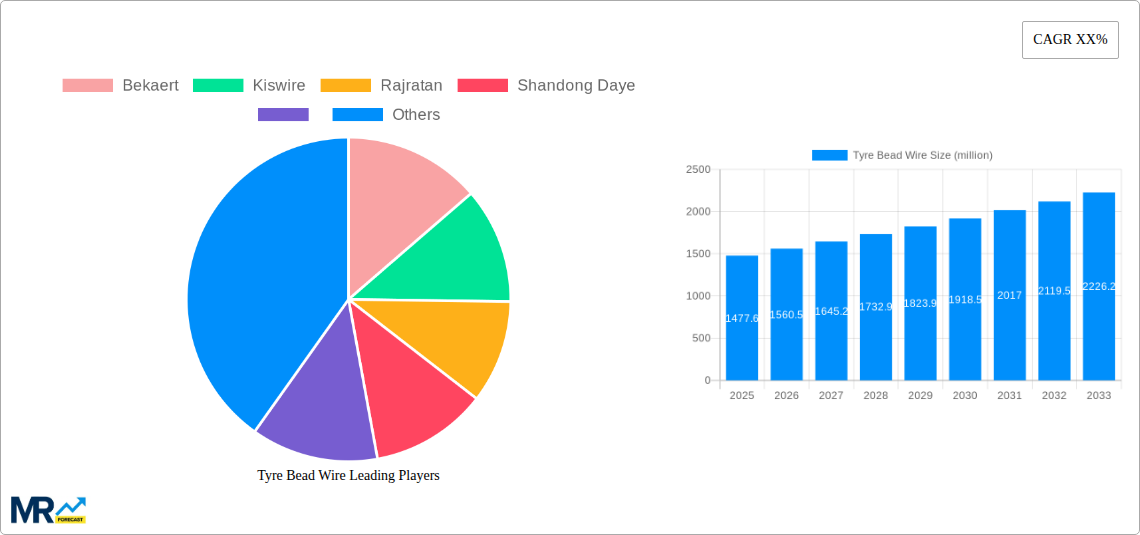

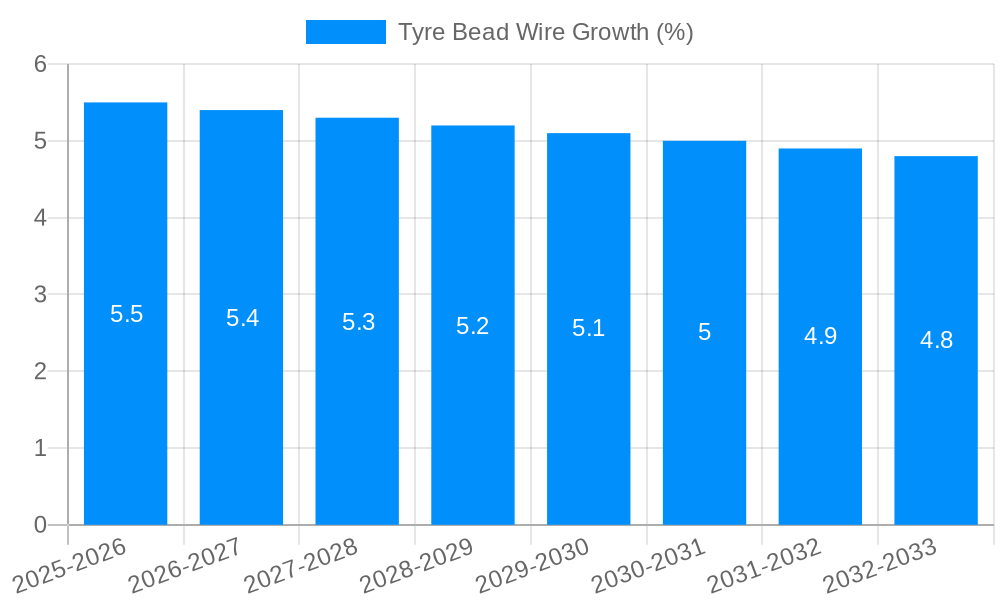

The global Tyre Bead Wire market is poised for significant expansion, with a robust projected market size of approximately $1477.6 million in 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR), driven by the ever-increasing demand for automobiles and commercial vehicles worldwide. The expanding global automotive fleet, coupled with the continuous replacement cycle of tires, serves as a primary impetus for the sustained demand for tyre bead wire. Furthermore, advancements in tire technology, including the development of high-performance radial tires that offer enhanced durability and fuel efficiency, are fueling the adoption of specialized bead wire for improved structural integrity. Emerging economies, particularly in Asia Pacific and South America, are demonstrating substantial growth potential due to rising disposable incomes and increasing vehicle ownership, thereby creating new avenues for market penetration.

