1. What is the projected Compound Annual Growth Rate (CAGR) of the Ticlopidine Hydrochloride Tablets?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ticlopidine Hydrochloride Tablets

Ticlopidine Hydrochloride TabletsTiclopidine Hydrochloride Tablets by Application (Hospital and Clinic, Pharmacy), by Type (0.1g, 0.25g), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

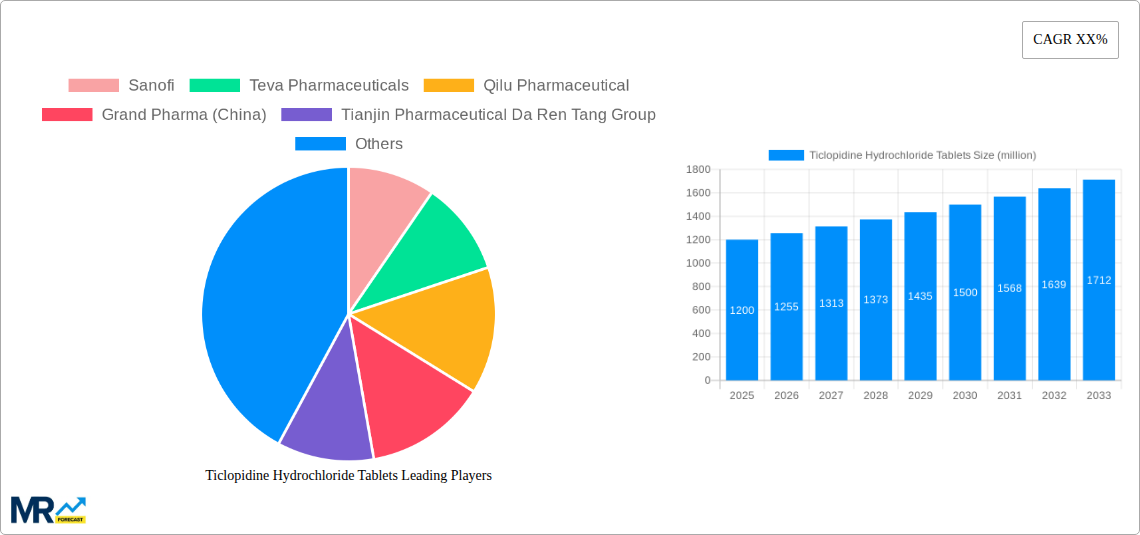

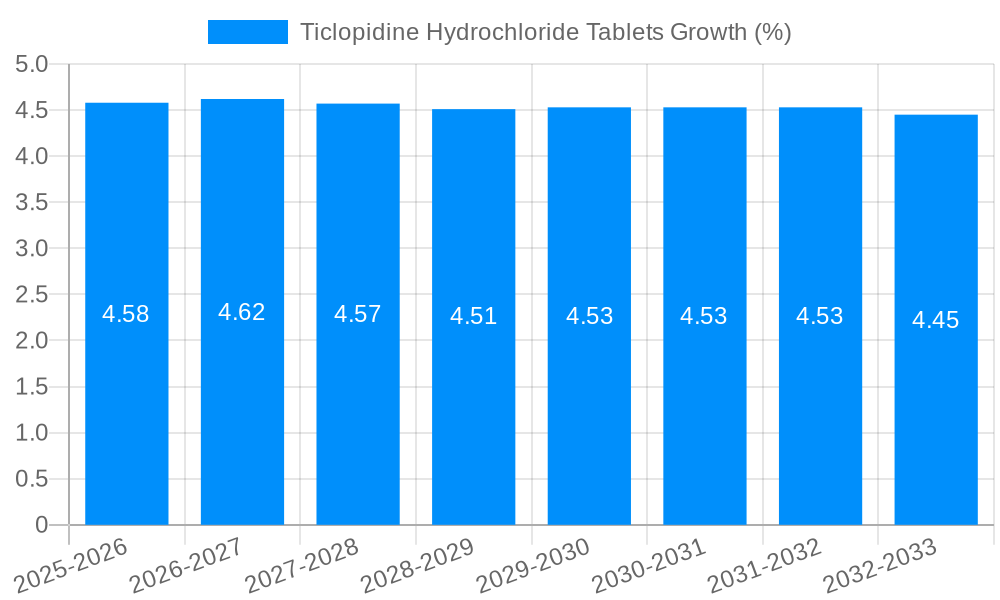

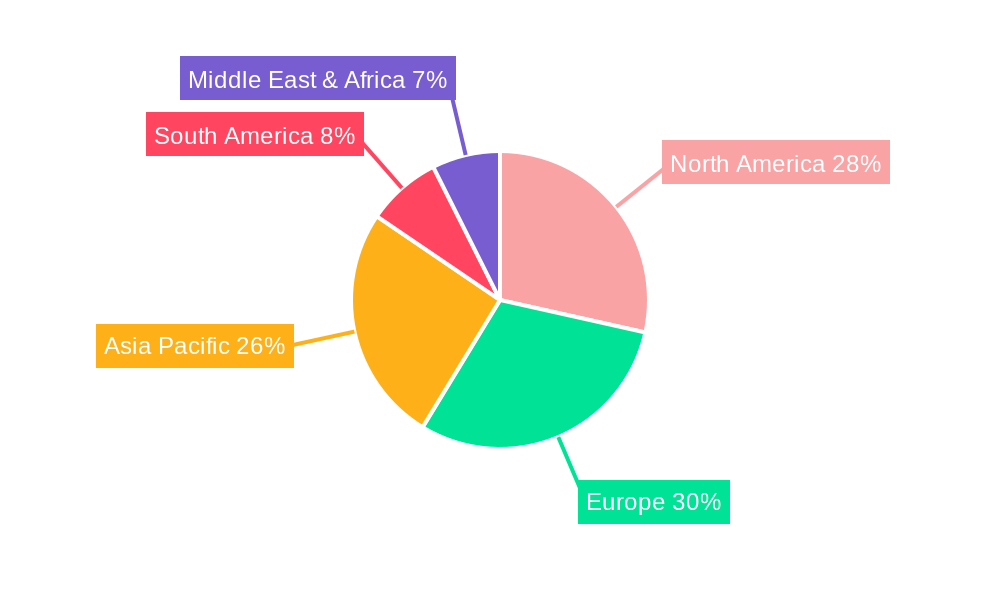

The global market for Ticlopidine Hydrochloride Tablets is a niche but significant segment within the antiplatelet drug market. While precise market size figures for 2019-2024 are unavailable, considering the overall growth in the antiplatelet market and the established presence of Ticlopidine, a reasonable estimate for the 2024 market size could be in the range of $150-200 million. Assuming a Compound Annual Growth Rate (CAGR) of 3-5% (a conservative estimate given the availability of alternative antiplatelet medications), the market is projected to reach a value between $180-260 million by 2025 and continue its moderate growth through 2033. Market drivers include the ongoing need for effective antiplatelet therapy in patients at risk of cardiovascular events, particularly those with a history of stroke or peripheral artery disease. However, restraints include the emergence of newer, safer antiplatelet agents with fewer side effects, such as clopidogrel, which has largely supplanted Ticlopidine in many markets. The market segmentation reveals a relatively even distribution across hospital/clinic and pharmacy channels. The 0.25g dosage form is likely to dominate over the 0.1g, reflecting typical prescription patterns. Key players such as Sanofi and Teva Pharmaceuticals, alongside significant regional manufacturers like Qilu Pharmaceutical and others in China and India, compete in this market. Geographic distribution likely favors mature markets in North America and Europe, with emerging markets in Asia-Pacific experiencing gradual growth.

The future of the Ticlopidine Hydrochloride Tablets market depends on several factors. Continued demand in regions with limited access to newer antiplatelet drugs or those with specific patient populations requiring Ticlopidine will support market growth. However, the overall trajectory suggests a slow but steady growth trajectory, primarily driven by sustained demand in specific niche applications and regions rather than widespread expansion. The competitive landscape will likely remain relatively stable, with existing players continuing to dominate the market. The focus for manufacturers might shift toward improving product quality, ensuring regulatory compliance, and potentially developing specialized formulations or delivery systems. Price competition, especially in emerging markets, could also play a significant role in shaping the market dynamics.

