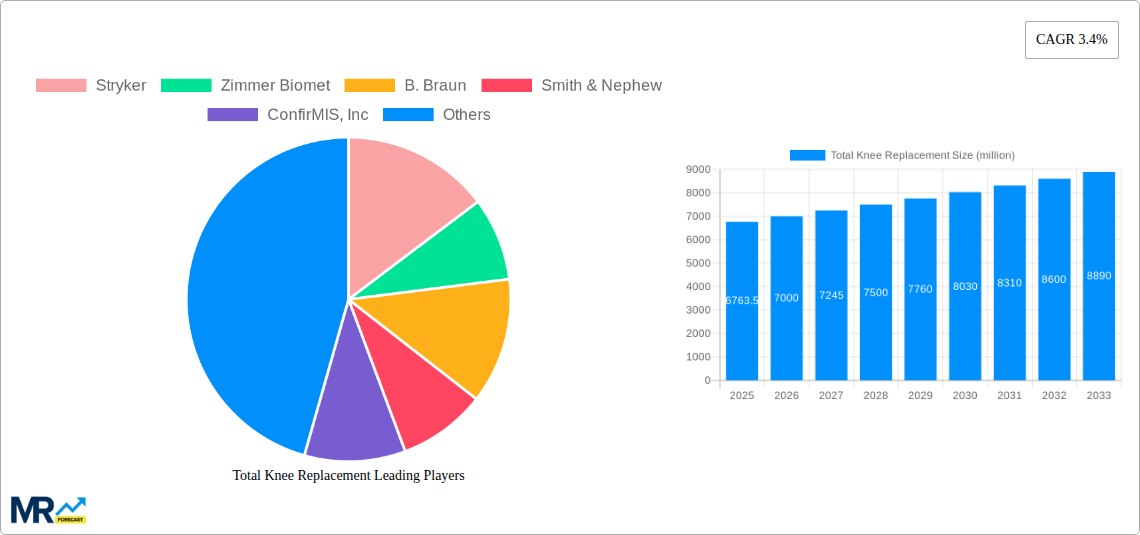

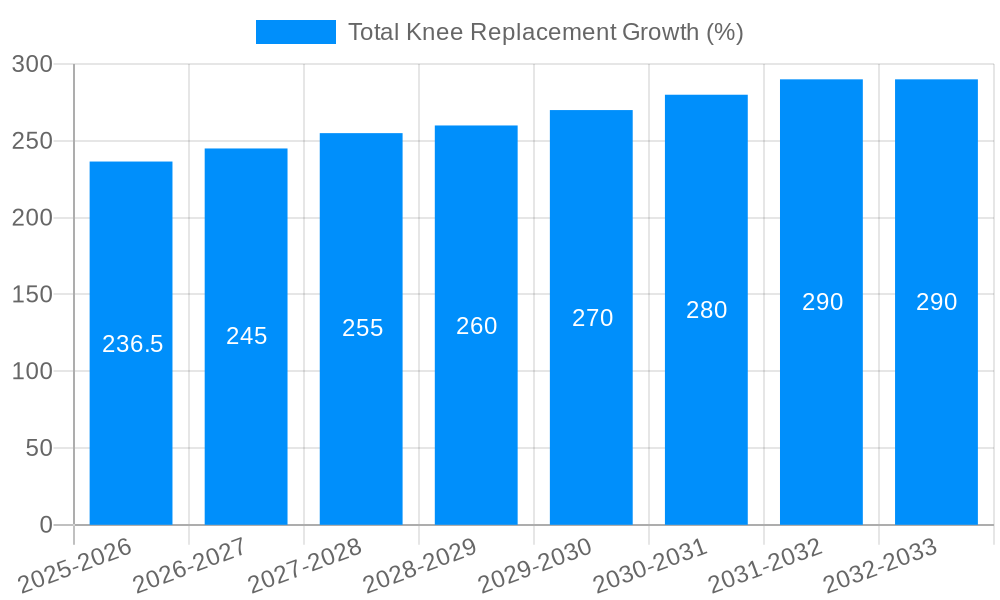

1. What is the projected Compound Annual Growth Rate (CAGR) of the Total Knee Replacement?

The projected CAGR is approximately 3.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Total Knee Replacement

Total Knee ReplacementTotal Knee Replacement by Type (Primary Knee Systems, Partial Knee Systems), by Application (Hospitals, Ambulatory Surgical Centers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Total Knee Replacement market is poised for steady expansion, projected to reach a valuation of USD 6763.5 million by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.4% from 2025 to 2033. This sustained growth is primarily fueled by the increasing prevalence of osteoarthritis and other degenerative knee conditions, driven by an aging global population and a rise in obesity rates. Advances in implant technology, including the development of more durable materials and minimally invasive surgical techniques, are also significant drivers, enhancing patient outcomes and encouraging broader adoption. The demand for sophisticated primary knee systems, designed for initial implantations, is expected to remain robust, while the segment for partial knee systems will witness substantial growth due to its less invasive nature and quicker recovery times. Hospitals and ambulatory surgical centers will continue to be the dominant end-user segments, benefiting from enhanced surgical efficiency and improved patient care pathways.