The market's expansion is further propelled by a series of positive trends, including a growing emphasis on tire safety and performance standards, which necessitates the use of high-quality bead wire. Innovations in manufacturing processes, leading to improved tensile strength and fatigue resistance of bead wire, also contribute to market dynamics. However, certain factors could moderate this growth trajectory. Fluctuations in raw material prices, particularly steel, can impact manufacturing costs and subsequently affect market pricing. Additionally, stringent environmental regulations concerning manufacturing processes and waste management could present operational challenges for producers. The market is segmented by application into Radial Tire and Bias Tire, with radial tires dominating due to their widespread use in modern vehicles. By type, the market is categorized based on wire diameter, with 0.78-1.60 mm, 1.65-1.83 mm, and Above 1.83 mm segments catering to diverse tire specifications. Key players like Bekaert, Kiswire, Rajratan, and Shandong Daye are actively shaping the competitive landscape through strategic investments and product development.

This report offers an in-depth analysis of the global Tyre Bead Wire market, spanning a comprehensive study period from 2019 to 2033. Focusing on a base year of 2025, the report provides a granular look at historical trends (2019-2024) and forecasts future market dynamics through 2033. The analysis delves into the intricate interplay of production volumes, key industry players, technological advancements, and the evolving demands of the tire manufacturing sector. With an estimated market value projected to reach into the tens of millions of units by 2025, this report is an indispensable resource for stakeholders seeking to understand the current landscape and future trajectory of the tyre bead wire industry.

The global Tyre Bead Wire market, valued in the tens of millions of units and poised for sustained growth, is characterized by a dynamic interplay of technological advancements, shifting application demands, and evolving manufacturing capabilities. Over the study period of 2019-2033, with a specific focus on the base year 2025, a significant upward trend in production and consumption is projected. The historical period (2019-2024) laid the groundwork for this expansion, driven by an increasing global demand for vehicles and, consequently, for tires. The estimated year of 2025 serves as a critical juncture, with the forecast period (2025-2033) promising continued momentum. Key insights reveal a strong preference for radial tire applications, which now dominate the market, accounting for a substantial portion of the millions of units consumed annually. This dominance stems from the superior performance characteristics of radial tires, including better fuel efficiency, enhanced handling, and improved ride comfort, making them the standard for passenger cars, commercial vehicles, and off-road applications alike. The bias tire segment, while still relevant for certain niche applications and older vehicle models, is experiencing a relative slowdown in growth compared to its radial counterpart.

Furthermore, the market is segmented by wire diameter, with the 0.78-1.60 mm range representing the most widely adopted due to its versatility and suitability for a broad spectrum of tire sizes. However, the 1.65-1.83 mm and Above 1.83 mm segments are witnessing increasing demand, particularly for heavy-duty truck, bus, and industrial tires that require greater strength and durability. This indicates a growing sophistication in tire design and a demand for specialized bead wire solutions. The World Tyre Bead Wire Production figures underscore this global demand, with production volumes consistently in the millions of units and projected to climb steadily. Emerging economies, with their burgeoning automotive industries, are becoming increasingly significant contributors to both production and consumption. The industry is also observing a subtle yet important trend towards enhanced fatigue resistance and corrosion protection in bead wire, driven by manufacturers' continuous efforts to improve tire longevity and safety. Innovations in steelmaking and galvanization processes are crucial in meeting these evolving performance requirements. The competitive landscape is characterized by a handful of major global players, alongside a growing number of regional manufacturers, all vying for market share through product innovation, cost optimization, and strategic partnerships.

The Tyre Bead Wire market's robust growth trajectory, measured in millions of units, is underpinned by several potent driving forces that are reshaping both the tire industry and the broader automotive ecosystem. Foremost among these is the persistent global increase in vehicle production and sales. As more cars, trucks, and commercial vehicles roll off assembly lines worldwide, the demand for replacement tires and original equipment (OE) tires naturally escalates. This direct correlation translates into a consistent and substantial demand for tyre bead wire, the critical component that secures the tire to the wheel rim. The tens of millions of units produced annually are directly tied to this fundamental market dynamic. Furthermore, the ongoing shift in consumer preference towards radial tires, as opposed to bias tires, is a significant propellant. Radial tires offer superior performance, contributing to better fuel economy, enhanced safety, and a more comfortable ride. This technological evolution in tire design necessitates the use of specialized bead wire that can withstand the higher operating pressures and stresses associated with radial construction. Consequently, the demand for bead wire optimized for radial applications is continuously rising, further boosting the overall market volume.

