1. What is the projected Compound Annual Growth Rate (CAGR) of the Traditional Chinese Medicine Drinking Pieces Processing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Traditional Chinese Medicine Drinking Pieces Processing

Traditional Chinese Medicine Drinking Pieces ProcessingTraditional Chinese Medicine Drinking Pieces Processing by Type (Rhizome, Whole Grass, Fruit Seeds, Other), by Application (Hospital, Clinic, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

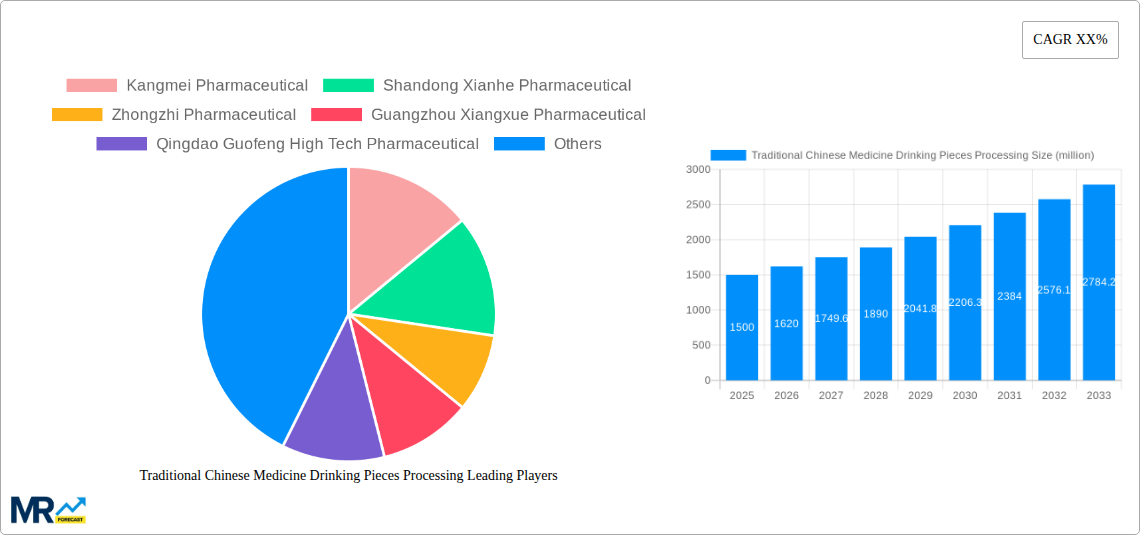

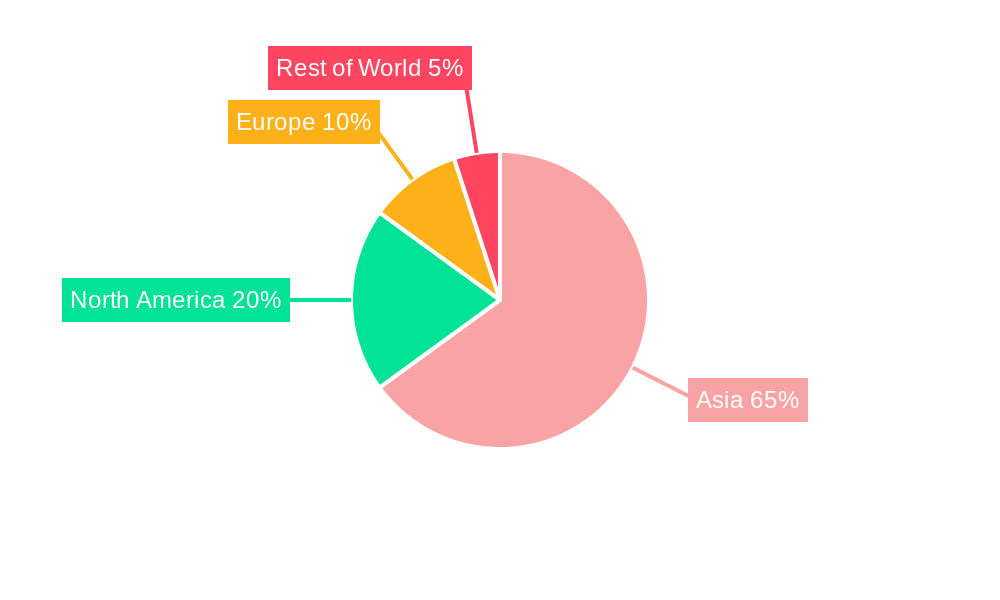

The Traditional Chinese Medicine (TCM) Drinking Pieces Processing market is experiencing robust growth, driven by increasing consumer awareness of TCM's efficacy and safety, coupled with rising disposable incomes and a preference for convenient, ready-to-consume health solutions. The market's expansion is further fueled by ongoing research validating the therapeutic benefits of various TCM formulations, leading to increased adoption among both younger and older demographics. Key trends include the integration of modern technologies in processing and quality control, a rise in personalized TCM solutions tailored to individual needs, and increasing demand for organic and sustainably sourced ingredients. While challenges such as stringent regulatory approvals and maintaining consistent product quality across diverse manufacturing processes exist, the overall market outlook remains positive. We estimate the market size in 2025 to be $1.5 billion USD, based on analyzing similar markets and considering a conservative CAGR of 8% for the next few years. This positive trajectory is expected to continue, driven by the factors mentioned above. The market's segmentation is likely driven by product type (e.g., herbal teas, concentrated extracts), ingredient source (organic, conventional), and distribution channels (online, offline). The identified companies represent significant players in the market, with their market share likely varying depending on geographic presence, product offerings and marketing strategies. This is further emphasized by the regional distribution of the market; While specific regional data is not available, Asia would hold the most significant market share, due to the origin and popularity of TCM, followed by North America and Europe, exhibiting moderate but growing demand due to increasing interest in holistic and alternative medicine practices.