The global ticlopidine hydrochloride tablets market exhibited a steady growth trajectory throughout the historical period (2019-2024), reaching an estimated value of XXX million units in 2025. This growth is projected to continue during the forecast period (2025-2033), driven by several factors analyzed in detail below. While precise figures for each year within the historical and forecast periods aren't readily available without access to specific market research data, the overall trend suggests a consistent, albeit perhaps moderate, increase in consumption. The market is influenced significantly by pricing strategies employed by major players like Sanofi and Teva Pharmaceuticals, as well as the availability of generic versions from manufacturers such as Qilu Pharmaceutical and others based in China. The increasing prevalence of cardiovascular diseases in developing nations presents a considerable opportunity for growth, although this is counterbalanced by concerns regarding the drug's side effects and the availability of newer, potentially safer alternatives. The distribution channels, encompassing hospitals and clinics, as well as pharmacies, also play a crucial role in shaping market dynamics. Variations in dosage forms (0.1g and 0.25g tablets) cater to different patient needs and treatment protocols, impacting market segmentation. Future growth is likely to be shaped by regulatory changes, the introduction of novel antiplatelet therapies, and evolving healthcare infrastructure globally.

Several factors contribute to the continued growth of the ticlopidine hydrochloride tablets market. The rising prevalence of cardiovascular diseases, including stroke and peripheral artery disease, constitutes a primary driver. Ticlopidine's efficacy in preventing thromboembolic events, particularly in patients at high risk or those intolerant to aspirin, maintains its relevance despite newer antiplatelet agents entering the market. Furthermore, the availability of generic versions of ticlopidine has significantly reduced its cost, making it more accessible in both developed and developing countries. This affordability factor is particularly crucial in regions with limited healthcare resources where cost-effectiveness is a major consideration. The established presence and widespread acceptance of ticlopidine within the medical community also contribute to its continued use. However, it's important to acknowledge that the growth trajectory might be moderated by concerns about its side effect profile, leading to a more cautious approach in prescribing by some clinicians.

Despite the market's steady growth, several challenges and restraints hinder its expansion. The significant risk of neutropenia and other adverse hematological effects associated with ticlopidine treatment necessitates careful patient monitoring and limits its widespread application. The emergence of newer, arguably safer antiplatelet agents like clopidogrel and prasugrel poses stiff competition, eroding ticlopidine's market share, especially in regions with robust healthcare infrastructure and access to advanced treatments. Stringent regulatory requirements and safety concerns related to its use also impact market growth, potentially leading to restrictions on its prescription and distribution. Furthermore, variations in healthcare policies and reimbursement frameworks across different countries can significantly affect the accessibility and market penetration of ticlopidine hydrochloride tablets.

While precise market share data by region and segment require specific market research reports, several factors suggest potential dominance. Developing countries with high prevalence of cardiovascular diseases and limited access to newer, more expensive antiplatelet therapies might experience significant consumption of ticlopidine due to its lower cost. Similarly, the 0.25g dosage form, often employed for higher-risk patients requiring stronger antiplatelet action, could hold a larger market share compared to the 0.1g dosage.

The pharmacy segment also plays a role, particularly for patients requiring ongoing maintenance therapy after initial hospitalization. The geographic distribution of market dominance is complex and depends on factors including access to healthcare, prevalence of cardiovascular disease, and the specific regulatory environment within each country or region.

The ongoing need for affordable and effective antiplatelet therapy in regions with limited resources will continue to drive market growth. Furthermore, improvements in patient monitoring and management of adverse effects could mitigate some of the risks associated with ticlopidine, potentially expanding its use. Generic competition ensures affordability, enabling broader access to the medication. Focused marketing and targeted campaigns to highlight its specific advantages in certain patient populations could also contribute to growth, provided these are ethically sound and align with patient safety guidelines.

A comprehensive report would provide detailed quantitative and qualitative analysis, including historical and projected market values (in million units) for each segment (application, dosage, region) and major players, supporting the trends and insights presented above with robust data and analysis from reliable sources. It would also include a thorough assessment of the competitive landscape, regulatory environment, and future market outlook, providing valuable information for stakeholders in the pharmaceutical industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sanofi, Teva Pharmaceuticals, Qilu Pharmaceutical, Grand Pharma (China), Tianjin Pharmaceutical Da Ren Tang Group, Jiangsu Hengrui Pharmaceuticals, Suzhou Homesun Pharmaceutical.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ticlopidine Hydrochloride Tablets," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ticlopidine Hydrochloride Tablets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.