The growing emphasis on vehicle safety and longevity is another crucial driver. Tire manufacturers are under increasing pressure to produce tires that are not only durable but also safe under a wide range of operating conditions. Bead wire plays a pivotal role in ensuring the structural integrity of the tire and its secure attachment to the rim, directly impacting safety. This has led to a demand for higher-quality bead wire with improved fatigue resistance and enhanced adhesion properties. Consequently, advancements in manufacturing processes and material science are being driven by this demand, with companies continuously investing in R&D to meet these stringent requirements. The increasing sophistication of tire designs, catering to diverse applications ranging from high-performance vehicles to heavy-duty industrial machinery, also fuels the demand for specialized bead wire. This includes variations in diameter and material composition to meet specific performance criteria, thereby expanding the market for different types of bead wire and contributing to the millions of units produced.

Despite the promising growth outlook for the Tyre Bead Wire market, estimated to reach tens of millions of units in value, several challenges and restraints can impede its full potential. One of the most significant headwinds is the volatility in raw material prices, particularly steel. As steel is the primary input for bead wire production, fluctuations in its cost can directly impact the profitability of manufacturers. Global economic downturns, geopolitical tensions, and disruptions in the supply chain can lead to unpredictable price swings, making it difficult for producers to maintain stable pricing and profit margins. This can also lead to increased costs for tire manufacturers, potentially impacting their overall production expenses. The constant need for technological upgrades and investment in advanced manufacturing equipment poses another substantial challenge. To meet the increasingly stringent quality standards and performance requirements for bead wire, especially for radial tires, manufacturers must continuously invest in state-of-the-art machinery and sophisticated production processes. This capital-intensive nature can be a barrier for smaller players and may lead to consolidation within the industry.

Furthermore, intense competition within the market, characterized by a significant number of global and regional players, can exert downward pressure on prices. This price competition, while beneficial for tire manufacturers, can squeeze the profit margins of bead wire producers, especially those unable to achieve significant economies of scale. The environmental regulations and sustainability pressures are also growing concerns. The production of steel and the subsequent manufacturing of bead wire can have environmental implications, leading to stricter regulations concerning emissions and waste management. Companies are compelled to invest in eco-friendly processes and materials, which can add to their operational costs and require significant adaptation. Moreover, the automotive industry itself is subject to cyclical fluctuations and evolving trends, such as the increasing adoption of electric vehicles (EVs) which, while boosting tire demand, might also necessitate specific bead wire designs for lighter and quieter tires. These evolving demands require continuous adaptation and research, adding another layer of complexity and potential restraint to market growth. The millions of units of production are subject to these various pressures.

The global Tyre Bead Wire market, a sector with production volumes reaching tens of millions of units annually and projected for robust growth, is anticipated to witness significant dominance from specific regions and application segments. Among the application segments, Radial Tire is poised to be the undisputed leader and the primary growth engine. This dominance is not a recent phenomenon but a trend that has solidified over the historical period (2019-2024) and is expected to accelerate significantly through the forecast period (2025-2033). The global automotive industry's overwhelming preference for radial tires, driven by their superior performance characteristics such as enhanced fuel efficiency, improved handling, increased tread life, and a more comfortable ride, is the fundamental reason behind this segment's supremacy. As vehicle manufacturers increasingly equip new models with radial tires, and the aftermarket demand for tire replacements continues to be dominated by radial technology, the requirement for bead wire specifically engineered for radial applications remains exceptionally high. The production volumes for bead wire destined for radial tires are consistently in the tens of millions of units, far surpassing that of bias tires.

Within the Radial Tire application, the 0.78-1.60 mm diameter range is expected to maintain its leading position due to its broad applicability across a vast spectrum of passenger cars, light commercial vehicles, and many medium-duty trucks. This segment accounts for a substantial share of the total millions of units produced, catering to the most common tire sizes in global markets. However, the 1.65-1.83 mm and Above 1.83 mm diameter segments are not to be underestimated. These larger diameter wires are experiencing robust growth, driven by the increasing demand for heavy-duty truck tires, bus tires, off-road vehicles, and industrial tires. These applications require bead wires with exceptional strength, durability, and fatigue resistance to withstand heavier loads and more demanding operating conditions. The expansion of global logistics networks, increased construction activity, and the growth of mining and agricultural sectors are all contributing factors to the rising demand for these specialized, larger diameter bead wires, further solidifying the overall dominance of the radial tire segment.