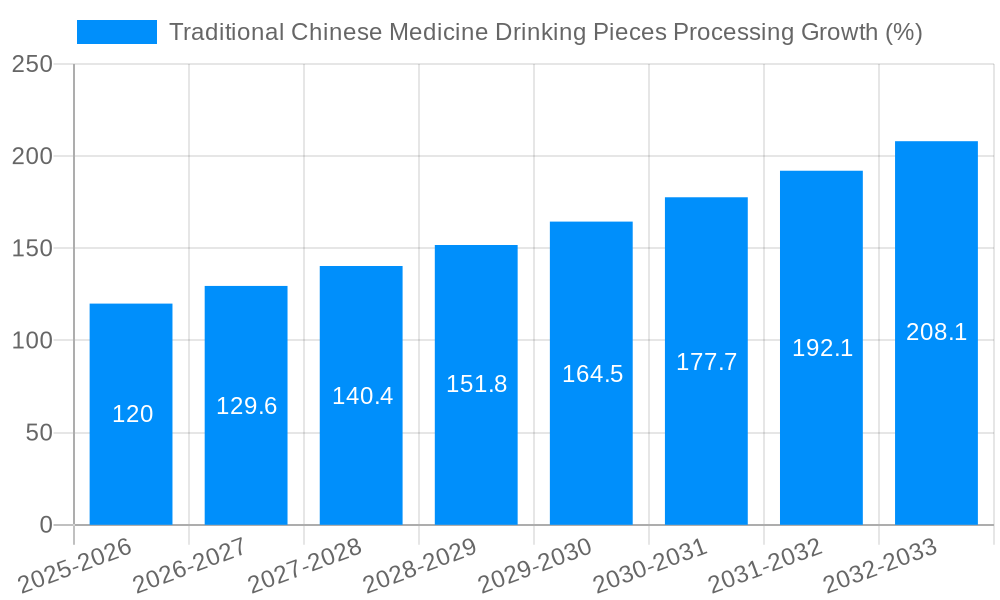

The competitive landscape is characterized by both established pharmaceutical companies and smaller, specialized TCM processors. Companies are focusing on enhancing product quality, diversifying their offerings, and expanding their market reach through e-commerce platforms and strategic partnerships. Further growth is likely to be influenced by government initiatives supporting the TCM industry, increased investment in R&D, and the rising integration of TCM into mainstream healthcare systems. The forecast period from 2025 to 2033 shows significant growth potential; we project a CAGR of 8% to 10%, indicating a considerable market expansion throughout this time. Success in this market requires a combination of superior product quality, robust supply chain management, effective marketing strategies targeting specific demographics, and compliance with evolving regulations.

The Traditional Chinese Medicine (TCM) drinking pieces processing market exhibits robust growth, driven by increasing consumer preference for convenient and readily available TCM formulations. The market, valued at approximately $XX billion in 2024, is projected to reach $YY billion by 2033, showcasing a Compound Annual Growth Rate (CAGR) of X%. This expansion is fueled by several factors, including the rising prevalence of chronic diseases, increasing awareness of TCM's efficacy, and the burgeoning global demand for natural and holistic healthcare solutions. The historical period (2019-2024) witnessed a steady rise in market size, punctuated by periods of accelerated growth correlating with government initiatives promoting TCM and increased research validating its therapeutic benefits. The estimated year 2025 marks a significant milestone, representing a crucial juncture in market trajectory where established trends solidify and new market segments emerge. The forecast period (2025-2033) promises sustained growth, influenced by innovative processing techniques, enhanced product quality, and expansion into new geographical markets. Key market insights reveal a strong preference for ready-to-consume formats, particularly among younger demographics. This segment is further propelled by the increasing integration of TCM into modern lifestyles, reflected in the growing availability of TCM-infused beverages and convenient packaging options. Furthermore, the market witnesses a diversification of product offerings, catering to specific health concerns and age groups, and an ongoing trend towards premiumization, reflecting consumers' willingness to pay more for high-quality, ethically sourced ingredients and sustainable manufacturing practices. This evolution positions the TCM drinking pieces processing industry for continued substantial growth and consolidation within the broader global wellness market.