The market's trajectory is further shaped by evolving healthcare landscapes and technological innovations. Emerging trends include the integration of AI and robotics in surgical planning and execution, leading to greater precision and personalized treatment approaches. Furthermore, the increasing emphasis on outpatient surgical settings for knee replacement procedures is a key trend, contributing to cost containment and improved patient convenience. However, potential restraints such as the high cost of advanced implants and procedures, coupled with concerns regarding reimbursement policies in certain regions, could temper the market's pace. Despite these challenges, the strong pipeline of innovative products and the continuous efforts by leading companies like Stryker, Zimmer Biomet, and Smith & Nephew to expand their global reach and product portfolios are expected to overcome these hurdles, ensuring a positive growth outlook for the total knee replacement market in the coming years.

The global Total Knee Replacement (TKR) market is poised for substantial growth, driven by an aging global population and a rising prevalence of osteoarthritis and other debilitating knee conditions. Our comprehensive report analyzes the market from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period, 2019-2024, has witnessed steady expansion, setting the stage for accelerated growth in the coming years. In 2025, the estimated market value is projected to reach several tens of millions of units, a figure that is expected to climb significantly by 2033. This expansion is fueled by advancements in implant technology, minimally invasive surgical techniques, and an increasing demand for enhanced patient outcomes. The shift towards outpatient procedures in Ambulatory Surgical Centers (ASCs) is also a notable trend, offering cost efficiencies and improved patient convenience compared to traditional hospital settings. The market is characterized by a dynamic competitive landscape, with major players continuously investing in research and development to introduce innovative solutions. Primary Knee Systems continue to represent the largest segment, reflecting the high incidence of primary TKR surgeries. However, Partial Knee Systems are also gaining traction as less invasive alternatives for specific patient populations. The report delves into regional market nuances, identifying key growth areas and understanding the factors contributing to their dominance. Furthermore, we explore the evolving regulatory environment and reimbursement policies, which play a crucial role in shaping market access and adoption of new technologies. The increasing focus on personalized medicine and patient-specific implants is another transformative trend, promising to revolutionize TKR procedures and improve long-term implant survival rates. The integration of digital technologies, such as AI-powered pre-operative planning and robotic-assisted surgery, is also set to reshape the TKR landscape, offering greater precision and predictability in surgical outcomes.

The robust growth of the Total Knee Replacement (TKR) market is primarily propelled by a confluence of demographic, medical, and technological factors. The most significant driver is the escalating global aging population. As individuals live longer, the cumulative wear and tear on their knee joints increases, leading to a higher incidence of degenerative conditions like osteoarthritis, the leading cause of knee pain and disability requiring TKR. This demographic shift directly translates into a larger pool of potential patients seeking surgical intervention. Complementing this is the growing awareness and acceptance of TKR as an effective solution for restoring mobility and alleviating chronic pain. Patients are increasingly seeking to maintain an active lifestyle well into their later years, making TKR a desirable option for regaining quality of life. Medical advancements in implant materials and design have also been pivotal. Modern implants offer enhanced durability, biocompatibility, and improved range of motion, leading to better long-term outcomes and patient satisfaction. Furthermore, the development and refinement of minimally invasive surgical techniques have reduced recovery times, hospital stays, and post-operative complications, making TKR a more appealing option for a wider patient demographic and facilitating its adoption in Ambulatory Surgical Centers.

Despite the promising growth trajectory, the Total Knee Replacement (TKR) market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the substantial cost associated with TKR procedures and implant devices. The high price of implants, coupled with surgical fees and post-operative rehabilitation, can be a significant barrier for both patients and healthcare systems, particularly in developing economies or regions with limited healthcare coverage. Reimbursement policies, while generally supportive in developed nations, can be complex and vary significantly across different geographies, potentially impacting market access and the adoption of advanced, albeit more expensive, technologies. Another restraint is the occurrence of implant-related complications and revision surgeries. While rare, issues such as infection, loosening of the implant, or wear and tear can necessitate further surgical intervention, leading to increased healthcare costs and patient dissatisfaction. This risk, however small, can deter some patients from undergoing the initial procedure. The availability of skilled orthopedic surgeons and adequate post-operative care infrastructure is also crucial. In some regions, a shortage of trained professionals or insufficient rehabilitation facilities can limit the capacity for performing TKR and ensuring optimal patient recovery, thereby acting as a bottleneck for market growth.