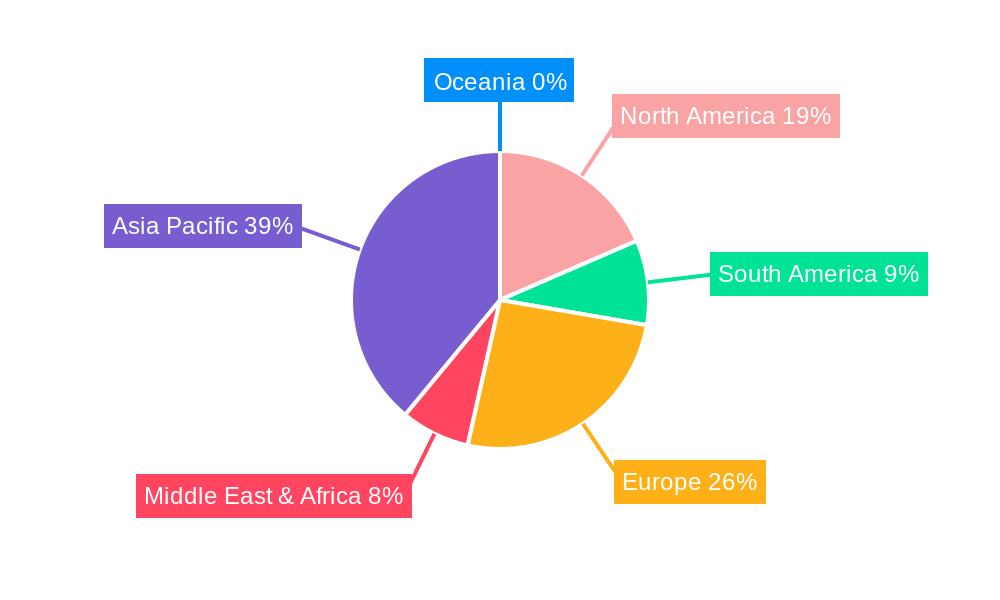

Geographically, Asia-Pacific is projected to be the dominant region in the Tyre Bead Wire market. This dominance is multifaceted, stemming from a confluence of factors. Firstly, the region is the global manufacturing hub for automotive and tire production, with countries like China, India, and Southeast Asian nations boasting massive production capacities. These countries are home to numerous tire manufacturers, both domestic and international, leading to a substantial and consistent demand for tyre bead wire in millions of units. The growing middle class in these regions also fuels an increasing demand for personal vehicles, thereby expanding the market for both OE and replacement tires. Secondly, Asia-Pacific is a significant exporter of tires to other regions, further bolstering the demand for bead wire within the region. China, in particular, is a powerhouse in both the production and consumption of tyre bead wire, driven by its extensive automotive industry and its role as a global supplier of tires. India is also emerging as a critical player, with its rapidly expanding automotive sector and increasing investments in manufacturing capabilities. The presence of key bead wire manufacturers like Bekaert, Kiswire, Shandong Daye, and Rajratan within or with significant operations in the Asia-Pacific region also contributes to its market dominance, ensuring localized supply chains and catering to regional demands efficiently. The strategic importance of this region cannot be overstated, as it dictates much of the global production and consumption trends for tens of millions of units of tyre bead wire.

Several key growth catalysts are driving the expansion of the Tyre Bead Wire market, estimated in the tens of millions of units. The continuous global increase in vehicle production and sales, both for new vehicles and the replacement market, directly translates to a higher demand for tires and, consequently, bead wire. Furthermore, the ongoing technological advancements in tire design, particularly the widespread adoption of radial tires due to their superior performance, necessitate the use of specialized and higher-quality bead wire. The increasing emphasis on vehicle safety, durability, and fuel efficiency further fuels the demand for improved bead wire properties like enhanced fatigue resistance and corrosion protection.

This comprehensive report provides an unparalleled view of the global Tyre Bead Wire market, from its historical performance in the 2019-2024 period to its projected trajectory up to 2033. With a keen focus on the base year of 2025 and estimated figures reflecting the market's value in the tens of millions of units, the report meticulously analyzes production volumes, technological trends, and the key segments driving demand. It offers detailed insights into the primary application segments like Radial Tire and Bias Tire, as well as the diverse Type classifications based on wire diameter. Furthermore, the report identifies and elaborates on the critical driving forces, challenges, and growth catalysts shaping the industry. Leading market players and significant recent and anticipated developments are also thoroughly documented, providing stakeholders with a holistic understanding of the market's intricate dynamics and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bekaert, Kiswire, Rajratan, Shandong Daye, .

The market segments include Application, Type.

The market size is estimated to be USD 1477.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tyre Bead Wire," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tyre Bead Wire, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.