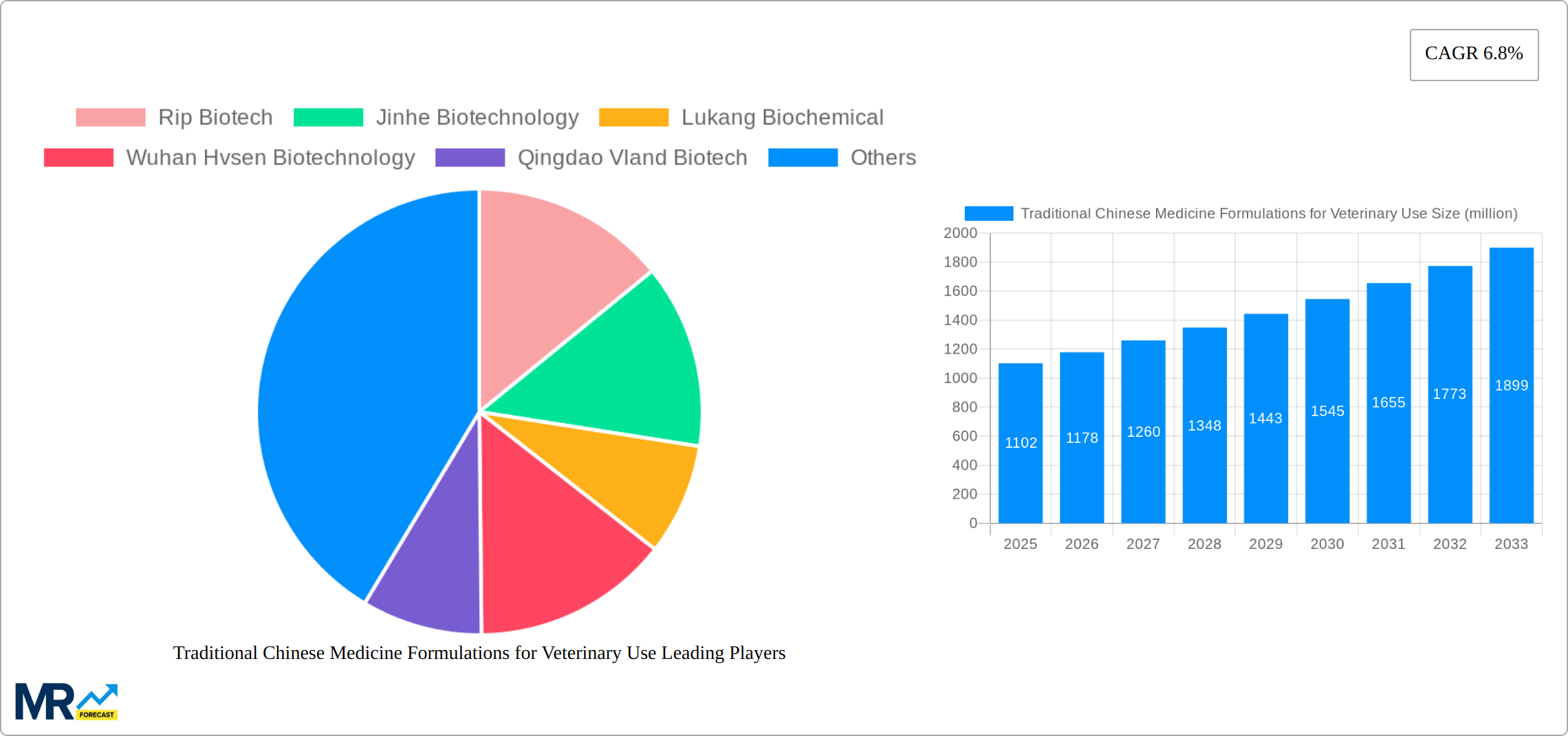

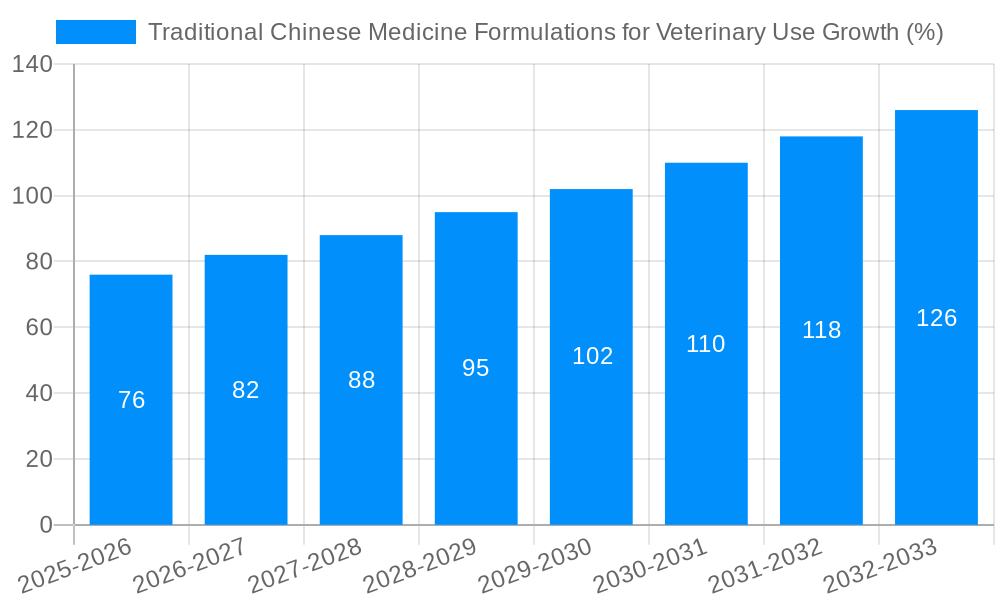

1. What is the projected Compound Annual Growth Rate (CAGR) of the Traditional Chinese Medicine Formulations for Veterinary Use?

The projected CAGR is approximately 6.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Traditional Chinese Medicine Formulations for Veterinary Use

Traditional Chinese Medicine Formulations for Veterinary UseTraditional Chinese Medicine Formulations for Veterinary Use by Type (Prevention Of Livestock And Poultry Diseases, Enhancement Of Livestock And Poultry Immunity, Improvement Of Livestock And Poultry Products), by Application (Animal Husbandry Industry, Pet Industry, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The market for Traditional Chinese Medicine (TCM) formulations for veterinary use is experiencing robust growth, projected to reach $1102 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033. This expansion is driven by increasing awareness of TCM's efficacy in treating animal ailments, coupled with a growing preference for natural and holistic veterinary treatments among pet owners and livestock farmers. The rising prevalence of chronic diseases in animals, coupled with limitations of conventional veterinary medicine in certain cases, further fuels market demand. Key segments within the market likely include formulations for common animal diseases like respiratory infections, digestive disorders, and skin conditions, as well as specialized treatments for specific animal species, such as cattle, poultry, and companion animals. The market is characterized by a multitude of players, ranging from large pharmaceutical companies like Zhongcheng Medicine and Dabeinong to smaller, specialized biotech firms such as Rip Biotech and Jinhe Biotechnology. Competition is likely intense, with companies focusing on product innovation, expanding distribution networks, and building strong brand recognition to secure market share.

The significant presence of Chinese companies such as Wuhan Hvsen Biotechnology, Qingdao Vland Biotech, and Shandong Xundakang Veterinary Medicine suggests a strong domestic market within China. However, given the global appeal of TCM and the increasing international interest in alternative veterinary medicine, significant opportunities exist for market expansion into other regions. Factors such as regulatory hurdles in different countries, ensuring quality control and standardization of TCM formulations, and educating veterinary professionals about the benefits and proper usage of these products represent potential restraints. Nevertheless, the overall market outlook remains positive, indicating considerable growth potential for both established and emerging players in this dynamic sector. The increasing demand for animal healthcare and the growing recognition of TCM's potential create a fertile ground for continued market expansion in the coming years.