Several key factors are propelling the growth of the TCM drinking pieces processing industry. Firstly, the rising prevalence of chronic diseases globally, including diabetes, cardiovascular diseases, and various types of cancers, is driving demand for effective and accessible healthcare solutions. TCM, with its holistic approach and emphasis on preventative care, is increasingly viewed as a complementary or alternative therapy, contributing to market expansion. Secondly, a growing global awareness of the benefits of natural and herbal remedies is fostering consumer preference for TCM products. This shift toward natural healthcare is particularly strong in developed economies, where consumer spending on wellness and preventative healthcare is significantly higher. Government initiatives promoting TCM within many Asian countries play a crucial role in stimulating market growth, through funding for research and development, promoting TCM education, and facilitating access to TCM practitioners. Furthermore, technological advancements in TCM processing techniques are improving product quality, shelf life, and standardization, enhancing consumer confidence and market appeal. These improvements, coupled with the expanding reach of e-commerce and direct-to-consumer sales channels, facilitate wider market penetration and increased accessibility of TCM drinking pieces. Finally, the increasing integration of TCM into mainstream healthcare systems contributes to the overall growth of the industry.

Despite its considerable growth potential, the TCM drinking pieces processing sector faces several challenges. The stringent regulatory environment surrounding the production and distribution of TCM products poses significant hurdles for companies, requiring adherence to strict quality control measures and compliance with international standards. This can significantly increase operational costs and impede market entry for smaller players. Furthermore, the inherent variability in the quality and efficacy of herbal ingredients is a recurring concern. Ensuring consistent ingredient quality and standardization across different production batches requires sophisticated quality control systems and reliable sourcing channels, posing a considerable challenge. Another key restraint is the lack of extensive clinical evidence supporting the efficacy of certain TCM formulations. While traditional knowledge and anecdotal evidence exist, robust scientific validation remains essential to gain wider acceptance from healthcare professionals and consumers. This necessitates significant investment in clinical research and development. Maintaining intellectual property rights and preventing counterfeiting are also critical challenges, impacting the overall growth of the industry and consumer confidence. The cost of raw materials, particularly those sourced from rare or endangered plant species, represents an ongoing price volatility risk. Effectively managing these challenges is crucial for maintaining sustainable growth and building consumer trust in the TCM drinking pieces processing industry.