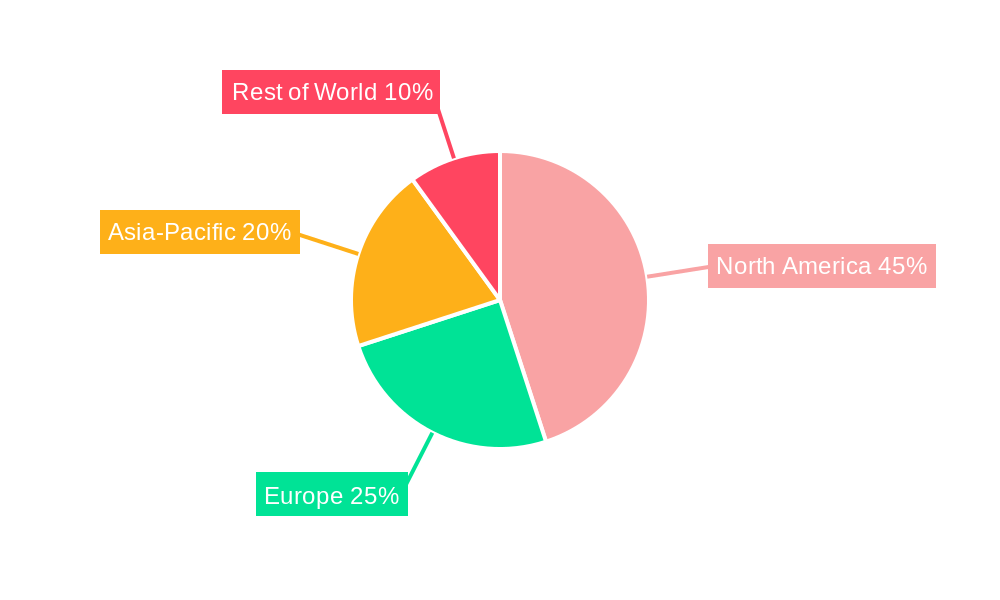

The Total Knee Replacement (TKR) market is characterized by distinct regional dynamics and segment dominance. From a regional perspective, North America and Europe are anticipated to continue their stronghold as key markets, driven by several interconnected factors. The substantial aging populations in these regions, coupled with high disposable incomes and advanced healthcare infrastructures, contribute to a high demand for TKR procedures. Furthermore, the widespread adoption of advanced medical technologies and a strong emphasis on patient outcomes and quality of life make these regions fertile ground for market growth. The presence of leading medical device manufacturers, robust research and development activities, and favorable reimbursement policies further solidify their dominant position. The Asia-Pacific region, however, is emerging as a high-growth market. Factors such as a rapidly expanding middle class, increasing awareness of advanced medical treatments, and a growing prevalence of lifestyle-related diseases leading to joint degeneration are fueling the demand for TKR. Government initiatives aimed at improving healthcare access and affordability are also playing a crucial role in unlocking the potential of this region.

In terms of market segments, Primary Knee Systems are expected to dominate the market in terms of volume and value. This is directly attributed to the overwhelming prevalence of primary TKR surgeries performed globally to address first-time severe knee joint damage caused by osteoarthritis or trauma. The sheer number of patients undergoing initial knee replacement procedures ensures the sustained demand for primary implant systems.

However, the segment of Ambulatory Surgical Centers (ASCs) for TKR procedures is poised for remarkable growth and increasing dominance in terms of procedural shift. The ability of ASCs to offer cost-effective, efficient, and patient-centric care for select TKR cases is a significant draw. These centers often cater to healthier patients who can undergo surgery and recover in a less hospital-centric environment, leading to shorter lengths of stay and reduced healthcare expenditures. Technological advancements in implant design and surgical techniques, facilitating less invasive procedures, are making TKR increasingly suitable for the ASC setting. This shift is supported by payers and healthcare systems seeking to optimize resource utilization and reduce the burden on traditional hospitals. While Hospitals will continue to be a crucial venue, especially for complex cases and patients with significant comorbidities, the trend towards ASCs for primary and uncomplicated TKR is undeniable and will shape the future landscape of TKR delivery.

The Total Knee Replacement (TKR) industry is experiencing significant growth catalyzed by continuous technological innovation. Advances in implant design, materials like advanced polymers and ceramics, and patient-specific instrumentation are enhancing implant longevity and improving patient outcomes. The rise of robotic-assisted surgery and AI-driven pre-operative planning tools is further refining surgical precision, leading to reduced invasiveness and faster recovery times. This technological evolution is directly addressing patient and surgeon needs for improved efficacy and efficiency.

This report offers a panoramic view of the Total Knee Replacement (TKR) market, delving into its intricate dynamics from 2019 to 2033. It meticulously analyzes key market insights, including the driving forces behind its expansion and the inherent challenges that need to be navigated. With a dedicated focus on identifying dominant regions and segments like Primary Knee Systems and the growing influence of Ambulatory Surgical Centers, the report provides actionable intelligence. It further illuminates the growth catalysts propelling the industry forward, such as technological advancements and evolving patient demographics. A comprehensive list of leading players and significant developments, complete with timelines, offers a granular understanding of the competitive landscape and industry innovation. The report serves as an indispensable resource for stakeholders seeking to comprehend the current state and future trajectory of the TKR market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.4%.

Key companies in the market include Stryker, Zimmer Biomet, B. Braun, Smith & Nephew, ConfirMIS, Inc, Medacta, Biomet, Exactech, Inc, MicroPort Scientific Corporation, Corin Group, Waldemar LINK, DJO Global, C2F Implants, .

The market segments include Type, Application.

The market size is estimated to be USD 6763.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Total Knee Replacement," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Total Knee Replacement, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.