The market for Traditional Chinese Medicine (TCM) formulations in veterinary use is experiencing robust growth, driven by increasing consumer awareness of natural and holistic animal healthcare options. The study period, 2019-2033, reveals a significant upward trajectory, with the estimated market value in 2025 exceeding several hundred million units. This growth is fueled by several key factors. Firstly, a rising preference for TCM's perceived gentler approach, particularly for chronic conditions and preventative care, contrasts with concerns about the long-term effects of conventional pharmaceuticals. Secondly, a growing body of research is validating the efficacy of certain TCM formulations in addressing specific veterinary ailments, lending credibility to the market. Thirdly, the expanding pet owner population and increasing pet expenditure are contributing significantly. This report, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), projects continued expansion, surpassing several billion units by 2033. However, challenges exist. The standardization and regulation of TCM products remain a key hurdle, alongside ensuring quality control and consistency across various manufacturers. Furthermore, the integration of TCM practices into mainstream veterinary care requires further education and awareness among practitioners. This necessitates a collaborative approach involving researchers, regulatory bodies, and veterinary professionals to unlock the full potential of TCM in veterinary medicine. The market demonstrates strong potential, particularly in regions with a pre-existing acceptance of traditional healing practices, combined with a burgeoning middle class capable of affording higher quality pet care products.

Several key factors are driving the expansion of the TCM formulations market in veterinary applications. The growing global awareness of the potential side effects associated with synthetic pharmaceuticals is leading many pet owners to seek more natural and holistic alternatives. TCM, with its emphasis on balancing the body's energy and promoting natural healing, is increasingly perceived as a safer and gentler option, especially for chronic conditions and preventative care in animals. The increasing availability and accessibility of TCM products through both online and offline channels further contribute to market growth. Furthermore, the expanding body of scientific research validating the efficacy of various TCM formulations for specific veterinary ailments is boosting consumer confidence and attracting investment in research and development. This growing scientific basis is critical in legitimizing TCM's role in veterinary care and in promoting its integration into mainstream veterinary practice. The increasing disposable income in many parts of the world, coupled with the growing human-animal bond, is translating into higher pet healthcare expenditure, creating a favorable market environment for premium pet care products including TCM formulations.

Despite the promising growth trajectory, several challenges and restraints hinder the widespread adoption of TCM formulations in veterinary medicine. One major obstacle is the lack of standardized production processes and quality control measures for TCM products. This inconsistency can lead to variations in product efficacy and safety, impacting consumer confidence. The regulatory landscape surrounding TCM products also presents difficulties, with varying regulatory requirements across different countries and regions. This lack of harmonization can increase the cost and complexity of bringing TCM products to market. Furthermore, the integration of TCM practices into mainstream veterinary education and clinical practice faces significant hurdles. Many veterinarians lack sufficient training and experience in using TCM formulations, hindering their widespread adoption. Finally, the relatively higher cost of some TCM formulations compared to conventional veterinary drugs can limit accessibility for some pet owners. Addressing these challenges requires collaborative efforts from researchers, regulatory bodies, veterinary professionals, and TCM manufacturers to establish industry standards, enhance regulatory frameworks, and promote wider adoption through education and training.