China: China holds a dominant position in the global TCM market, encompassing a significant portion of production, consumption, and research and development activities. The vast domestic market and extensive history of TCM usage contribute to its leading role. Government initiatives supporting the modernization and global expansion of TCM further solidify China's market dominance. Within China, specific regions like Guangdong, Jiangsu, and Shandong demonstrate particularly strong production and consumption of TCM drinking pieces due to their established pharmaceutical industries and high consumer demand.

Other Key Regions: Significant growth is also anticipated in other Asian countries, particularly those with strong cultural ties to TCM practices, like Japan, South Korea, Vietnam, and Singapore. These countries are experiencing a resurgence of interest in traditional medicine, coupled with a rapidly growing middle class with increased disposable income.

Key Segments: The ready-to-drink segment, offering convenience and ease of consumption, is projected to be the fastest-growing segment. This is further supported by innovative product formats, incorporating diverse flavors and functional components, appealing to a wider consumer base. Segments catering to specific health conditions, such as those addressing immunity, digestive health, and stress management, will likely experience strong growth, based on the rising prevalence of these conditions and the increasing consumer preference for targeted health solutions. Premium segments, focusing on high-quality, ethically sourced ingredients and sustainable practices, are also expected to expand.

The combination of strong domestic markets, increasing global interest in TCM, and the emergence of convenient and targeted products positions the TCM drinking pieces processing industry for robust growth across various geographical regions and product segments. The continued investment in research and development, along with government support and market consolidation, will play pivotal roles in shaping the market's future. The forecast period (2025-2033) will likely witness a greater level of international trade in TCM drinking pieces as manufacturers seek to meet the growing global demand.

The TCM drinking pieces processing industry is experiencing significant growth, propelled by several key factors. The rising global awareness of the benefits of traditional medicine, coupled with the increasing prevalence of chronic diseases, is creating a strong demand for effective and accessible healthcare solutions. This is further fueled by technological advancements in processing techniques, leading to higher quality and more standardized products, increasing consumer confidence and market appeal. The expanding market for convenient and readily available health solutions, particularly in the ready-to-drink segment, contributes significantly to market expansion. Finally, increased government support and funding for TCM research and development are enhancing the credibility and legitimacy of the sector.

This report provides a comprehensive analysis of the TCM drinking pieces processing market, encompassing detailed market sizing, segmentation, and growth forecasts for the study period (2019-2033). It identifies key market trends, drivers, challenges, and growth catalysts, offering valuable insights for industry stakeholders. The report also profiles leading companies within the sector, highlighting their strategies, market share, and competitive landscape. The comprehensive nature of this report makes it an invaluable resource for businesses, investors, and researchers seeking a deep understanding of this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kangmei Pharmaceutical, Shandong Xianhe Pharmaceutical, Zhongzhi Pharmaceutical, Guangzhou Xiangxue Pharmaceutical, Qingdao Guofeng High Tech Pharmaceutical, Shanghai Medicinal Materials Co., Ltd, Yunnan Te'an Na Pharmaceutical, Sichuan New Lotus Chinese Medicine Tablets, Inner Mongolia Furui Medical Science, Chengdu Jinxin Chinese medicine tablets, Anhui Xiehe Cheng Pharmaceutical Tablets, Beijing Tongrentang (Bozhou) drinking tablets, Sichuan Enwei Pharmaceutical, Shandong Bokang Chinese medicine tablets, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Traditional Chinese Medicine Drinking Pieces Processing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Traditional Chinese Medicine Drinking Pieces Processing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.