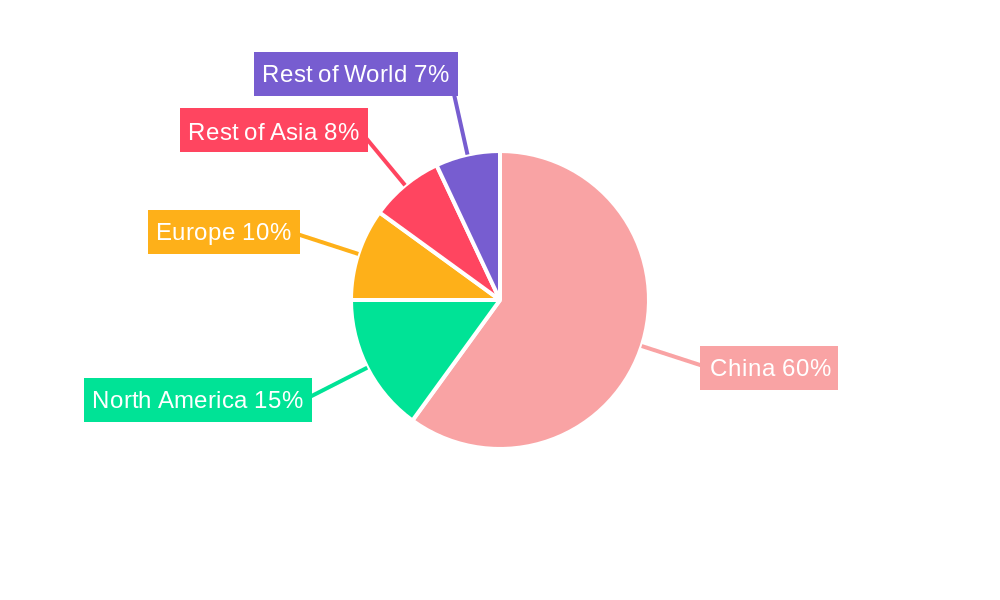

China: China, being the birthplace of TCM, holds a significant market share due to high consumer awareness and acceptance of traditional therapies. The government's support for TCM research and development further strengthens its position. This region is predicted to maintain its dominance throughout the forecast period due to its vast pet population and increasing expenditure on animal healthcare.

Other Asian Countries: Countries in Southeast Asia and East Asia, with cultural affinities to TCM, exhibit strong growth potential. These regions are expected to see a rapid increase in demand for TCM veterinary products as consumer awareness grows.

North America and Europe: While adoption is slower in these regions, growing interest in holistic pet healthcare is driving modest growth. The rising awareness of side effects of conventional medications and the growing demand for natural alternatives are contributing to this trend. However, regulatory hurdles and a lack of widespread veterinary knowledge of TCM may slow down market penetration.

Segments: The segments exhibiting the strongest growth are predicted to be those catering to chronic conditions such as arthritis and allergies. Preventative care formulations are also gaining traction. The demand for high-quality, scientifically validated TCM products is driving growth in premium segments, while cost-effective formulations cater to a broader market.

The dominance of China and other Asian countries stems from cultural acceptance and historical usage of TCM. However, the growing interest in natural pet health products in Western markets, albeit at a slower pace, showcases a global trend moving away from solely relying on conventional pharmaceuticals. The focus on chronic conditions and preventative care signifies a shift towards proactive pet health management, a significant catalyst for TCM formulation adoption.

The TCM veterinary market is being fueled by several key growth catalysts. Increasing consumer demand for natural and holistic animal healthcare solutions is a primary driver. This is further amplified by growing scientific evidence supporting the efficacy of certain TCM formulations in treating various animal ailments. Government initiatives promoting research and development in TCM are also fostering market expansion. The rising pet ownership rates and disposable incomes globally are creating a favorable environment for premium pet care products, including TCM formulations. Finally, improving distribution networks and increased accessibility of TCM products through various channels contribute significantly to market growth.

This report provides a comprehensive overview of the TCM formulations market for veterinary use, encompassing market size estimations, growth projections, key trends, driving factors, challenges, and leading players. It delivers a detailed analysis of market segments and regional dynamics, offering valuable insights for businesses, investors, and researchers interested in this rapidly expanding sector. The report's robust methodology and extensive data ensure a well-rounded understanding of the market's current state and future prospects, enabling informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.8%.

Key companies in the market include Rip Biotech, Jinhe Biotechnology, Lukang Biochemical, Wuhan Hvsen Biotechnology, Qingdao Vland Biotech, China Animal Husbandry Industry, Pleco, Dabeinong, Beijing Centre Biology, Luoyang Huizhong Veterinary Medicine, Shandong Xundakang Veterinary Medicine, Henan Muxiang Animal Pharmaceuticals, Alpine Group, Apeloa Pharmaceutical, Jizhong Pharmaceutical, Zhongcheng Medicine.

The market segments include Type, Application.

The market size is estimated to be USD 1102 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Traditional Chinese Medicine Formulations for Veterinary Use," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Traditional Chinese Medicine Formulations for Veterinary Use, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.